- Bullish expectations are high for Uniswap this cycle.

- Network metrics are well below 2021 highs, suggesting further growth is possible.

At press time, Uniswap (UNI) appeared to be showing strong bullish confidence. It’s up 97% since November 20th while also breaking several key resistance levels. Open interest also rose 12% in 24 hours. This is a sign of optimism.

According to technical and on-chain indicators, Uniswap is currently in a strong upward trend. And further gains are expected in the coming months. This is despite the UNI price being at $44.9 in May 2021, still 61% below its all-time high.

The major low was retested as support.

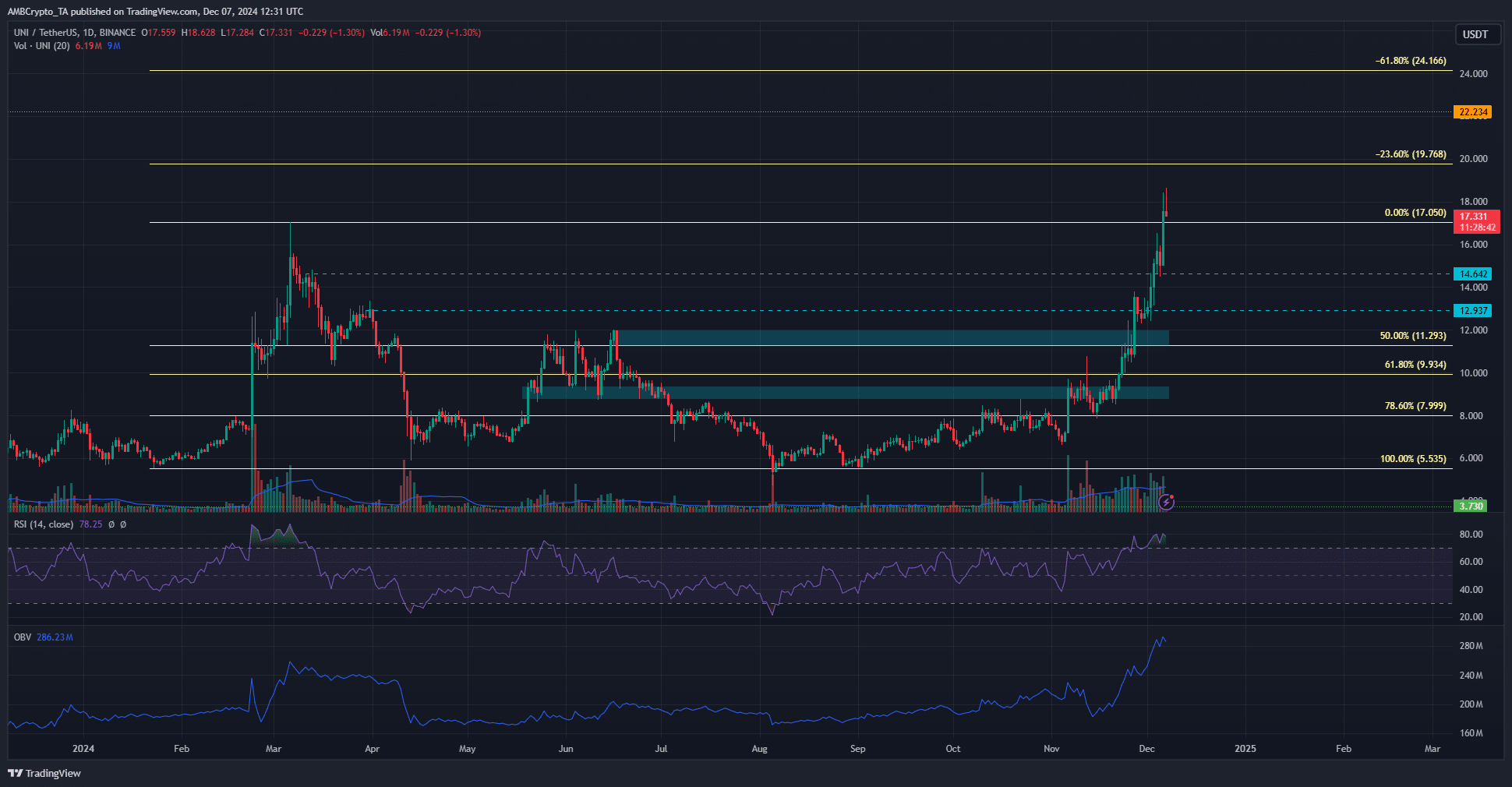

Source: UNI/USDT on TradingView

Uniswap bulls managed to break above the $17.05 level, which hit a March 2024 high. Along the way, the major lows of that downtrend, set at $12.93 and $14.64, were both retested as support.

