- The CRV has seen a surge of 24 hours according to Trump’s new legislative order, which gives Defi Assets Independence.

- Spot market investors continued to increase exposure to assets.

In the last 24 hours, Curve DAO (CRV) has seen significant rally in accordance with Trump’s latest legislative orders.

Purchasing feelings have since been strengthened since the spot market traders have accumulated considerable amounts. However, it is likely that there will be drops that come in before the constant rally heads up.

How does Trump’s bill affect the CRV?

On April 10, US President Donald Trump protected Defi by signing the law on the first cryptographic bill.

This new law has been set to prevent the sale and exchange rules of digital asset sales and exchange rules by IRS (IRS). The legislation, also called the Defi Broker rules, is set to implement custody and non -parenting services to submit a report to the IRS at intervals.

Representative of MIKE CAREY of House Way and Sudan Committee

“Defi Broker’s rules were to overwhelm the IRS with an overflow of new reports that unnecessarily interfere with US innovation, infringed on everyday Americans’ privacy and no infrastructure to handle during the tax season.”

Following the news, Defi tokens reacted positively. CRV, the basic token of the curve, led the charging. It surged 19% to 48% of monthly profits.

Therefore, AMBCRYPTO analyzed the market and decided whether the participants could react and whether the rally could continue.

Traders accumulate CRVs and watch almost $ 2 rally.

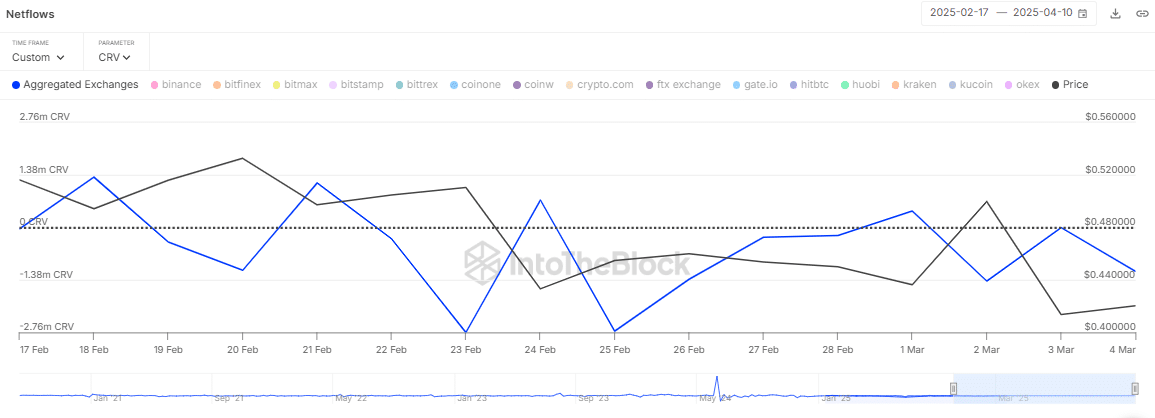

After the update, SPOT Market’s trader has accumulated about $ 667,000 of 11.5 million CV as pointed out by Exchange Netflows.

This purchase will be long -term because this merchant cohort moves the CRV to a personal wallet.

