Main takeout

- Hashdex has been approved for launching its first XRP ETF in Brazil.

- XRP was selected as the third largest digital asset with a market cap.

Share this article

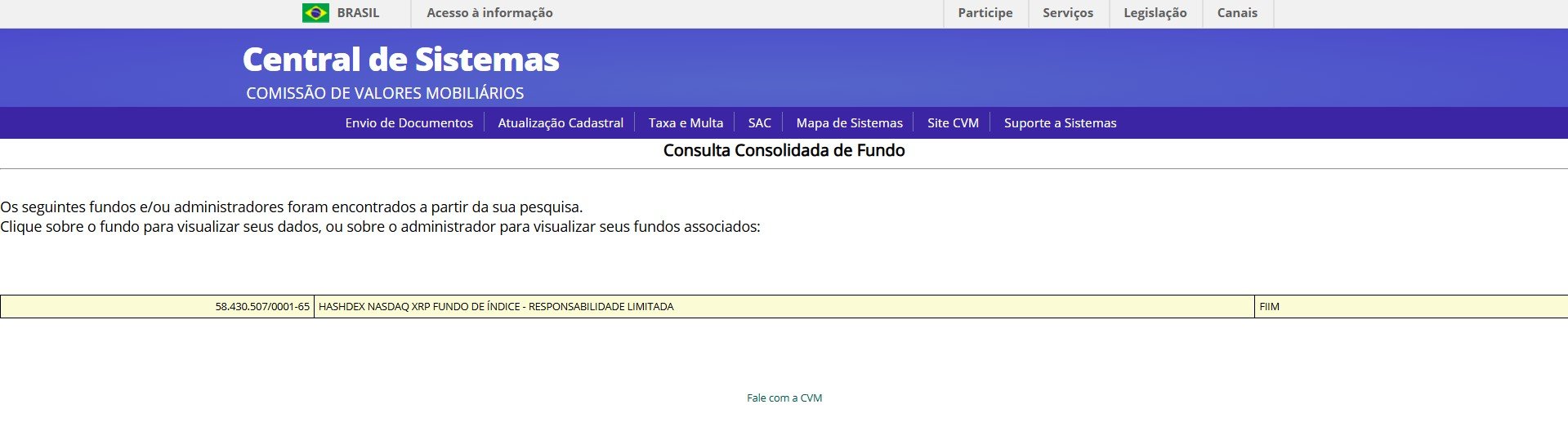

The Brazilian Securities and Exchange Commission (CVM) has approved the world’s first exchange trading fund with XRP, the default coin of RIPPLE in HashDex, as shown in the CVM’s database.

The newly approved ETF, called “Hashdex Nasdaq XRP Index Fund,” is expected to be released on Brazil’s major stock exchange B3. The official release date and details of the funds have not been announced yet. But Hashdex confirmed the approval and pointed out that it would soon provide details.

The fund was officially established on December 10, 2024, according to the information released by CVM. Genial Investimentos, a major financial service company, will serve as a manager of the fund.

“XRP is a natural choice of ETFs due to actual utility, institutional demand, and total market cap,“ XRP) said, Silvio Pegado, executive director of Ripple.

According to Coingeko Data, XRP is now ranked as the third largest encryption asset in the world with market caps that only track Bitcoin and Ethereum.

HashDex, an existing asset manager who focuses on encryption investment products, has already introduced several encryption ETFs in Brazil and the United States.

In August, the company was approved by investors to start the Hashdex Nasdaq Solana Index Fund, an investment product exposed to Solana. Hashdex also provides funds related to Bitcoin and Ethereum.

Pegado said, “The approval of the first XRP ETF by CVM shows the approach of vision for Brazil’s encryption market and financial development. “Through regulation and public counseling, Brazil continues to be an open country and is expected to be the center of more pioneering development in the future encryption sector.”

Brazil accepted the Crypto ETF, but despite the recent approval of Bitcoin and Etherum ETF, the United States was more hesitant. But the new administration’s regulatory change could open a way for more encryption ETFs to be approved.

JP MORGAN predicts that if SOC approves, Solana and XRP ETF can lead to an investment of $ 14 billion for the first 12 months.

Share this article