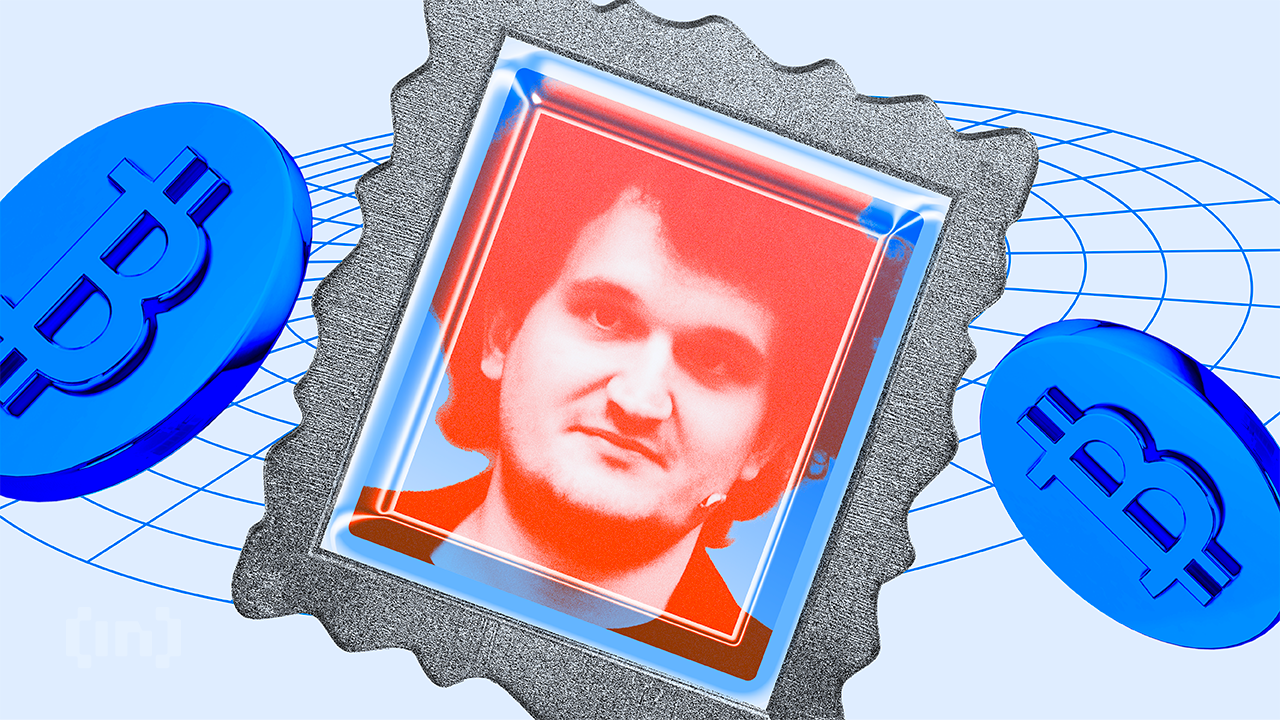

FTX founder Sam Bankman-Fried could face 50 years in prison.

The downfall of Bankman-Fried, who was convicted last November of masterminding what prosecutors called “the largest financial fraud in American history,” is a story of failed ambition set against the backdrop of the cryptocurrency boom.

Sam Bankman-Fried sentenced to up to 50 years in prison

The core of the prosecution’s argument rests on the fraudulent activities of Sam Bankman-Fried, which led to the spectacular collapse of cryptocurrency exchange FTX. A jury in Manhattan federal court found him guilty on all charges, including defrauding investors, customers and lenders. This has destabilized the once booming cryptocurrency market.

Prosecutors painted a damning portrait of Bankman-Fried’s recent life, describing it as marred by “unrivaled greed and arrogance.” They claim his actions were risky and a deliberate ploy to gamble billions of dollars with others.

Despite the severity of his actions, Sam Bankman-Fried has not admitted wrongdoing. This is a position that will only make the lawsuit against him worse.

“Even now, Bankman-Fried refuses to admit that what he did was wrong. In recent years, his life has been filled with unparalleled greed and arrogance. ambition and rationalization; He takes risks and repeatedly gambles with other people’s money,” prosecutors wrote.

In contrast, Bankman-Fried’s attorneys argued for leniency and suggested a prison sentence of just over five to six years. They claim that most FTX customers will recover their lost funds and that Bankman-Fried was not intentionally trying to commit fraud.

However, this defense appears to be shaky compared to the weight of the evidence presented during the trial. It includes testimony from several of Bankman-Fried’s closest associates who later became witnesses for the state.

Read more: FTX collapse explained: How did Sam Bankman-Fried’s empire fall?

The impending sentencing on March 28 will close this chapter of Bankman-Fried’s life and set a precedent for regulating and overseeing the cryptocurrency industry. U.S. Attorney Damian Williams emphasized the age-old nature of the corruption exposed in the case, reflecting that while the players and platforms may be new, the fraud perpetrated is as old as time.

“Sam Bankman-Fried perpetrated one of the greatest financial frauds in American history. The cryptocurrency industry may be new. Players like Sam Bankman-Fried may be rookies. But this type of corruption is as old as time itself,” said Attorney Williams.

Read more: Top 8 Centralized Exchange Tokens You Need to Know in 2024

As Bankman-Fried prepares to appeal his conviction and sentence, the outcome of this case could define the future trajectory of regulatory oversight in the cryptocurrency industry.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.