- According to analyst forecasts, the USDT dominance pattern hints at the upcoming altcoin season.

- Solana’s declining metrics and performance indicate bearish sentiment, with market fundamentals not yet supporting a rally.

The altcoin market has had a roller coaster ride throughout 2024, surpassing $1.27 trillion in March before continuing its decline. Since then, the market has formed a series of lower highs and lower lows, indicating an overall bearish trend.

Despite the occasional appreciation, this was not enough to offset the losses at the start of the year. Most recently, altcoin market cap reached $921 billion at the end of last month, but has since retreated to $872 billion.

This downward trend has sparked speculation about a potential altcoin season. Notably, a cryptocurrency analyst known as Mustache shared an optimistic view on the upcoming altcoin season based on his analysis of Tether (USDT) dominance.

Technical patterns indicate a bullish trend in the altcoin market.

Mustache on social media platform highlighted USDT’s dominance is currently forming a “rising expanding wedge” pattern, which usually means bearish.

Source: X’s Mustache

The analyst noted that USDT has been stuck in this pattern for over six months and suggested that this could signal a bearish “backtest” phase. Accordingly, Mustache believes that the long-awaited “altcoin season” could emerge, providing potential opportunities for altcoin holders.

For context, a rising expanding wedge is a bearish reversal pattern characterized by two diverging trend lines that widen as they move upward. This indicates increased volatility and indecisiveness within the market. Typically, when an asset or indicator forms this pattern, it suggests a possible downside breakout in the future.

In the context of USDT dominance, a bearish breakout could signal capital flowing back into altcoins, potentially triggering an altcoin rally or “altcoin season.”

Solana Use Cases

While the possibility of an altcoin season approaches, validating this possibility requires a closer look at the performance and fundamentals of the major altcoins. For example, Solana (SOL), one of the major altcoins on the market, has faced serious difficulties in recent weeks.

Solana has seen its value and usage metrics continue to decline over the past week. The altcoin has lost 6.2% in price over the past 7 days, with a further 4.2% decline over the past 24 hours.

SOL was trading around $141.51 at press time, reflecting a bearish trend and raising questions about its near-term outlook.

