- Toncoin was ready for recovery, but after the whale started selling, the hope was quickly broken.

- Tokens lost 32%of their values in five days and did not relieve sales pressure.

Toncoin (TON) looked quite optimistic a week ago. It went up more than $ 3.95 local resistance at the end of March and was making a higher lowest level in the process. This suggests the potential of the strong and the recovery of $ 4.8 in the chart.

But in early April, whale activities surged. The daily deal was higher, but combined with whale activities to emphasize potential selling. Since then, Ton has shown 26.6%in eight days.

Is the seller being quite stronger than the end of March?

Toncoin Bulls’s WORRISOME display

Source: Glass Node

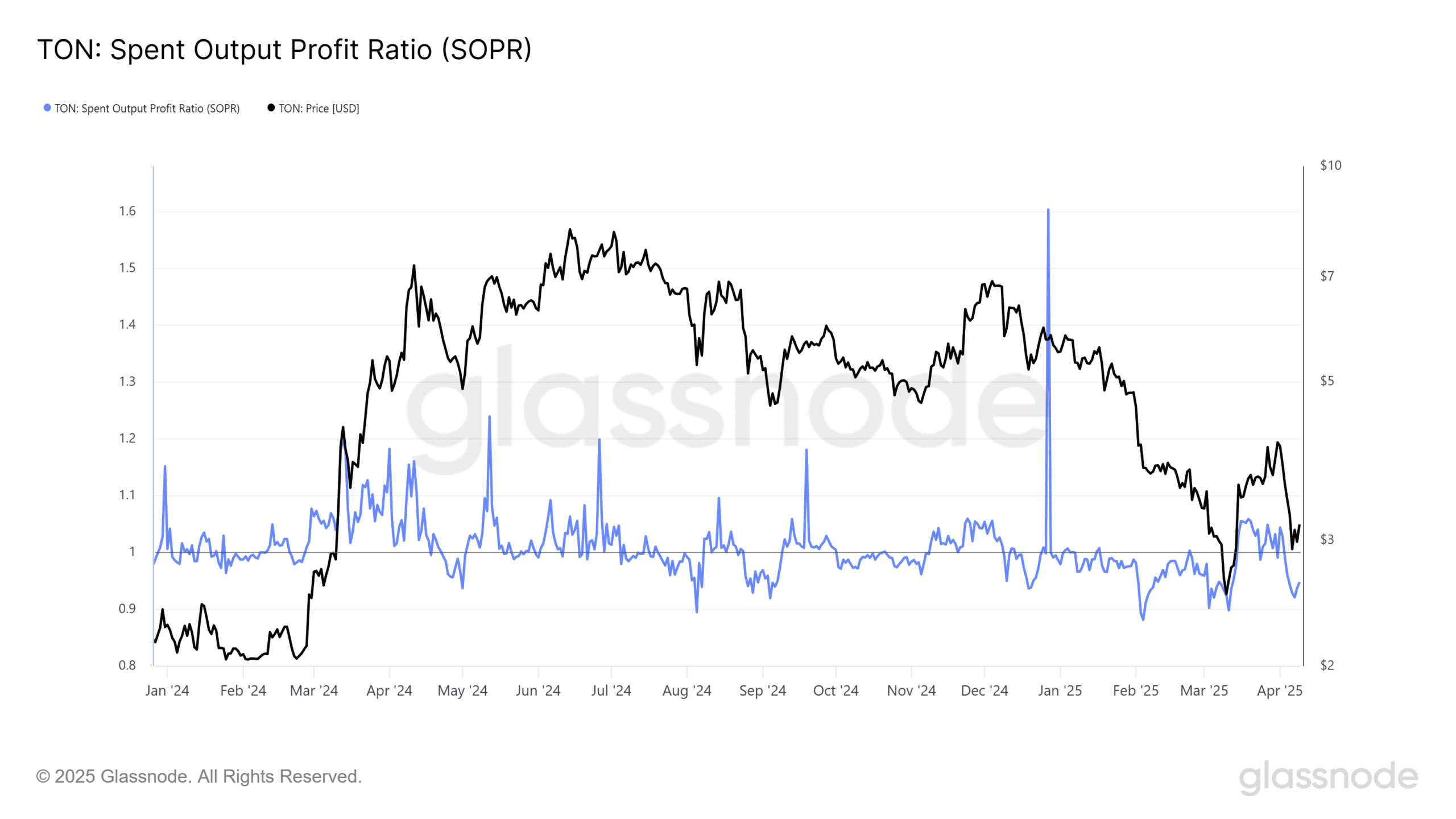

Consumed output margin (SOP) not only tracks Ton’s benefits or losses, but also compares the value of Coins with the value when creating. This is the value divided by the value of the tone.

The drop of less than 1 means that coins are being sold due to losses. By the end of March, the clear recovery of the tone has seen SOP goes up to one or more. But this rise was short life.

Source: Glass Node

Hodler Net Position Change Metric has revealed its monthly position change for long -term holders. Derived from Coin Liveliness Metric, this product allows you to calculate net position metrics to understand if the market is witnessing the transition from accumulation to distribution.

In February and March, the price falls, which seems to be accumulating. In the last 10 days, the net position change is much lower, indicating that the holder is selling and the potential distribution stage is in progress.

This seemed to be well connected to the whale activity and the recent tone weakness.

Source: TradingView Ton/USDT

The optimistic market structure occurred when it surpassed the lowest of $ 3.95 on March 27. The CMF was +0.05 or more. From mid -March, a signal to announce strong capital inflow. This turned around quickly.

Toncoin decreased 32% in five days, and the current outlook is weak. At the time of writing, the $ 3.5 support area did not stop tone bears, and CMF was -0.14 to indicate high sales pressure.