- TRUMP has been consolidating in range over the last 12 hours.

- Muted volume and bearish momentum meant traders had to wait for longer-term investments.

OFFICIAL TRUMP has settled in a short-term range from $40 to $31.3. The intermediate level of $35.7 acted as resistance this morning, but has reversed into support in recent hours.

Trading volume has decreased over the last 12 hours. If TRUMP breaks out of its short-term range, the Fibonacci retracement level will likely act as resistance. Is that so?

Short-Term Range Formation Disturbs TRUMP Bulls

Source: TRUMP/USDT on TradingView

Price action on the hourly chart has been bearish over the past 24 hours. The official MELANIA release sent TRUMP down 39.9% in one hour. Since then, memecoin has been on a downward trend.

The range formation over the last 12 hours was around the 78.6% Fibonacci retracement level. This was a good sign for holders and offered hope for recovery.

However, technical indicators on the hourly charts were bearish. CMF was -0.05 and was below -0.05 a few hours ago. This shows that capital outflows are dominant, making a bullish breakout unlikely.

Likewise, DMI showed a dominant downward trend, with -DI and ADX both exceeding 20.

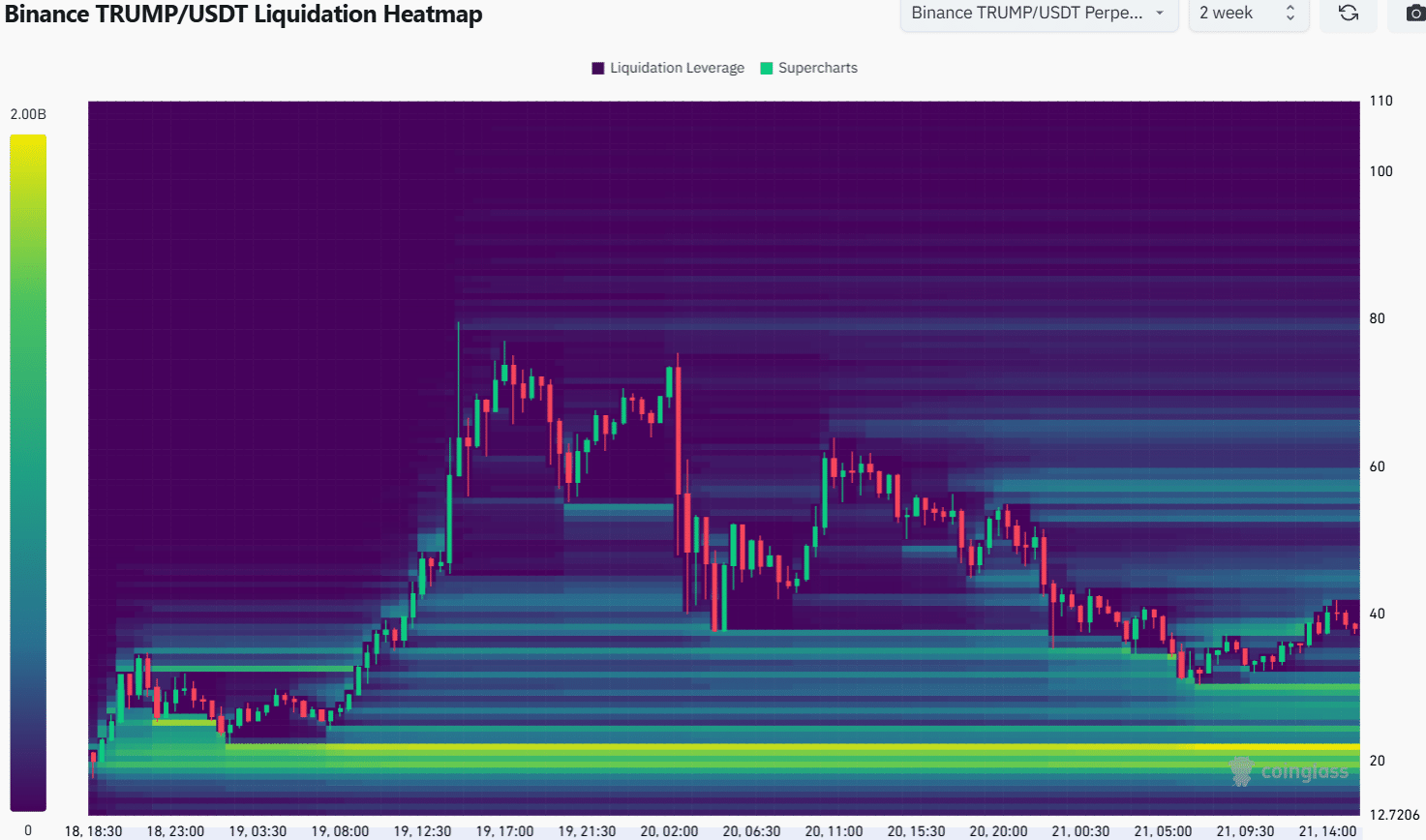

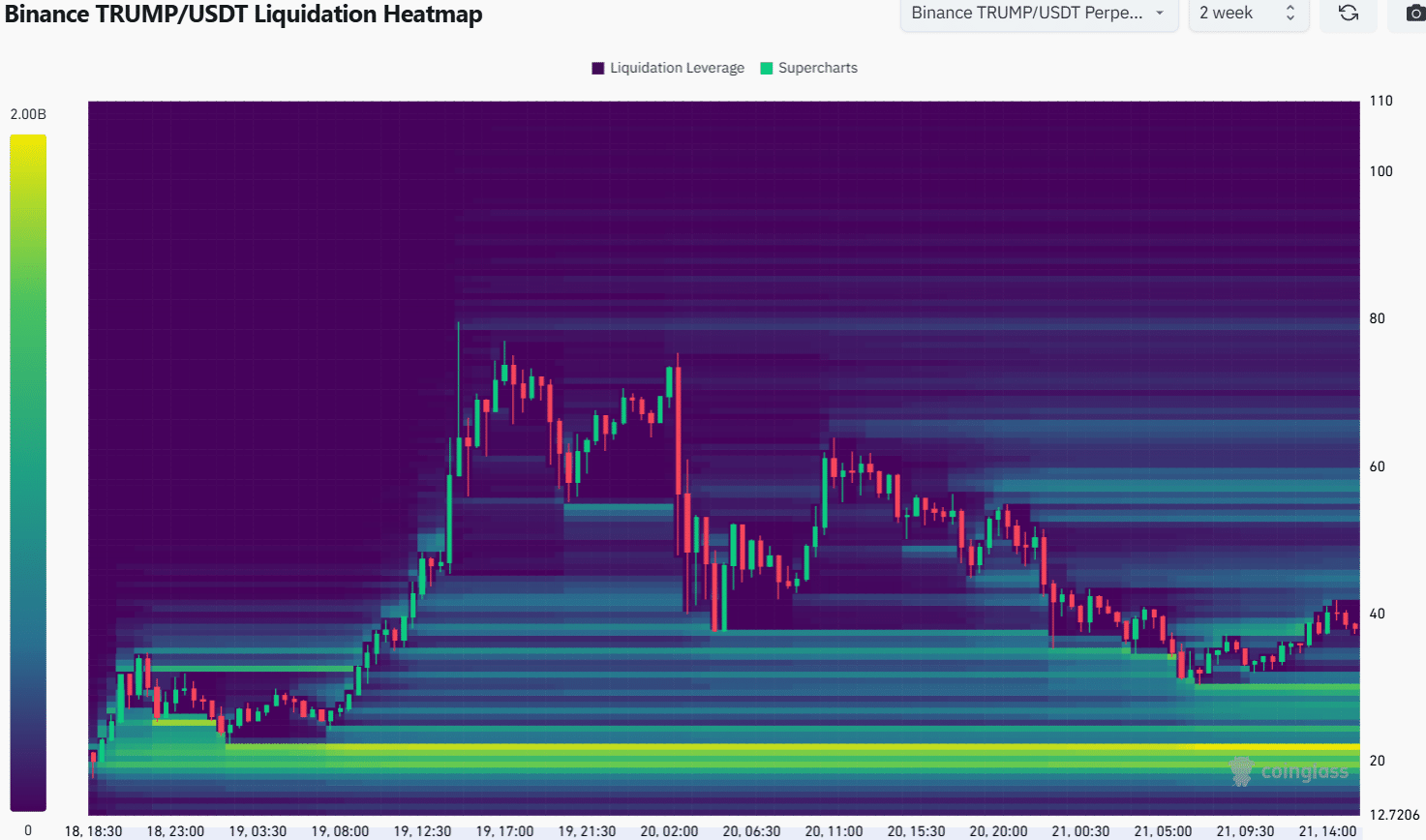

Source: Coinglass

Clearing data highlighted the $20 area as a strong magnetic zone that could pull prices south.

