August 7, 2023 PayPal’s entry into the stablecoin market has been welcomed by many in the industry, with Circle CEO Jeremy Allaire saying that competing with PayPal has been ‘the best’.

News of the launch caused a slight 4% rise in the price of Bitcoin, and within a few days, exchanges were offering low-fee promotional opportunities for traders looking to take advantage of PayPal’s PYUSD. Before the end of August, Coinbase, Kraken, and HTX listed stablecoins, with Venmo adding support just a month later.

Five months after launch, PYUSD reached $300 million around January 22nd, ranking 8th by market capitalization on the global stablecoin chart. However, PYUSD fell to 11th overall in terms of orders by volume, with just $10 million. Based on 24-hour trading volume. That’s only slightly ahead of the UST Classic, which is 98% off its intended $1 peg price and has only traded $500,000 cheaper over the past day.

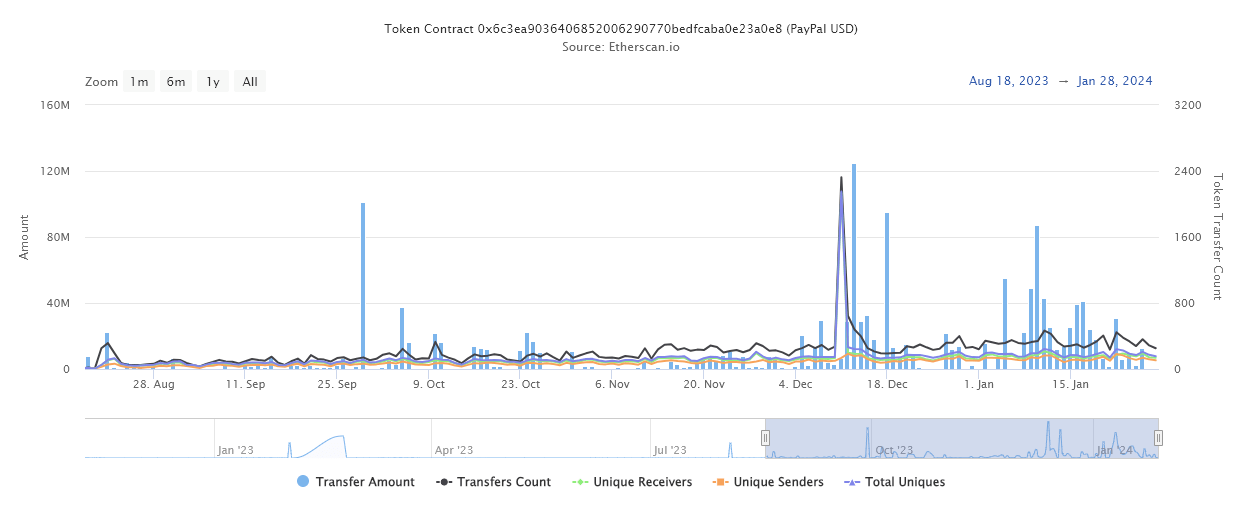

Still, it’s impressive that PayPal’s PYUSD value has risen to $300 million in just five months. In addition to the market capitalization increase, the token has also seen consistent on-chain activity with 200 to 400 transactions per day.