OBV is showing high demand with a significant increase in price as well. RSI was in overbought territory at press time but had not yet formed a bearish divergence. Consolidation in the $16-$17 area may materialize before the next leg materializes in the coming weeks.

The $15.45-$15.95 zone is likely to be a solid demand zone if UNI prices decline.

A new address that has not yet started an upward trend.

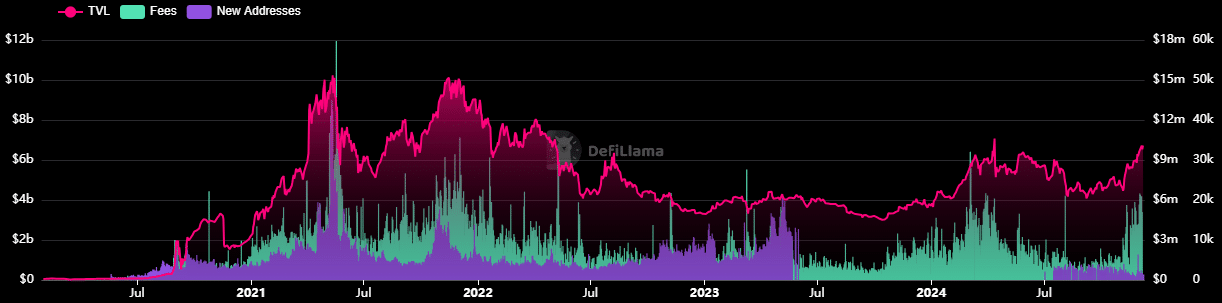

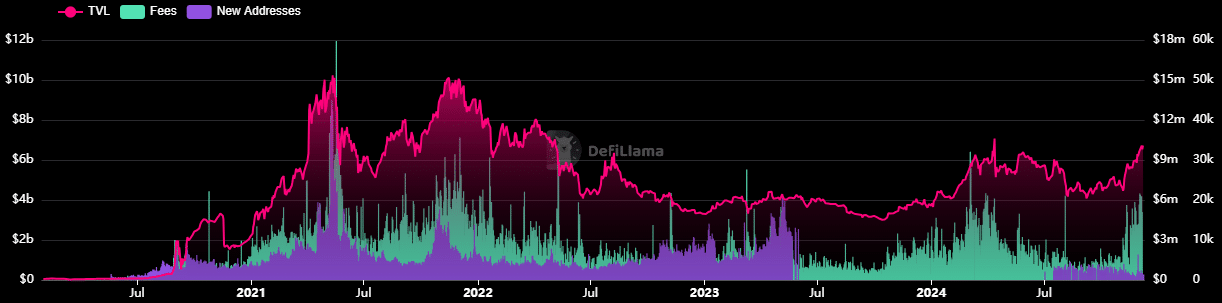

Source: DefiLlama

In previous cycles, the launch of numerous small coins on the Ethereum network led to the creation of many new addresses on Uniswap, the largest decentralized exchange (DEX), to trade these tokens. A similar scene is currently occurring on the Solana (SOL) network, which is causing a memecoin craze.

As new addresses increase and engagement increases, fees rise, especially in the later stages of the uptrend. Comparing 2021 and 2024, the number of new addresses and network fees were lower than those peaks.

