- An RSI result of 56 indicates that UNI is trading below overbought territory.

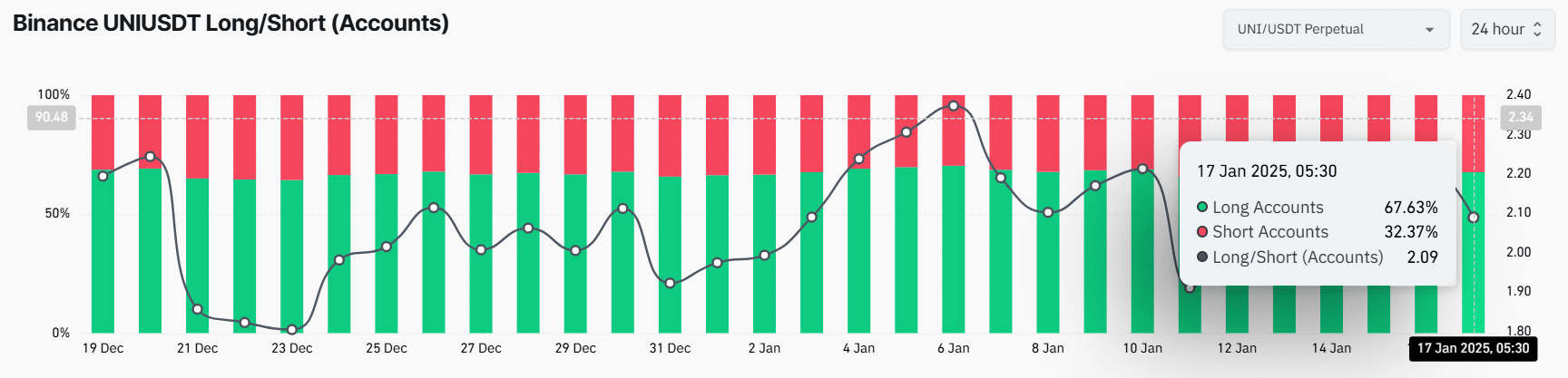

- At press time, 67.63% of Binance’s top UNI traders hold buy positions, while 32.37% hold sell positions.

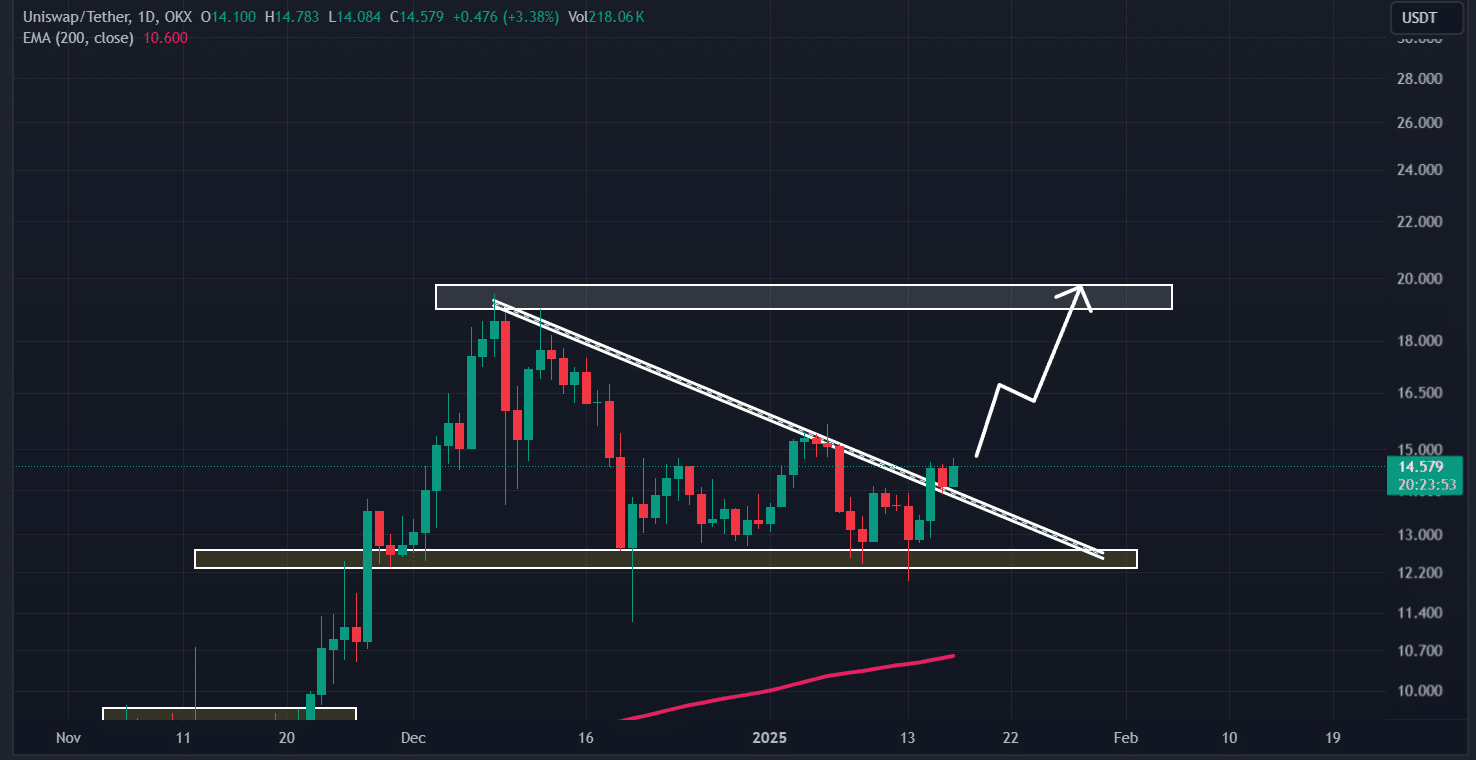

Uniswap’s native token, UNI, has broken out of a bullish price pattern as the larger cryptocurrency market rebounds overall. This signaled a potential upward move, with this breakout occurring after a prolonged period of difficulties faced by the asset since December 2024.

Uniswap (UNI) technical analysis

According to technical analysis by AMBCrypto, UNI broke out of its descending triangle pattern on the daily time frame and reached the $15.20 resistance level for the third time since December 2024.

However, the history of cryptocurrencies has not favored the bulls when it comes to these resistance levels.

Source: TradingView

UNI price prediction

The altcoin’s recent price action suggests that if UNI breaks the horizontal level and closes the daily candle above $15.50, it is likely to surge 30% to reach the next resistance level of $20 in the near future.

However, UNI’s performance over the past few days has been quite impressive. In fact, data shows that the asset has surged more than 16% in the past three days alone.

Major assets such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) also saw significant price surges. These assets and their performance are influencing broader market sentiment and UNI as well.

On the positive side, UNI appeared to be well below overbought territory, with an RSI of 56. This is a sign that there is ample room for further upside.

67.63% of top UNI traders bet on Buy.

As revealed by on-chain analytics firm Coinglass, there has been a surge in trader interest and confidence over the past 24 hours as of this writing.

In fact, Binance’s UNI/USDT long/short ratio was 2.09, highlighting the bullish market sentiment among traders.

Source: Coinglass

Additionally, among Binance’s top UNI traders, 67.63% held buy positions and 32.37% held sell positions, further supporting the overall bullish mood in the market.

Combining these on-chain indicators with technical analysis, it looks like a bull market is currently ruling the asset. Therefore, they could facilitate UNI’s violation of the $15 hurdle to achieve the expected goal.