In a recent interview, BlackRock CEO Larry Fink discussed the future of cryptocurrencies, specifically Bitcoin and Ethereum, and their role in the financial system.

His insights provide a clear perspective on the future of digital currencies and tokenization.

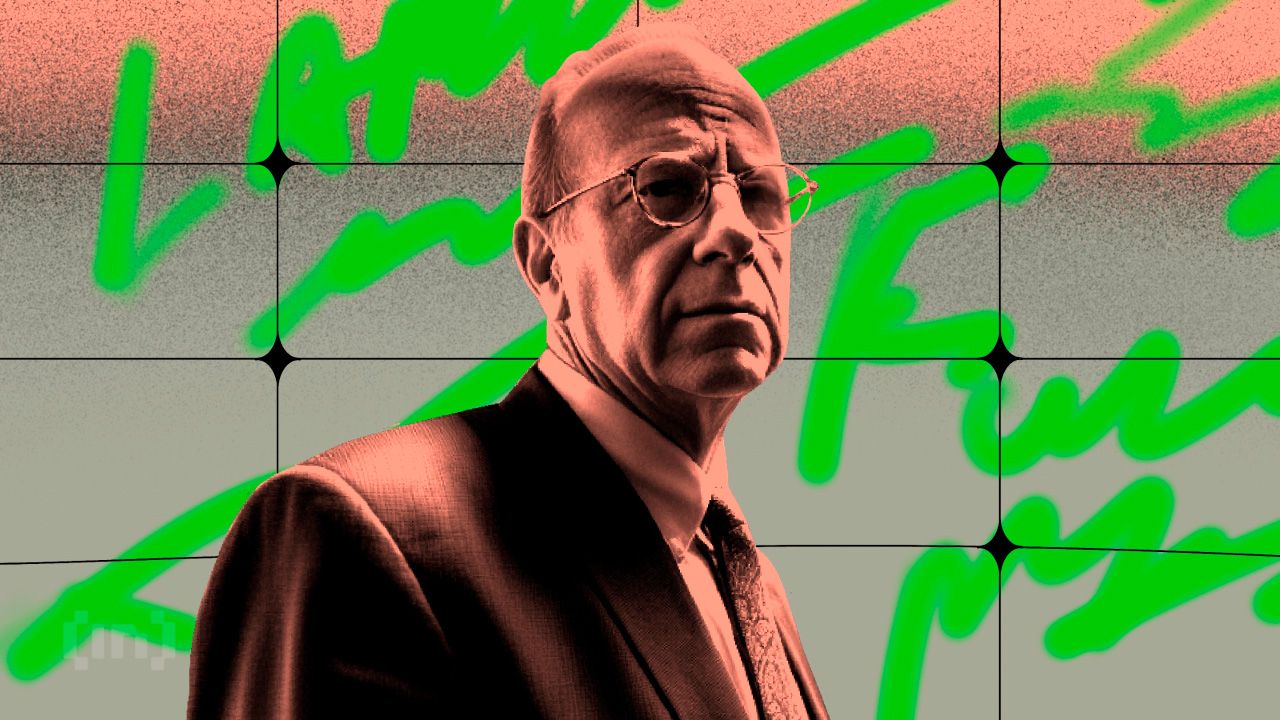

BlackRock CEO Larry Fink Talks Cryptocurrency

Larry Fink, who previously expressed skepticism about Bitcoin, admits his views have changed significantly. About two years ago, he became a firm believer in Bitcoin as an alternative source for holding wealth.

Nonetheless, he does not view Bitcoin or other cryptocurrencies as currencies themselves, but rather as an asset class. Fink emphasized Bitcoin’s finite nature and drew parallels with gold, a traditional safe asset. In his view, Bitcoin, like gold, serves as a protective asset class, especially in times of geopolitical risk.

“I am a believer in this because I believe it is an alternative source of wealth holding. I don’t believe (Bitcoin) will become a currency. I believe it is an asset fraud. But we will create a digital currency and use blockchain,” Fink said.

The BlackRock CEO also discussed the recent launch of the Bitcoin ETF, describing it as an important step toward widespread acceptance and integration of digital currencies in financial markets. He believes ETFs are just the beginning of a technological revolution in financial markets.

Fink’s vision extends to the idea that ETFs will ultimately transform all asset classes, with the ultimate step being the tokenization of assets.

According to Fink, tokenization is a significant technological advancement that could revolutionize the way assets are handled. This involves converting the rights to the asset into a digital token on the blockchain. He therefore sees this as a future where transactions are recorded instantly and ownership is transferred seamlessly, improving the efficiency and transparency of the financial system.

“We have the technology today to tokenize. If you have tokenized security and identity, it’s all created together the moment you buy or sell something in the general ledger. I would like to talk about issues related to money laundering. This eliminates all corruption through a tokenized system,” Fink explained.

Bitcoin ETF and Ethereum ETF

Moreover, BlackRock aims to embed ETFs deeply into its operations, viewing them as the first step in a broader technological revolution. Fink commented positively on the inflows observed with the Bitcoin ETF launch, indicating strong interest from investors.

In fact, he sees this as a sign of a growing market and the potential of a new customer base interested in digital currencies and asset classes.

Addressing competition from other funds such as Grayscale, Fink highlighted the difference in fees, suggesting that over time people will prefer more cost-effective options. This is an important point in the context of a wider investment strategy where fees play a significant role in long-term returns.

Read more: How to Invest in Spot Bitcoin ETFs

| name | ticker | fee |

| Bitwise Bitcoin ETF | BITB | 0.0% (0.20%) |

| ARK 21Shares Bitcoin ETF | ARKB | 0.0% (0.21%) |

| Fidelity Wise Origin Bitcoin Trust | FBTC | 0.0% (0.25%) |

| WisdomTree Bitcoin Fund | BTCW | 0.0% (0.30%) |

| Invesco Galaxy Bitcoin ETF | BTCO | 0.0% (0.39%) |

| Valkyrie Bitcoin Fund | BRRR | 0.0% (0.49%) |

| iShares Bitcoin Trust | I will go | 0.12% (0.25%) |

| VanEck Bitcoin Trust | hoddle | 0.25% |

| Franklin Bitcoin ETF | B.C. | 0.29% |

| Hashdex Bitcoin ETF | DEFI | 0.90% |

| Grayscale Bitcoin Trust | GBTC | 1.50% |

When asked about the potential for other cryptocurrency ETFs like Ethereum, Fink acknowledged the potential but refrained from making any definitive statements. He emphasized regulatory issues and the need for approval from agencies such as the SEC. But he sees these developments as a stepping stone toward a more tokenized future.

“I see the value of owning an Ethereum ETF. This is a stepping stone towards tokenization. And I really believe that this is where we are going,” Fink said.

In conclusion, Larry Fink’s insights demonstrate a significant shift in the financial industry’s approach to cryptocurrencies. Under Fink’s leadership, BlackRock’s vision, with a focus on technological advancements such as ETFs and tokenization, will play a pivotal role in shaping the future of digital currencies and asset management.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.