- Despite the recent price decline, it has been revealed that US investors are actively buying ETH.

- Although mixed signals from various indicators cast uncertainty on the possibility of a rally, technical patterns point to an uptrend.

Over the past 24 hours, the cryptocurrency markets have seen a significant drop, with Ethereum (ETH) down 8.41%, bringing its weekly performance down 4.76%.

However, further analysis suggests that this downtrend may be short-lived, as US investors appear ready to push the ETH price higher.

US investors are supporting ETH despite market volatility.

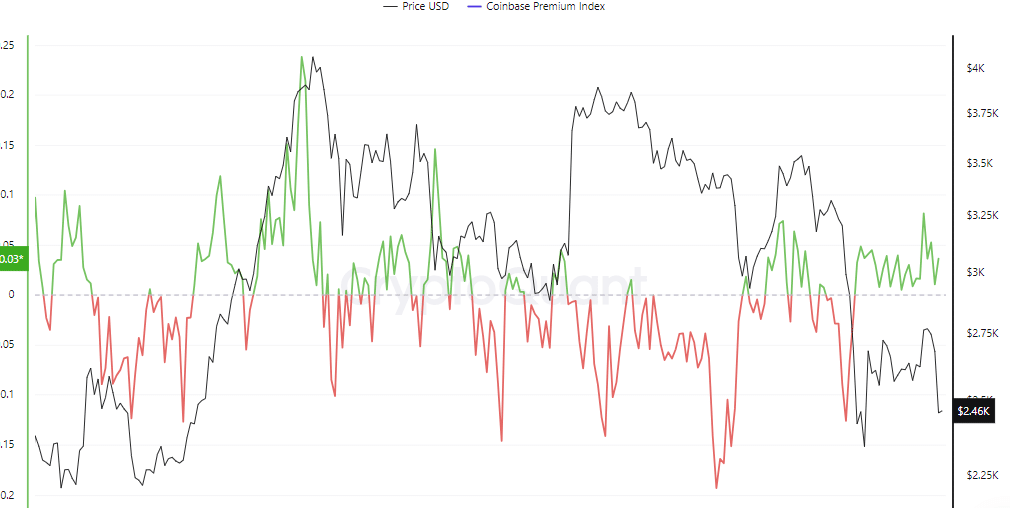

Recent data from Crypto Quant on Ethereum, which measures the price difference between Ethereum on US-based Coinbase Pro and global exchange Binance (BNB), shows that interest from US cryptocurrency investors is growing despite the recent market decline.

A positive reading for this indicator indicates that Ethereum is trading at a higher price on Coinbase Pro than on Binance, suggesting strong buying interest among US investors.

Source: Crypto Quant

At the time of writing, the index was positive at 0.03, indicating that investor confidence has persisted despite the widespread market turmoil. If this buying activity continues, the price of Ethereum is likely to follow suit.

Further research by AMBCrypto found that while US investors are supportive of the rally potential, opinions remain mixed within other sectors.

Mixed sentiments among retailers on ETH outlook

While some retailers remain enthusiastic about Ethereum, indicators are sending mixed signals about future price action.

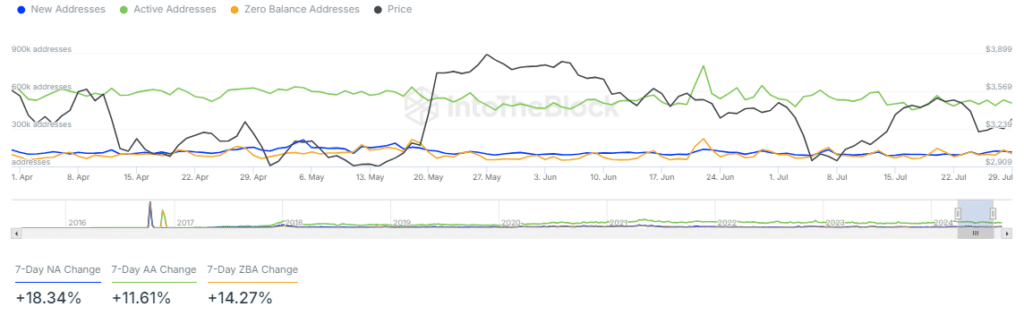

Increasing numbers of active addresses and new addresses indicate bullish sentiment.

Specifically, over the past few days, new addresses have increased by 18.34% and active addresses have increased by 11.61%, showing high participation on Ethereum.

Source: IntoTheBlock

In the last 24 hours, the number of new addresses reached 114.92K, while the number of active addresses reached 507.15K. This high level of activity indicates that bullish sentiment is steadily increasing in the market.

