- Social indicators for both VET and VTHO increased in the past week.

- Technical indicators suggested a price correction for VTHO.

VeChain (VET) and VeThor (VTHO) Recently, it has surprised investors with its upbeat performance.

With the market turning in investors’ favor, the token is not late in registering a promising uptrend. Therefore, AMBCrypto planned to take a closer look at these tokens to find out what we can expect from them.

Bull market for VeChain and VeThor

CoinMarketCap’s data It said VET prices have surged more than 28% in the past seven days. Things were better for VTHO as the token witnessed a price increase of over 43% in one day.

At the time of writing, these tokens are trading at $0.02546 and $0.002527, respectively.

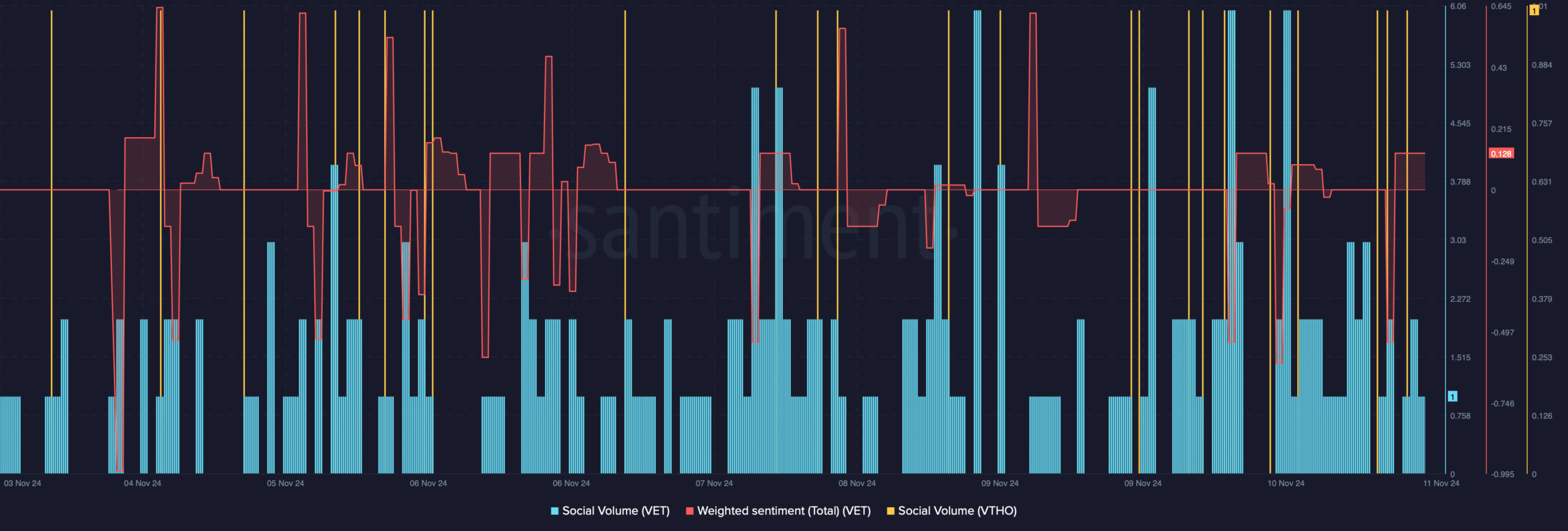

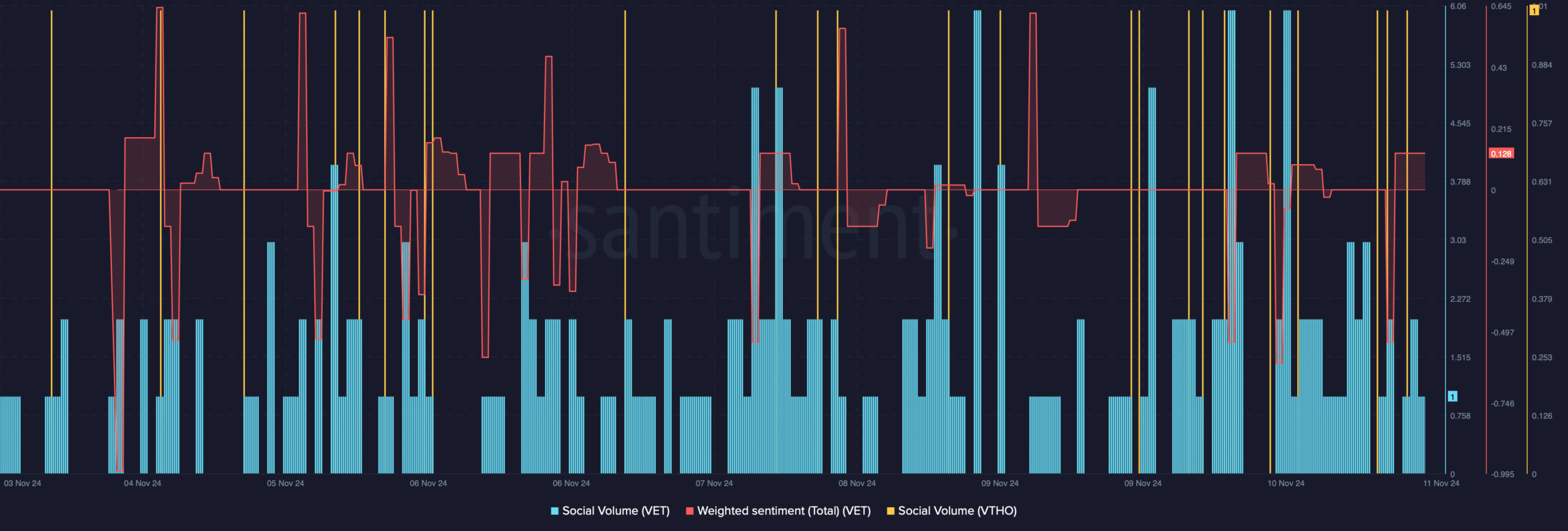

AMBCrypto’s analysis of Santiment’s data shows that these tokens’ social metrics were also affected by these price increases.

We found that the social volume of both VET and VTHO has increased, reflecting their growing popularity. Weighted Sentiment for VET also turned positive after falling sharply.

This suggests that there has been a late increase in optimistic sentiment towards the token.

