ORDI price is up 185% over the past 7 days, making it the biggest gainer of the week.

Yesterday, prices created the first daily bearish candle, following six bullish candles. Is this a sign of things to come or will we hit new all-time highs?

ORDI continues its rapid rise

ORDI prices have risen since hitting a local low on September 11. The altcoin hit a higher low on October 16 and then started rising rapidly.

Initially, ORDI price was rejected by the then all-time high resistance of $25 (red icon). However, the price did so on December 2 and hit an all-time high of $69.72 yesterday.

Since the September low, ORDI prices have risen 1850%.

Crypto Trader The Wolf of Crypto Streets mentioned because of thatE ORDI all-time highLiquidity may be associated with BRC-20 tokens.

The BRC-20 token standard is an innovative approach to facilitating the creation and exchange of fungible tokens on the Bitcoin blockchain by utilizing ordinal inscriptions. This experimental standard is similar to the ERC-20 token standard commonly found on Ethereum and EVM blockchain networks.

NiftyNFTNerd was also impressed by the rally and told his followers: ORDI price is New all-time high It will soon be $100.

Read more: 9 Best Cryptocurrency Demo Accounts for Trading

ORDI Price Prediction: Can It Reach $100?

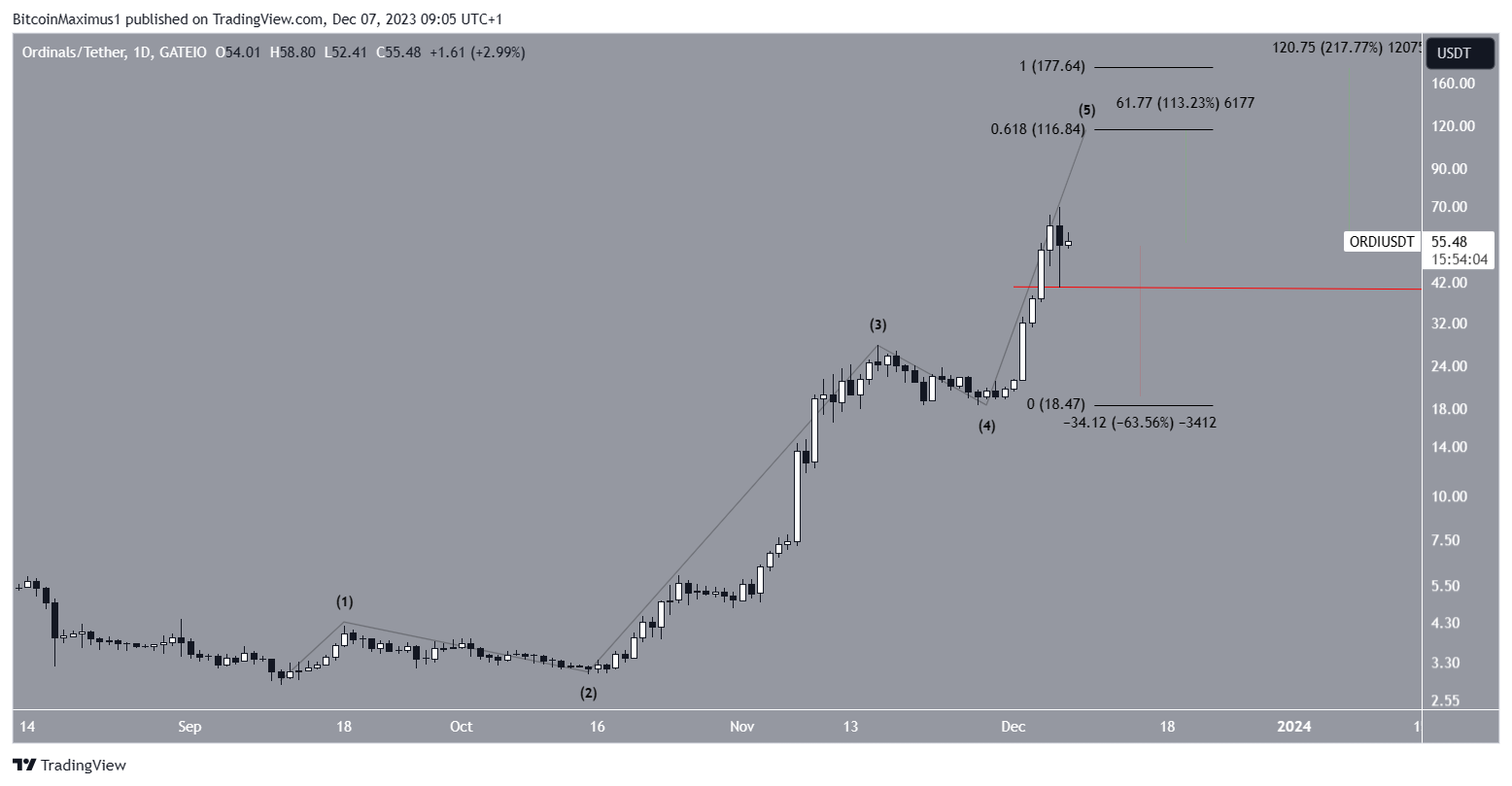

Technical analysts use Elliott Wave Theory to identify recurring long-term price patterns and investor sentiment, which helps determine trend direction.

The most likely readings suggest ORDI is in the fifth and final wave of the upward move that began in September.

Read more: 9 Best AI Cryptocurrency Trading Bots to Maximize Your Profits

The most likely area to be the top of this wave is $116, with wave 5 being 0.618 times the length of waves 1 and 3. If wave 5 extends, it will reach the $177 resistance line, making wave 5 the same length as waves 1 and 3.

The first goal is a 110% increase, the second goal is a 220% increase.

Despite this optimistic ORDI price prediction, a drop below yesterday’s low of $41.80 would mean the price is still in the midst of a correction. In this case, we expect a 60% decline to the nearest support level at $18.50.

In the case of BeInCrypto‘Click here for the latest cryptocurrency market analysis..

Are there any fees associated with using MultiHODL? | YouHodler Series – YouTube

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions.