- While UNI drops on the Ethereum network, exchange supply increases.

- A decline in sentiment due to lower demand suggests that ETH could fall to $9.20 in the near term.

Uniswap (UNI) price and Ethereum (ETH) have not moved in the same direction over the past seven days. At press time, UNI was trading at $9.98, up 2.22% over the past seven days.

On the other hand, the price of ETH was $3,687. It decreased by 2.56% during the same period. But that’s not the main problem right now.

What AMBCrypto observes, using on-chain data from Glassnode, is that the tide may soon turn.

Correlation disappears

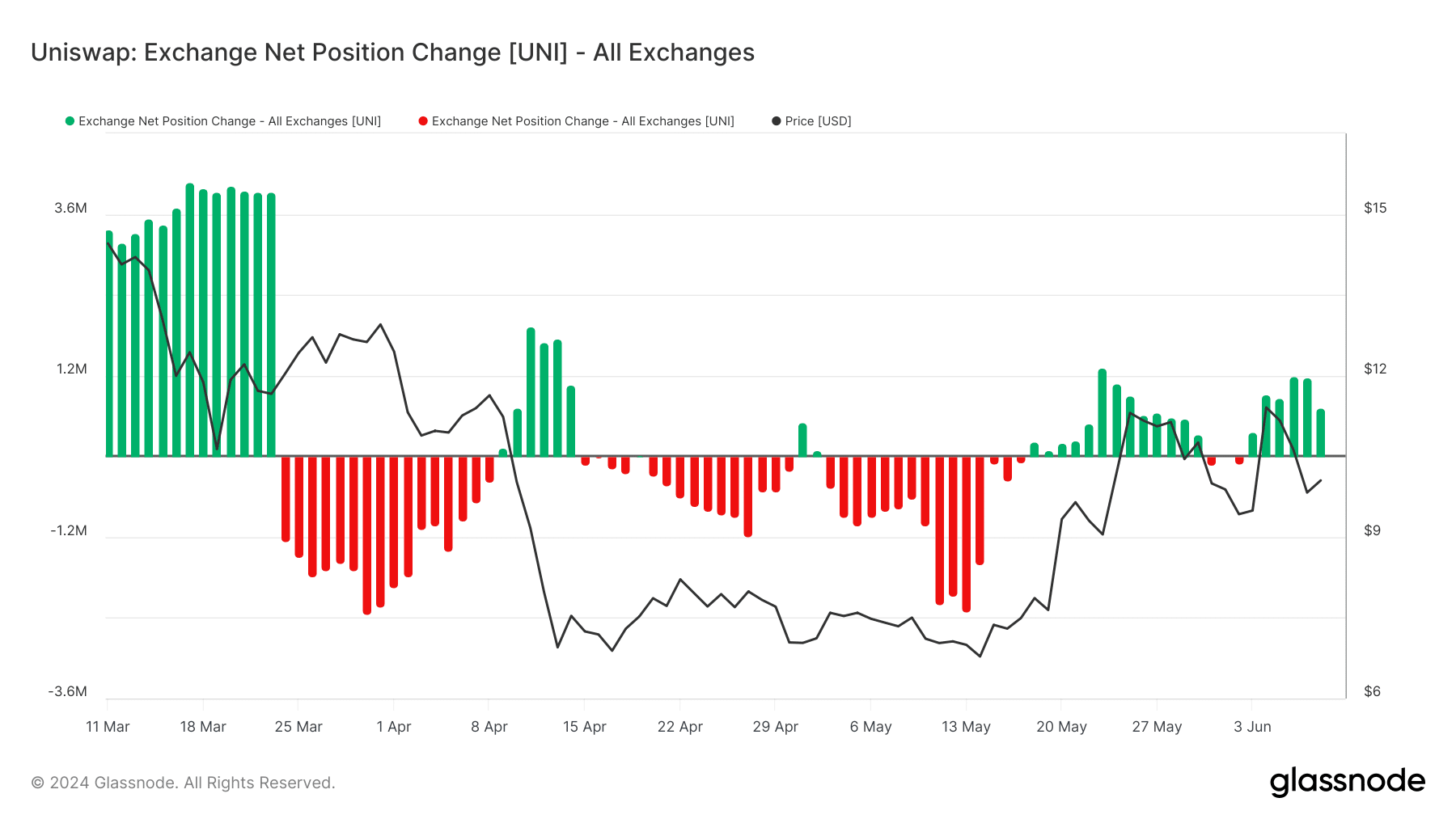

Evidence of this is reflected in the changes in exchange net positions. According to our analysis, Uniswap’s exchange net position change on June 8 was 733,683.

This indicator is the total supply of tokens held in exchange wallets. If positive, it means more tokens are flowing into the exchange, which could lead to a price drop.