Source: Santiment

What to expect from VET and VTHO

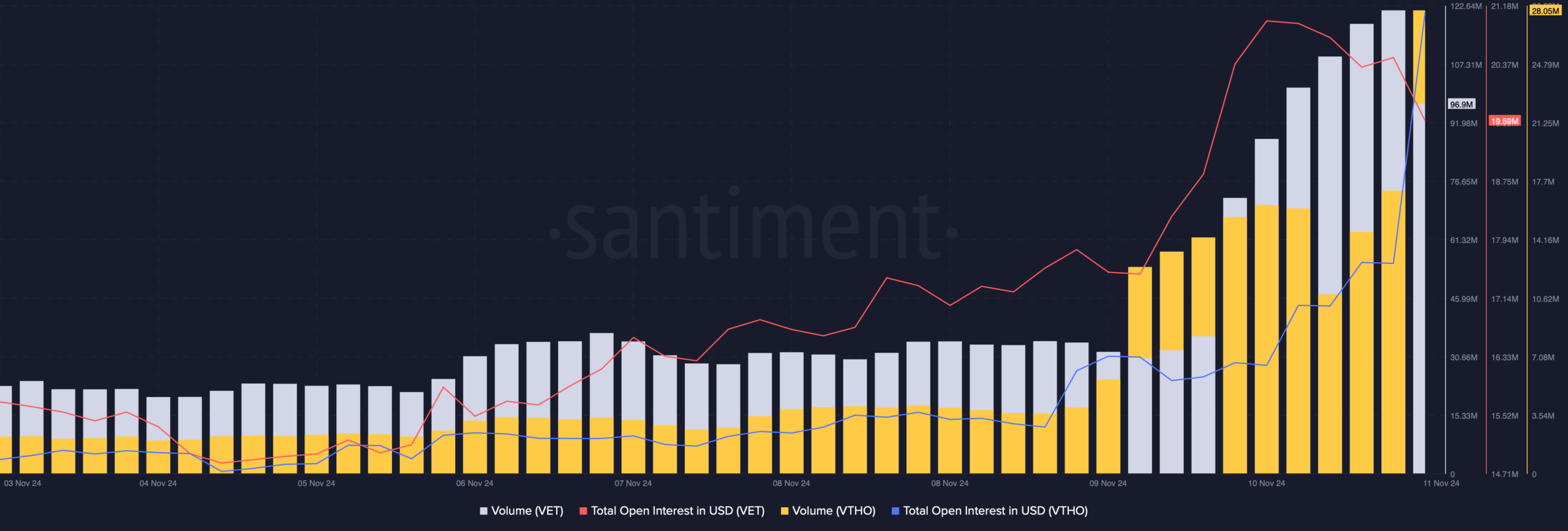

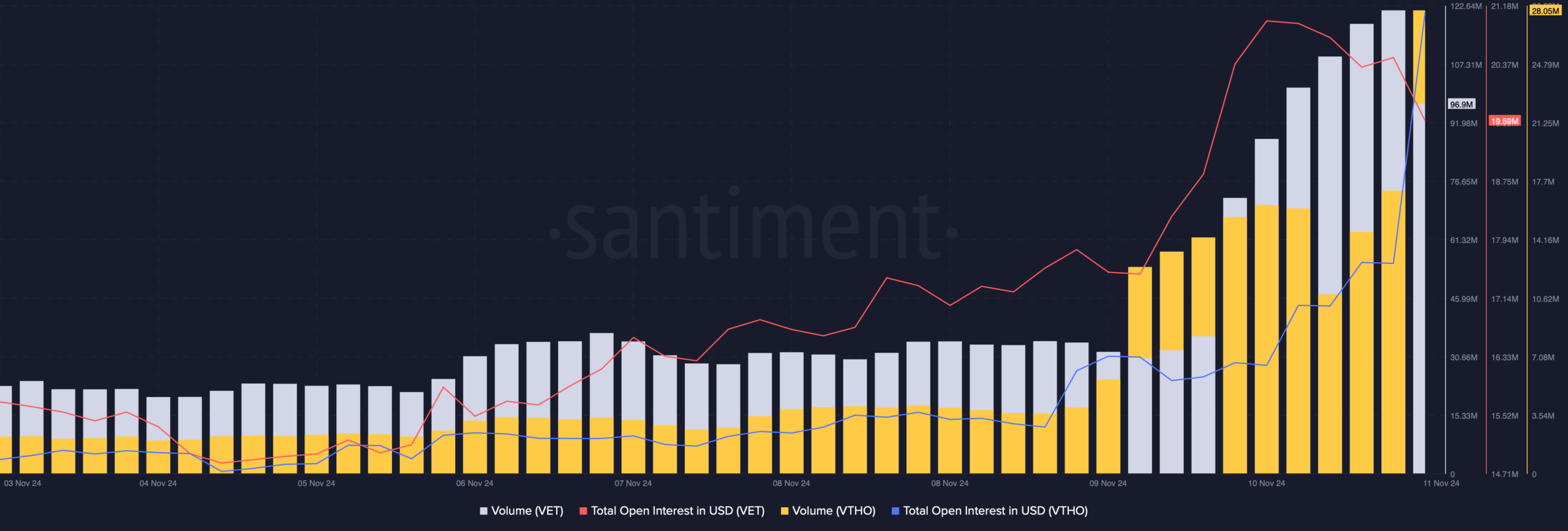

We then checked the on-chain data for both tokens to see whether this price increase would persist. Trading volumes for both VET and VTHO increased.

Whenever the indicator rises during a price increase, it acts as a basis for an upward rally.

The open interest of VET and VTHO has also increased, meaning that the current price trend is likely to continue.

