- AVAX surged 8.2% last week amid strong bullish signals.

- Analysts forecast a potential upside in the coming months with price targets of $130 and $228.

Amid the overall downturn in the global cryptocurrency market, Avalanche (AVAX) has shown green performance and emerged as one of the top 20 cryptocurrencies by market capitalization.

Despite widespread market declines, AVAX has seen notable performance gains, with assets up 8.2% over the past week.

This positive momentum has continued over the past 24 hours, with the asset registering a further 1.2% gain and currently trading around $29.46 at the time of writing.

What is AVAX’s next goal?

Amid AVAX’s green performance, renowned cryptocurrency analyst CryptoBullet recently took to X (formerly Twitter) to share his perspective on Avalanche’s current price movements.

According to analysts, AVAX broke out of a months-long “Falling Wedge” pattern, which is a bullish technical signal in market analysis.

A falling wedge usually occurs after a long downward trend when prices begin to consolidate and form lower highs and lower lows, similar to a wedge shape.

When the price breaks above the upper trend line of this wedge, it is often a sign that a bearish trend is ending and a new rally is beginning.

CryptoBullet commented on the recent breakthrough:

“AVAX has been rolling out Falling Wedge for several months. “We are expecting a good rally in the next three to six months.”

He also shared an ambitious price target for the upcoming rally, predicting that Avalanche could rise to $130, and potentially $228, depending on market conditions.

While these price targets are ambitious, they reflect the growing optimism surrounding Avalanche as the cryptocurrency market shows signs of recovery.

Avalanche’s Technology Assessment

Technical analysis suggests upside potential for AVAX, but gauging the potential for such significant price upside requires an in-depth examination of the asset’s fundamentals.

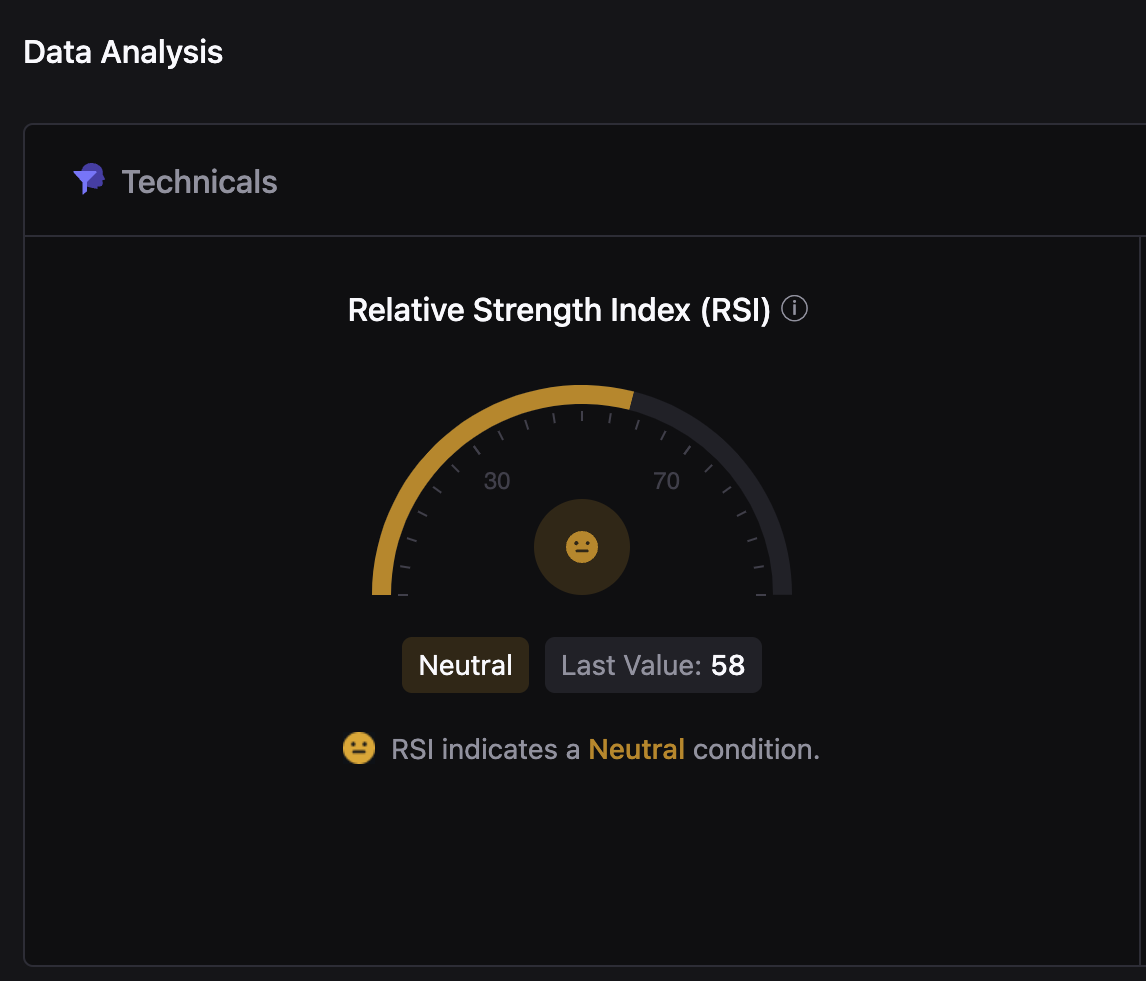

One important indicator to consider is the Relative Strength Index (RSI), which measures the momentum of asset price movements.

