A widely respected cryptocurrency analyst believes that an artificial intelligence (AI) altcoin project is poised for a bull run.

Analyst known by the pseudonym The Flow Horse says 199,800 followers on social media platform

OI is an indicator that tracks the amount of open leveraged long and short positions in cryptocurrency assets.

According to analysts, FET bulls are aggressively taking over supply coming into the market using leveraged long positions.

“FET could be a decent bounce from here. “Increased OI on seller absorption, high volume relative to January lows with significantly skewed bids/asks.”

Looking at his chart, FET is in a position to potentially turn the $0.56 level into support.

As of this writing, FET is trading at $0.566, up more than 4% in the last 24 hours.

Next is the merchant proposal April’s Bitcoin (BTC) halving event may be more bullish than previous events. That’s because financial giant BlackRock, which currently has about $9 trillion in assets under management (AUM), is likely to focus on marketing its recently launched spot BTC exchange-traded fund (ETF).

“This Bitcoin halving is unlike any other because it is the first time a trillion-dollar asset manager is marketing it.”

Bitcoin is trading at $43,167 at the time of writing and has risen slightly over the past 24 hours.

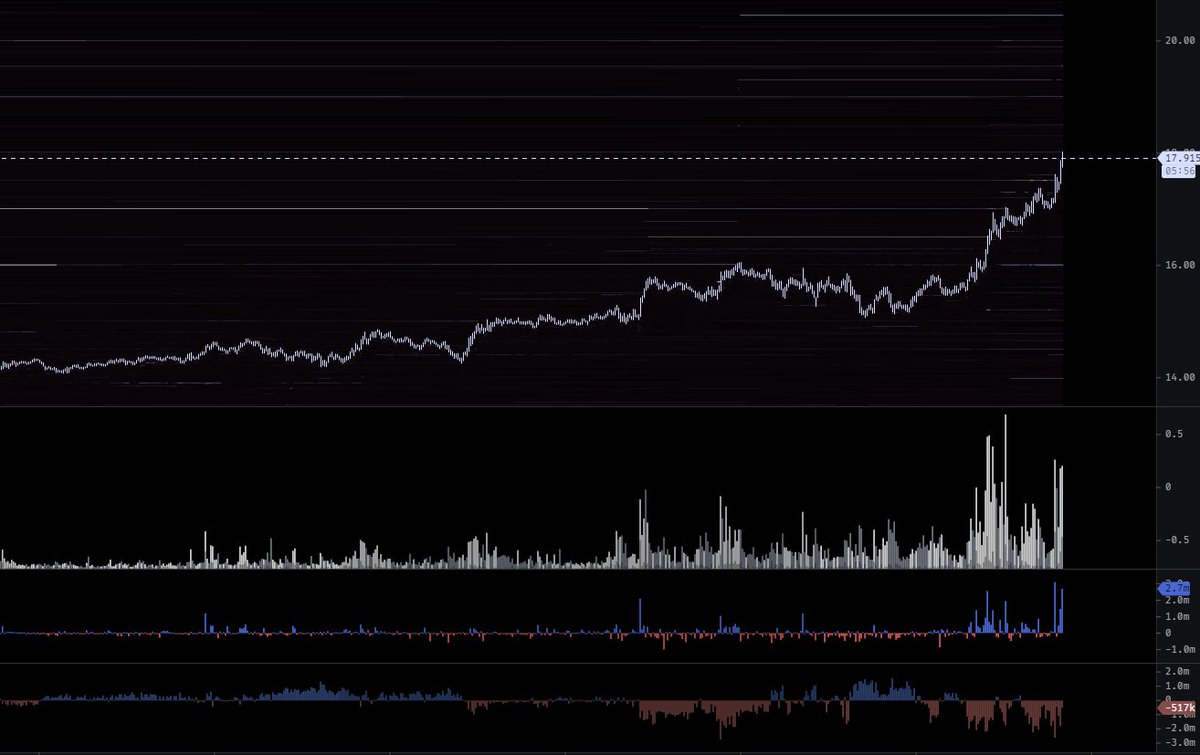

The next deck has a merchant. Called Decentralized oracle provider Chainlink (LINK) appears to be maintaining its upward trend with the token reaching the $18 resistance level.

“Impressive continuous movement. LINK I think I closed the bag too early.”

LINK is trading at $17.83 at the time of writing and has fallen slightly over the past 24 hours.

Finally, the merchant turned around. optimistic On Solana-based decentralized exchange (DEX) aggregator Jupiter (JUP).

“I started buying some JUP. Mindshare is high and I think the downside of the airdrop mechanism is that it ultimately creates an unbalanced auction. In the short term, airdrop play is pretty predictable…

Volume Weighted Average Price (VWAP) is your friend, especially in newly listed alternatives. JUP VWAP is already locked onto the catalyst, which is very useful. Whatever happens in the long term, I know this is going to give us a really good long-term setup.”

Traders use VWAP to help determine whether an asset is trading underbought or overbought based on intraday price action.

Jupiter is trading at $0.579 at the time of this writing, down more than 3% in the last 24 hours.

Don’t miss a beat – subscribe to get email alerts delivered straight to your inbox

Check Price Action

follow us TwitterFacebook, Telegram

Daily Hodl Mix Surfing

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that your transfers and transactions are entirely at your own risk and that you are responsible for any losses that may occur. The Daily Hodl does not recommend the purchase or sale of any cryptocurrency or digital asset, and The Daily Hodl is not investment advice. The Daily Hodl engages in affiliate marketing.

Featured Image: Shutterstock/Fortis Design/VECTORY_NT/PurpleRender