One analyst recently explained how a buy signal for XRP was formed on the weekly chart, which could lead to a long-lasting upward trend.

XRP recently observed a TD sequential buy signal.

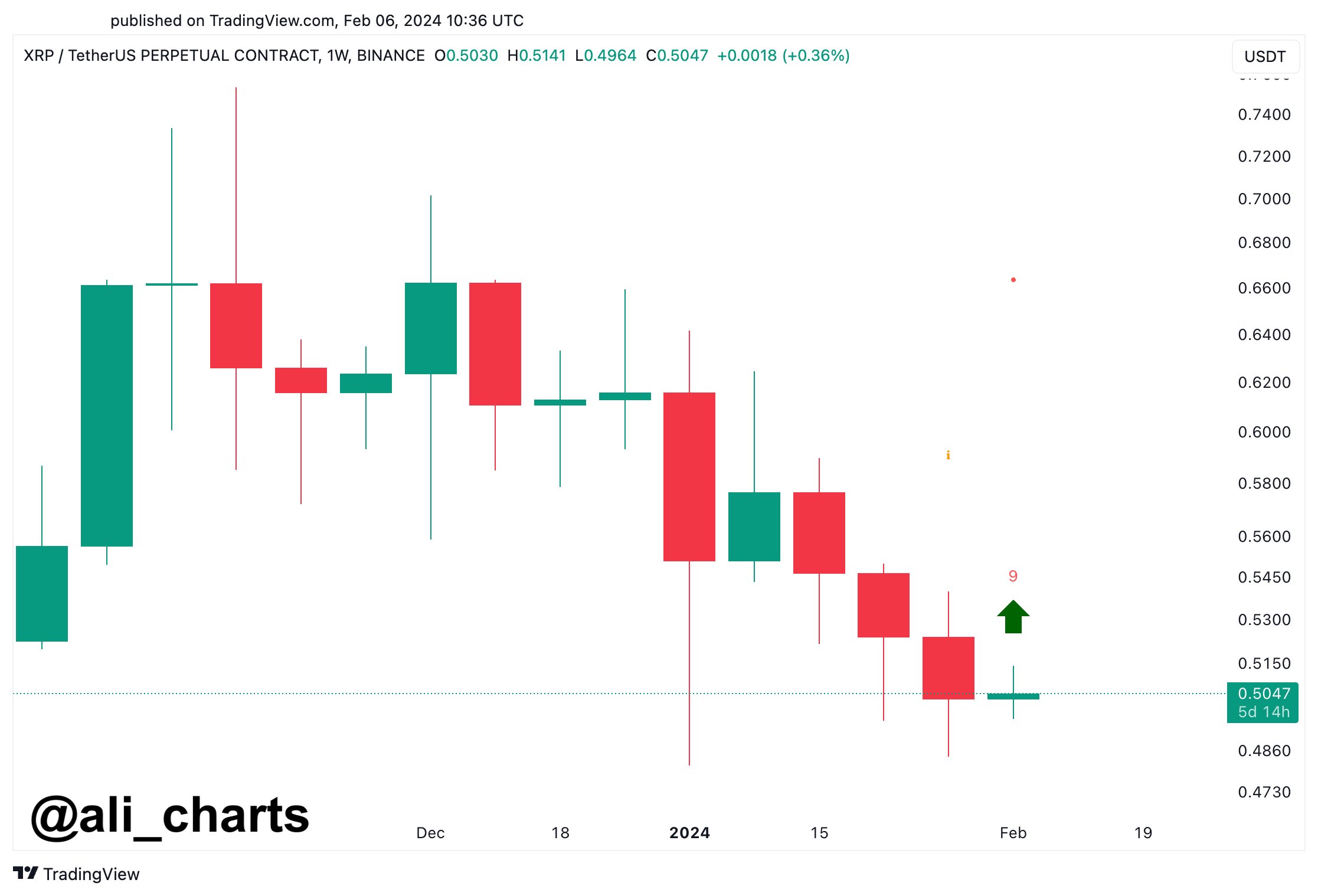

new post At X, analyst Ali discussed a buy signal forming in the weekly price of XRP. The relevant indicator is the “Tom Demark (TD) Sequential”, a technical analysis tool to pinpoint possible reversal points in the price of any asset.

This indicator consists of two steps: The first stage is called “Setup” and lasts for 9 candles. At this stage, up to 9 candles with the same polarity are counted, and after the 9th candle, it can be assumed that the product has hit a high or low point.

Once the setup is complete with 9 green candles (the main trend is bullish), the indicator suggests a shift in the bearish direction. Likewise, a red candle means a buy signal for that asset.

The second stage of the TD Sequential is the “Countdown”, which works identically to the setup except that it lasts for 13 candles. Another price reversal may have occurred after these 13 candles.

A previous type of TD Sequential phase was recently completed for XRP. Below is a chart shared by an analyst showing the TD Sequential setup forming in the weekly price of the cryptocurrency.

Looks like the phase has finished with nine red candles for the asset recently | Source: @ali_charts on X

The graph shows that this TD Sequential setup for the 7-day price of the cryptocurrency has formed as a red candle as the price of the coin has been struggling recently.

Past patterns may suggest that the asset has now reached a possible bottom. Ali suggested that XRP is “poised for a 1-4 week uptrend.”

XRP has continued to decline since the start of the year.

2024 began with a sharp decline for XRP, with the asset still unable to recover as the price continued to fall, keeping the tone set by a sluggish start.

The chart below shows the coin’s performance over the past three months.

The price of the coin appears to have been going down during the last few weeks | Source: XRPUSD on TradingView

There was a brief relief rally for

After all the downward trends since then, the cryptocurrency is currently trading around $0.50, which is down nearly 18% year-to-date.

Featured image from Shutterstock.com, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.

Source: NewsBTC.com