- VIRTUAL increased by more than 10% in a single 24-hour period.

- VIRTUAL risks liquidating the overly leveraged order at $3.10.

Virtuals Protocol (VIRTUAL) has recently seen price increases, with the altcoin price peaking at $3.22, up from around $2.95. This move represented a 10.57% rise in just one day and brought the market capitalization to $3.22 billion. .

Despite a 5.78% decrease in daily trading volume to $290.57 million, the volume-to-market capitalization ratio remained healthy at 9.05%. This means strong trading activity.

The recent performance of altcoins is a sign of investor optimism. This indicates VIRTUAL’s strong market position and could potentially influence its future price trajectory.

Hypothetical price action and predictions

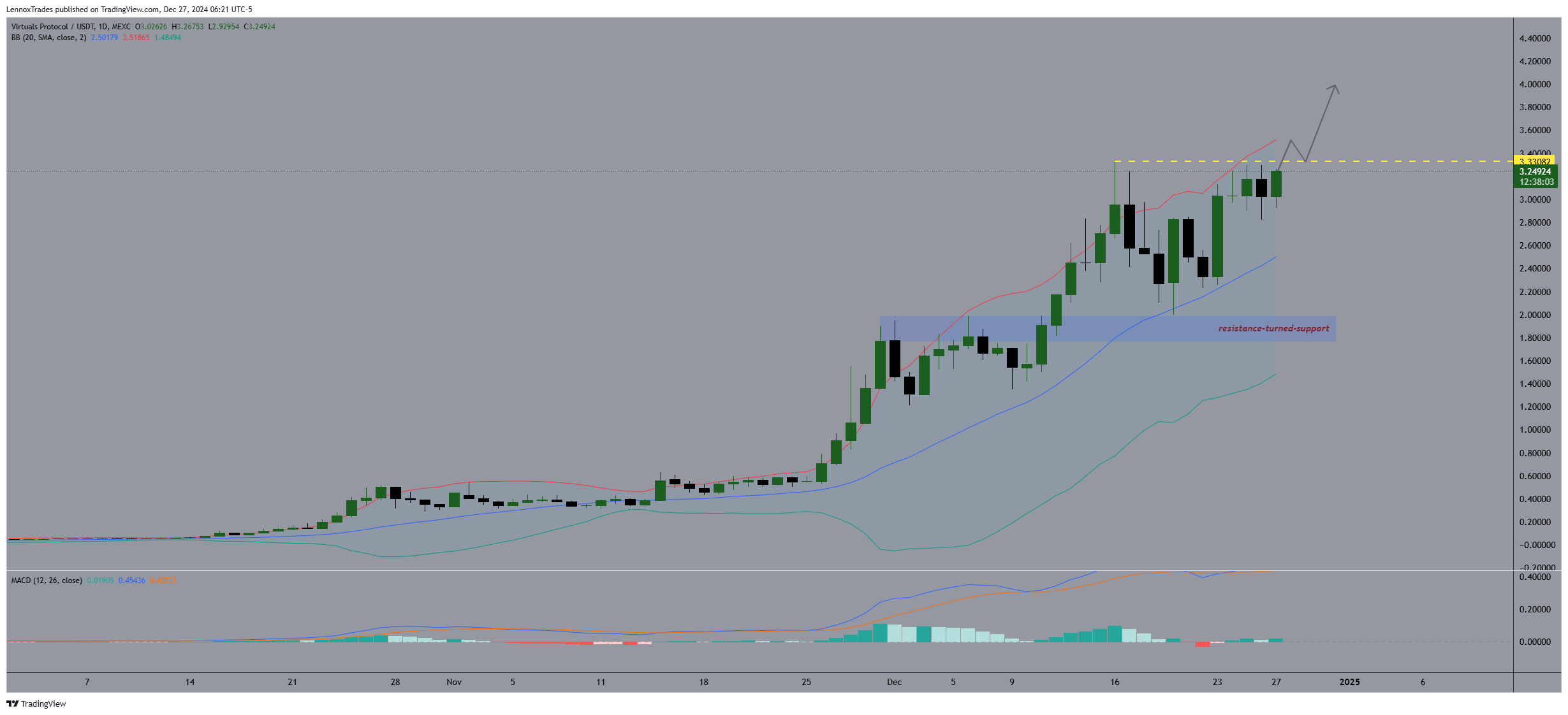

Looking at the chart, VIRTUAL showed a strong test of ATH in an attempt to break above the resistance level. The price initially peaked at $2 and broke through that level, setting the stage for a further rally with VIRTUAL hitting ATH of $3.33.

However, after retreating from the high, the price stabilized near $2, suggesting a resistance-to-support dynamic. This supported the bullish outlook, suggesting that VIRTUAL’s price action could reach the $6 level.

Source: Trading View

Conversely, a fall below the sideways zone could lead to a retest of the midline of the Bollinger Bands or even their lower bounds, providing important support.

