- At press time, LINK was showing signs of a potential breakout, supported by bullish technical indicators.

- Foreign exchange reserves have declined and long-term clearing has highlighted strong bullish sentiment.

Chainlink (LINK) has made significant progress recently through technological innovation and notable improvements in overall market performance. After launching CCIP private transactions for banks and integrating with Bitcoin, Chainlink is establishing itself as a leader in cross-chain tokenized asset payments.

With ANZ’s pilot program and AI-driven initiatives to manage unstructured financial data, LINK has recorded a 4.46% price surge in the last 24 hours. Trading at $11.79 at press time, LINK appears to be approaching a critical resistance level.

Now the question is – can this momentum take it to new heights?

Is LINK set to breakout?

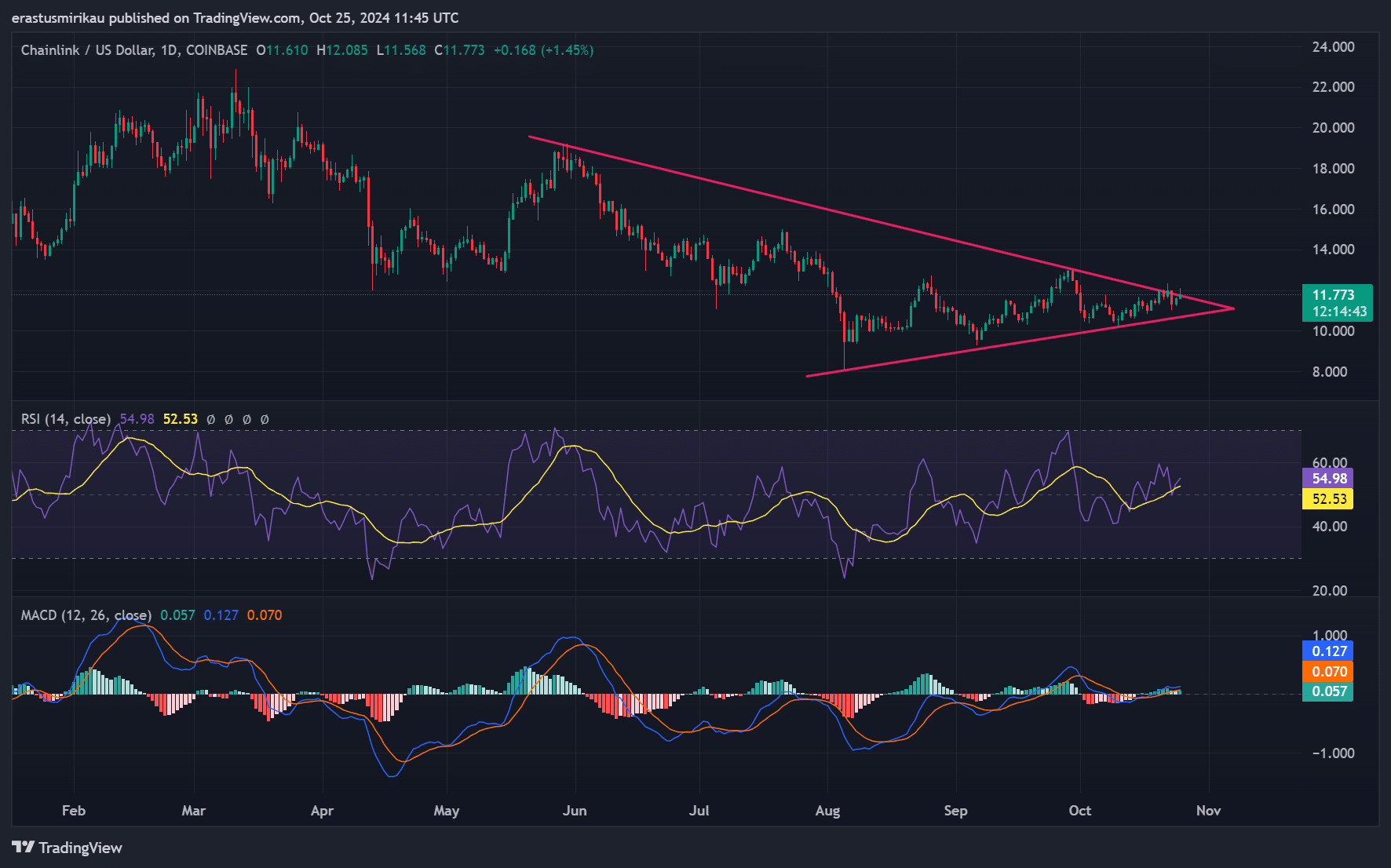

LINK’s charts have been showing a symmetrical triangle pattern that has been tightening since mid-July. At press time, LINK was trading near the top of this triangle, hovering at $11.77. Additionally, the relative strength index (RSI) is 54.98, indicating that LINK has a bullish edge.

Additionally, the Moving Average Convergence Divergence (MACD) highlighted a recent bullish crossover that could be a sign of upward momentum. So, if LINK breaks out of the triangle, the next target could be the psychological level of $13.

Source: TradingView

A strong on-chain signal indicates increased usage.