However, this would be a strong bearish outcome, taking the price below the low and swing low range where it started its move to $81.2.

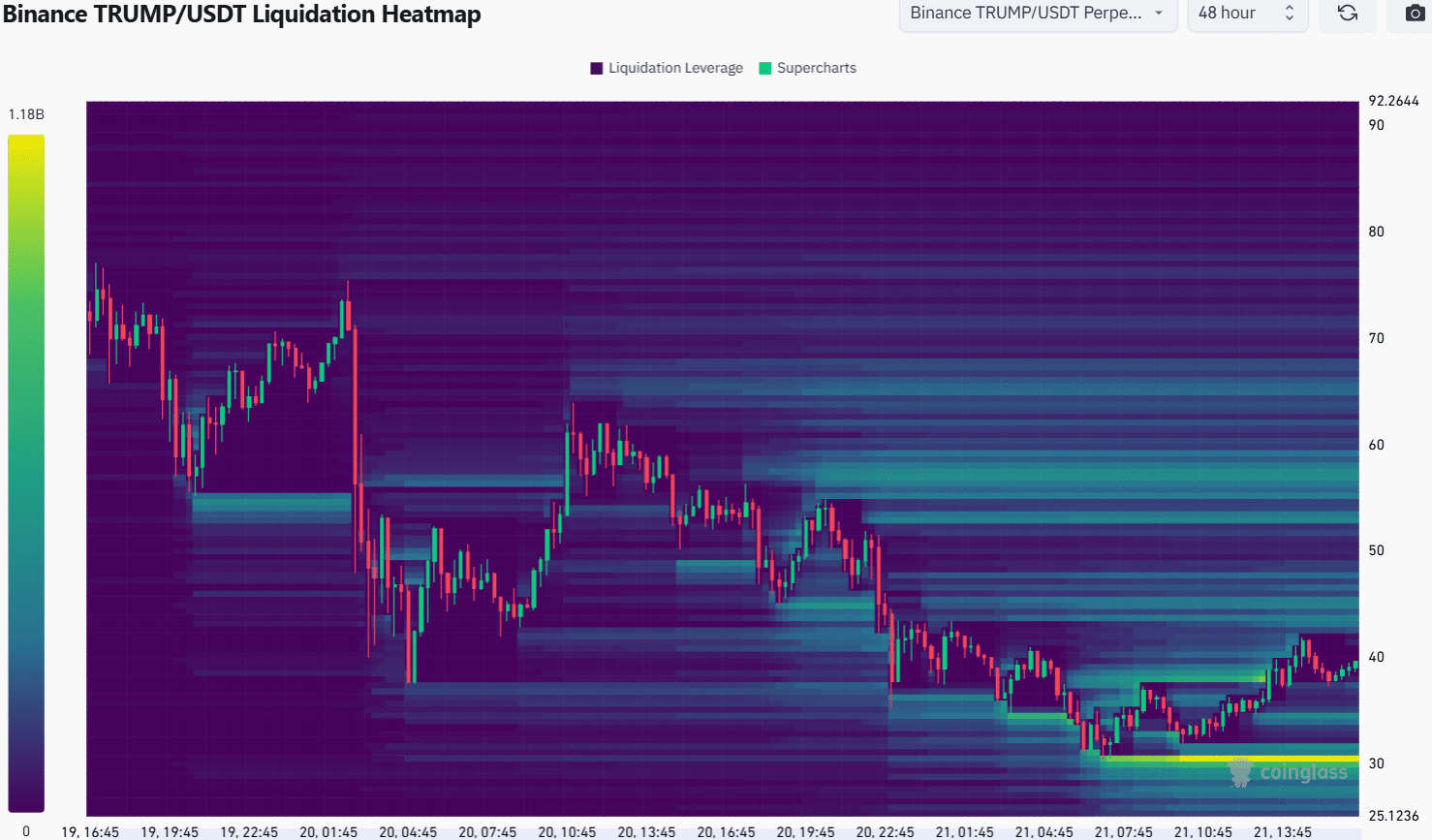

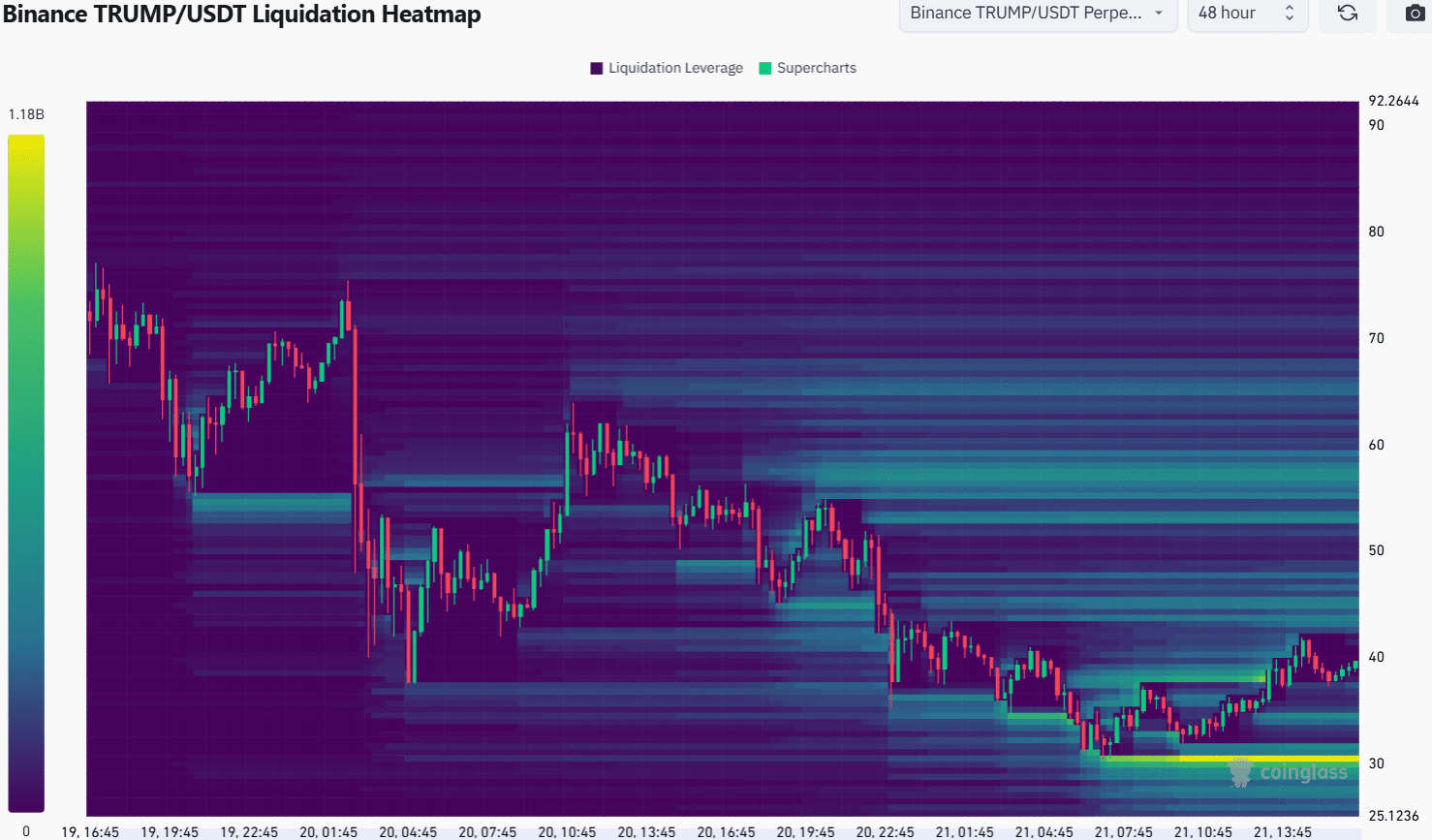

Source: Coinglass

The two-day look back highlighted $30.3 as a short-term target. To the north, the $43-$44 region was the next price target. This was consistent with the high of the range around $40.

Realistic or not, TRUMP’s market cap in BTC terms is:

Therefore, testing the range high increases the likelihood of a temporary pullback.

TRUMP memecoin tends to rise quickly, so traders should watch for increased volume on a breakout and may want to buy if volume is large enough.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.