- Justin Sun suggests potential Tron ETFs for TRX aiming to expand institutional markets.

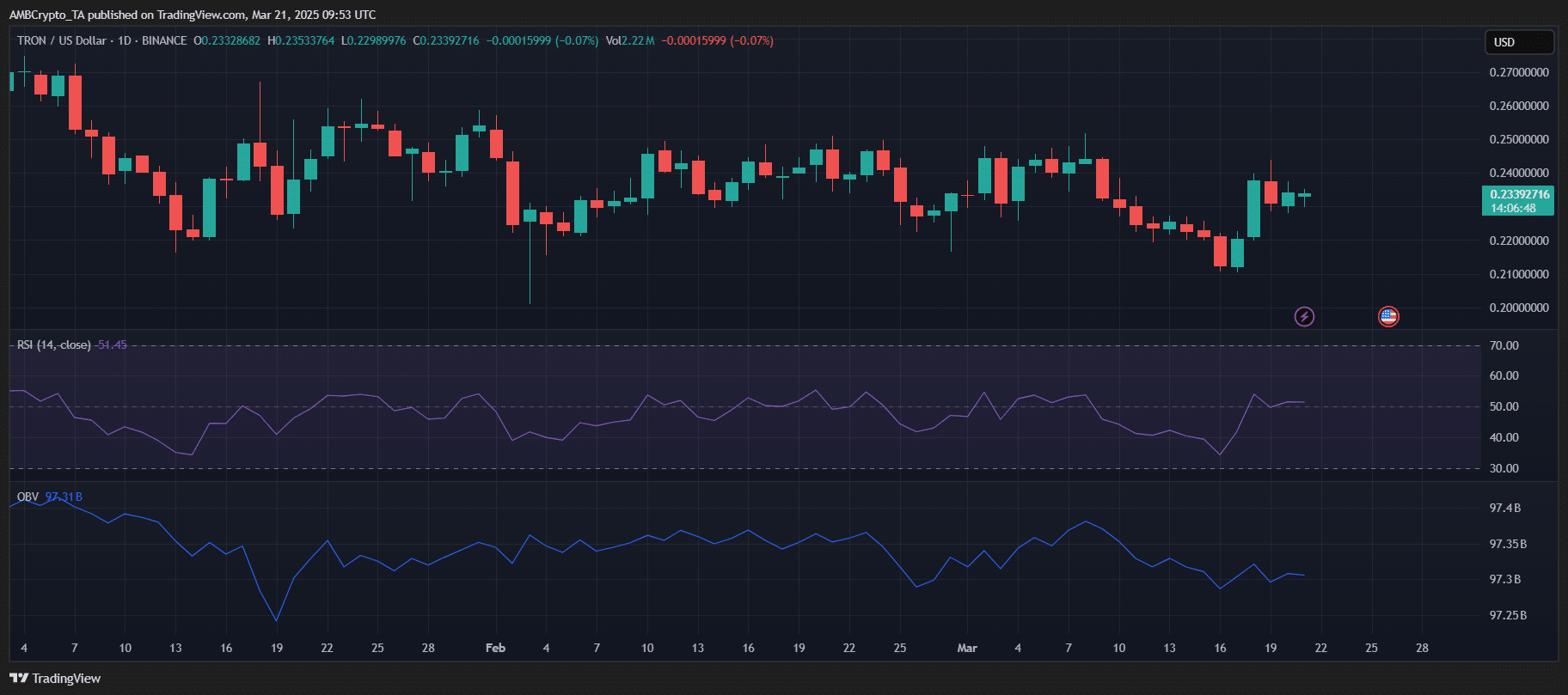

- TRON’s USDD Stablecoin grows steadily and TRX shows a small amount of recovery.

Justin Line This time, we are attracting attention again with the hint of possible ETFs for TRON (TRX).

With the expansion of TRX to SOLANA blockchain, TRX seems to be working hard with more institutional participation and wider market integration with the continuous growth of USDD, an algorithm Starble recoin.

Among the market uncertainty and integration, TRX focuses on regulatory compliance, cross chain integration and Starble lecoin development. This strategy is located so that the TRX can take advantage of the following steps of encryption adoption.

Why is the rumor of TRON ETF swirl?

In recent social media posts, Justin Sun, the founder of TRON, has encouraged the TRON ETF to guess whether TRX will soon join the regulated encryption financial instruments.

Timing is noteworthy: If Bitcoin and Etherum Spot ETF are already approved, traditional finance warms up more assets of encryption.

Source: X

Blackrock and Fidelity are actively developing new applications, and TRON can soon follow the lawsuit. Although the official submission has not been confirmed, the hint of SUN on institutional interest suggests continuous behind -the -scenes.

When the TRX ETF becomes a reality, it represents an important stage of transition from TRON’s niche to the mainstream financial market.

USDD’s constant climbing

TRON’s USDD STABLECOIN has recently gained a driving force to surpass the market cap of $ 270 million. As the survey of the algorithm Starble Lecomin is intensifying, the elasticity of the USDD is especially prominent in emerging markets, which are essential for daily transactions.

SUN is doing its best to expand the USDD on several blockchain networks to expand the reaching range beyond the ecosystem of TRON.

Stablecoins, one of the most widely used innovations in Crypto, emphasizes the extensive goal of TRX to achieve actual utility rather than simply speculative attention.

As the global demand for stable censorship prevention assets increases, USDD growth can play a pivotal role in forming the next chapter of the TRX.