- The cryptocurrency crash is mostly token Nursing double digits Loss rate.

- investor Compete answer About what triggered it Market confusion.

- Changes in finances Policy And geopolitical tensions are rising. nervous Being blamed.

Cryptocurrency markets are known for their volatility and sudden sell-offs. A prime example is China’s restrictions on cryptocurrency trading and mining in May 2021, which caused the Bitcoin price to plunge 50% to $30,000. Cryptocurrency crashes are a feature of the digital asset environment, continually testing investor resolve and market resilience.

Nevertheless, the crypto world has been rocked by a sudden $360 billion market cap drop over the past 24 hours. Bitcoin fell 14% on Monday to hit an intraday low of $49,300, its lowest in 25 weeks, reigniting bearish sentiment and concerns about the end of the bull market. Given the scale of the crypto crash, investors are looking for answers urgently.

What caused the crash?

The cryptocurrency crash intensified on Sunday evening, raising questions about what is driving the market turmoil. Investor SlumDOGE Millionaire asked, “Why are cryptocurrencies crashing?” and demanded an explanation.

The total cryptocurrency market cap has plummeted by $360 billion in the past 24 hours to $1.8 trillion, representing a 14% drop, while token prices have also plummeted.

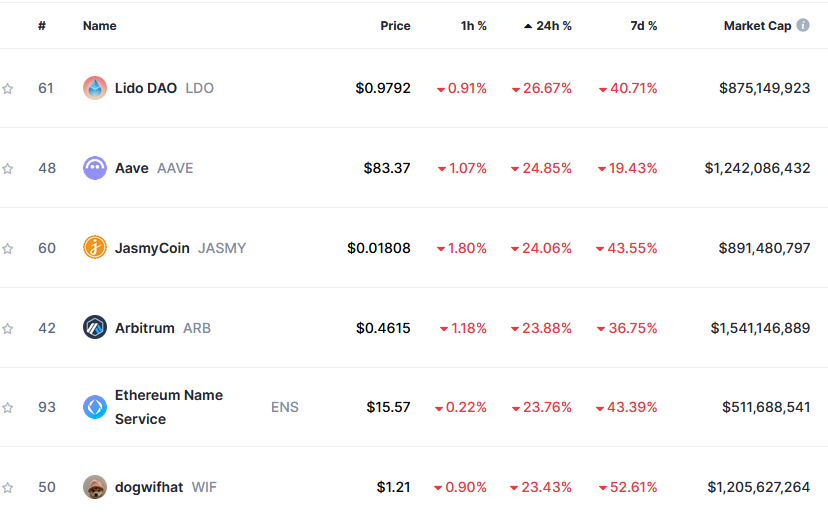

Altcoins have been generally underperforming compared to Bitcoin, with the biggest losers among the top 100 coins being Lido DAO, Aave, and JasmyCoin, which are down 27%, 25%, and 24% respectively over the last 24 hours at the time of writing.

The losses by investors have sparked a palpable fear in the market, with many bracing for further selling. Amid this anxiety, there is a concerted effort to understand the cause of the confusion.

The End of the Yen Carry Trade

In an attempt to understand the cause of the cryptocurrency crash, BitMEX co-founder Arthur Hayes speculated that major corporations may have had to liquidate their cryptocurrency holdings. However, Hayes noted that this information is unverified.

To add context to Hayes’ claims, Crypto Banter Podcast founder Ran Neuner shared on-chain data showing that Jump Trading was selling cryptocurrencies at an unusually fast rate, which he speculated could be due to a potential liquidation or urgent financial obligation.

Investor Jonathan (Love) Wu claims there is a connection between the cryptocurrency selloff and the Bank of Japan’s second interest rate hike in 17 years. He explains that the yen carry trade has been thrown into disarray. The yen carry trade is when traders borrow yen at 0% interest and invest it in high-yielding assets overseas.

The Bank of Japan’s policy shift has increased borrowing costs and raised interest rates, strengthening the yen and potentially forcing carry traders to close out their positions. This could involve selling foreign assets, including cryptocurrencies, to buy back yen and repay loans.

jonathan(love)wu speculated that this dissolution may have contributed to the sharp decline in cryptocurrency prices.

In addition to the unraveling of the yen carry trade, uncertainty in the cryptocurrency market is also increasing as geopolitical tensions in the Middle East increase.

Tensions in the Middle East

The assassination of Hamas leader Ismail Haniyeh in Tehran on July 31 heightened tensions in the Middle East. Iranian authorities vowed retaliation, claiming that Israeli forces used short-range missiles in the attack, and accused the United States of supporting the attack. Israeli officials have not claimed responsibility for the incident.

This situation has cast a shadow over global financial markets, including cryptocurrencies. The threat of further escalation and potential widespread conflict has increased pressure on risky assets, contributing to the recent downturn in crypto markets.

However, opinions within the cryptocurrency community remain divided. Some, such as trader Satoshi Flipper, dismiss the situation as “overblown FUD” and do not foresee a recession or all-out war in the near future.

Others, like trader ‘Scient’, see the recent cryptocurrency crash as a potential precursor to a larger market downturn, suggesting that more conflict is likely to erupt in the Middle East. These differing views reflect the uncertainty that is prevalent in the markets.

On the other side

- Glass node data showed it Bitcoin whale ~is Buy it Dip.

- gold The deal is near notepropose market Don’t look Bitcoin As a safe haven Legacy.

- Kamala Harris have Surpass donald trump in CBS voteFuel supply Concerns that erase‘ in favor of –password Policy If he doesn’t win, it may not come true. Us election.

Why this matters

Cryptocurrency markets have weathered storms in the past, but this selloff highlights the delicate balance between digital assets and the broader macro picture.

Token prices plummeted due to weekend cryptocurrency selling.

Cryptocurrency Markets, Bloodbath as Top Coins Crash

Jan van Eck makes his Bitcoin price prediction.

VanEck CEO: Bitcoin Price at $350K in Worst-Case Scenario