- The correlation between OI, price and active addresses indicates a drop to $4.93 is likely.

- TON may soon begin a slow recovery, so you may not reap the rewards of late short selling.

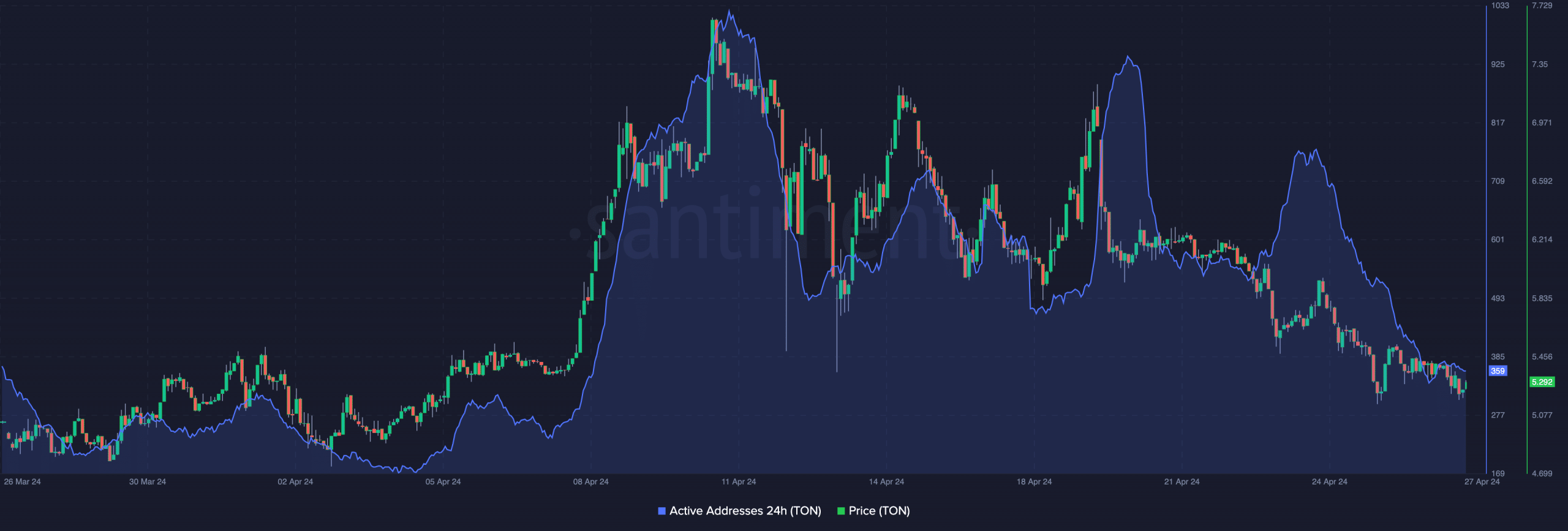

According to analysis by AMBCrypto, the number of active addresses on the Toncoin (TON) network has declined after reaching several peaks. At press time, the number of addresses active 24 hours a day was 359. However, on April 24th the number doubled, and on April 11th the indicator reached an even higher level.

The increase in active addresses means that the number of unique addresses being traded on the network will skyrocket. Therefore, this decrease could be a sign of decreased deposits and withdrawals of Toncoin.

Interestingly, TON’s price and network activity appear to have a strong correlation. In fact, based on the chart below, one could argue that the price of TON goes up almost every time an indicator goes up on the chart.

Source: Santiment

The indicator finds a decline below $5.

