- TON has earned over 160% more than BTC so far.

- TON also saw more activity in some on-chain metrics.

Toncoin (TON) has emerged as the only layer 1 network that can effectively compete with Bitcoin (BTC) since the beginning of this year.

TON has outpaced BTC by over 160% and boasts a greater number of active addresses.

Despite these achievements, traders appear to lack confidence in TON as sentiment surrounding the coin turns negative.

Toncoin is up more than 100% compared to Bitcoin.

AMBCrypto’s analysis of Bitcoin and Toncoin price trends shows that Toncoin has surpassed BTC in terms of gains.

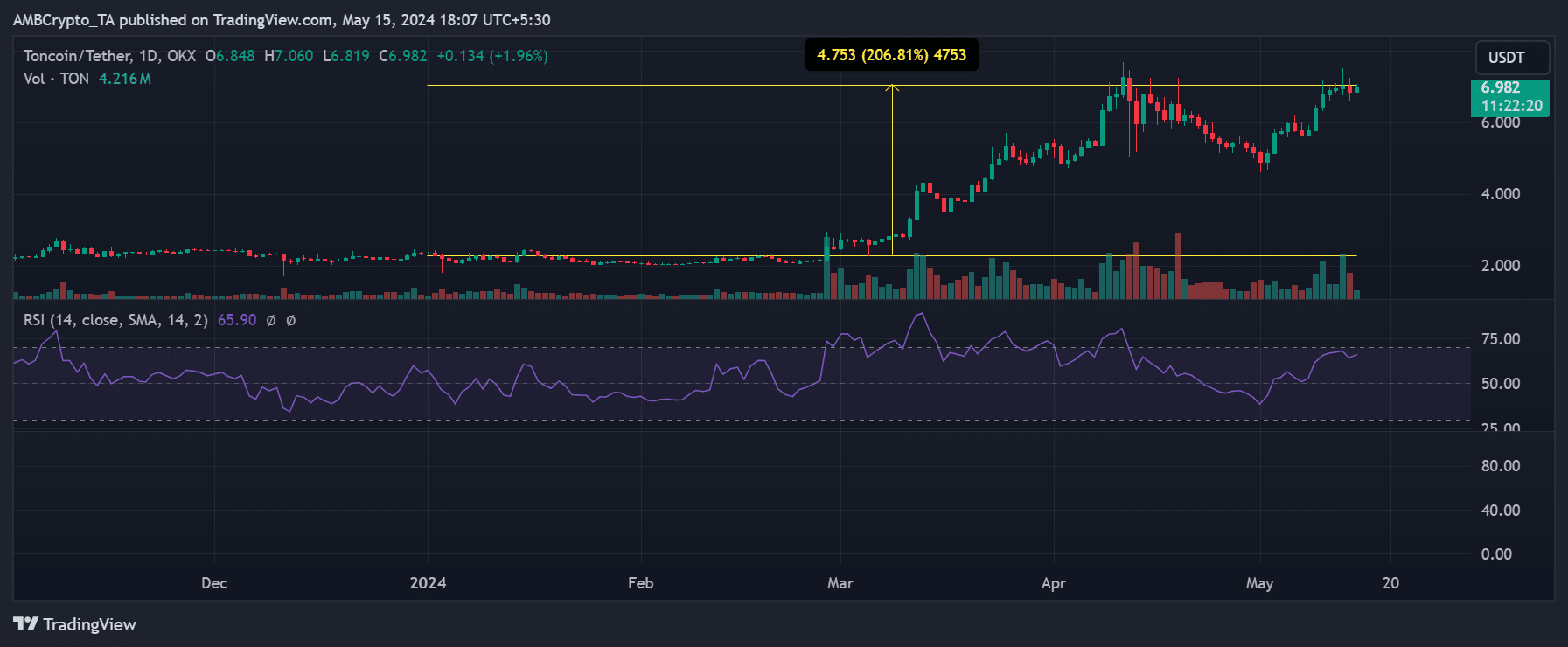

TON started the year at around $2.3 and has experienced a significant upward trend in recent months, reaching around $6.8 at the time of this writing.

Using our price range tool, it is clear that TON has surged more than 200% from the beginning of the year to press time.

