Uniswap, the leading Ethereum decentralized exchange, contributes significantly more volume to the layer 2 blockchain compared to its activity two years ago.

The decentralized exchange (DEX) runs on top of Ethereum (ETH), the second largest blockchain in cryptocurrencies, while accounting for approximately 37% of total trading volume at layer 2.

21.co researcher Tom Wan noted that the platform’s L2 volume has grown more than 650% in 24 months, rising from about $4 billion in 2022 to more than $30 billion this year. Analysts added that this trend could further strengthen as more high-quality protocols are launched on layer 2 networks such as Arbitrum, Coinbase’s Base, and Optimism.

“L2 is gaining more economic activity, especially Base and Arbitrum, which account for 82% of Uniswap’s total L2 volume. L2’s volume dominance on Uniswap is expected to continue to increase to 50% by the end of this year.”

Tom Wan, 21.co Researcher

Data showed that exchanges only contributed 2.9% of altcoin L1’s overall trading volume, but Wan said this story could change in the future. Wan explained that high-performance EVM-compatible L1 combined with a multi-chain scaling strategy allows the DEX to capture more volume from networks such as Sei and Monad.

Crackdown on Uniswap

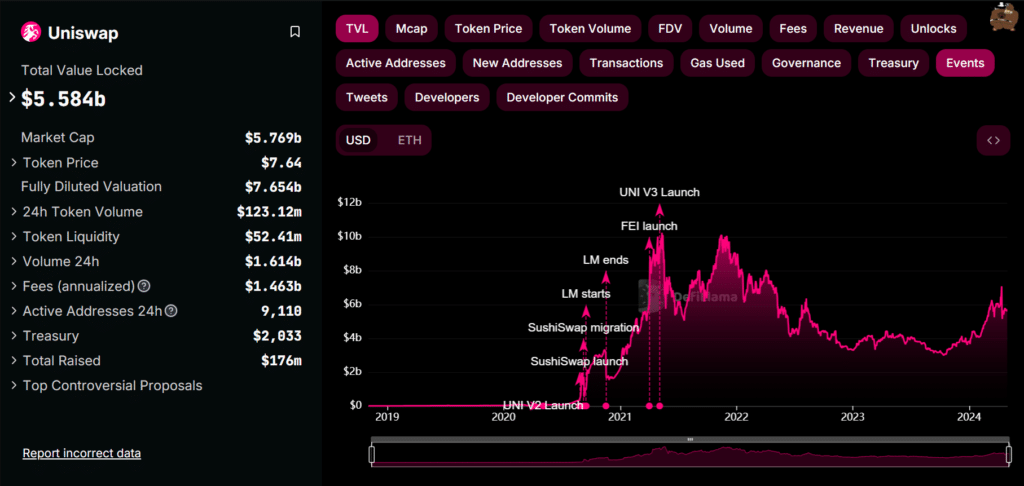

Uniswap (UNI) was Ethereum’s first DEX and remains the largest on-chain trading venue on the cryptocurrency L1 blockchain. The protocol boasts over $2 trillion in cumulative transaction volume across 17 chains. DefiLlama said its users have deposited more than $5.5 billion in total value locks.

The Brooklyn-based cryptocurrency services provider, founded by Hayden Adams in 2017, is currently facing enforcement action from the US SEC, which has been implicated in a broader crackdown on the cryptocurrency industry.

As crypto.news reported, the SEC served Adams’ business with the Wells notice, and the DEX plans to defend itself against the decision, which it calls “disappointing but not surprising.”