- XRP is down despite its 24-hour volume surging by 19.53% due to ongoing legal issues.

- While technical patterns suggest a possible uptrend, legal uncertainty has had a major impact on XRP prices.

Ripple (XRP) The ongoing legal dispute between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) continues to be a challenge.

At the time of writing, XRP was trading at $0.4802, up a modest 0.31% over the past day. CoinMarketCap.

Meanwhile, the market cap rose by 0.32% to $26,738,837,168, and XRP ranked 7th. The 24-hour volume surged by 19.53% to $924,854,796.

XRP: Market Sentiment

Analyst Avon Marks recently said: tweeted About the possibility of large price fluctuations in XRP.

According to his analysis, XRP has formed a symmetrical triangle or pennant pattern with decreasing volume, suggesting that the previous uptrend may continue.

He noted:

“Yes, you have probably seen similar pattern setups in $XRP many times. But when you combine the way the price twists and turns, the source of the price (historical data), and the high volume and already confirmed hidden bullish divergence, something really big could be coming.”

The RSI (Relative Strength Index) is setting lower lows while the price is making higher lows, indicating a hidden bullish divergence. This pattern could suggest a reversal to the $1.44 level.

Historically, XRP has seen significant uptrends, including gains of over 110,000%, suggesting the potential for a massive uptrend.

Source: X

Avon Marks speculated that a full log follow-through could send the XRP price soaring above $200, which would represent a 400x increase from its current price.

More conservatively, if a breakout occurs, prices could reach $15-$20.

Spot inflow/outflow analysis

However, AMBCrypto’s analysis using Coinglass’ XRP spot inflow/outflow chart shows that since September 2023, outflows (red bars) have been greater than inflows (green bars).

This trend indicates continued selling pressure, which has contributed to the decline in the XRP price.

Source: Coinglass

The current XRP price has been gradually declining from around $0.60 in late 2023 to below $0.50 in mid-2024. This suggests that the market is under persistent selling pressure despite intermittent buying interest.

The persistent negative net flow shows that XRP continues to struggle to maintain its upward momentum.

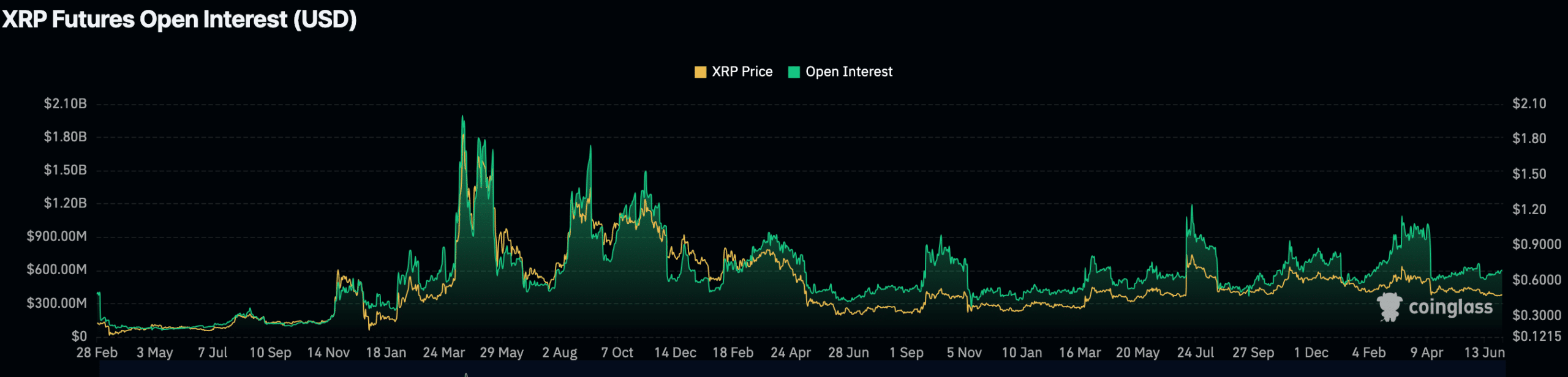

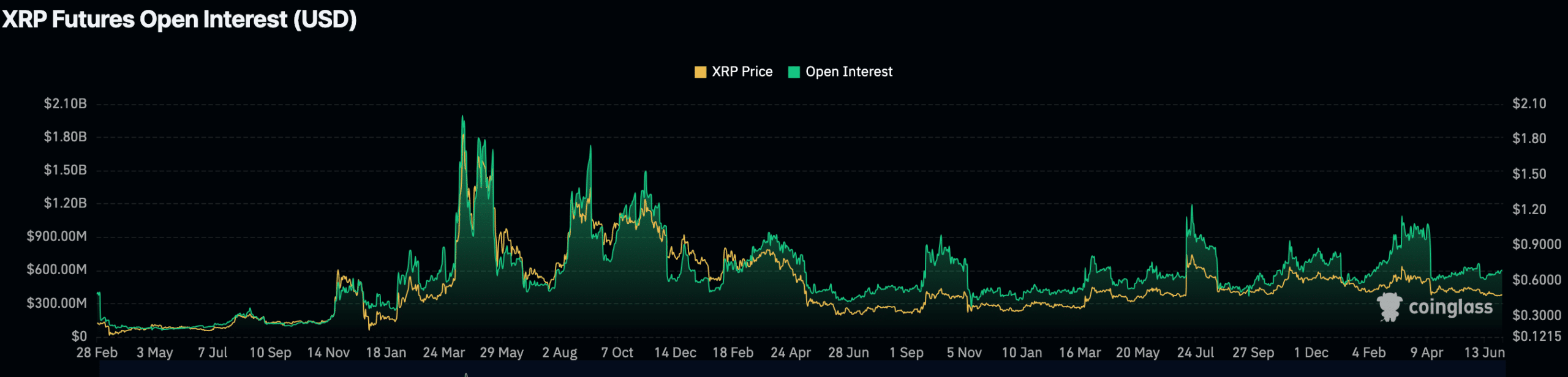

AMBCrypto took a closer look at Coinglass’ XRP futures open interest chart, which shows a strong correlation between open interest and XRP price throughout the year.

Peak levels of open interest often occur with significant price movements, indicating high trading activity and investor interest during this period.

Source: Coinglass

Realistic or not, here is XRP’s market cap in BTC terms:

Prices fluctuated significantly during periods with large numbers of outstanding contracts, such as late March or mid-November.

This pattern indicates that traders are actively positioning in the futures market in anticipation of potential volatility and price movements in XRP.