RSI oscillates between 0 and 100, with anything above 70 indicating overbought conditions and anything below 30 indicating oversold conditions.

Source: CryptoQuant

At press time, the Avalanche’s RSI was 58, according to data from CryptoQuant.

This shows that the asset is neither overbought nor oversold, but rather neutral, giving it room to move up or down depending on broader market factors.

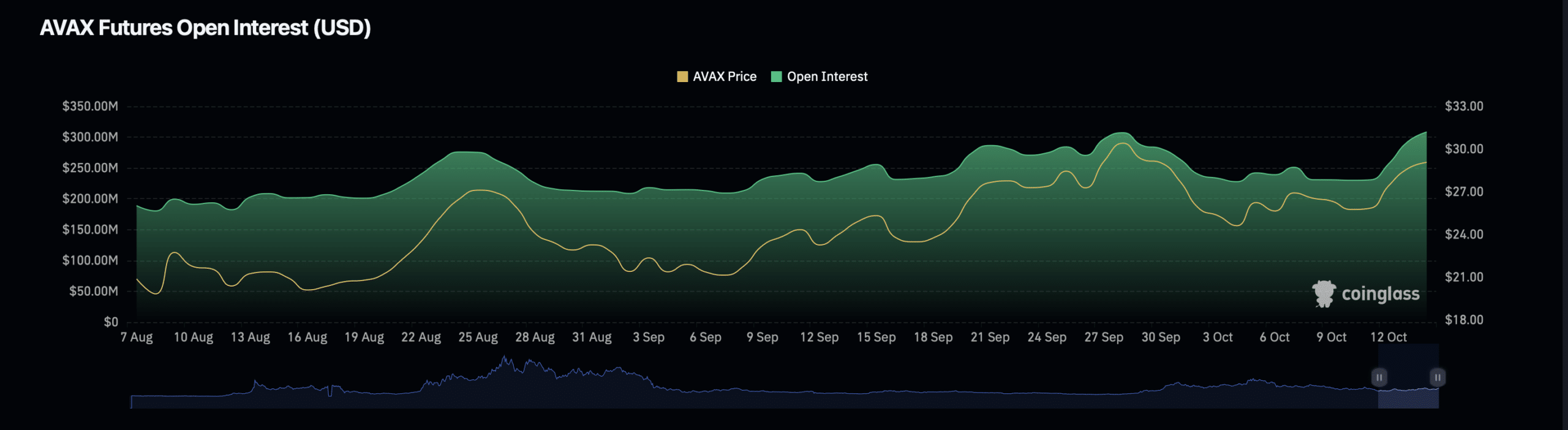

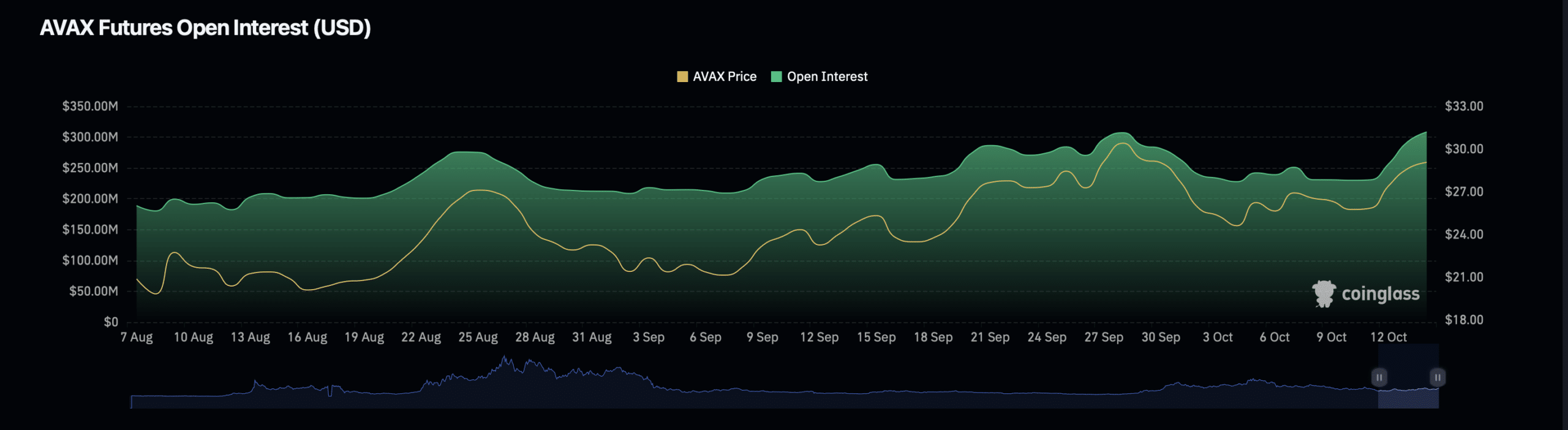

Besides RSI, another important indicator is open interest, which measures the total number of open futures contracts for an asset.

AVAX’s open interest fell 2.33% to $299.64 million at press time, according to data from Coinglass.

Source: Coinglass

Read Avalanche (AVAX) price prediction for 2024-2025

However, this decline was offset by a significant 27% increase in AVAX’s open interest volume to $541.01 million.

This means that participation in the AVAX derivatives market is increasing, a factor that can influence asset price movements in the short term.