- Etherum ETFS has recorded $ 10 million, bringing a total leak to $ 100 million over the last two days.

- Will the decrease CME ETH are produced after the continued leak?

USA Ether Leeum (ETH) ETF recorded another leak of $ 35.89m daily on March 6, with a second day of Blade Out. The regenerated risk sentiment was suspended on Tuesday for eight consecutive days.

Source: SOSO value

Overall, ETF ETF investors have withdrew more than $ 400 million from the product over the past two weeks.

This was completely different from the stable inflow seen in early February. Especially as the market intensifies in the Trump tariff war, the market intensifies.

Eth CME yield decrease

In February, ETFS has seen relatively higher inflow than BTC ETF -Trend Coin Base Analyst It is connected High returns that cannot be resisted in cme eth standard transactions.

For those who are not familiar with, transactions are related to the purchase of SPOT ETF and the lack of price difference (yield).

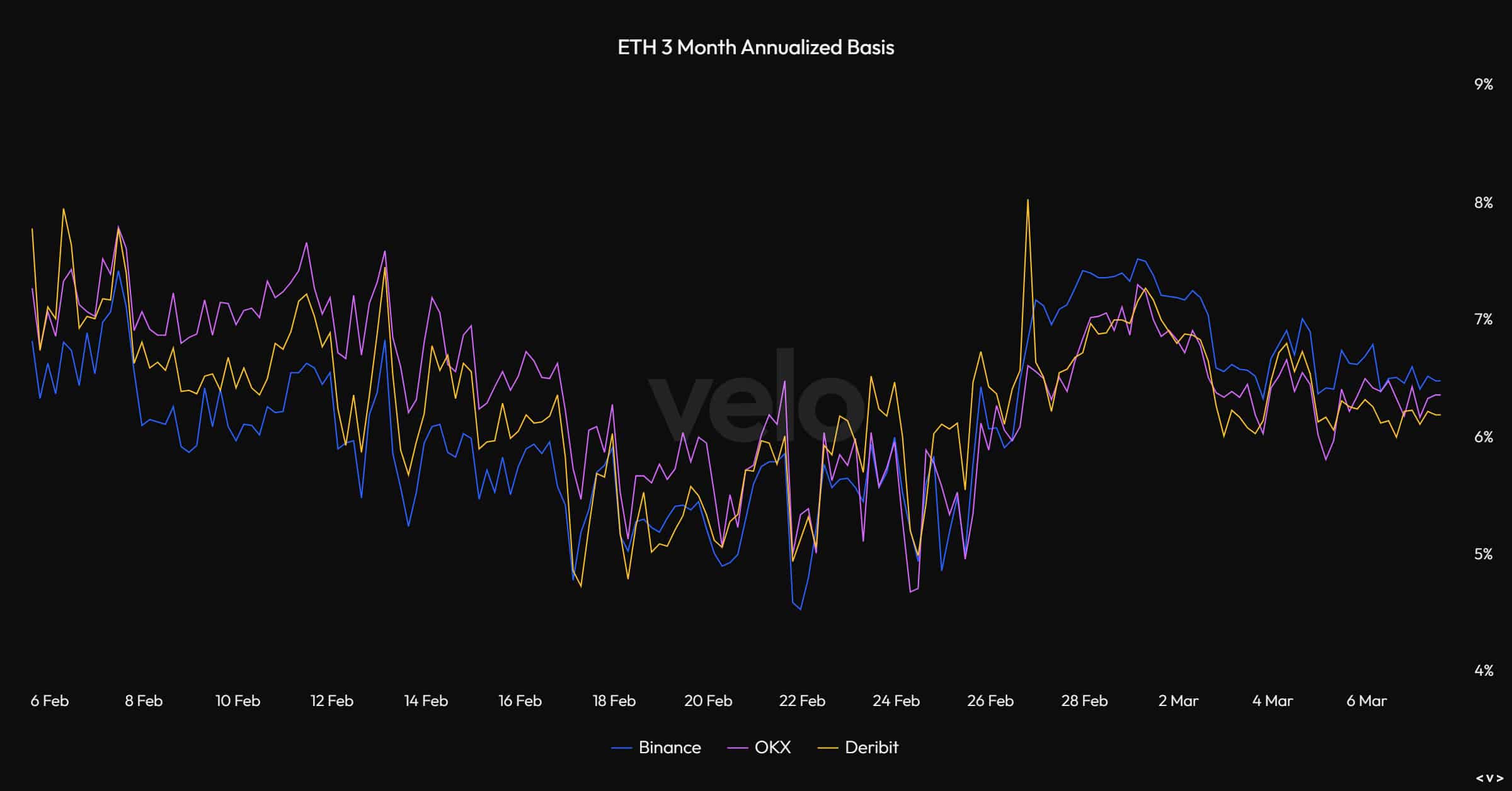

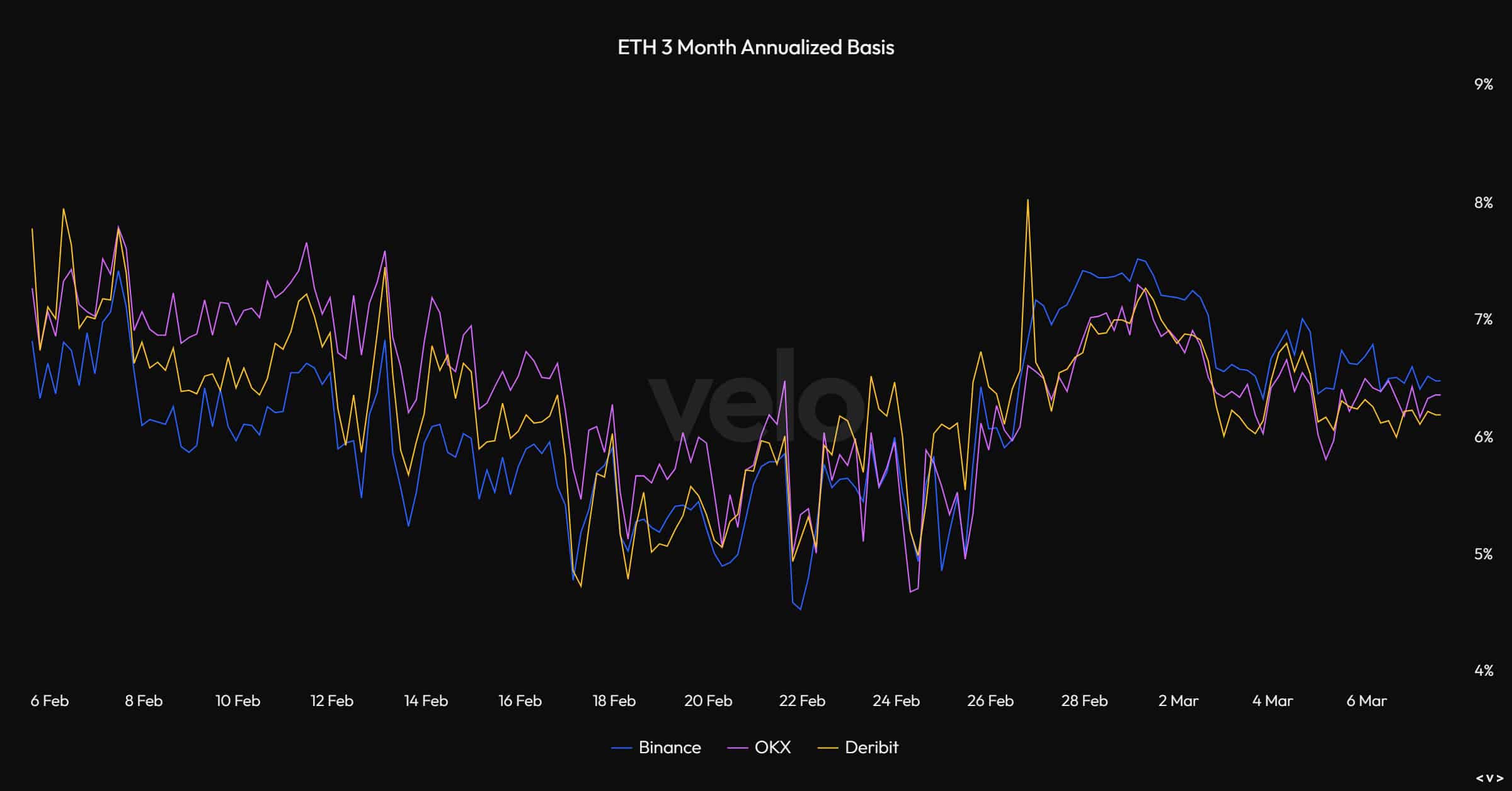

Source: Bello

According to VELO, ETH yields surged to 8%at the end of February and were marked with strong ETF flow.