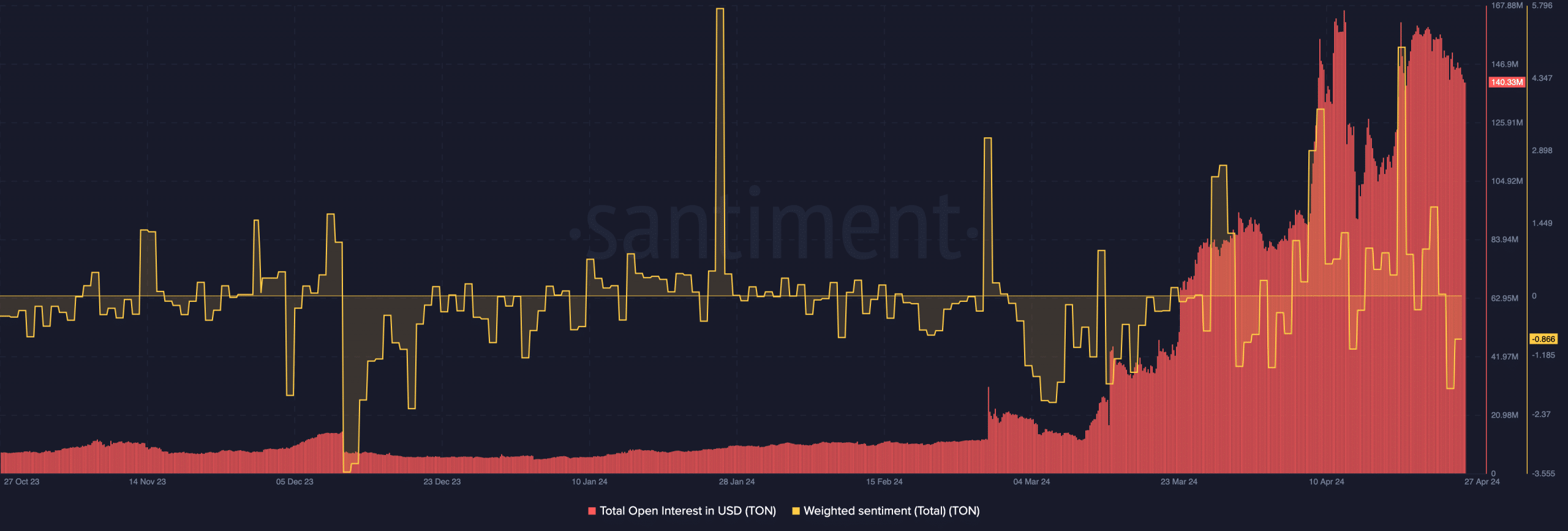

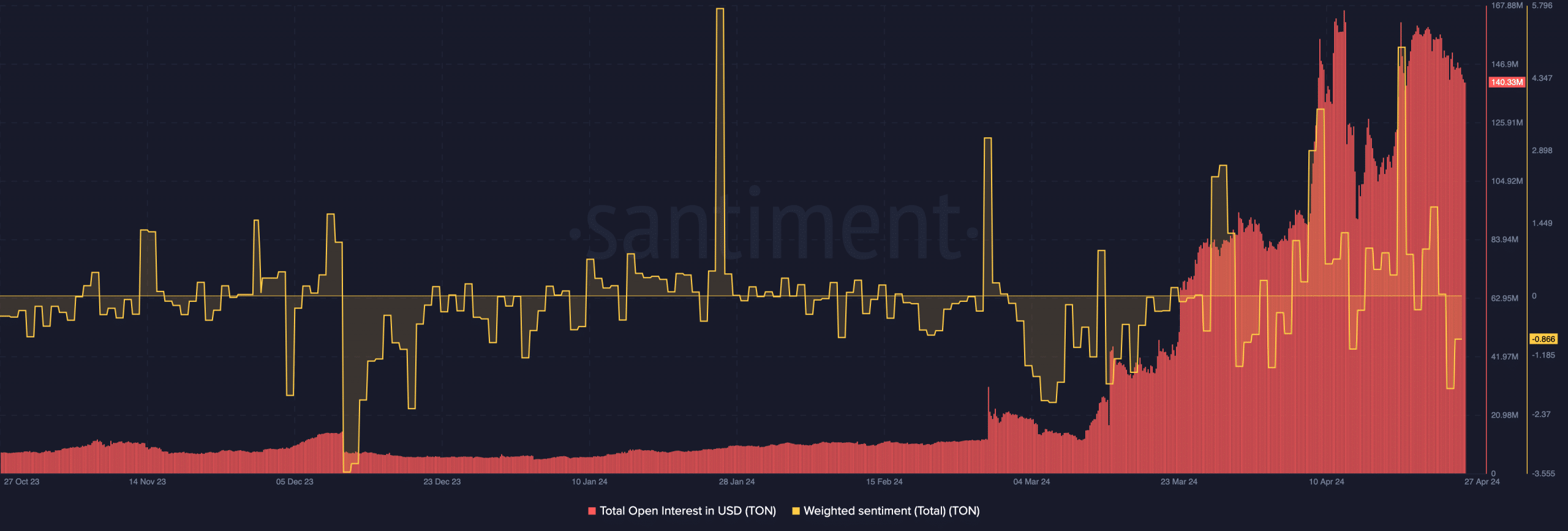

We also took other steps as soon as network activity ceased. With these connections, it may not be appropriate to predict a further decline in the value of TON. In this case, the price of TON could reach $4.93. It is worth noting here that open interest (OI) has also been trending downward on the chart.

Contextually, OI increases or decreases depending on net position. If it increases, it means buyers are being aggressive and there is more liquidity flowing into the contract. On the other hand, a decline means the seller is an aggressive seller.

At press time, Toncoin’s total OI had fallen to $140.33 million. From a trading perspective, this value could result in the token being dumped on native support. Therefore, the value of TON may fall below $5 in the short term.

Moreover, market participants who were once confident in the performance of cryptocurrencies have switched to other options. Evidence for this appeared in Weighted Sentiment. At press time, Weighted Sentiment stood at -0.866. This negative reading reinforces the aforementioned conclusion, indicating that most opinions regarding TON are bearish.

Source: Santiment

tone is not dead

If this situation continues, it may be difficult to secure demand for TON. However, if altcoins start to rise, the sentiment surrounding the token could be favorable for a price increase.

Another way to evaluate TON’s near-term potential is to look at its liquidation levels. Liquidation levels show the expected price at which large liquidations may occur.

If traders know about this, they can gain an advantage over others who do not have data. Our analysis suggests that many short positions may be liquidated if Toncoin rises to $5.78. At the same time, if TON falls to $5.02, there is a risk that long positions will be wiped out.

Meanwhile, Cumulative Liquidation Level Delta (CLLD) was negative at press time. Here, this indicator represents the difference between open bid liquidation and short liquidation.

Is your portfolio green? Check out our TON profit calculator

As it stands, the CLLD readings suggest that late short sellers trying to capture dips could be punished. This is because a sharp price drop could later trigger a bullish bias and cause TON to begin a slow recovery.