- Bitcoin, Ethereum ETF trading volume soars to nearly $6 billion

- BTC and ETH have bounced slightly over the past 24 hours.

Bitcoin (BTC) and Ethereum (ETH) experienced notable price declines in the last trading session, breaking through key support levels.

Despite these price declines, trading volumes within each of the exchange-traded funds (ETFs) surged in contrast, reaching impressively high levels.

Bitcoin, Ethereum ETF Trading Volumes Hit All-Time Highs

Recent data from Coinglass highlights the significant increase in trading volumes for Bitcoin and Ethereum ETFs, with these assets totaling close to $6 billion in the last trading session.

Bitcoin ETFs took the lion’s share, at $5.7 billion, with BlackRock’s Bitcoin ETF taking the lion’s share at nearly $3 billion.

These figures show that BlackRock holds a dominant position in the market.

On the Ethereum side, ETFs also saw significant activity, with trading volumes exceeding $715 million.

Grayscale’s Ethereum Trust was the largest contributor with trading volume exceeding $261 million, making it a standout among Ethereum investment products.

Trading volumes for Bitcoin and Ethereum ETFs over the past trading day have been particularly notable, as both cryptocurrencies have been trading amidst general market volatility and price declines.

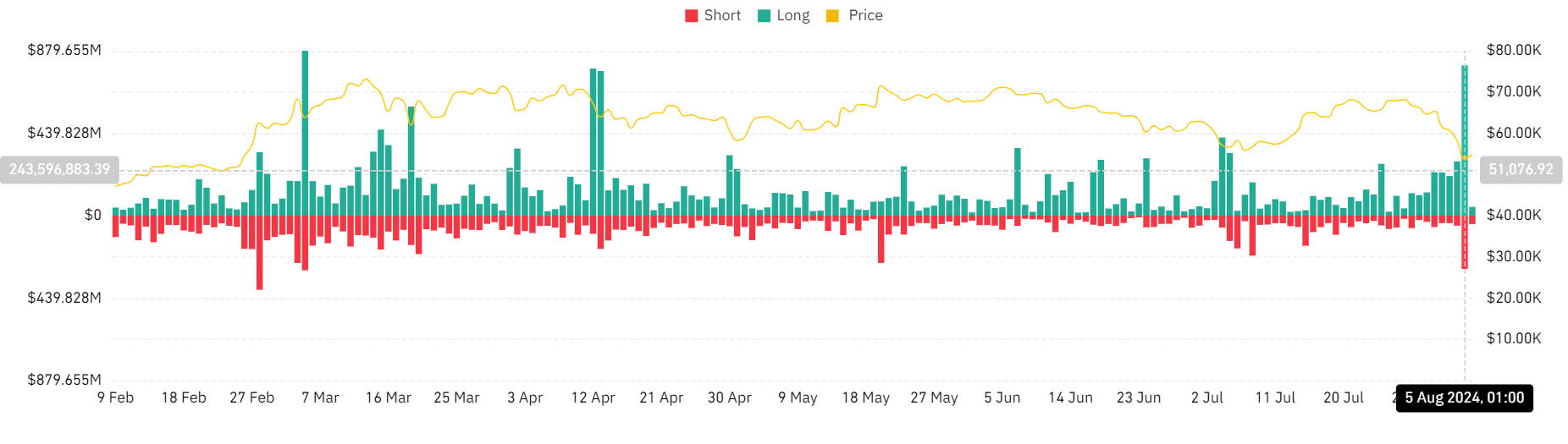

Market liquidation amid ETF surge

The broader trade saw a dramatic surge in liquidation volume amid a notable surge in Bitcoin and Ethereum ETF trading volumes, reaching levels not seen since March.

Data analysis shows that the total market liquidation that day was over $1 billion. A closer look at the breakdown of this figure shows that long positions accounted for the majority of these liquidations.

According to records, long-term liquidations exceeded $801 million and short-term liquidations amounted to $284 million.

Source: Coinglass

Focusing on individual cryptocurrencies, Bitcoin accounted for over $408 million in total liquidations, with long volumes increasing again.

Ethereum also saw significant liquidations, totaling nearly $280 million, with long positions similarly dominant. BTC and ETH liquidations accounted for more than half of total market liquidations.

BTC and ETH showed some recovery.

According to AMBCrypto’s analysis, the price trends of Bitcoin and Ethereum show a moderate daily recovery. Bitcoin was trading at around $55,600 at the time of writing, up more than 2%.

Is your portfolio green? Check out our ETH yield calculator

This follows a 6% drop from the previous trading day, when the price fell to around $54,000.

Meanwhile, Ethereum is trading at $2,466, up more than 1% from the previous trading day’s high of $2,421, after falling more than 9%.