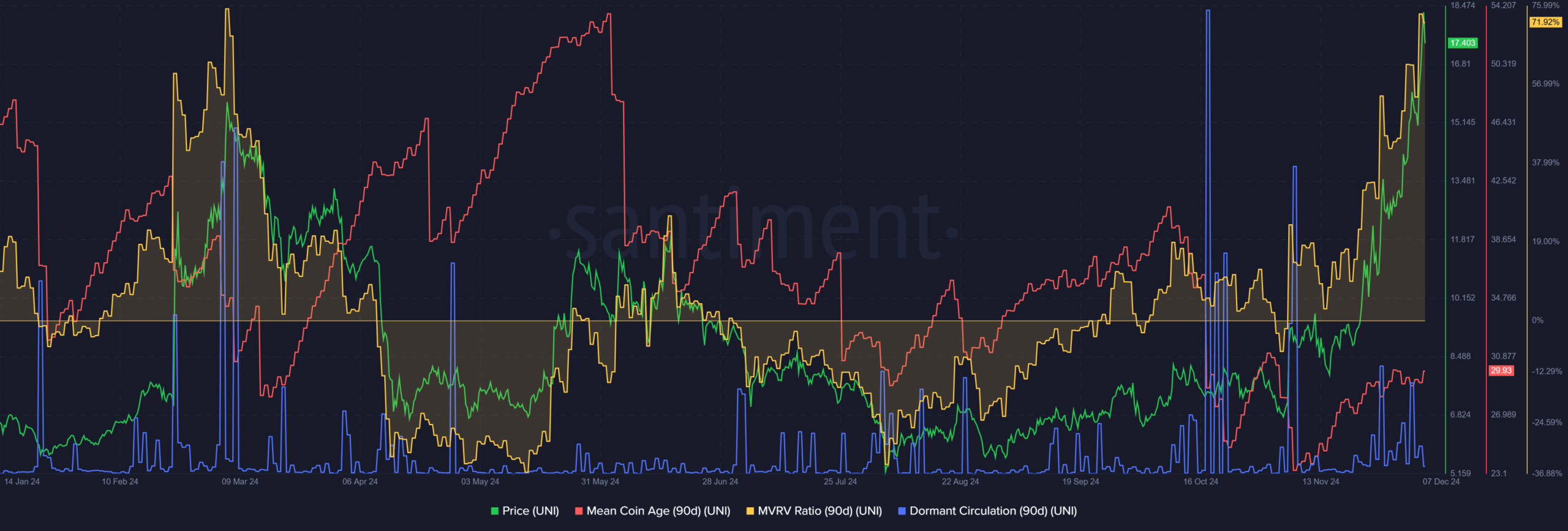

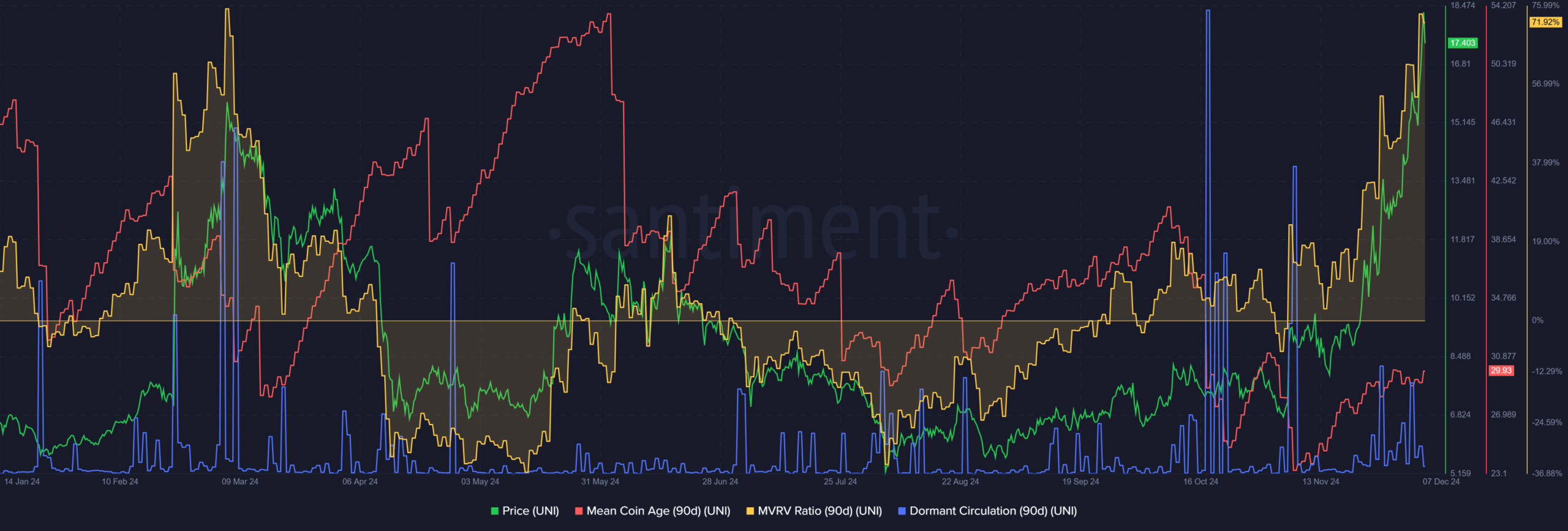

Source: Santiment

While these indicators suggested long-term growth was possible, others suggested a short-term decline was possible. Uniswap saw a circulation phase in October and early November, which was characterized by a lower average currency age.

Read Uniswap (UNI) Price Prediction for 2024-25

Meanwhile, the MVRV ratio soared and hit a record high in March, suggesting improved profitability. This revealed that the token could be seriously overvalued. Therefore, traders and investors should be prepared to take profits and wait for a downtrend to buy more UNI.