- Large transactions on Uniswap surged 200% in just 24 hours.

- Exchange inflows have steadily declined over the past three days, with altcoin prices plummeting 9% in less than 48 hours.

Uniswap’s (UNI) market activity is sending mixed signals, leaving market participants pondering its potential trajectory in the near future.

On the one hand, there has been a surge in whale activity in altcoins, as evidenced by a 200% surge in large transactions in the last 24 hours alone.

Rather, the UNI exchange inflow has been decreasing for three consecutive days. To further complicate matters, Uniswap’s price plummeted, losing 9% of its value in less than 48 hours.

What does this conflicting data mean for the future of altcoins? Let’s analyze it.

Uniswap whale activity is surging, why?

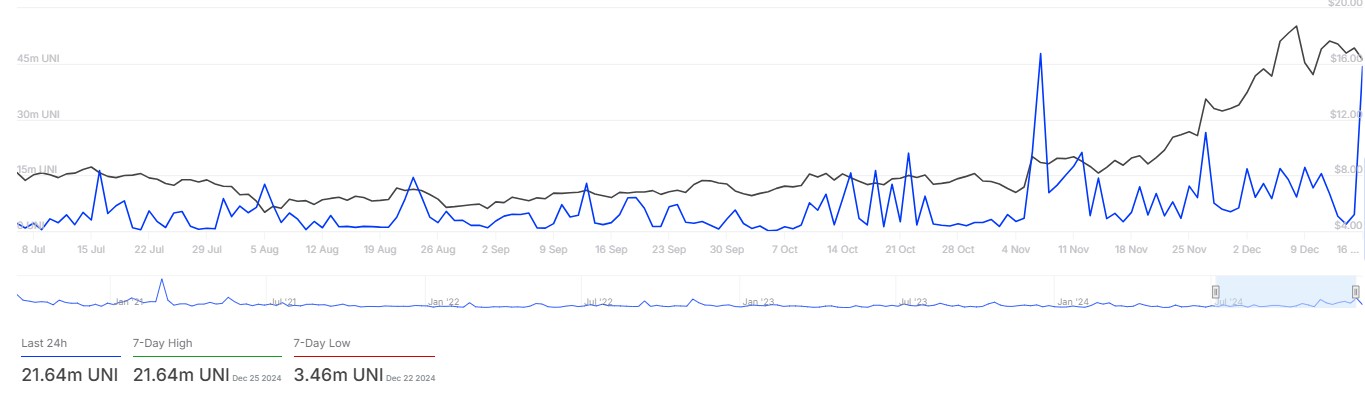

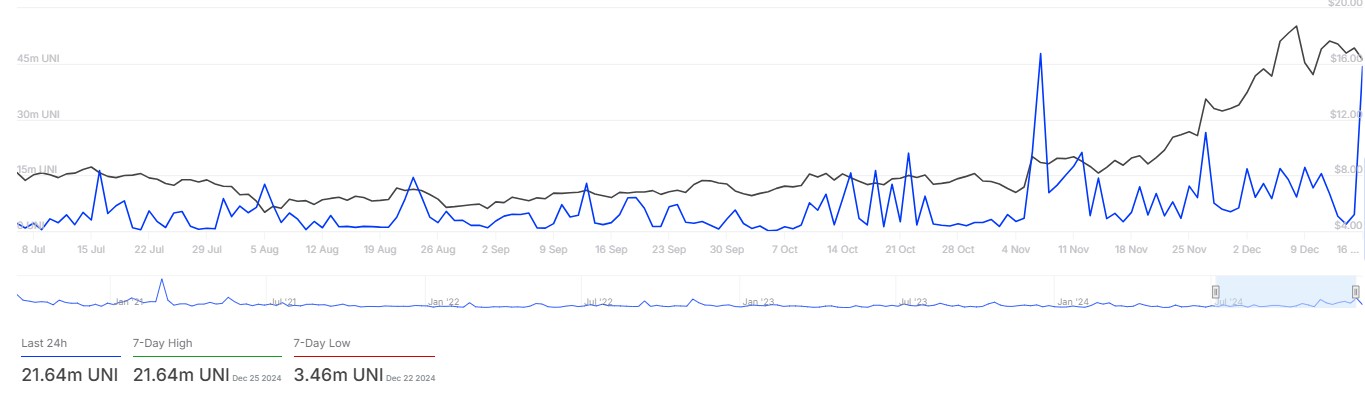

Historically, large transactions reflect whale activity, and IntoTheBlock data shows that Uniswap large transactions have seen a dramatic surge.

The 200% increase in large-scale transactions in altcoins in the last 24 hours indicates that big players in the market are making big moves.

This type of activity can be interesting because it often heralds strategic market positioning.

However, it cannot be confirmed whether the whales are actually accumulating Uniswap tokens for a bullish play or are preparing to offload their holdings.

Source: IntoTheBlock

The lack of clarity leaves markets guessing and market participants cautiously navigating uncertainty.

Declining exchange inflows add to the mystery.

While whale activity is heating up, exchange inflows are decreasing. According to data from CryptoQuant, the volume of tokens flowing into exchanges has declined sharply over the past three days.

Typically, this downward trend is a sign that traders are holding on to assets rather than preparing to sell them.

However, as inflows decline, retailer interest may decline.

This contrast between increased whale activity and decreased influx creates the following questionable scenario: Whales either see opportunities that retail traders miss, or they see something bigger in the cards.

Source: CryptoQuant

Uniswap price plummets despite market activity

Adding to the complexity, Uniswap’s price fell 9% in less than 48 hours. This steep dive indicates that the bear is exerting its strength.

So the question arises: Are the whales supporting this market, or are they taking advantage of its relative weakness?

Source: TradingView

However, over the longer term, Uniswap’s price action indicated a bullish trend. This suggested that the altcoin may undergo a brief correction before the final rally.

Technically, the price could fall to test the key support level at $12. This resistance level has turned into support during the recent bullish rally.

Read Uniswap (UNI) price prediction for 2025-2026

AMBCrypto’s in-depth analysis of Coinglass liquidation data may provide the answers you’ve been hoping for. If the price falls further to the key price level of around $12, approximately 818K worth of UNI will be liquidated.

Increasing buying pressure from whales could push the altcoin further down to $12 before a potential rebound.

Source: Coinglass