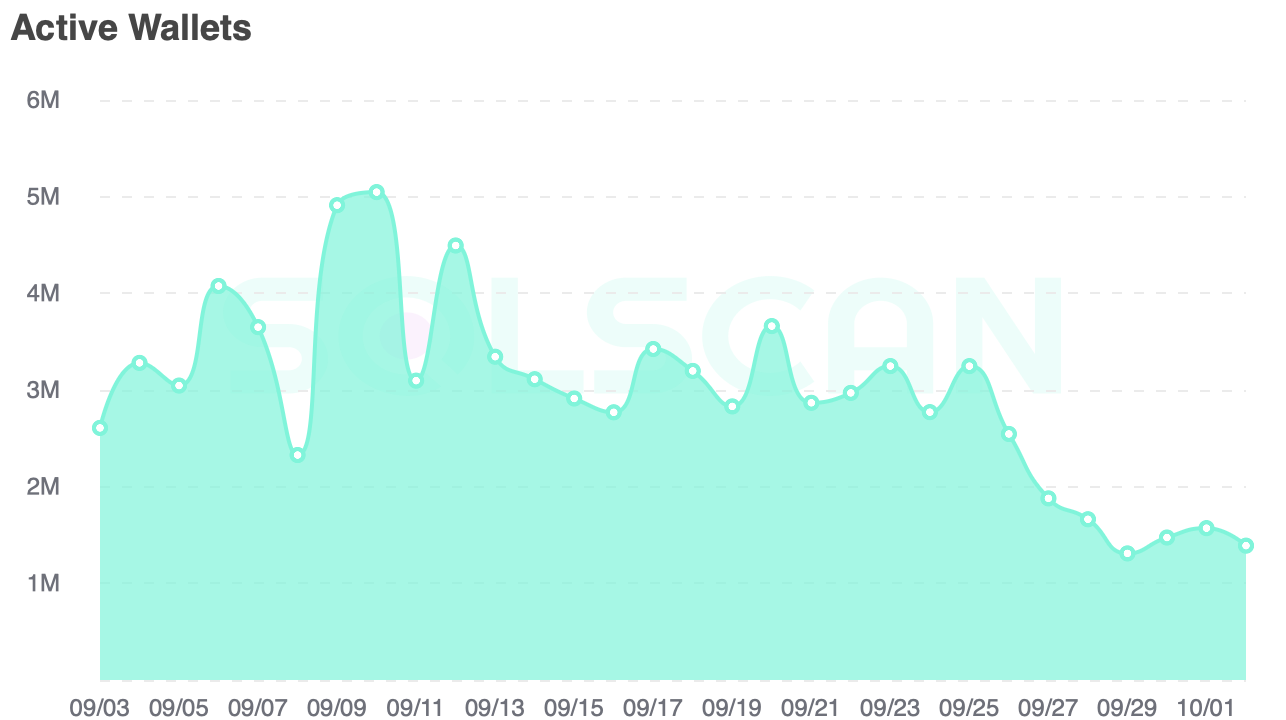

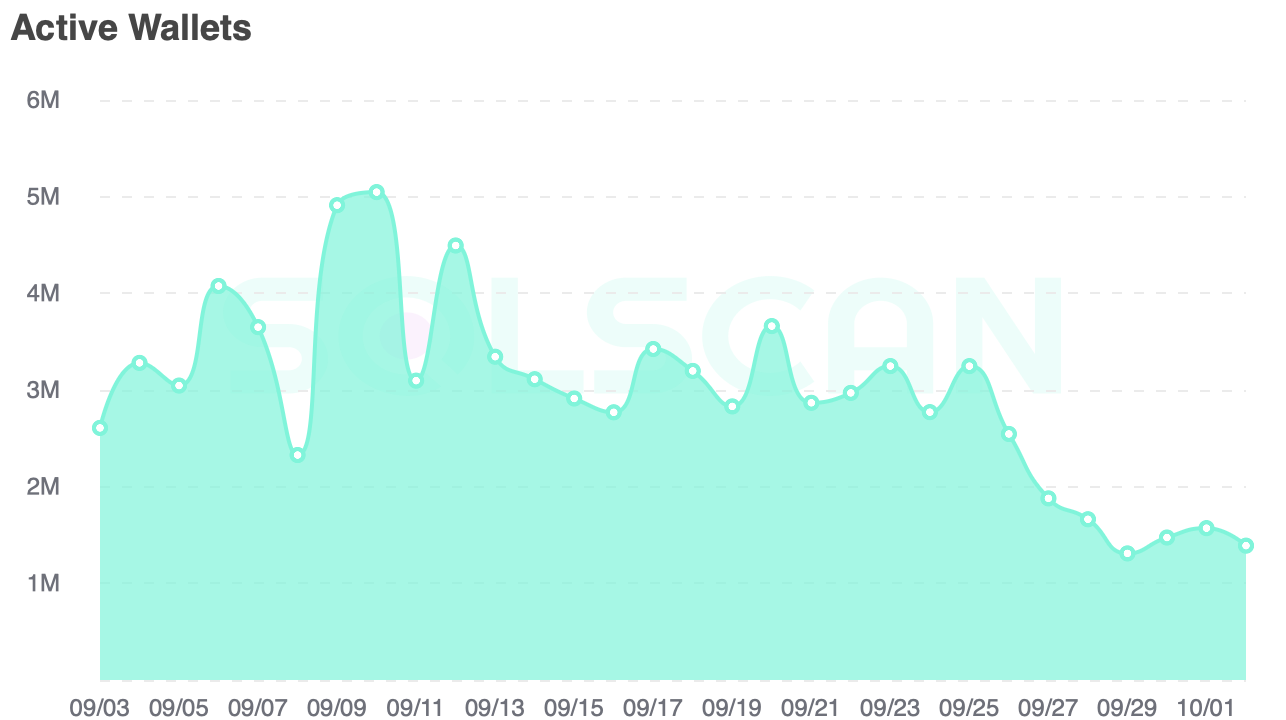

More concerning is the sharp decline in Solana’s active addresses, a key indicator reflecting retail investor participation and network activity.

data Data from Solscan shows a significant decline in active addresses, from more than 5 million last month to about 1.3 million today.

Source: SolScan

This sharp decline in active addresses signals a waning interest in Solana’s network activity, which could be caused by lower network participation, lower trading volume, and potentially lower confidence among individual investors.