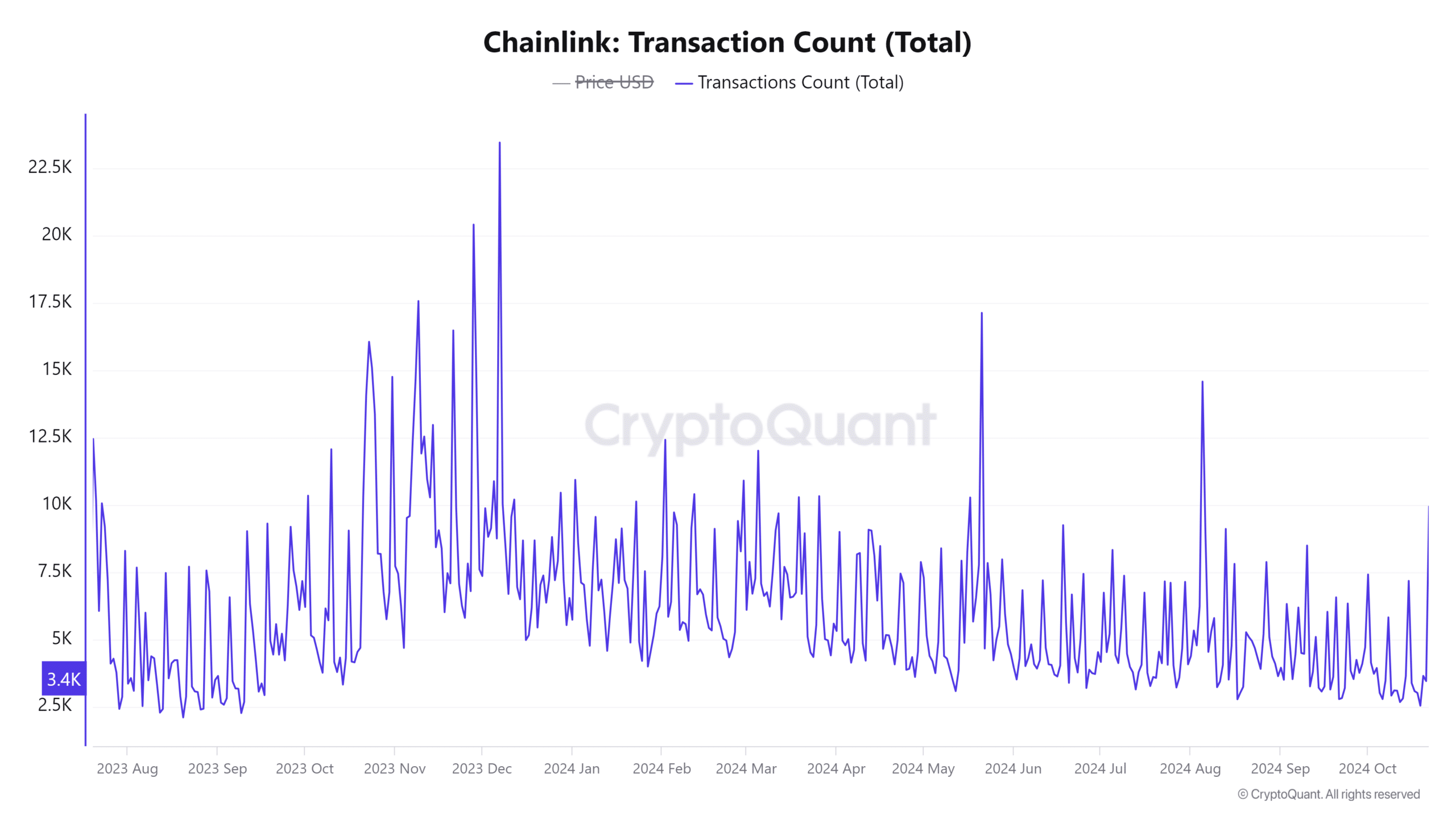

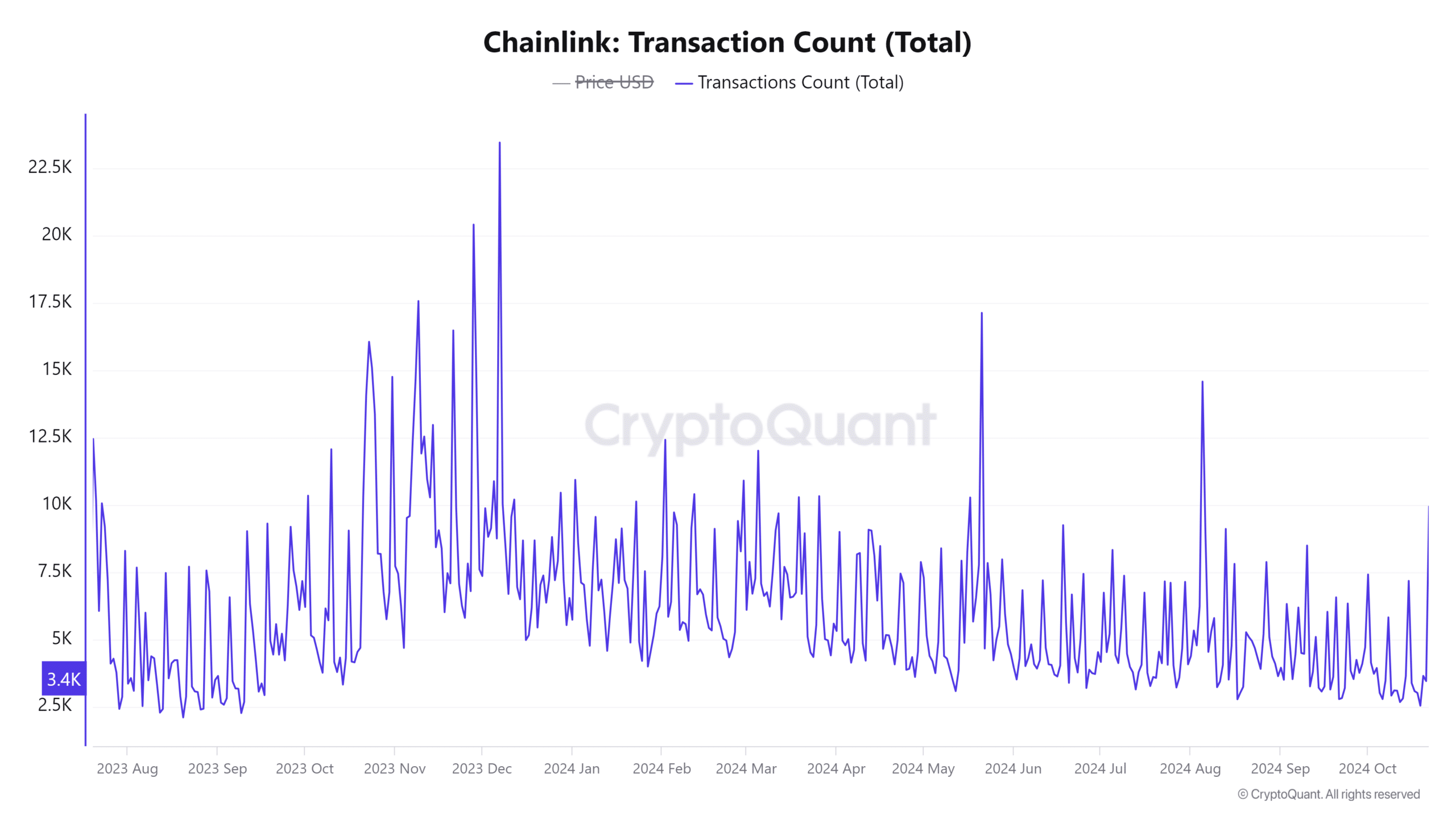

On-chain indicators paint a promising picture for Chainlink. Active addresses increased by 1.11% in the last 24 hours to 176.45k. This can be interpreted as a sign of increasing interest and activity within the Chainlink network.

Additionally, the number of transactions increased by 1.18%, reinforcing the notion that more users are utilizing the platform’s decentralized services. Together, these signals supported an optimistic narrative, highlighting greater network participation.