Source: Santiment

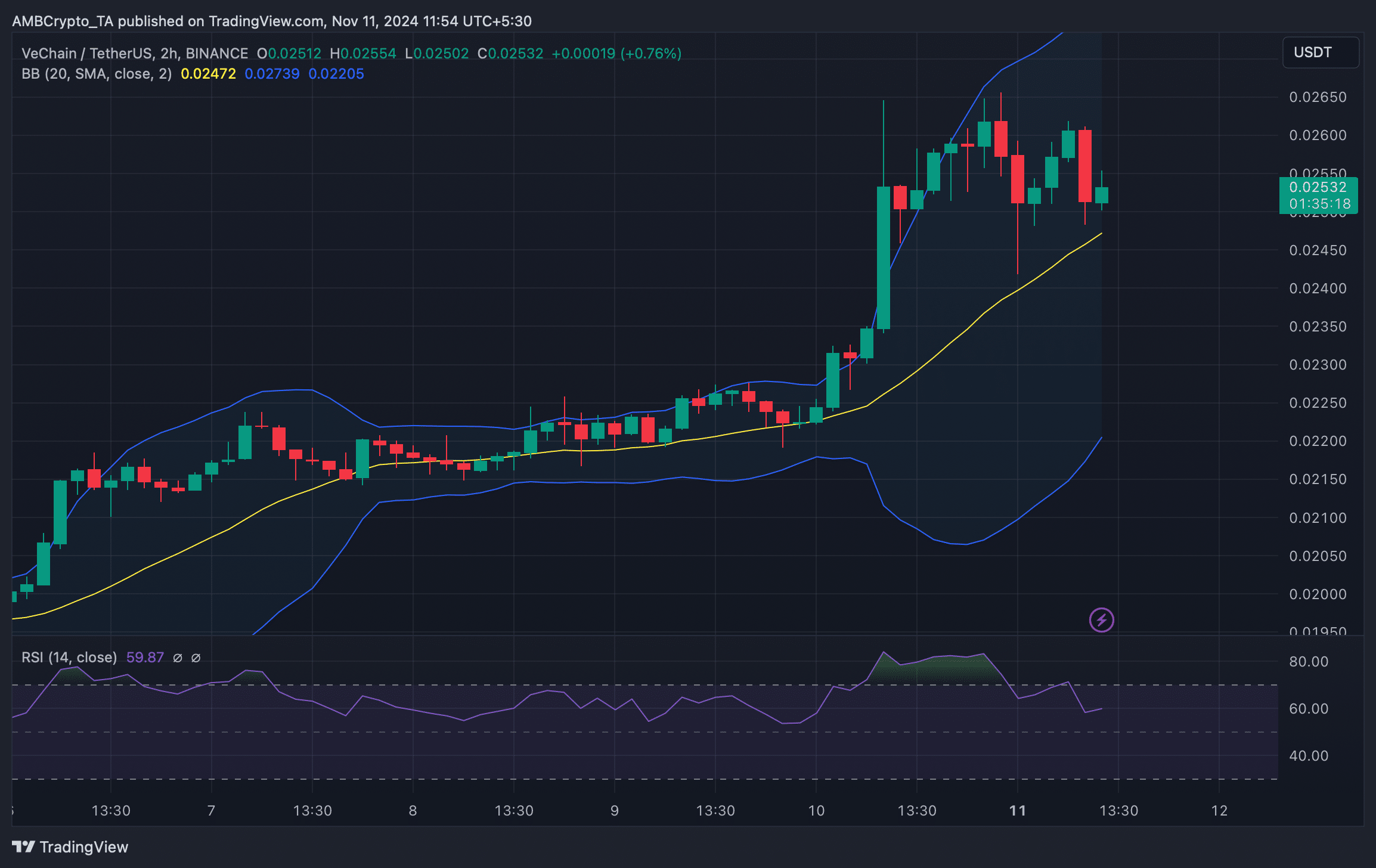

According to TradingView charts, VET fell after touching the upper Bollinger band.

At the time of writing, VeChain was approaching support near its 20-day simple moving average (SMA).

While that was happening, VET’s Relative Strength Index (RSI) moved south, indicating that VET was likely to test its 20-day SMA support.