However, negative numbers mean withdrawals may surge, which could reduce selling pressure. In the case of UNI, the number of tokens held on the exchange has been increasing since June 3rd.

Source: Glassnode

Therefore, if supply remains positive, the token price is likely to lose its hold on the $9 region. But on Ethereum it was a different game.

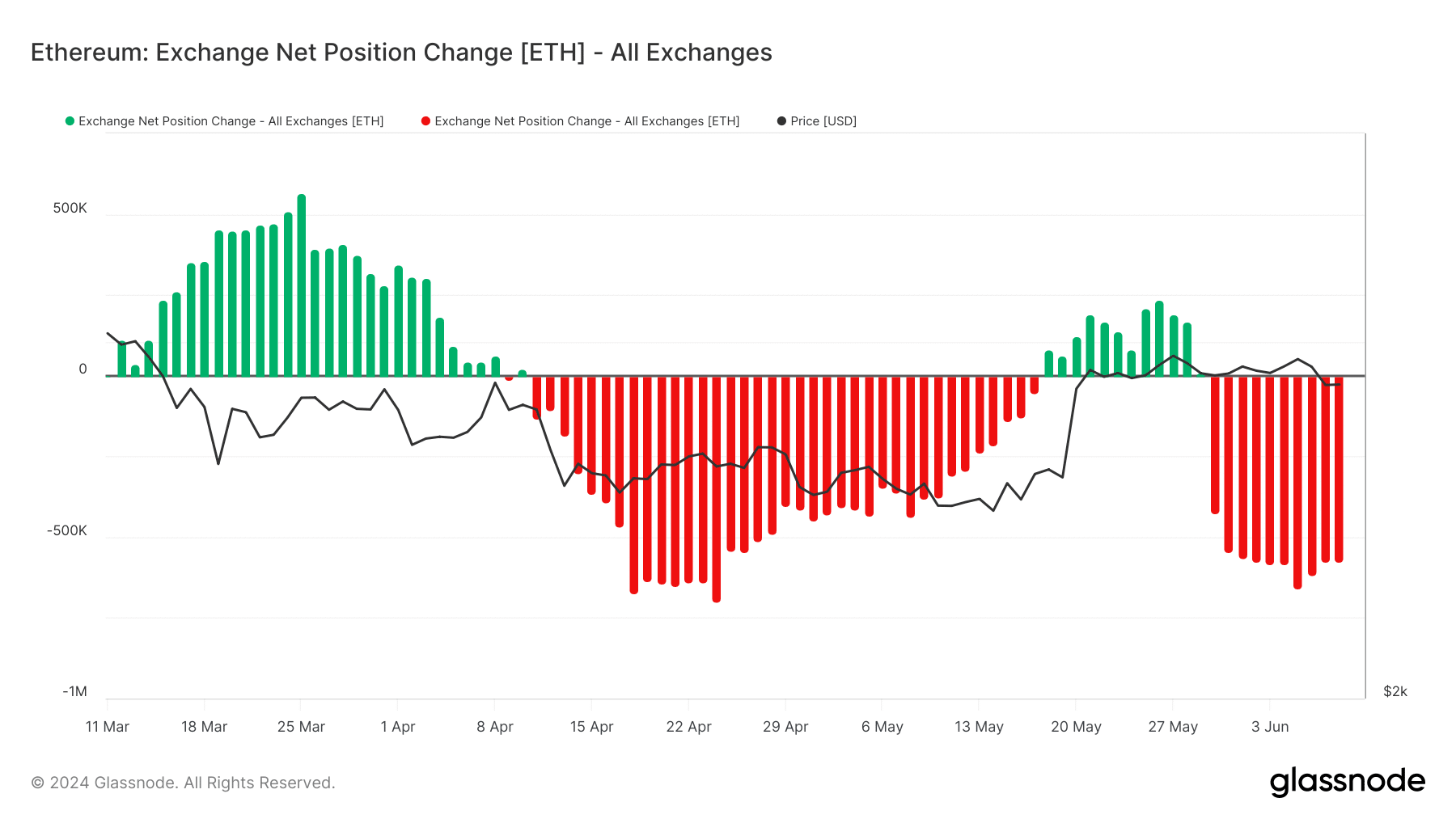

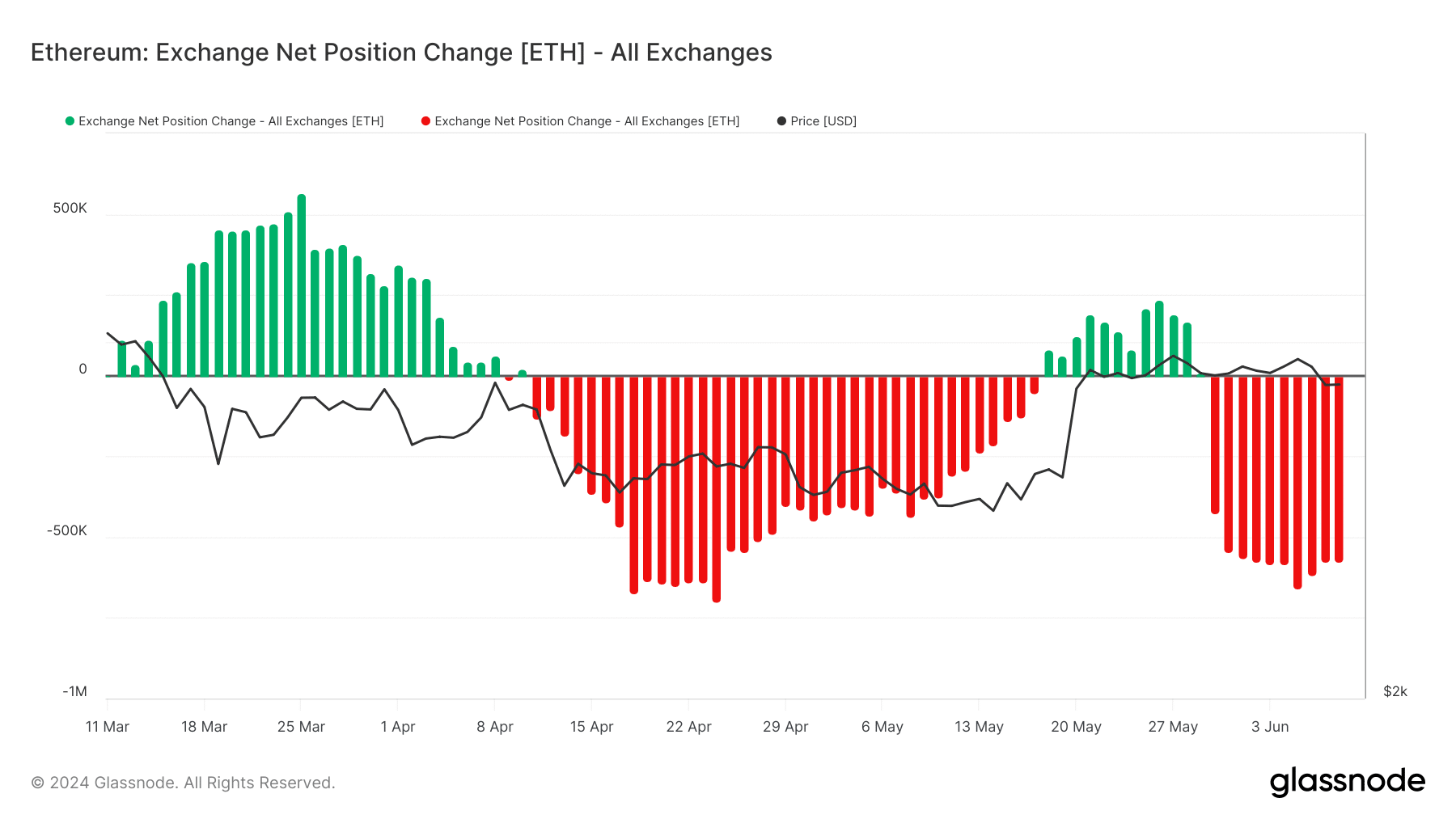

Evaluating the same indicators as ETH, we found that the number of coins being fetched from exchanges has increased. According to Glassnode, on the same day, 733,683 UNI tokens were inflow, resulting in approximately 576,851 ETH being withdrawn from the exchange.

Source: Glassnode

UNI is expected to fall further

Therefore, it is likely that the price of UNI will fall and ETH will recover quickly.

If verified, this could run counter to the cryptocurrency’s price performance when the U.S. SEC approved a spot Ethereum ETF.

While the announcement was taking place, the price of ETH soared and UNI’s connection to the blockchain ensured that the price would move in the same direction. But how low can UNI go this time?

To identify possible targets, AMBCrypto analyzed Weighted Sentiment, which shows the perception market participants have about the project. At press time, Weighted Sentiment was -0.173.

This negative reading suggests that most opinions on Uniswap are tilted towards the downside. This may reduce demand for the token and cause its price to fall.

Additionally, the Market Value to Realized Value (MVRV) Z-score dropped from 27% a few days ago to 23.58%. A positive MVRV Z-score means the token is in an upward phase.

Source: Santiment

Realistic or not, UNI’s ETH market cap is:

On the other hand, a negative ratio indicates that you are in a bearish cycle. However, the recent decline does not mean that UNI has entered a bearish phase. However, this is a sign that the price may fall below the chart.

Looking at the situation, a drop to $9.20 seems quite possible.