The cryptocurrency market is in the midst of a bull cycle. With all eyes on Bitcoin’s potential surge to new highs, anticipation is growing for the start of what has been an interesting phenomenon in the past: the altcoin season.

However, this cycle may be out of the norm. An altcoin season, where demand and investment shifts significantly from Bitcoin to altcoins, may simply not happen. Several reasonable factors suggest why this may be the case.

Too many altcoins create decentralized liquidity.

The main reason why altcoins are underperforming compared to Bitcoin is because the altcoin market is completely saturated, with supply already far outstripping demand.

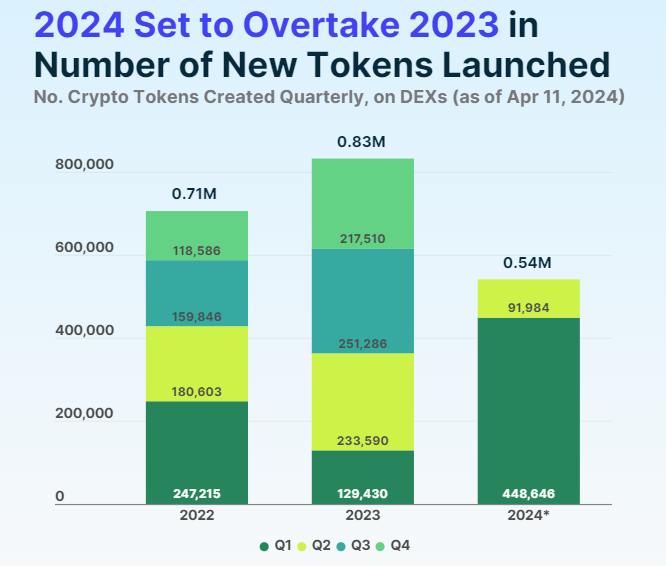

There are over 3 million tokens distributed in the cryptocurrency market so far. 540 million of them were released in the first half of 2024. And the vast majority are Mimecoins.

With so many altcoins to choose from, there’s fierce competition for investors’ money. It also means that liquidity (the ease with which you can buy or sell an asset without significantly affecting its price) is spread thinly across too many coins.

When this happens, individual coins struggle to maintain investor interest and price momentum, and the overall altcoin market momentum weakens.

The negative trend is evident in the numbers: 80% of newly launched coins lost value and never recovered from their listing price.

Additionally, during the recent bull market, approximately 74% of tokens distributed via airdrops saw their market value drop by double digits on the day of launch.

The project funding paradigm has changed

Advances in technology have made token issuances more accessible to everyone. Altcoin creation no longer requires programming skills or significant capital. Platforms like Pump.fun allow this for as little as 0.02 SOL.

But that’s not the only reason. The rise of new altcoins, especially Mimecoins, is driven by a fundamental shift in how crypto projects are funded.