Source: TradingView

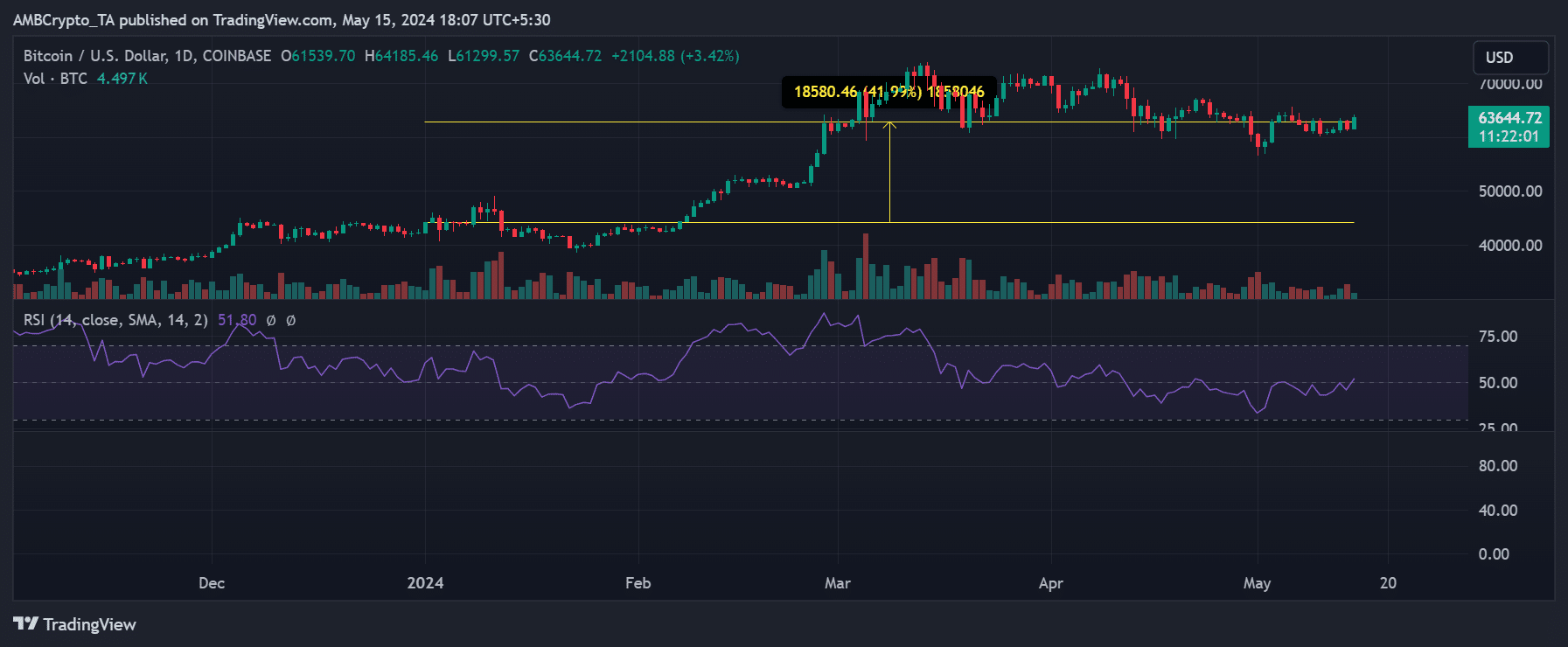

Conversely, BTC started the year at around $44,220 and rose to around $62,400. During the same period, it recorded growth of approximately 42%.

Comparing the charts, Toncoin has grown almost 160% more than BTC.

Source: TradingView

Additionally, RSI (Relative Strength Index) analysis showed that BTC was below the neutral line at the time of evaluation, suggesting a bearish trend.

In contrast, Toncoin’s RSI was above 60, indicating a strong bullish trend.

Toncoin sees more active addresses than Bitcoin.

