- On-chain metrics show that the number of active addresses is decreasing and open interest has recently decreased.

- Technical indicators suggest that NEAR’s recent downtrend is losing steam.

NEAR is one of the worst-performing tokens on the market recently, down 16.44% over the past month and down 6.57% over the last 24 hours. This is a sign of a bearish trajectory.

However, despite this negative sentiment, market analysis suggests that the bearish momentum may be easing somewhat. This cooling off period could set the stage for a significant price rebound, potentially offsetting recent losses.

NEAR declines due to lack of interest

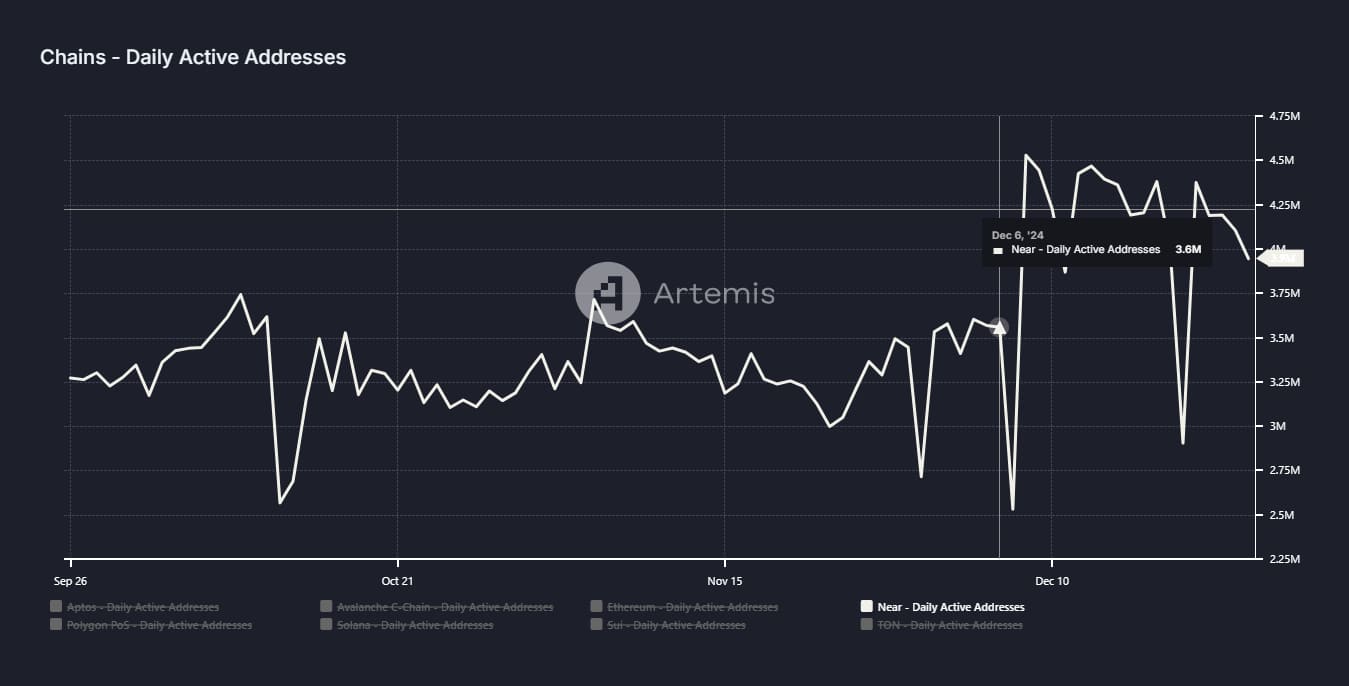

Artemis reports that daily active addresses on the NEAR network have decreased. This is a sign that interest from users and investors is waning.

Active Addresses (AA) are a key measure of the usefulness and usage of the network and are closely tied to the perceived value of the token. If both active addresses and price drop simultaneously, it is a sign that interest is waning, potentially leading to further price drops.

As of this writing, NEAR’s daily active addresses have plummeted for the fourth day in a row, from 4.4 million to 3.9 million. According to CoinMarketCap, this decline is reflected in the price of NEAR, with the cryptocurrency trading at $5.11 at the time of press.

Source: Artemis

AMBCrypto’s analysis shows that high selling pressure, especially from derivatives traders, is putting more pressure on NEAR’s price performance.

Derivatives traders show lack of trust in NEAR.

Selling pressure on NEAR has also intensified, especially among derivatives traders who have primarily taken short positions.

According to Coinglass, NEAR’s long-short ratio is 0.8793, indicating a surge in short-term contracts. Traders open sell positions when they expect prices to fall. A long-short ratio below 1 means there are more sellers, and lower numbers indicate stronger bearish sentiment.

The impact of this selling pressure was evident when we looked at NEAR’s Open Interest. In fact, it has fallen 6.86% in the last 24 hours to $237.39 million on the charts.

Source: Coinglass

Liquidation data further reflected bearish market sentiment. Of the $966,310 worth of contracts cleared in the market, $901,510 came from long-term traders. They suffered losses when prices moved differently from their predictions. This trend suggests that the price of NEAR may continue to trend downward.

However, technical indicators seemed to point to a possible weakening of the bearish trend.

For example, the Average Directional Index (ADX), which measures the strength of market trends, was trending downward on the weekly chart. A high ADX reading indicates a strong trend, while a falling ADX indicates weakening momentum.

At press time, NEAR’s ADX hit 17.85 while in a downtrend, meaning selling activity could soon ease. If this trend continues, NEAR could see a rebound and start trading higher.

What’s next for NEAR?

On the weekly chart, NEAR appears to be trading within a symmetrical triangle pattern. This is a consolidation phase where price narrows between defined support and resistance levels as buying activity gradually increases. Historically, this pattern has often occurred prior to a significant upside breakout.

However, continued selling pressure could push NEAR lower to the $4.625 support level or potentially to the bottom of the symmetrical channel.

Source: Trading View

This decline is likely to mark the final leg of the ongoing downtrend before a rebound and the asset is expected to rally back to at least $10 on the charts.

In this context, a sustained recession could serve as a harbinger of large price movements in the near future.