A bull run is like a forest fire. You need a combination of conditions to get started.

For a forest fire to occur, there must be long periods of rain, high temperatures, and strong winds at the time of ignition.

Yes – wildfires have been made worse by record methane emissions, which Bitcoin helps mitigate. But that’s not what this article is about. This time it’s just a metaphor.

Halving causes new supply of Bitcoin to dry up (it doesn’t rain). They have increased interest in the timing of Bitcoin market entry (hot). But it also requires strong winds and an ignition event.

That strong wind is the wind of change surrounding the Bitcoin ESG narrative.

Ignition Event will be the first large-scale ESG investment committee to support Bitcoin for ESG reasons.

Problems faced by the rapid increase in ESG investors

By 2026, ESG-focused institutional investment will surge to $33.9 trillion. According to a PwC report, this is more than $1 for every $5 of assets under management.

But the more important takeaway from the report, which should be a warning for Bitcoin holders now and in the future, is that there is a problem for ESG investors now. In other words, demand for solid ESG investments exceeds supply. ESG investors say it takes them a long time to find the right ESG investments, with a very high 30% of investors saying they choose ESG investments. struggle To find attractive ESG investment opportunities

Bitcoin is now in a position to answer this question. Here’s why:

Bitcoin Opportunity

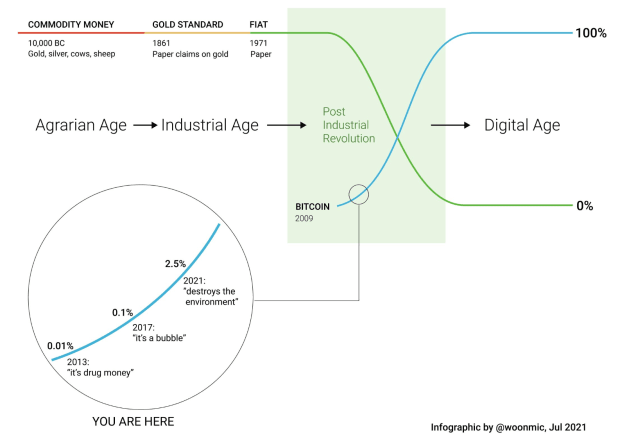

2023 was a year in which the flow of ESG stories surrounding Bitcoin changed.

In just 53 quiet days from August 1 to September 22 of this year, five events helped turn Bitcoin’s ESG story on its head. they:

1. KPMG report concludes that Bitcoin supports ESG obligations (August 1)

2. Peer-reviewed study supports thesis that Bitcoin could be good for the environment (August 8)

3. Cambridge admits Bitcoin energy is overvalued (August 30)

4. Bloomberg Intelligence chart shows Bitcoin mining leading decarbonization (September 14)

5. Risk Management Institute concludes that Bitcoin can help with the renewable transition (September 22)

These reports and papers were written independently from reputable researchers and organizations, and rather than concluding that Bitcoin is “not as bad for the environment as we thought,” they reach a much stronger conclusion that Bitcoin is a net positive as an ESG asset. I did.

These winds of change are likely to strengthen into the gales needed for Bitcoin to complete the set of conditions needed for a bull market.

what does this mean

Information is power. There is now information asymmetry. The narrative has changed based on new data. However, most ESG investors do not have this data. yet. Until they get this new data, they will continue to believe the old story that “Bitcoin is a net negative for the environment.”

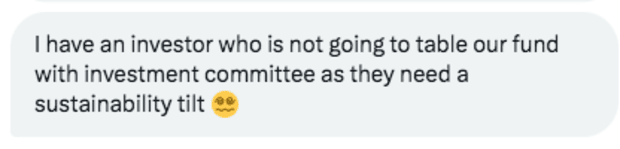

In case you need proof of this, I’ll send you a DM I received from a fund manager a while ago.

These types of ESG investors still cannot deploy higher percentages in Bitcoin because ESG information about Bitcoin is several years old and they are not yet aware of the five narrative reversal events described above.

ESG investment committee members’ views on Bitcoin are often very negative, but it has been my experience that, unlike environmental NGOs, their views are also loosely held. When I was in Sydney recently, a young Australian approached me enthusiastically and said: “Dan, I used your charts to peel the oranges of our investment committee!”

So what happens when this information asymmetry breaks down due to the gale of new Bitcoin ESG stories?