Source: TradingView

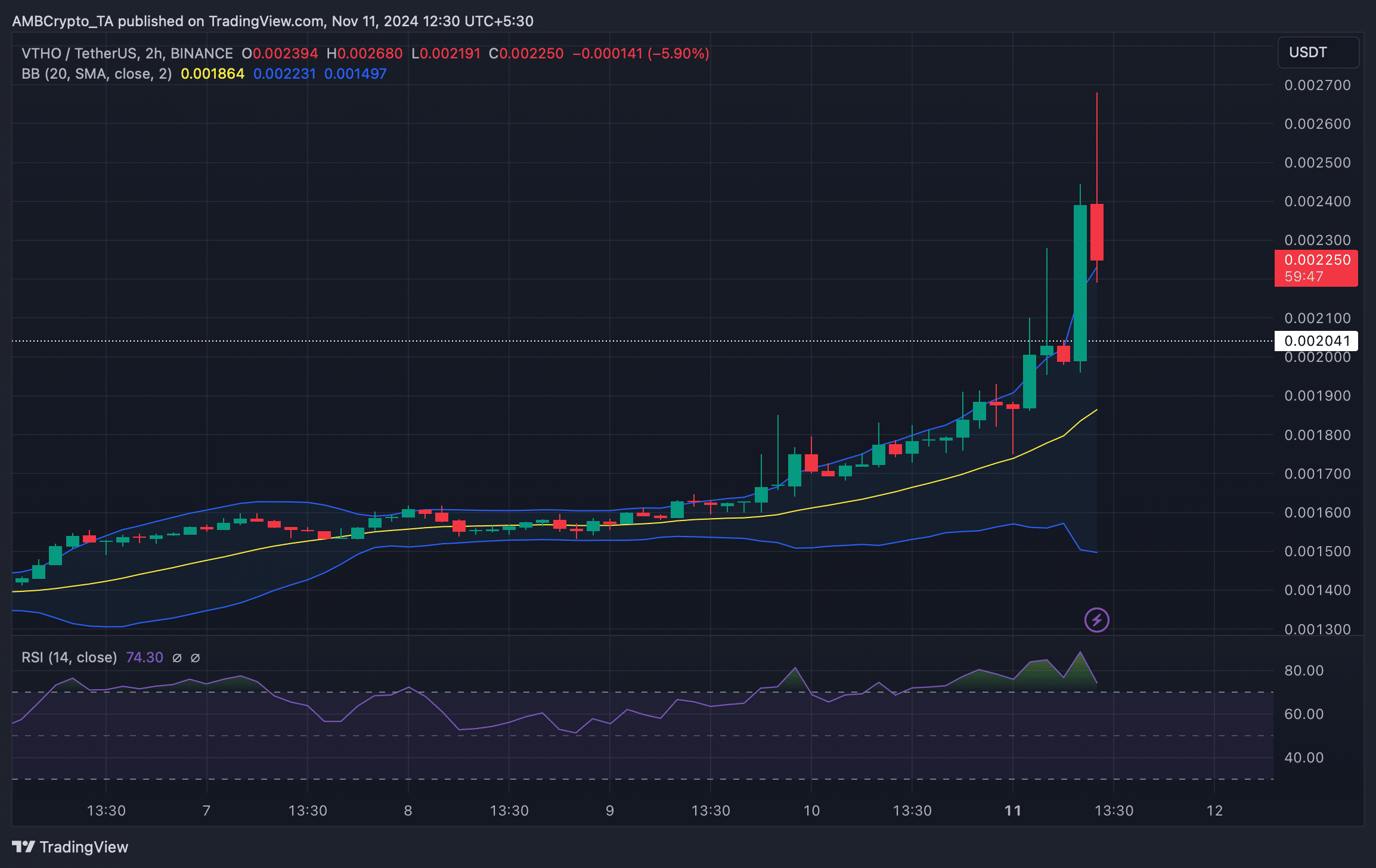

The situation at VTHO was slightly different. The token has experienced a huge price rise over the past 24 hours.

This pushed the token price above the upper Bollinger Band limit, meaning a price correction is likely.

read VeChain (VET) Price Prediction 2024~2025

Moreover, VTHO’s RSI remained in overbought territory. Whenever that happens, it indicates increased selling pressure, which could cause prices to fall in the future.

If a price correction occurs, investors could see VTHO fall to support levels near $0.0020.

Source: TradingView