But in March, yields fell to 6%. This can crush your appetite for transport trade and ETFs. In fact, this idea has been strengthened by the CME gift (OI) ratio.

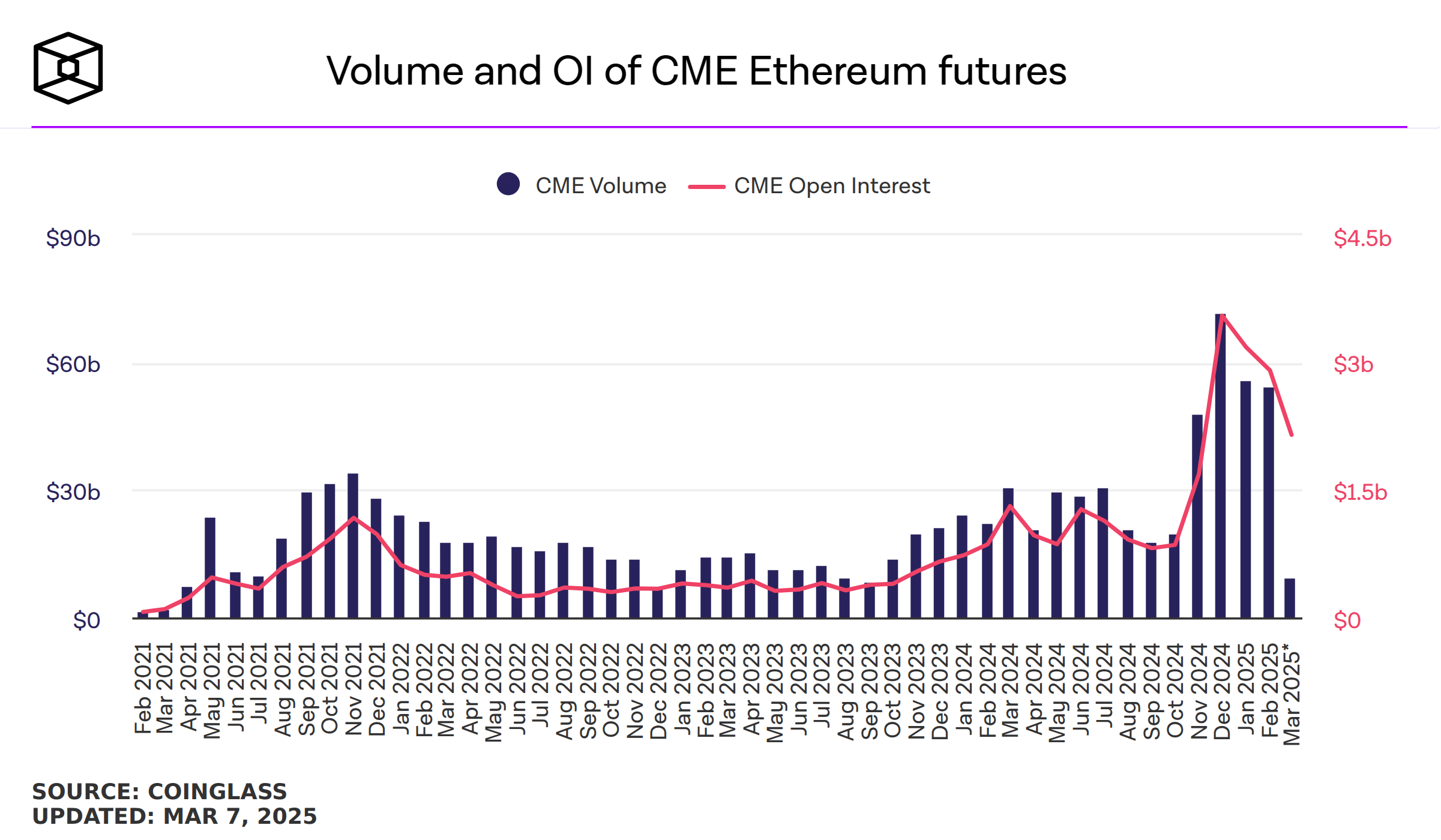

