trump same corner OFFICIAL TRUMP is in the cryptocurrency spotlight, recently entering the top 20 cryptocurrencies by market capitalization just three days after its debut. An impressive rally saw the coin rise approximately 670% from its launch date to an all-time high around $75.35. token transaction At press time, it stands at $49.24, up nearly 12% in the last 24 hours. The rise has sparked speculation that the coin could break the $100 mark in the coming days.

Trump’s Price Outlook: $100 Target Is Ahead

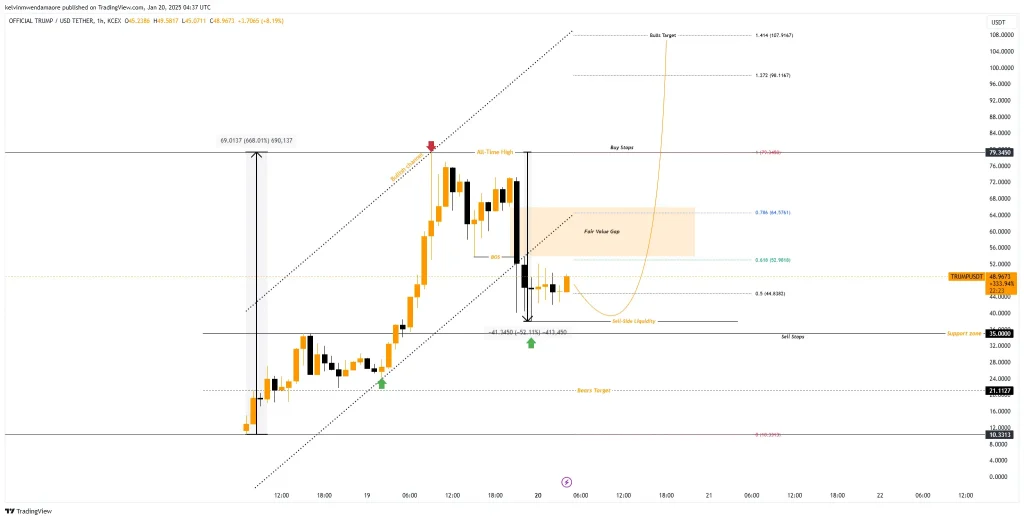

The 1-hour chart depicts the Trump/USDT trading pair and shows a very volatile market with strong price fluctuations. Historically, the price has experienced strong bull rallies, surging approximately 668% to record highs. This rally was driven by strong buying pressure within a well-defined bullish channel, but ATH acted as a resistance point, triggering a reversal and subsequent bearish momentum.

The Break of Structure (BOS) below ATH confirmed a change in trend as sellers gained control in the near term. Following this downward momentum, a significant fair value gap (FVG) formed between $53.86 and $66, highlighting an area of inefficiency that TRUMP’s price could reverse before continuing to rise.

Below that, the sell-side liquidity zone around the $38 level represents an area where stop-loss orders may reside and is a possible target for price consolidation. Meanwhile, the $35 support zone is consistent with historical buyer activity and serves as a psychological floor. As of this publication, TRUMP’s token price is trading around $48, reflecting the post-ATH adjustment phase.

However, the Fibonacci retracement level suggests a key pivot point, with the 0.618 – 0.786 area ($52.98 – $64.57) coinciding with FVG, an important resistance area. If the price moves back into this area and finds buyers, it could resume bullish momentum, potentially targeting $98.11 (1.272 Fibonacci) and $107.91 (1.414 Fibonacci).

Conversely, failure to maintain current levels could cause the cryptocurrency price to fall further into liquidity territory or test historical lows near $10.33 or $8.00. In the short term, the price is likely to oscillate within the range of $44.88 – $64.57, consolidating before determining the next trend.

TRUMP’s indicators suggest an imminent bullish outlook.

The Chaikin Money Flow (CMF) indicator, set at period 20, shows a value of 0.21, indicating positive capital inflows and strong buying pressure. This is consistent with the observed price recovery and supports the bullish outlook. Maintaining momentum above 0.20 is important for continued market strength.

Likewise, the relative strength index (RSI), set at the 14-day close, is currently at 59.59, just below the overbought threshold of 70. This means the market has regained strength after the recent sell-off, but is still within neutral levels. – Bullish range. RSI’s upward trajectory indicates further upside before reaching overbought levels, most likely towards the $100 level.

Also read: Cardano’s ADA Fix Done, Next Stop: $6?