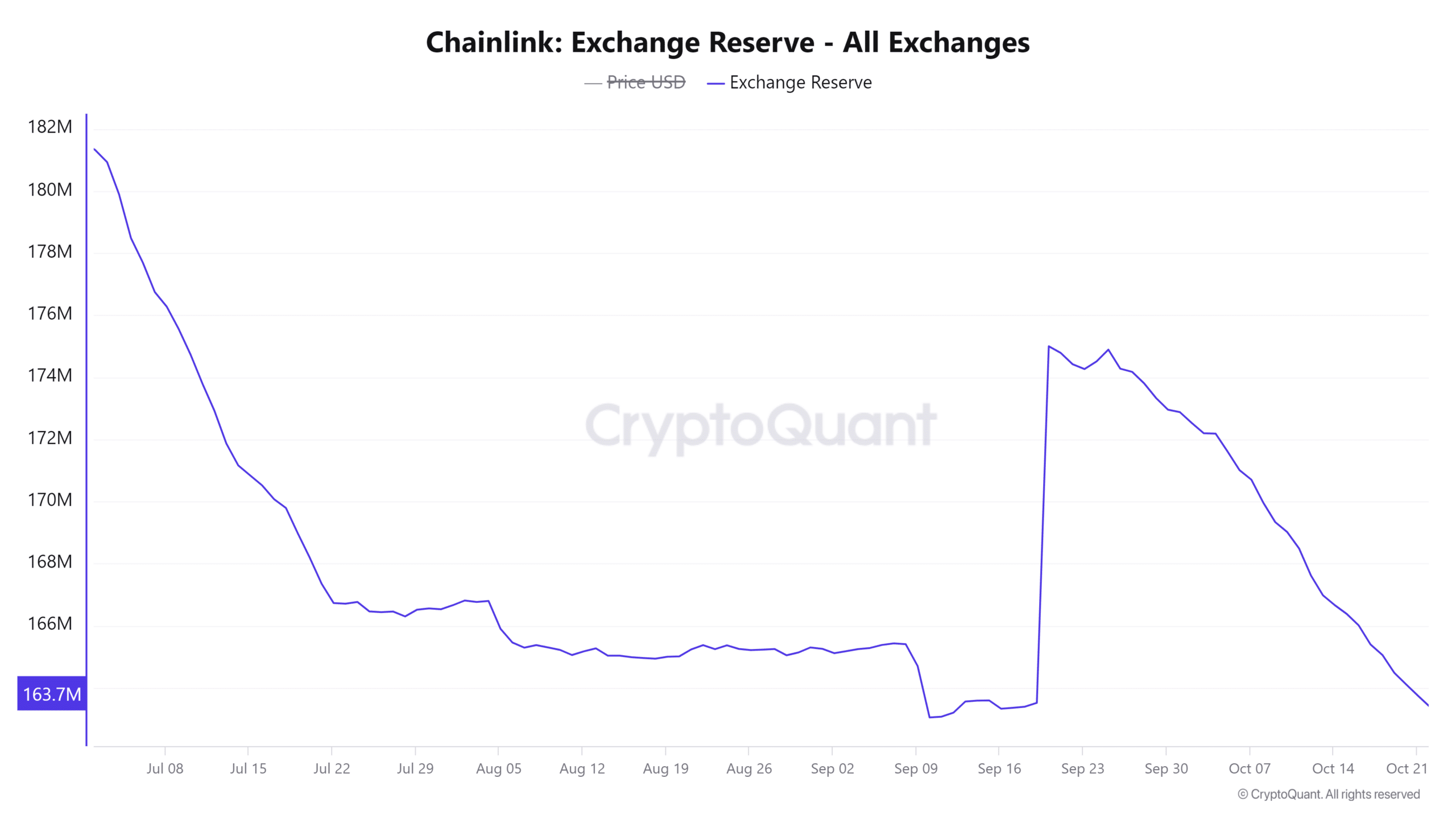

Source: CryptoQuant

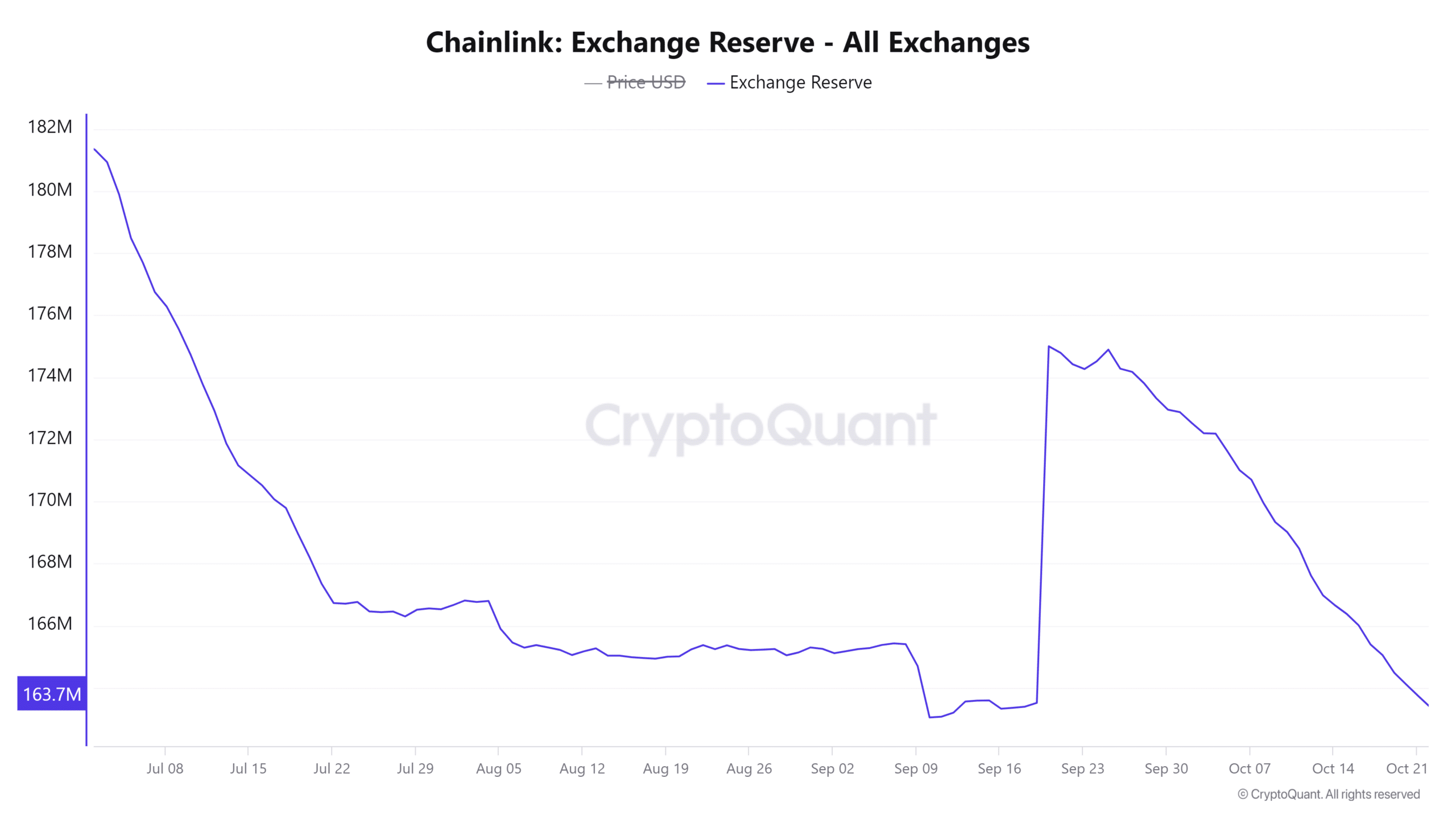

LINK exchange holdings have decreased, indicating supply constraints.

Interestingly, LINK’s exchange holdings have decreased by 0.27% over the past seven days, falling to 163.97 million tokens. The decline suggested that investors were moving their holdings from exchanges and into private wallets.

This could be a sign that selling pressure has eased, and if demand continues to rise, prices could rise further.

