- A falling wedge break indicates bullish potential, with key resistance at $10.88 targeting $24.

- Positive indicators, including an oversold RSI and strong social sentiment, strengthen Polkadot’s rally potential.

Polkadot (DOT) It broke out of a descending wedge pattern on weekly time frames, which is an important signal ahead of a significant bullish rally.

Trading at $6.83 at press time and down 1.98% at press time, the breakout and retest phase for the cryptocurrency presents a promising opportunity for traders. The next key question is whether DOT can maintain this momentum and rebound towards its medium-term target of $24.

DOT Breakout and Price Prediction

A breakout of the descending wedge on the Polkadot chart highlights the strong potential for a bullish reversal. The price is currently facing the first major resistance at $10.88, with an intermediate target of $24.

Additionally, a retest of the recent breakout level strengthens the technical outlook, suggesting buyers are entering a critical mass. Therefore, DOT’s trajectory appears to have significant upside if the momentum continues.

Source: TradingView

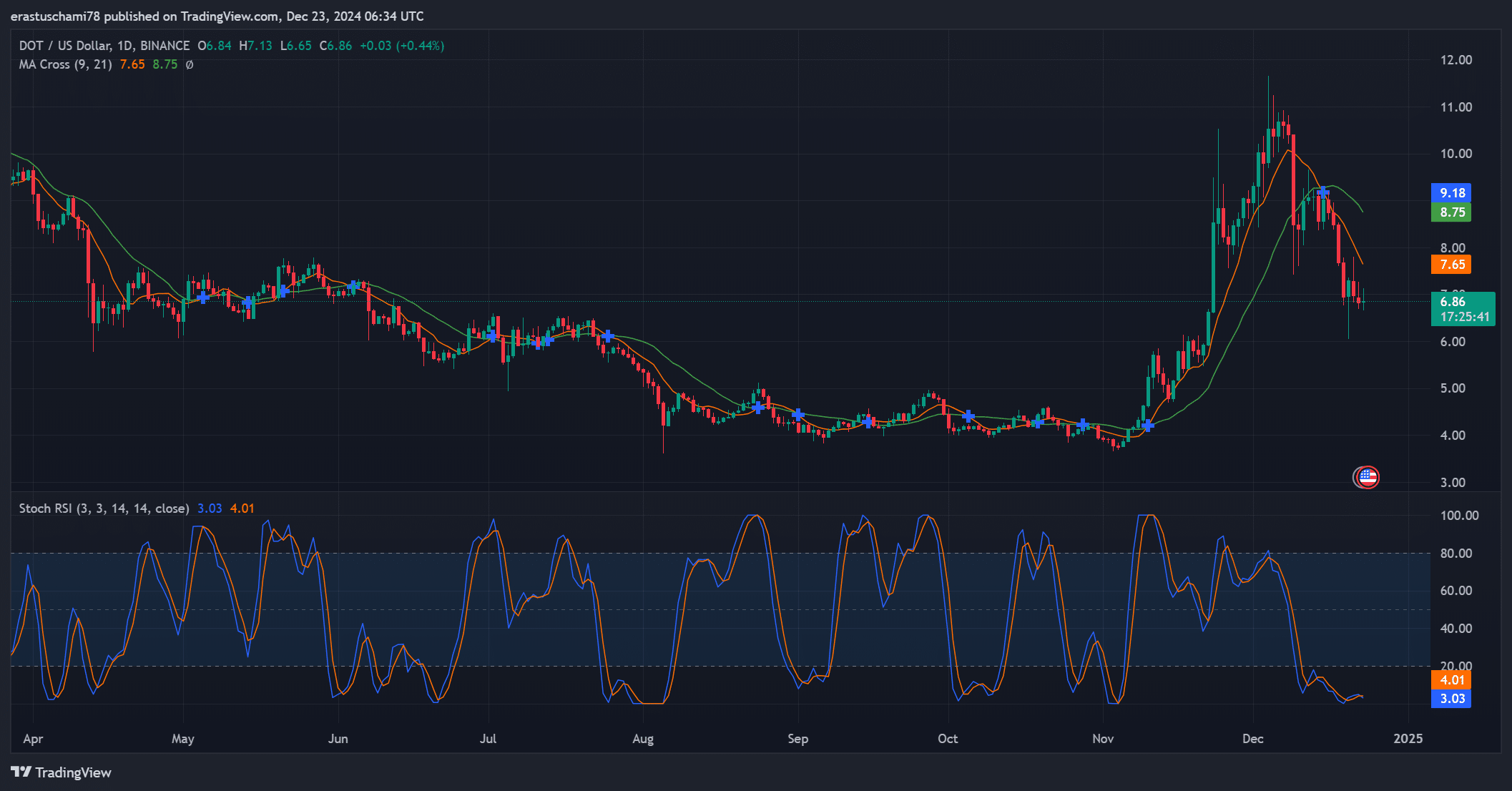

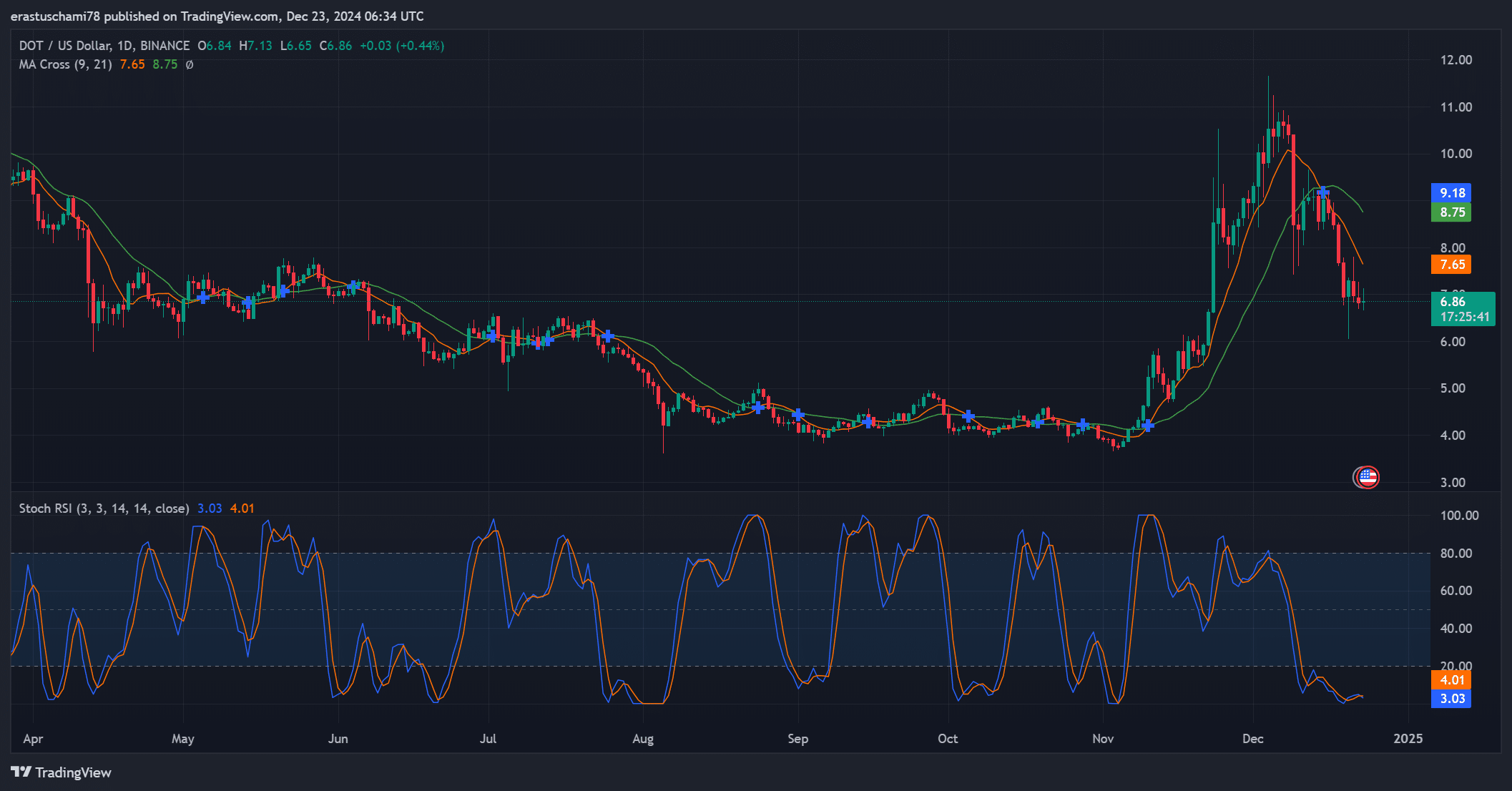

Stochastic RSI and Moving Average Analysis

Technical indicators further support Polkadot’s bullish potential. The stochastic RSI is close to 3.03 and 4.01, indicating oversold conditions and a possible near-term price rebound.

Additionally, the moving average (MA) crossover on the daily chart suggests a near-term consolidation, but also suggests that DOT may soon reverse the downtrend.

Together, these indicators indicate a promising outlook for cryptocurrencies in the coming weeks.

Source: TradingView

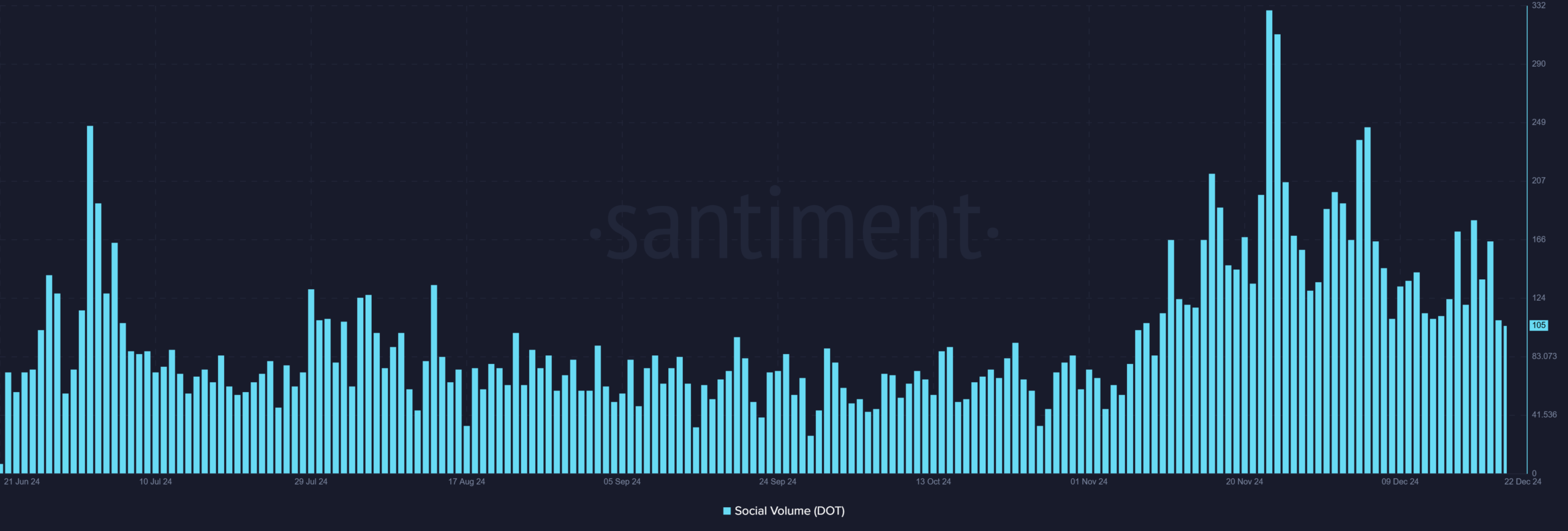

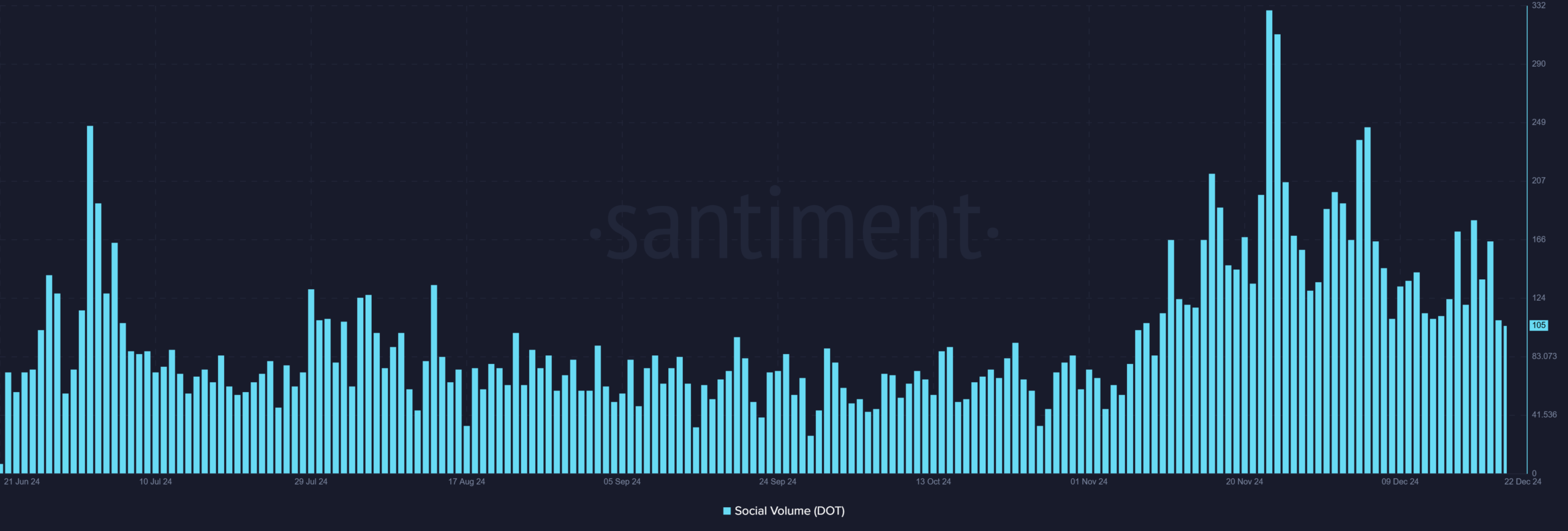

Social volume data of 105 points to growing interest in Polkadot as community engagement continues to grow across the platform. This heightened activity, noticeable through sustained surges, is often associated with renewed interest in an asset.

Therefore, the narrative surrounding Polkadot’s bullish potential continues to grow, creating a positive feedback loop for both sentiment and price action.

