Before Toncoin (TON) recently bounced to $6.75, the cryptocurrency had experienced a 12% drop over the past six days. TON initially fell below the critical level and has not been able to rise any higher since.

According to this analysis, it may be difficult for the token to break this resistance, so the price may remain below $7 for the next few days.

Toncoin Metric Reveals Potential Selloff

According to IntoTheBlock, the number of profitable holders has not reached its previous high due to the decline in TON last month. Also, the In/Out of Money Around Price (IOMAP) shows where the price is likely to go, and the data shows a significant sell barrier.

The IOMAP group deals with holding crypto assets based on unrealized losses or gains. If a large number of addresses are in unrealized losses, the price range acts as resistance. However, if a larger number are in profits, it becomes a support point for that crypto.

For Toncoin, 2,290 addresses that bought 1.15 million tokens at an average price of $7.05 are currently in unrealized loss. This is higher than the 1,510 addresses that bought 636,690 TON tokens at an average price of $6.61.

Read more: 6 Best Toncoin (TON) Wallets in 2024

That is, if the TON price continues to bounce and reaches at least $6.93, a large number of sell orders may occur at these addresses, which will likely cause the price to drop.

If this happens, the next level for TON could be around $6.43 and $6.52. Exchange supply provides further evidence of this.

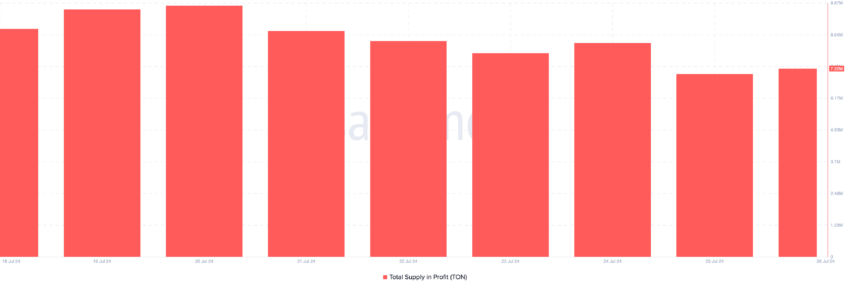

On July 25, Toncoin’s exchange supply was just under 7 million. However, at the time of writing, the figure has increased to 7.32 million. The increase in this metric means that investors are moving more tokens out of their own custody, indicating potential selling pressure.

If the number were lower, there would be less selling pressure and the price would likely spike. However, if this exchange supply continues to increase, the aforementioned TON price drop could be validated.

TON Price Prediction: Possible Rebound or Further Downside?

Between May and July 21, TON formed an uptrend line that ensured the price would not fall below $6.03. However, press time data displayed on the daily chart shows that the price fell below the trend line and the support at $7.00.

The Relative Strength Index (RSI) supports this condition, as the reading is below the neutral line. If the RSI is below the midpoint, it means that the momentum around the cryptocurrency is bearish. Therefore, the price is likely to continue its downtrend.

Another indicator that supports the bearish bias is the Ichimoku Cloud. The Ichimoku Cloud shows support and resistance levels and identifies the trend direction. If the cloud is below the price, the trend is bullish.

However, in the case of TON, the cloud is above the price, indicating a downward momentum. As shown in the chart below, the price of Toncoin can fall to $6.57, which is the 23.6% Fibonacci correction position.

Read more: What is Notcoin (NOT)? A Guide to Telegram-Based GameFi Tokens

However, if buying pressure increases, this prediction may be invalidated. In that case, TON may bounce to $7.18 or even rise to $7.45.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions may change without prior notice. Always do your own research and consult with a professional before making any financial decisions. We inform you that our Terms of Use, Privacy Policy, and Disclaimer have been updated.