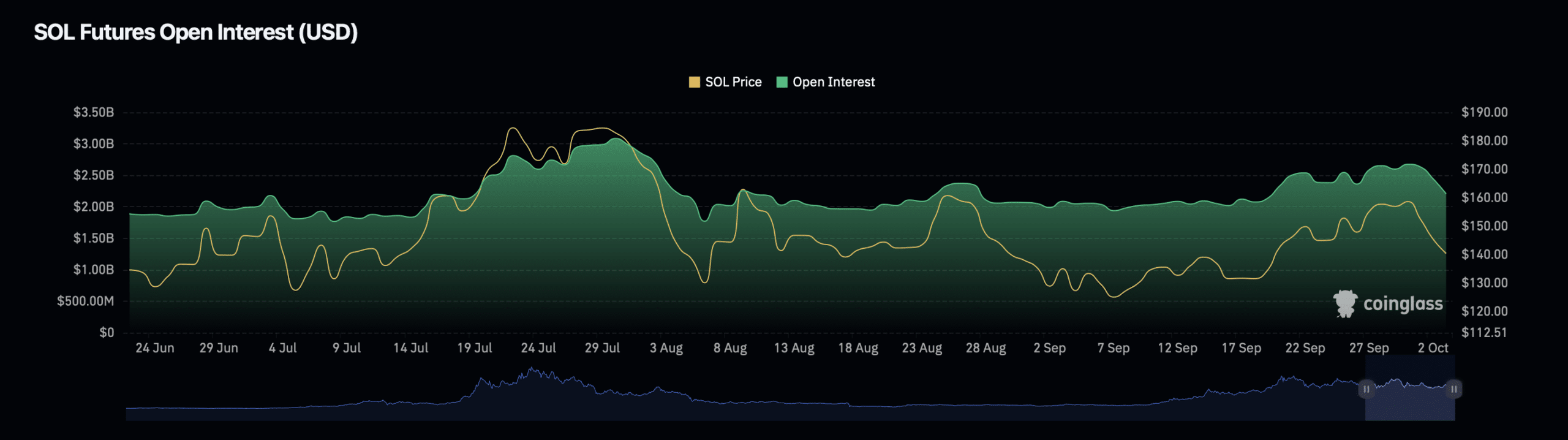

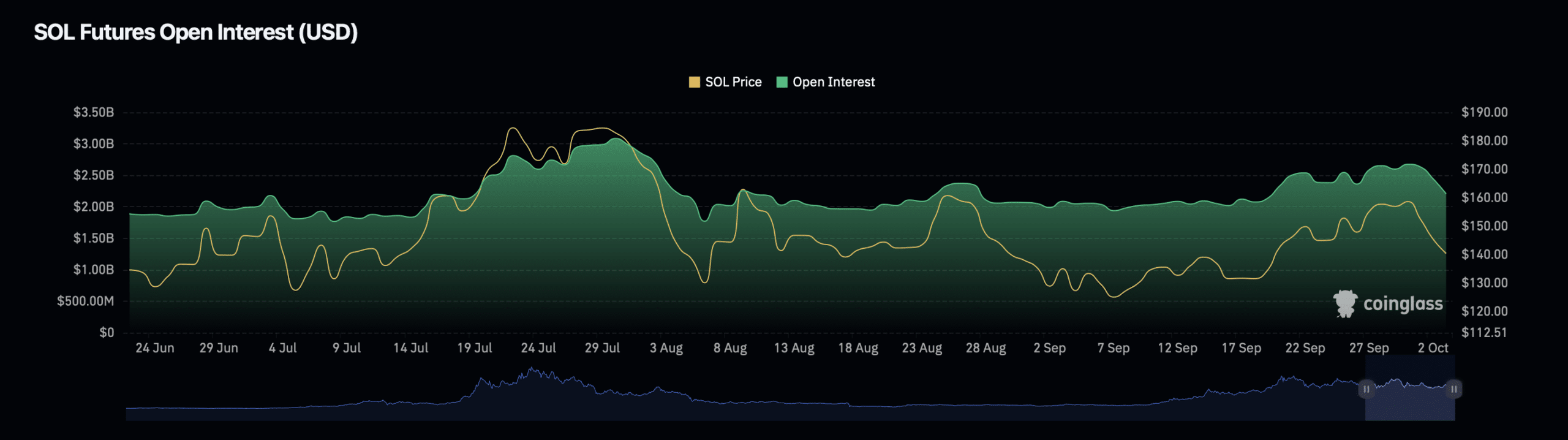

Moreover, Solana’s Open interest It has also experienced a decline, with its current value down about 7% to $2.27 billion. Open Interest reflects the total number of futures contracts or options outstanding, and a decrease in this number may indicate reduced trading activity or a lack of speculative interest in the asset.

Source: Coinglass

As a result, Solana’s open interest decreased by 29%, reaching a current value of approximately $7.25 billion.

Read Solana (SOL) price prediction for 2024-2025

This further highlights the decline in market interest in the asset, with lower trading volumes contributing to a less favorable market environment for SOL.

Overall, with several pullbacks spotted in the use cases for the altcoin market (SOL), analysts like Mustache are suggesting bullish momentum for the altcoin market, but fundamentals are not yet in line with this bullishness seen from a technical perspective. It appears to be.