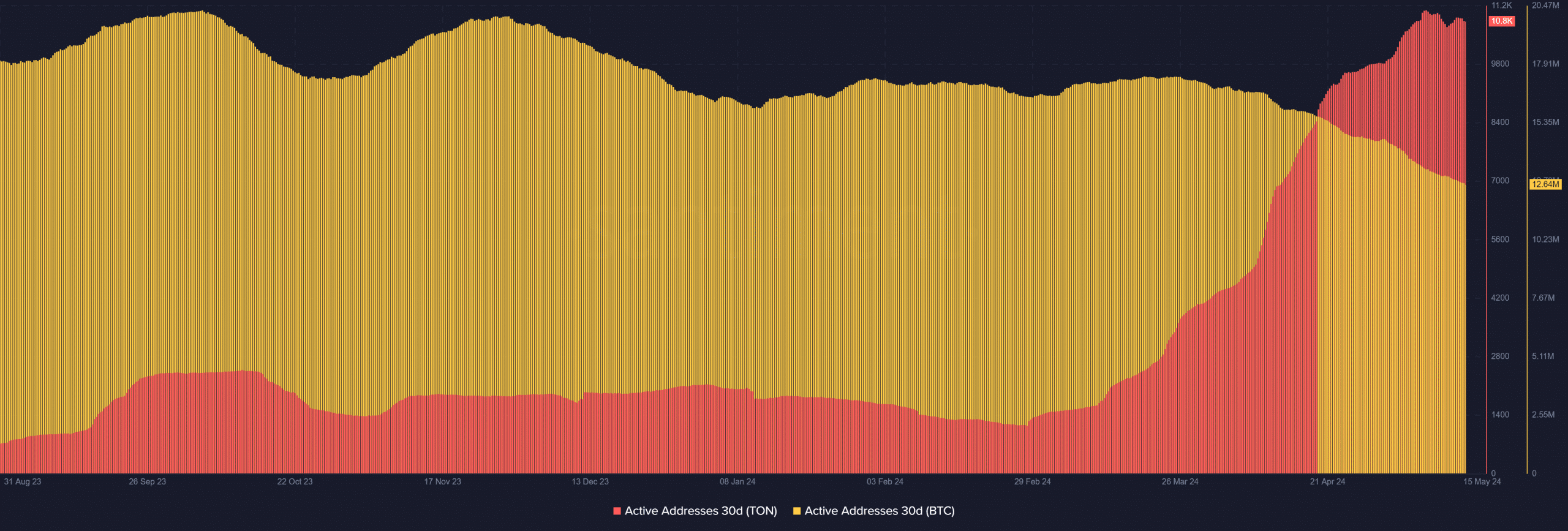

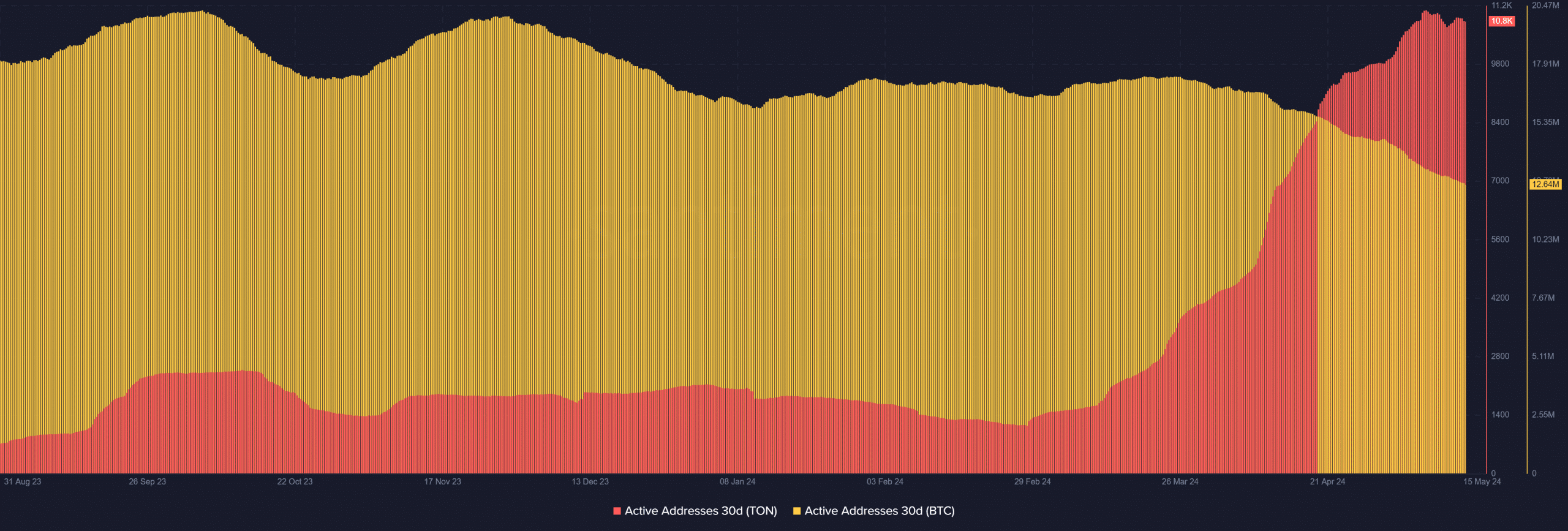

An analysis of Toncoin’s active addresses over the past 30 days shows a surge in activity surpassing Bitcoin.

Starting in March, Toncoin’s active addresses began to increase steadily, peaking in May and maintaining this high level.

Toncoin started with around 1,000 active addresses in March and has now surpassed 10,000 active addresses, with over 10,800 recorded at the time of this writing.

Source: Santiment

In contrast, Bitcoin’s Active Addresses indicator is on a downward trend, although the overall numbers are higher.

On April 15, Bitcoin hit nearly 16 million active addresses, but this number had fallen to around 12.6 million by press time.

This comparison highlighted that Toncoin is experiencing relatively more activity and growth, despite Bitcoin having a greater number of active addresses overall.

Bitcoin emotionally outperforms Toncoin.

AMBCrypto’s survey of Coinglass’ Bitcoin funding rate indicated positive sentiment at press time.

Despite the slight decline, it remained around 0.0018%, suggesting that buying power continues to lead the trend.

Read Bitcoin (BTC) Price Prediction for 2024-25

On the other hand, Toncoin’s funding rate revealed negative sentiment. At the time of writing, the funding rate is around -0.047%, indicating a wide spread of sellers in the market.

These indicators reflected a scenario in which more participants are betting on Bitcoin price increases. At the same time, Toncoin had a higher number of traders taking short positions.