Source: INTOTHEBLOCK

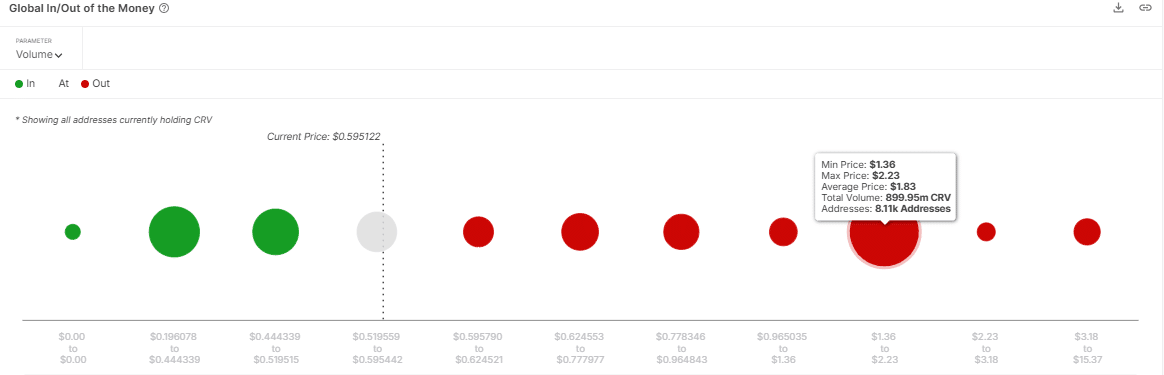

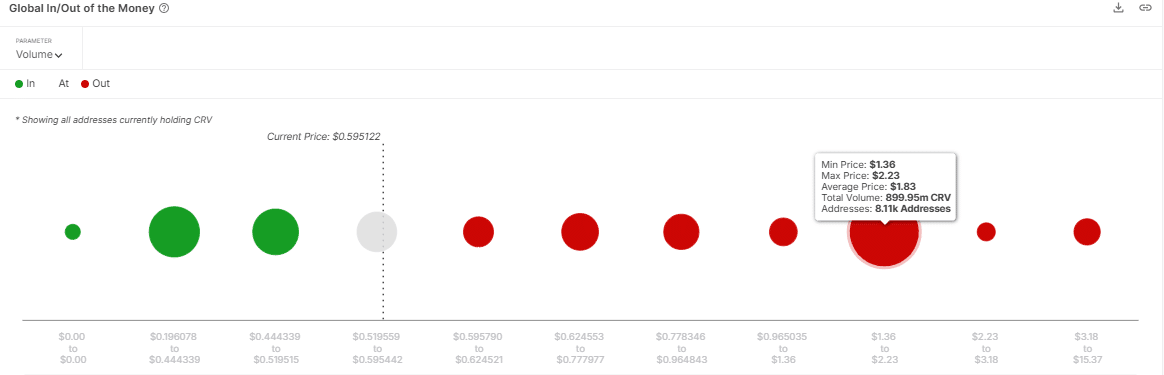

IN/OUT of Iomap indicators showed minimal resistance and implied more room for growth.

At the time of writing, Iomap did not emphasize strong resistance to $ 1.83. At this level, there may be about 899.95 million CRV sales orders.

If you buy a pressure, you can go up to the CRV.

This means that if the emotional purchase continues to increase in the market, the CRV can record the price of $ 1.83.