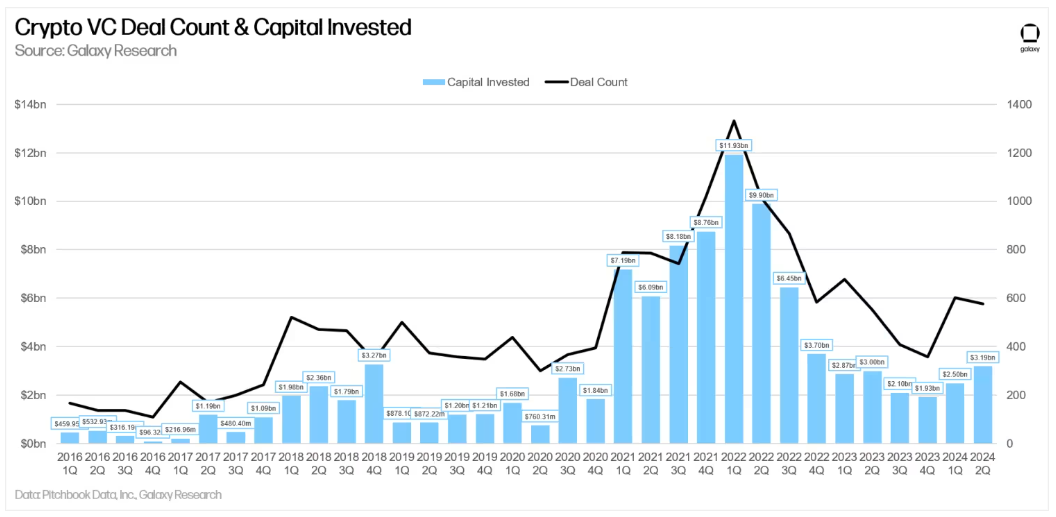

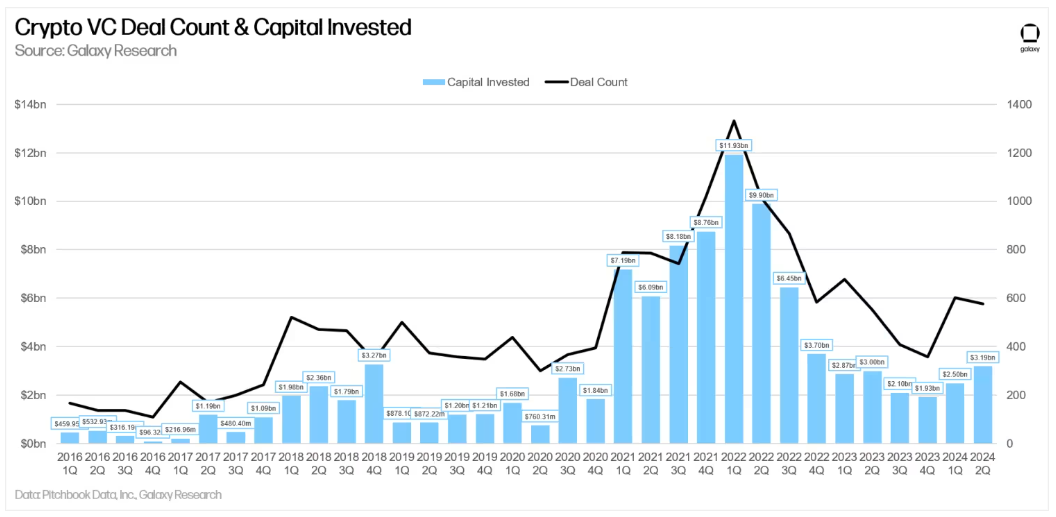

In 2017, cryptocurrency startups and projects relied heavily on Initial Coin Offerings (ICOs) to raise funds. In 2021, most of that has shifted to private funds and venture capital (VC) firms. VC investment has surged, reaching a record $11.93 billion by Q1 2022.

Nearly half of all deals were made to pre-seed or early-stage projects, many of which have yet to launch their tokens.

The startup was able to secure significant financial resources to scale and attract additional investment. VC investors acquired a significant portion of the total token supply at an exclusive discount price.

This wouldn’t be wrong, except for two things: First, a significant portion of the VC-backed project tokens allocated to insiders are locked for at least a year before being gradually distributed.

Second, due to pre-launch capital inflows, VC-backed tokens often become overpriced even before they are publicly launched. Private equity investments inflate token values, making them less attractive to retail investors seeking higher profit margins. As a result, the latter turn to more promising alternatives outside of VC-backed options, namely tokens that are launched fairly.

Unlike tokens backed by private equity firms, tokens that are released fairly aim to ensure fairness and equal return opportunities for all investors. They are not allocated to insiders before the public launch, so everyone has an equal chance to acquire tokens at the same time.

However, these tokens, often memecoins, prioritize hype over innovative goals. These tokens often lack long-term fundamentals, utility, and innovative use cases that could revolutionize and further develop the cryptocurrency market. As a result, demand for these tokens is driven by hype and short-term profit motives, which are not sustainable over time.

A vicious cycle emerges. VC-backed projects enter at high prices, benefiting early investors but alienating later investors. In search of better opportunities, retailers flock to a host of unsustainable but more profitable alternatives.

The market is flooded with a ton of altcoins, but none of them are gaining enough momentum to sustain significant growth.

Some altcoins have already shown an upward trend.

However, despite the diluted liquidity in the altcoin market, capital inflows into altcoins are significantly lower during these bull markets.

The total market cap of altcoins, excluding BTC and ETH, is more than 35% lower today than it was at a similar point in the mid-2021 bull cycle. Back then, investors poured more than $980 billion into altcoins, but this year, it’s just $785 billion.

In Q2 alone, altcoin market cap fell by $576 billion, or 33% of their value.

Nonetheless, at the start of this bull cycle, more altcoins than ever before have outperformed BTC ahead of its major rally. Tokens representing a variety of narratives, from RWA, AI, privacy to memecoin, have been successfully pumped, generating returns dozens of times higher than BTC.

This trend has never been so evident in the cryptocurrency markets before. Historically, altcoins have only hit record highs at the start of altcoin season, which usually starts when Bitcoin hits record highs and starts to surge.

So, with capital investment in the altcoin market decreasing and supply reaching all-time highs, the question naturally arises: is a new altcoin season coming?

Will there be enough new liquidity?

The previous bull cycle experience shows that new liquidity injections have a positive effect on the cryptocurrency market, driving up prices. The market successfully surged during the 2021 bull cycle, with retail investors actively participating.

Nearly one in ten Americans, or more than 33 million people, invested their stimulus checks in digital assets, resulting in over $39 billion being pumped into the struggling crypto economy.

Smart investors, mostly VCs, also participated, investing a record $11.93 billion in cryptocurrency projects.

Today, the situation is different. Retail has shifted to Mimecoin, and private capital investment has fallen sharply since its all-time high in early 2022. It only began to recover this year, barely surpassing $5 billion in the first half of 2024.

Moreover, traditional finance (TradFi) investors, a potential source of new liquidity, have already jumped into cryptocurrencies, primarily Bitcoin ETFs, investing about $15 billion in them since their launch in January.

It would take a miracle for new money to suddenly flow into the saturated altcoin market.

There are certainly some bullish indicators in this bull cycle, with the expected US rate cut, the anticipated launch of an ETH ETF, and the plan to distribute $14.5 billion to FTX victims later this year.

On the other hand, a significant portion of the total supply of VC-backed tokens will only be unlocked and circulated in the future, creating selling pressure and directly impacting the token price.

According to Binance Research, approximately $155 billion worth of tokens are expected to be unlocked between 2024 and 2030. This currently represents more than a quarter (27.2%) of the total altcoin market cap.

conclusion

With this in mind, it is highly doubtful that new capital investment alone will be enough to revive the altcoin season tradition in the long term.

The cryptocurrency market needs a breakthrough idea or use case that can revolutionize the market and rekindle the enthusiasm of diverse investors.

Learn more about how to research the Altcoin market.

Altcoin Season: Tips and Strategies for Market Research

Learn more about the Smart Money Cryptocurrency movement:

Smart Money Investigation: Is Blockchain Tracking Abusing Trust?