Source: CryptoQuant

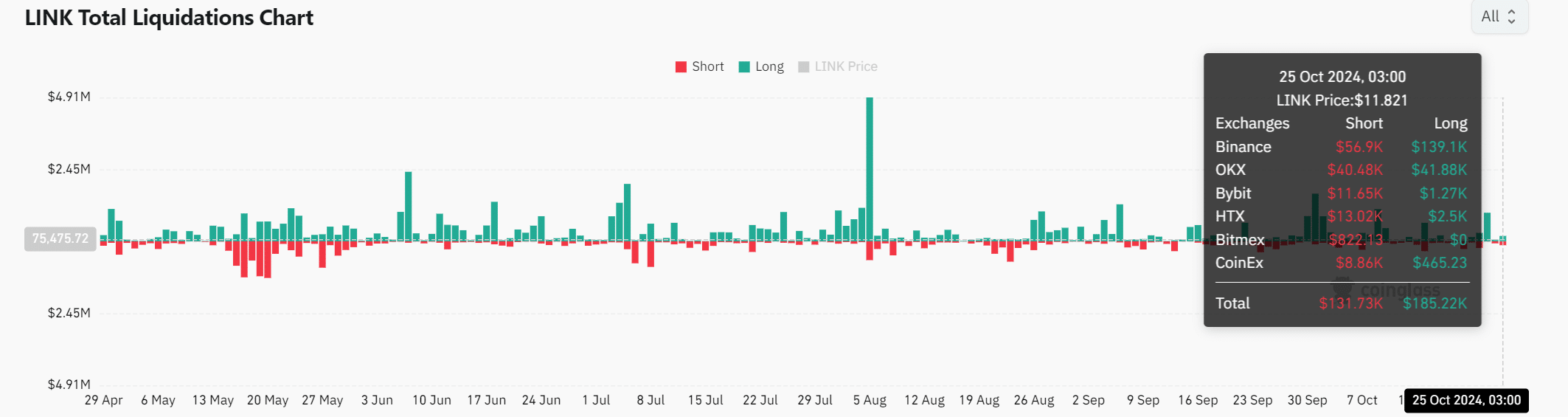

Long term liquidation adds fuel to the bullish fire

Another factor contributing to LINK’s potential upside is the imbalance between long-term and short-term liquidation.

The data shows that $185,220 in long positions were liquidated, while $131,730 in short positions were liquidated. This long-term liquidation trend accentuated traders’ confidence in the bullish move, accelerating LINK’s price breakout.

Source: Coinglass

Is your portfolio green? Check out the LINK Profit Calculator

Currently, Chainlink appears to be well-positioned for a breakout due to increased network activity, declining exchange reserves, and optimistic market sentiment.

A successful break above $12 could quickly target higher resistance levels. However, traders should exercise caution as resistance at $12 could trigger a decline before further upside.