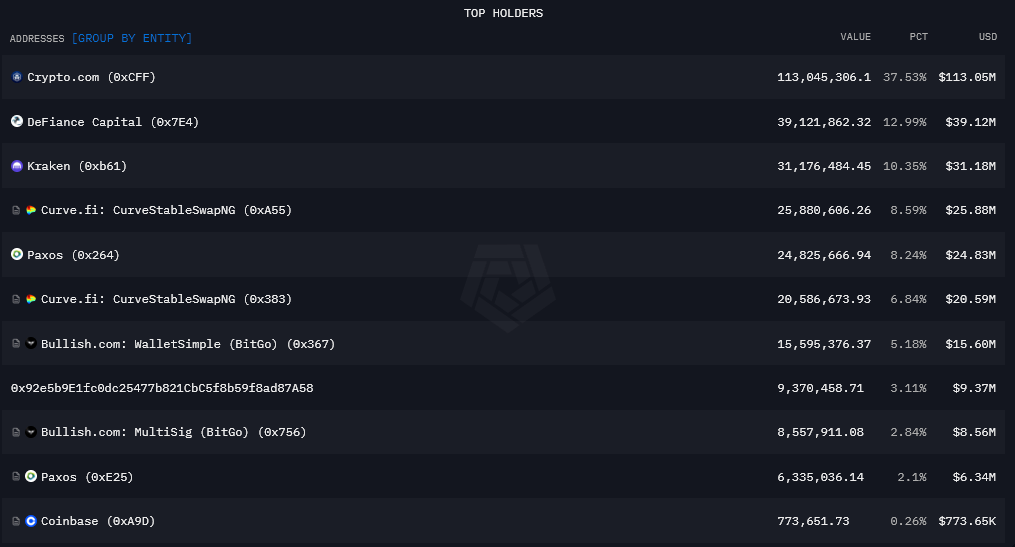

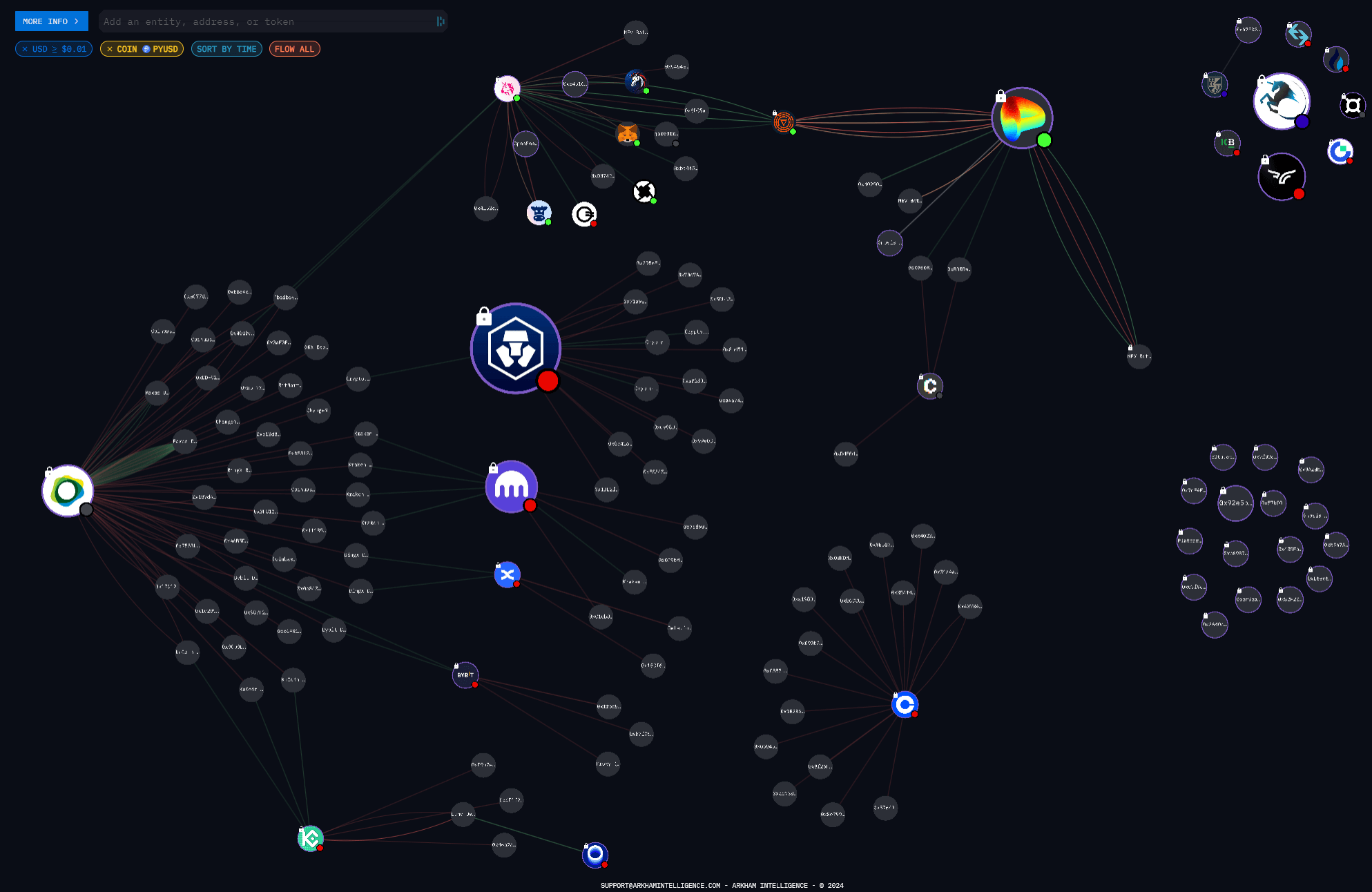

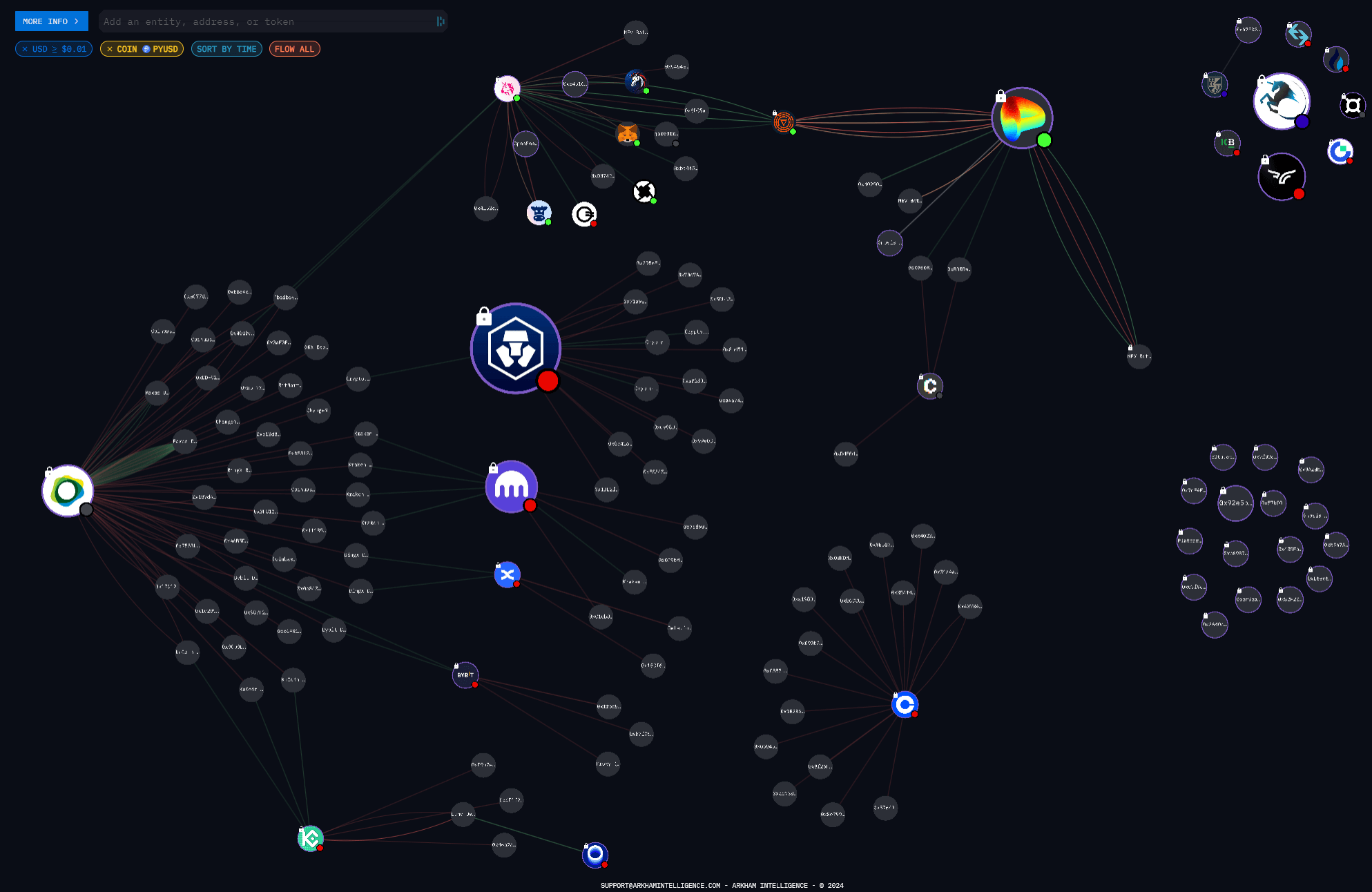

However, as highlighted in the table and diagram below, PYUSD has yet to enter the DeFi landscape in any meaningful way. The majority of PYUSD liquidity is on centralized exchanges, with Crypto.com being the largest single token holder with $113 million, just over a third of the total market capitalization.

The visualization below shows trading between major institutions exclusively for PYUSD. Companies with larger PYUSD holdings will display larger amounts than companies with smaller amounts. The object without a logo on the far right is an unknown wallet holding more than $30,000. The logo in the top right represents a corporate token (e.g. treasury holding).

Interestingly, there are several connections between PYUSD issuers Paxos, Uniswap, and Curve. However, these entities are not connected to any major exchange, suggesting that PYUSD’s DeFi and CEX ecosystems are completely separate.

PayPal was subpoenaed by the SEC when PYUSD accounted for half of its current market cap, but has reportedly complied with the request, and little has been heard about the matter since. The filing announcement also sent PayPal shares to a local low, up 24% since November.

Additionally, PayPal Ventures recently began using the PYUSD stablecoin as a strategic investment mechanism, using it as a stake in institutional cryptocurrency platform Mesh. Amman Bhasin, Partner at PayPal Ventures, said:

“As the world of financial services undergoes rapid change, we believe that user ownership and asset mobility will be critical components of product innovation, and where this is possible, cryptocurrencies will serve as the first beachhead.”

So while PYUSD still has a long way to go to catch giants like Circle and Tether, the debutant and web2 disruptor is certainly on its way to solidifying its position in the industry.