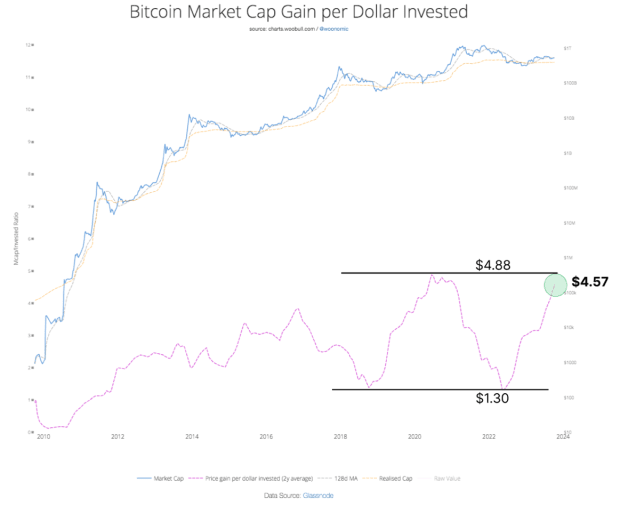

Thanks to Willy Woo’s analysis, we can quantify what this means for Bitcoin market capitalization within certain ranges.

How to quantify ESG = NGU

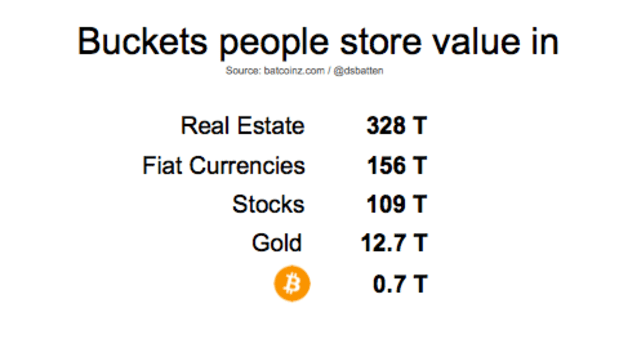

ESG’s Bitcoin adoption is very bullish on the relatively small $713 billion Bitcoin market at the time of this writing. Woo argues that Bitcoin would need to remain above 1 trillion before institutions holding the nation’s wealth and/or retirement funds would feel comfortable investing in large quantities.

So what will happen to Bitcoin market cap if ESG investors deploy 1% of their AUM (assets under management) into Bitcoin in 2026?”

At today’s rate of market cap growth per dollar invested, Bitcoin’s market cap would grow to a healthy $2.26 trillion. That’s more than three times what it is today.

If 2.5% of ESG fund AUM were deployed to Bitcoin, its market capitalization would increase to $3.87 trillion. This amount is more than five times the current market capitalization. This flies in the face of the roadmap for institutional investors, which leads to greater capital deployment, which in turn creates a very positive feedback loop.

Even without this feedback loop, a 2.5% ESG deployment could propel the Bitcoin price to around $193,000 during a possible 2026 bear market.

This is a simulation, not a prediction. i am talking If the ESG IC deployed 1-2.5% of AUM; Then The result could be 2 to 5 times the Bitcoin market cap.

In other words, Bitcoin has the unique potential to become the world’s first greenhouse gas reduction industry without offsets. This would require Bitcoin mining methane mitigation from just 35 medium-sized exhaust landfills. I would be surprised if Bitcoin does not achieve deployment of more than 2.5% of ESG investor AUM, if that happens by 2026, which is aggressive but possible.

ignition

As if we needed further confirmation that the winds of change in the ESG narrative were swirling, I recently spoke at the 2023 Plan₿ Forum in Lugano on the topic “Bitcoin is the world’s best ESG asset.” I had the idea of using claims for both. michael sailor and Baseload have previously written and made it into a keynote with supporting data backed up.

This recording is currently the most viewed talk from the 2023 conference on YouTube. Not because I was greatly infamous (there were many better known speakers), but because, as Victor Hugo once said, “There is nothing more powerful than an idea whose time has come.” .”

Bitcoin as an ESG asset is an idea whose time has come. Bitcoin has now proven its ability to increase renewable energy capacity and reduce methane emissions at a time when the world urgently needs solutions to both problems. In contrast, now that Ethereum has migrated to Proof-of-Stake, it can no longer support either of these pressing needs.

In early 2022, most Bitcoin users were still trying to “defend” Bitcoin from ESG attacks through egoism like “but tumble dryers use more energy than we do”. However, by 2023, Bitcoiners were starting to take the game to their opponents with consistent success. The strategy of sharing fact-based reports and inspiring stories about positive ESG cases for Bitcoin is working. This year, The Hill and Bloomberg began publishing positive press about Bitcoin mining. Positive mainstream news coverage outnumbered negative coverage by 4:1. And of course there was the epic twist of the 53 days.

Every four years a new false narrative is hatched.

But every four years, it is also a “false narrative about TikTok, the next chopping block.”

If Bitcoin isn’t dead, then the story about it “destroying the environment” is at least Nearly Headless Nick.

The upcoming halving will further deplete Bitcoin supply while also heating up investor interest. Meanwhile, winds of change are blowing in the ESG narrative. The conditions are now perfect to inevitably ignite large-scale deployment of ESG funds in Bitcoin.

ESG = IS.

Founder Daniel Batten CH4 CapitalProvides infrastructure financing to Bitcoin mining companies that utilize methane released from landfills.

This is a guest post by Daniel Batten. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.