However, Ethereum’s negative funding rate suggests a contrasting view, indicating that the majority of retail traders are expecting a price decline and are prepared to pay a premium to maintain their short positions.

If this bearish outlook persists, Ethereum’s upside potential could be hampered despite significant interest from US investors and positive growth in address statistics.

Support levels determine ETH’s next move.

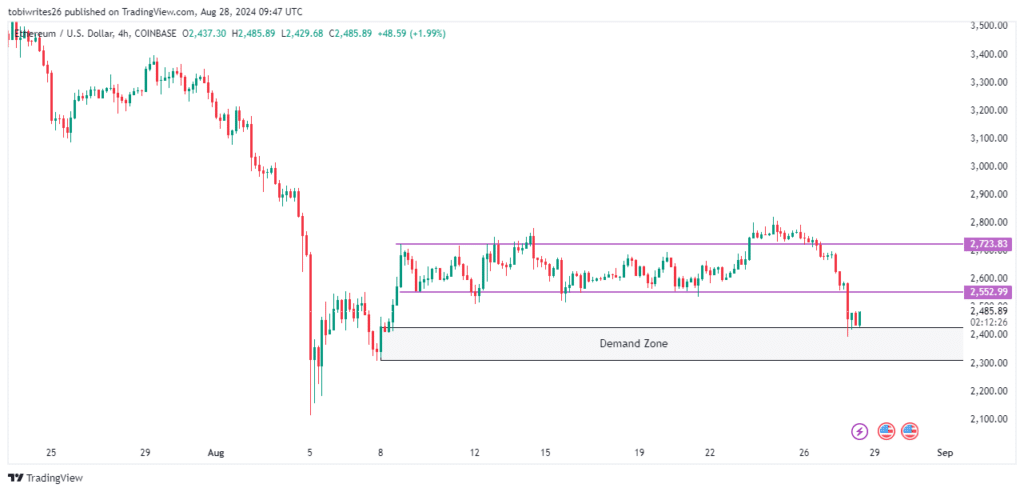

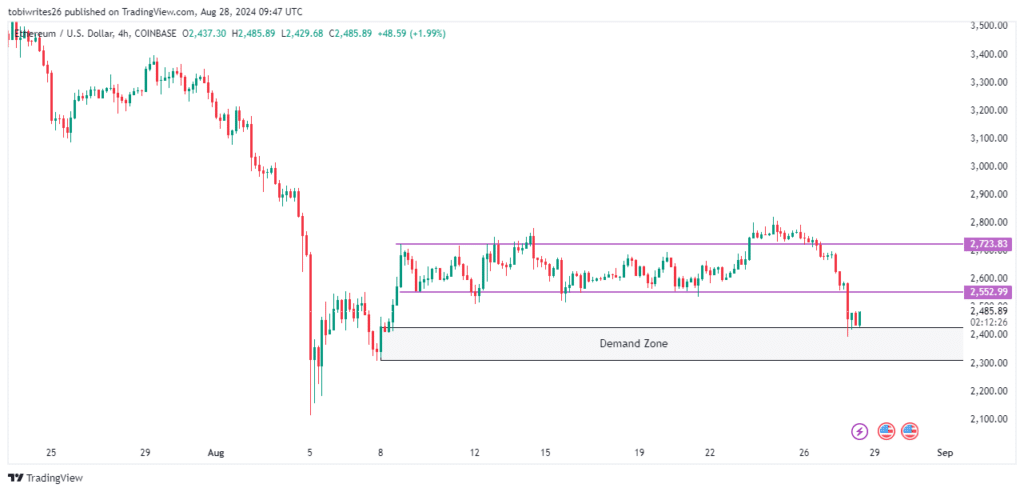

ETH has recently come out of a consolidation phase, which is usually marked by significant accumulation by whales in anticipation of a rally. This decline could be attributed to stop hunting.

Stop hunting involves large institutions intentionally manipulating the price of an asset to activate stop loss orders and cause rapid price movements.

This strategy allows you to buy or sell large amounts at favorable prices before the market stabilizes.

Source: Trading View

In this case, institutional traders could accumulate more ETH at lower prices. These levels also coincide with demand zones, potentially fueling an uptrend.

Read Ethereum (ETH) Price Prediction 2024-2025

However, the sustainability of this rally depends on whether the $2,552.99 support level turns into resistance, which would limit any upward price movement.

Additionally, a break above the resistance level of $2,723.83 would further solidify the bullish sentiment in the market.