- TON formed an inverted head and shoulders pattern on the daily chart.

- Negative exchange Netflow indicated a possible upside reversal, but mixed signals still cloud the market direction.

Last week was a turbulent time for Toncoin (TON), with its market price falling 9.26%. There are signs of recovery, but progress has been minimal, with a modest gain of 0.52% over the past 24 hours.

Despite the poor performance, there remains a glimmer of optimism, with AMBCrypto noting that it is likely to have positive momentum going forward.

TON of bullish potential

At press time, TON had formed an inverted head and shoulders pattern, a classic sign of potential bullish momentum.

As shown in the chart, the pattern consists of three peaks: left shoulder, high head, and right low shoulder.

Confirmation of strength usually occurs when price breaks above the neckline connecting the two lows between the shoulders.

Currently, TON has not yet broken through the neckline. That would confirm a bullish trend with a potential target price of $5.804. If not, it could fall below the October low of $5.139.

Source: Trading View

However, it is important to evaluate on-chain indicators to determine whether a breakout is imminent.

Metrics suggest uncertainty.

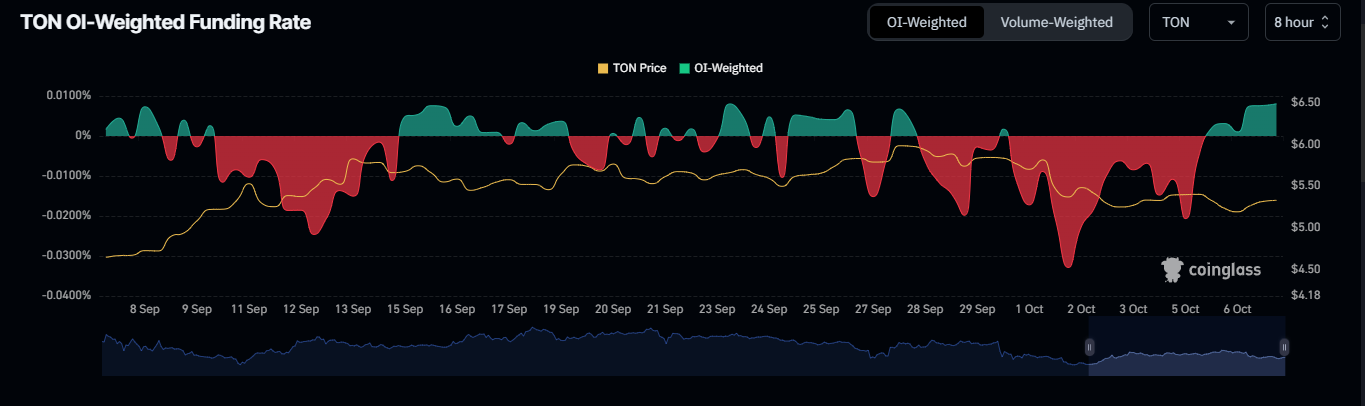

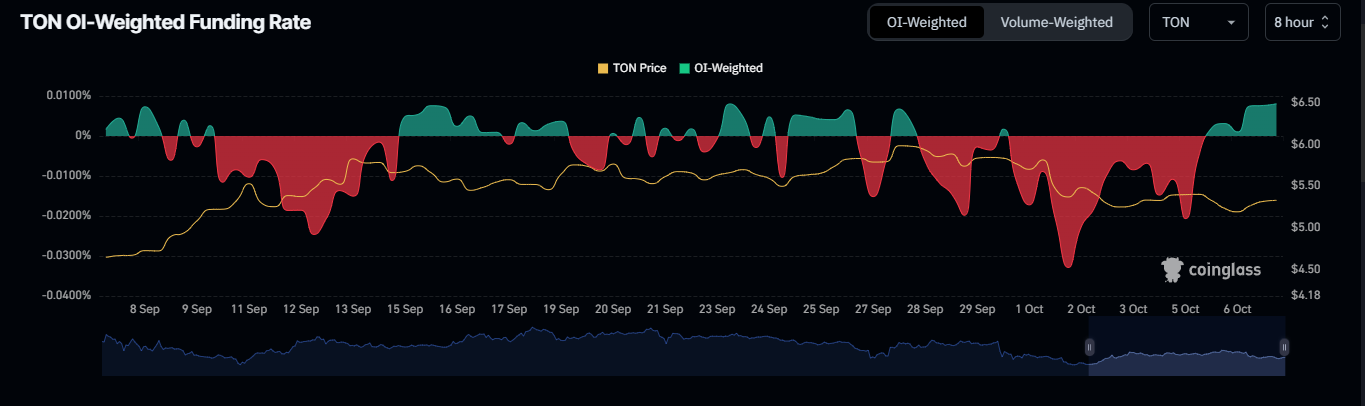

According to Coinglass, the OI weighted funding ratio remains positive at 0.0080% at press time, indicating a bullish mood in the market.

The OI Weighted Funding Rate combines the open interest rate and the funding rate to assess market sentiment and the cost of holding a long or short position in a derivative.

Source: Coinglass

This indicator points to a potential bullish move, but liquidation data suggests neutrality, suggesting a possible downward move.

Recent data shows that $268.15K was liquidated in the market, of which $146.96K was liquidated from long positions and $121.19K from shorts, reflecting a relatively balanced market.

For a bullish breakout to occur, a larger wave of short-term liquidations is needed, which is significantly different from long-term liquidations. If this does not happen, TON could fall to $5.139.

Reduced supply could lead to a breakthrough

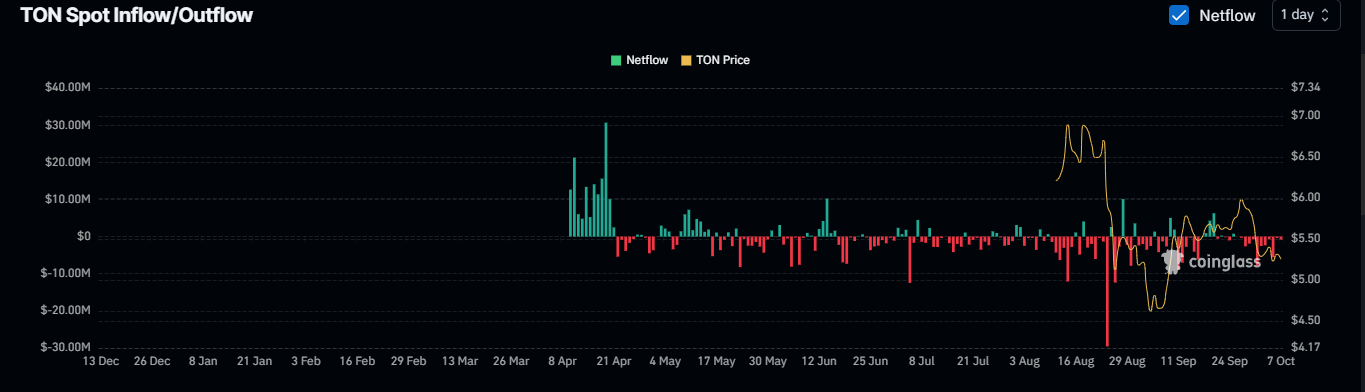

Recent data shows that a significant amount of TON has been withdrawn from several exchanges over the past seven days, which may have an impact on market dynamics.

Read Toncoin (TON) price prediction for 2024-2025

According to coin glass$19 million worth of TON has been moved off exchanges, suggesting traders are choosing to hold the assets privately rather than sell them.

Source: Coinglass

If these negative Exchange Netflows continue, the existing bullish sentiment in the market may be strengthened. This could potentially contribute to breakouts.