Source: Santiment

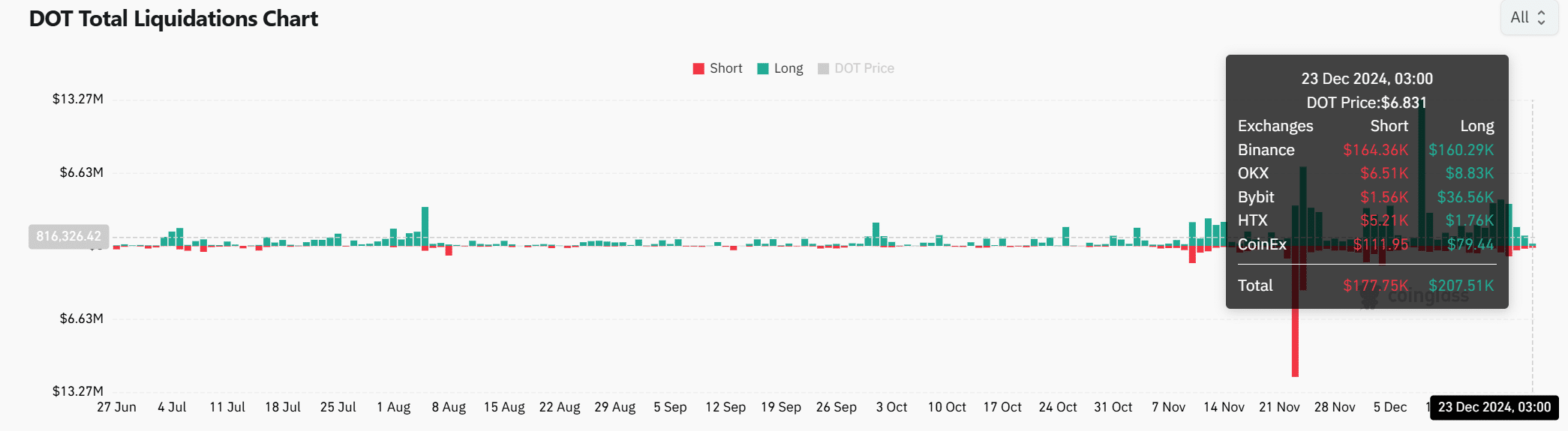

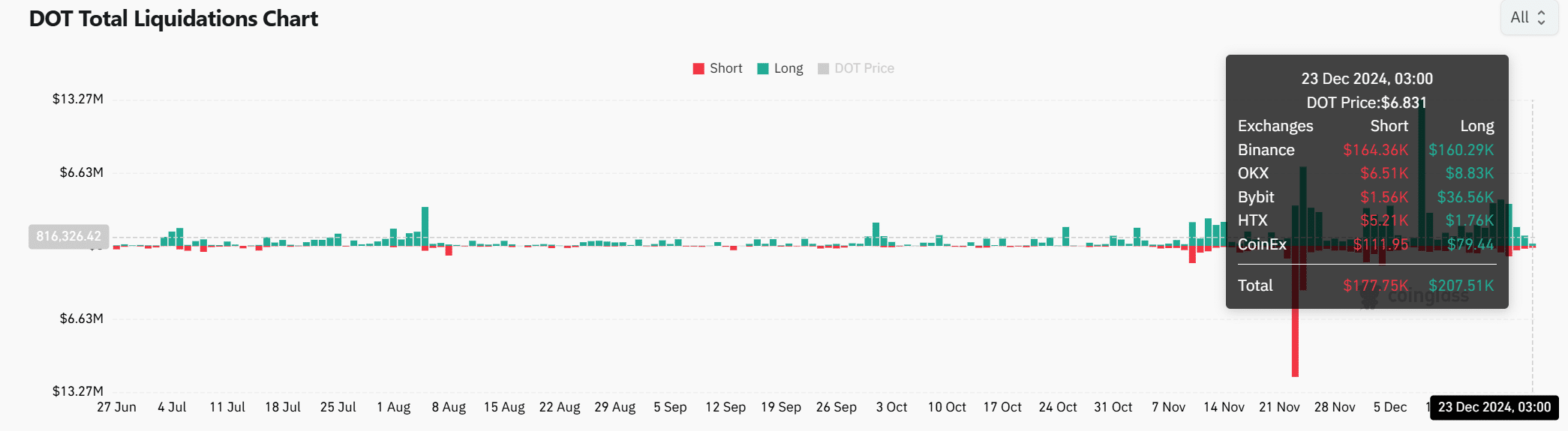

DOT Derivatives Market Supports Optimistic Outlook

Polkadot’s total liquidations show $207.51K in long liquidations compared to $177.75K in shorts, indicating growing confidence among long traders. Additionally, the OI-weighted funding ratio remains positive at 0.01%, reinforcing bullish sentiment.

These indicators indicate that Polkadot is showing strength in the derivatives market, further solidifying its upside potential.

Source: Coinglass

Read Polkadot (DOT) Price Forecast for 2024-2025

With a falling wedge breakout, bullish technical indicators, and increasing social and derivatives momentum, Polkadot appears well-positioned for a rally.

Overcoming the $10.88 resistance is important, but if the current momentum continues, the medium-term target of $24 is also achievable. Polkadot is undoubtedly headed for a significant breakthrough.