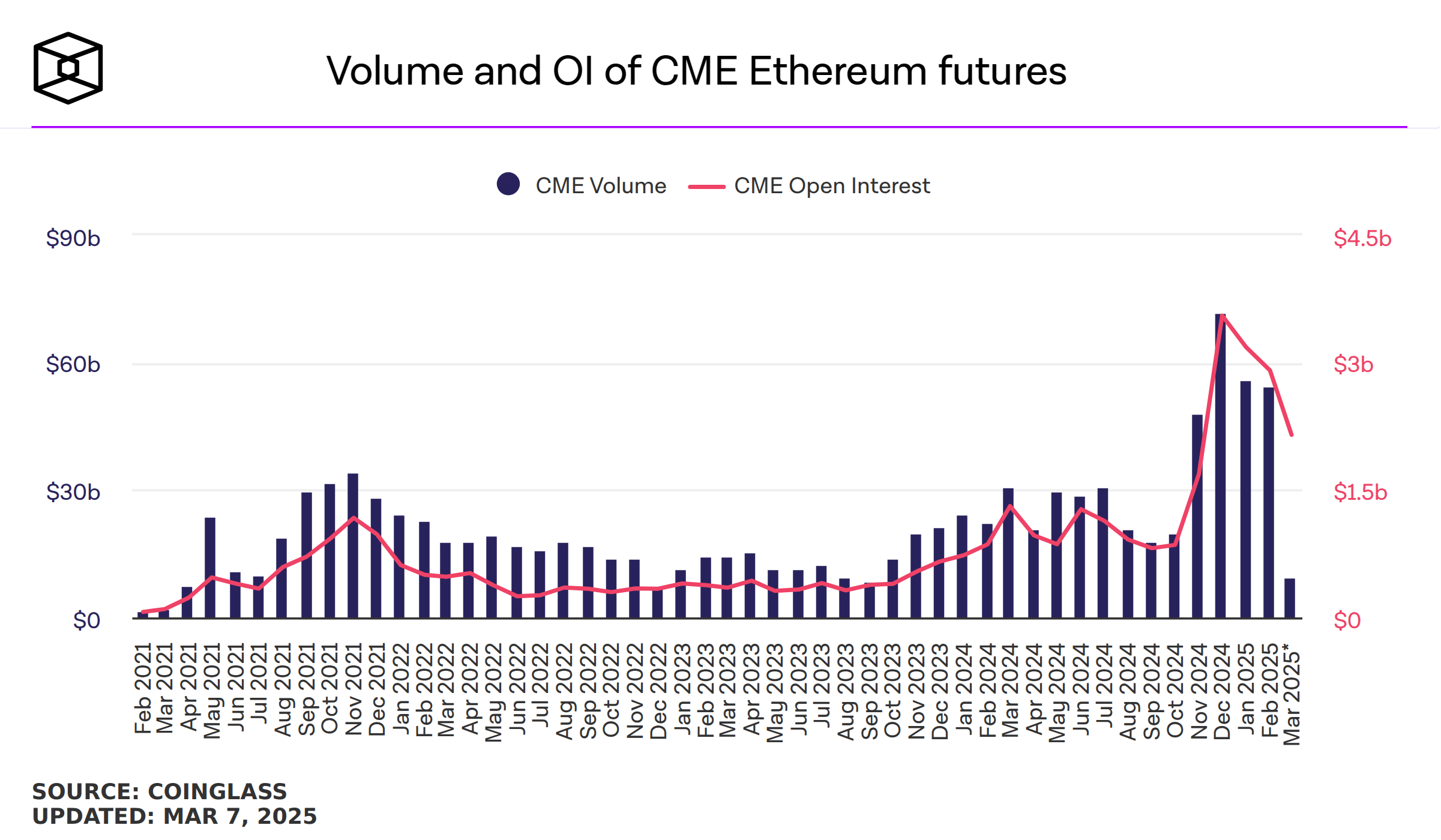

In January 2025, the OI steadily fell from $ 31.8 billion to $ 2.12 billion in March, and a player who relaxed or transported a little tension was closed.