Source: INTOTHEBLOCK

Drop

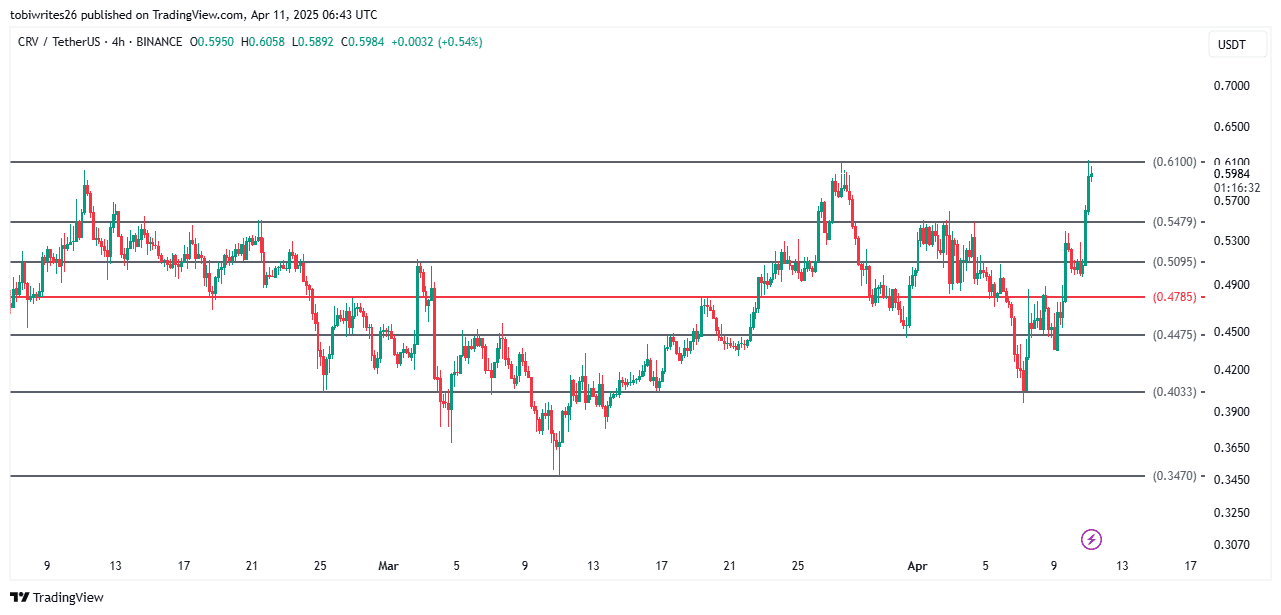

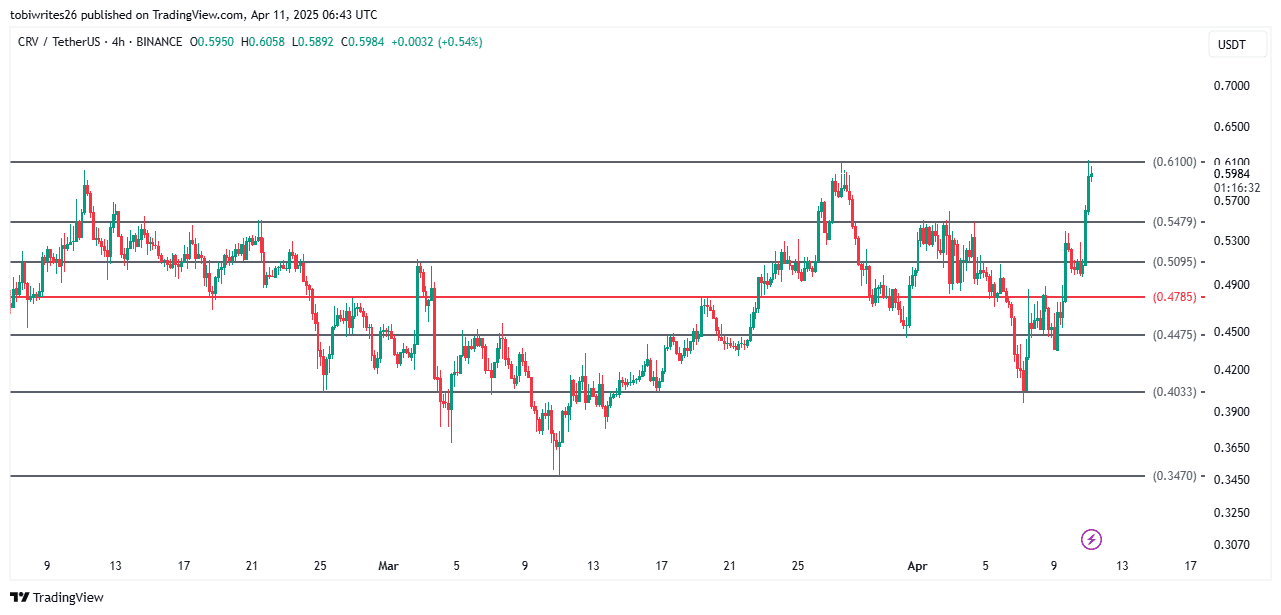

CRVs can witness the waiting time for the price reuse before the continuous market rally. At the time of writing, it was traded at a core resistance level of $ 0.61, which lowered the time when assets previously recorded this level.

This decline will not be important, especially when considering optimistic feelings. It is expected to serve as a support for further assets according to market exercise.

Source: TradingView

In the derivative market, sales pressure seemed to be constructed. OI weighted funding rates have also been negative. It is a sign of hiking of short activities.

CRV’s latest rally, in particular, reflects new trust in the back of the White House’s regulatory clarity.

Dip may soon occur for a while, but strong accumulation and minimal resistance suggested that there may be a space for the bull to run.