If price breaches this lower band, it could trigger a short-term bearish trend within the overall uptrend.

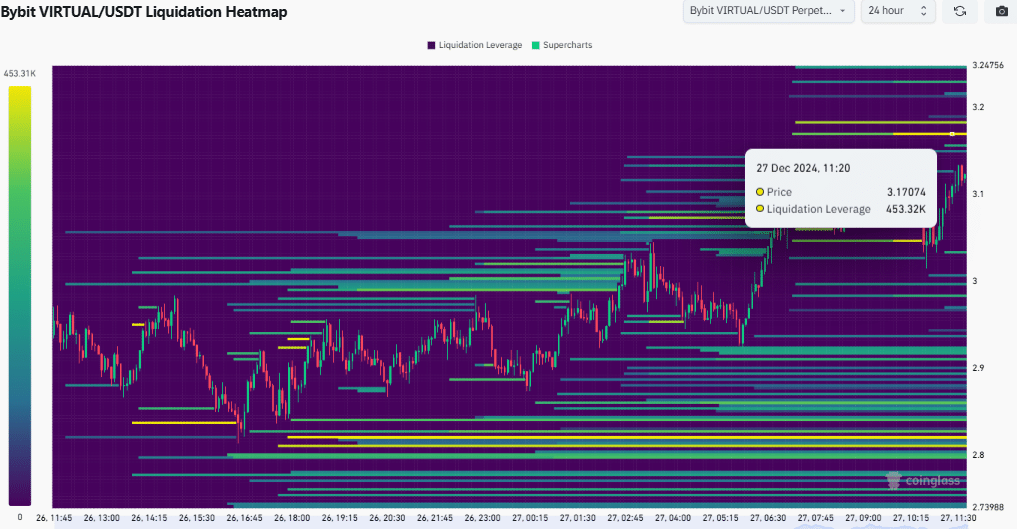

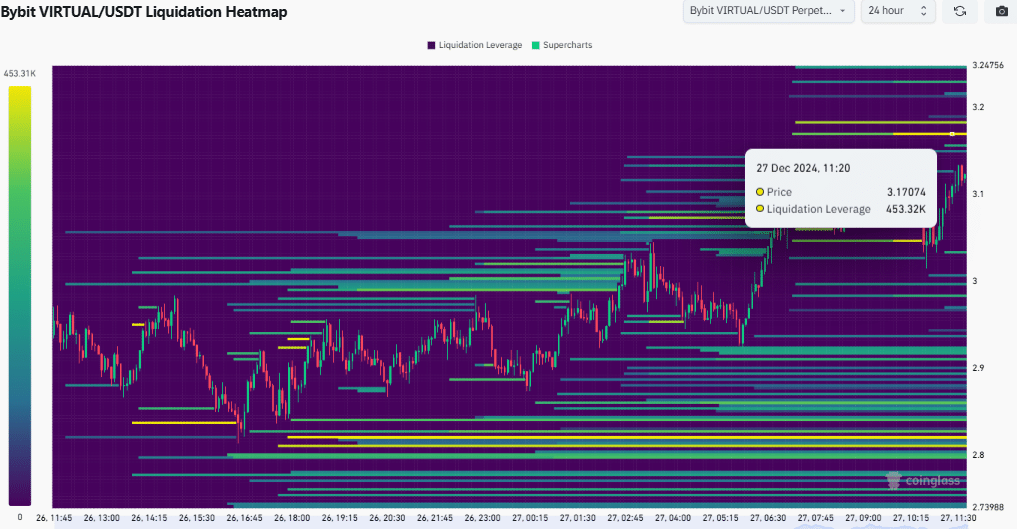

Clearing heatmap and whale activity

A liquidation heatmap indicates the level of concentrated liquidation at a particular price range where price fluctuations are prevalent.

In particular, the heatmap shows a high liquidation leverage of $3.1074, with leverage of 453.32k at risk of liquidation if the price reaches that level.

This level represents a critical area where price is concentrated, increasing trading activity and suggesting a potential pivot point for future movement.

Source: Coinglass

Past trends have shown that prices have often approached dense clearing zones, driven by traders looking to capitalize on changes in market sentiment.

If the price of VIRTUAL continues to interact with these areas, further price movements may occur around these liquidation levels. This represents the dynamics of supply and demand at key technological levels within the market.

Lastly, the Virtuals Protocol whale exchanged 9.9cbBTC for 19.13 million VIRTUAL, which was then worth about $896,000.

This strategic move was followed by a major sale in which the whale offloaded 1.026 million VIRTUALs for $2.7 million, realizing a profit of approximately $1.8 million.

Source: The Data Nerd/X

Whale currently owns 887,000 VIRTUALs, worth approximately $2.75 million. This is a sign that whales are anticipating a further upward trend as they systematically take profits.

During this period, whale trading activity peaked with total revenue of $4.56 million, representing a return on investment equivalent to 5.1 times the initial stake.