Source: Block

But the wider weaker market sentiment did not make a better work for Wang Altcoin. Therefore, the risk of falling Altcoin can be greatly maintained.

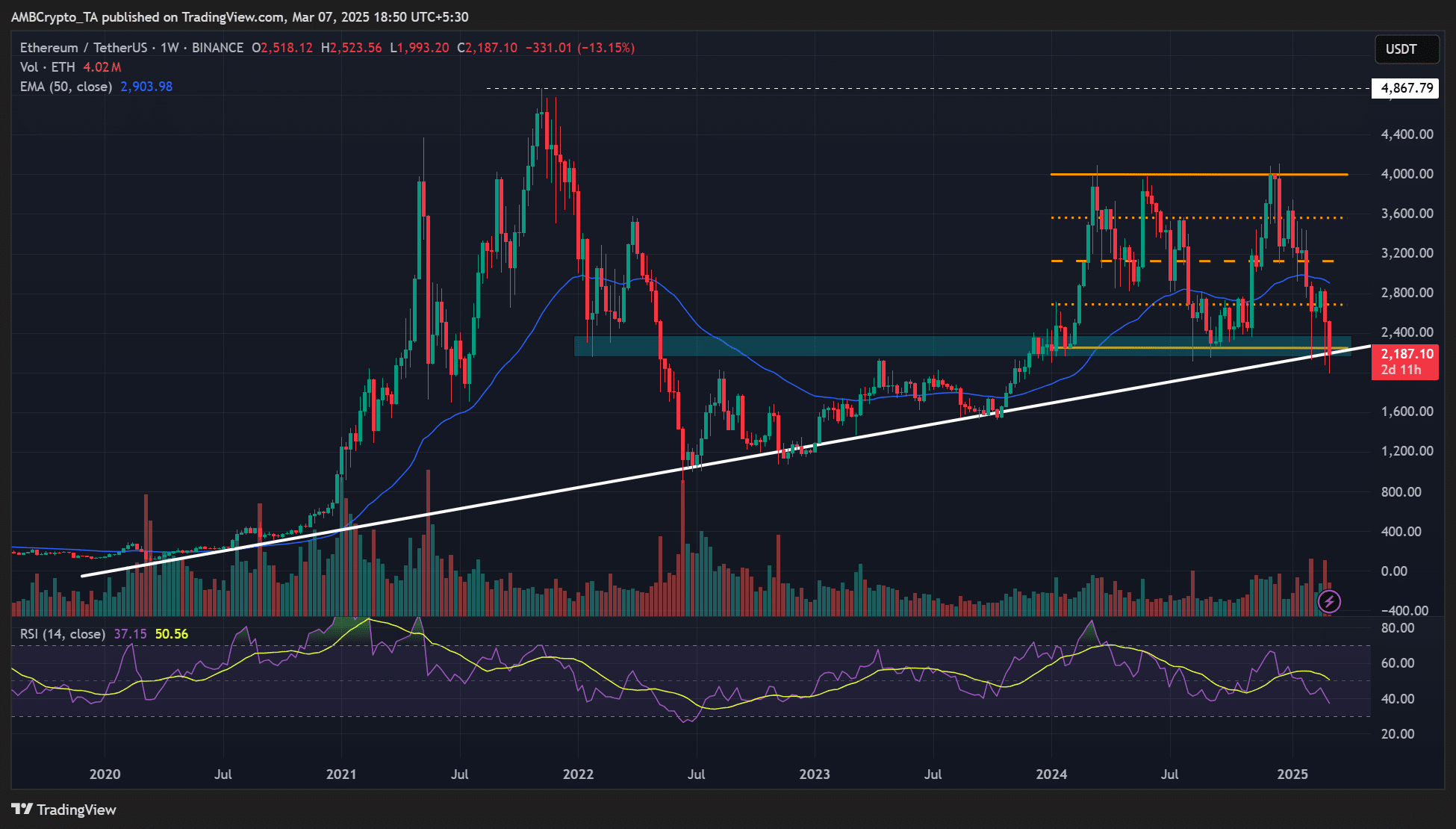

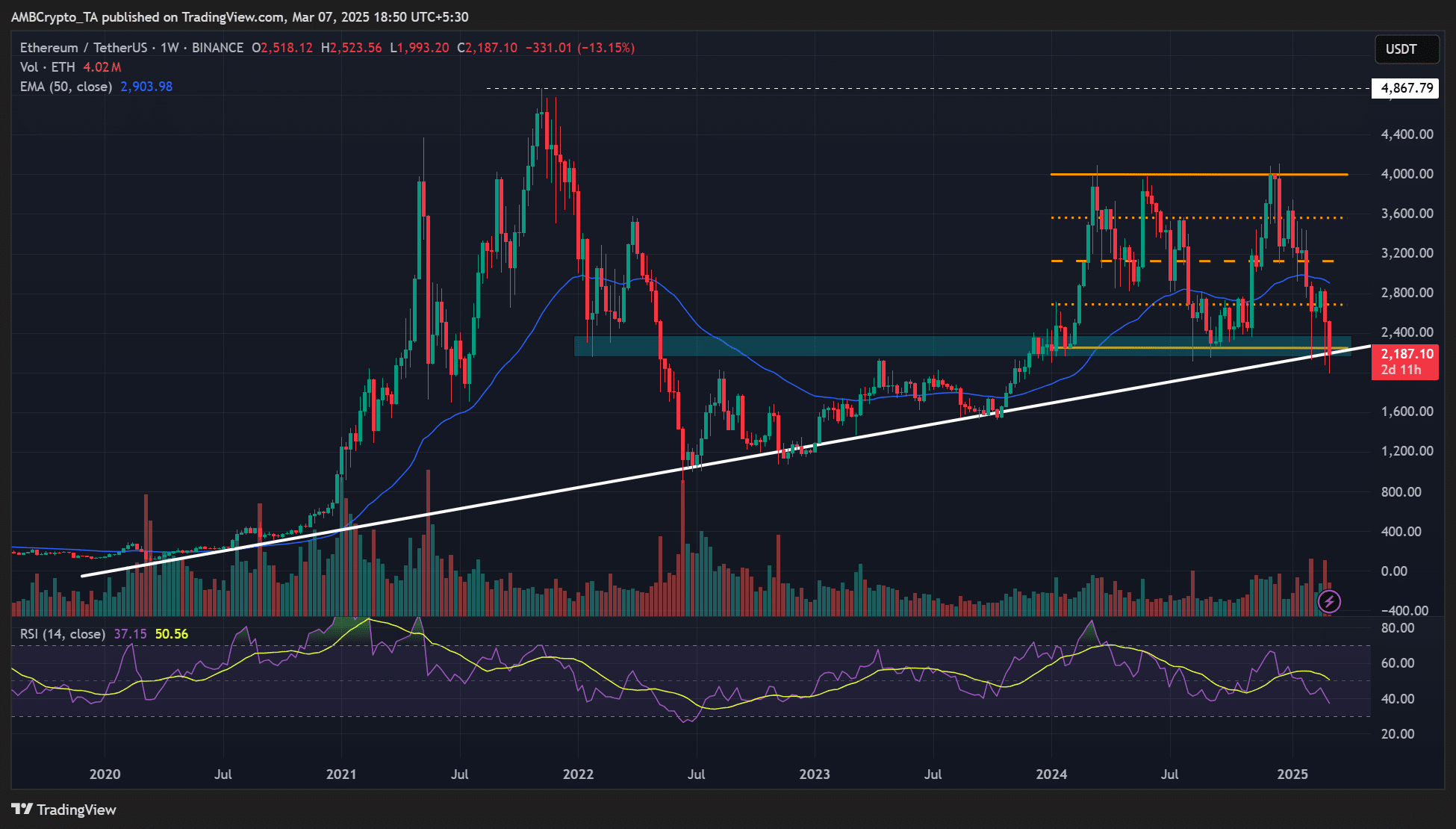

From a technical point of view, ETH seemed to be at a pivotal intersection of the minimum and long -term trend lines of more than $ 2000. Violations below the level can change their interest in the higher time market structure and the trader’s Altcoin.

Source: ETH/USDT, TradingView