U.S. Senator Mike Rounds’ remarks at the recent World Economic Forum in Davos highlighted an important aspect of the ongoing technology race between the United States and China. As the United States continues to impose strict controls on exports of advanced AI chips to China, it highlights the tenuous balance of power in global AI hegemony.

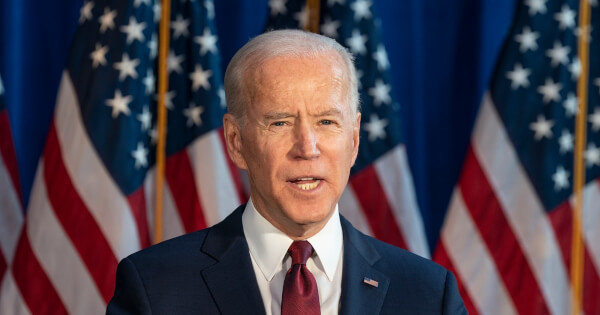

Senator Rounds said the United States recognizes that its advantage over China in AI technology is minimal and can be measured in months, not years. This statement highlights the rapid advancement of AI technology and the importance of maintaining a competitive advantage in this field. The Biden administration’s decision to restrict exports of advanced AI chips to China is seen as a strategic move to maintain this tenuous edge and reflects broader geopolitical concerns surrounding technology and national security.

On the other hand, China has made significant progress in AI technology. By 2023, major Chinese companies such as Baidu, Alibaba, and Tencent have introduced new AI technologies and integrated large-scale language models into various services. Baidu’s ERNIE Bot, Alibaba’s AI chatbot Tongyi Qianwen, and Tencent’s Hunyuan model are notable examples. These developments reflect China’s growing capabilities in AI and challenge the United States’ position as a leader in this field.

Restrictions on chip exports from the U.S. to China are aimed at curbing China’s technological advancements, but have implications for both countries. This measure by the United States is evaluated as violating market principles and harming the global semiconductor market. For China, the world’s largest semiconductor market, these restrictions hinder economic and technological cooperation between the two countries.

Despite its rapid growth, China’s AI sector faces several challenges. Limited access to advanced chips due to U.S. sanctions, strict regulations, and high development costs are major obstacles. The technological gap with Western countries has widened, mainly due to the development of models such as GPT and Google’s Gemini. These constraints highlight the competitive and complex nature of the global AI environment.

In response to these challenges, China has been actively nurturing its internal AI market and global positioning. However, concerns about duplicating efforts and focus on developing scalable AI products remain. The country’s pursuit of AI technology is impressive, but what stands out is the need to overcome limitations in computing power and develop a mature AI training ecosystem.

In conclusion, the United States’ decision to limit chip exports to China represents a strategic move to maintain technological hegemony, especially in the field of AI. However, China’s rapid progress in this field shows that China’s capabilities are strengthening and that the global AI race is becoming increasingly competitive. This technological tug-of-war between the two superpowers is shaping the future of AI development and applications in a variety of industries, from national security to consumer technology.

Image source: Shutterstock