Bitcoin’s current journey appears to mirror its past, presenting surprising patterns of growth and resilience. Experts in the field have observed a repeat of the historical uptrend, suggesting a continued upward trajectory for BTC.

As the market anticipates the introduction of spot Bitcoin ETFs, this stands at a pivotal moment, potentially reshaping investment strategies and reinforcing Bitcoin’s importance in the financial system. This scenario is a confluence of historical trends, regulatory developments, and market dynamics, all pointing to a period of continued bullishness for Bitcoin.

2 Years of Upside Potential for Spot Bitcoin ETFs

Bitcoin’s price action appears to be similar to previous market cycles. According to Ali Martinez, head of global news at BeInCrypto, BTC could reflect the bull market between 2015 and 2018 and again from 2018 to 2022.

Martinez predicts the next peak around October 2025, analyzing the length and upside of past bull cycles. For example, the bull market from 2015 to 2018 saw Bitcoin rise from less than $200 to $20,000. Meanwhile, in the 2018 to 2022 cycle, the BTC price rose from approximately $3,100 to $69,000.

“Bitcoin history could repeat itself… which means BTC still has 700 days of bullish momentum,” Martinez said.

The potential approval of a spot Bitcoin exchange-traded fund (ETF) could be one of the key drivers of the next bull market. Still, Dan Morehead, managing partner at Pantera Capital, believes that Wall Street’s motto of “buy the rumor, sell the news” could be indicative of investor fatigue when news breaks.

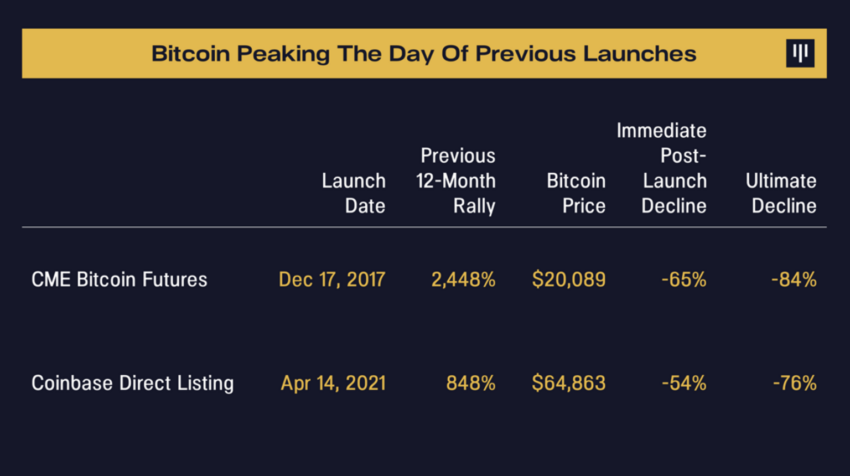

This pattern was evident during major regulatory announcements such as the launch of CME Bitcoin futures and the public listing of Coinbase, which signaled the start of a significant bear market immediately following the events.

“The market rose 2,448% to the very day CME Bitcoin futures were listed. That was the best. From that day on, a -84% bear market began. The market repeated the same cycle ahead of Coinbase’s public listing. The Bitcoin market rose 848% on the day of listing. Bitcoin peaked that day at $64,863 and began a -76% bear market,” Morehead explained.

Nonetheless, ETFs are expected to revolutionize access to Bitcoin. Bitcoin acquisition has evolved from the early days of “Bitcoin faucets” to trading on platforms such as Kraken and Coinbase. However, many current exchanges are offshore and opaque, hindering institutional participation.

Read more: How to Prepare for a Bitcoin ETF: A Step-by-Step Approach

Unlike futures markets, which have had limited impact, Bitcoin ETFs are expected to open up a significant new pool of investors.

“Starting a prediction with ‘this time it’s different…’ is usually not a good way to start, but here I believe it is… The existence of ETFs is a very important step in becoming an asset class. “Once an ETF exists, if you have no exposure, you are effectively short selling,” Morehead added.

BTC price prediction for next cycle peak

In particular, the BlackRock Spot Bitcoin ETF is seen as a game changer. Analysts link this to the launch of gold ETFs in the early 2000s.

Just as gold ETFs attracted new investors and legitimized gold as an investment, Bitcoin ETFs are expected to transform BTC’s demand function and further validate it as an asset class.

“Some people say Bitcoin ETFs will steal demand from traditional retail stores. I don’t think so. Consider the demand for gold bars/coins before and after a gold ETF. (In) 2003 (demand was) 293 tons. (in) 2022 (over demand) 1,107 tons. ETFs legitimize gold as investment in and demand for physical gold surges,” said Matt Hougan, CIO at Bitwise.

Bitcoin’s inherent circularity, driven by transparent supply and distribution rules, supports this optimistic outlook. Satoshi Nakamoto designed Bitcoin to have a predictable four-year cycle, influencing price fluctuations.

Morehead agreed with Martinez’s prediction and emphasized that if past trends continue, the current Bitcoin rally could extend into October or November 2025.

Read more: Analyst reveals how Bitcoin halving cycle could turn $5 into $130,000

Meanwhile, the broader economic and regulatory environment also plays a role. Ripple’s recent legal victory and the swift legal proceedings of Sam Bankman-Fried and Binance reflect the growing regulatory clarity and maturity for cryptocurrencies.

The combination of historical patterns, the upcoming Bitcoin ETF approval, and the broader regulatory environment indicate that Bitcoin may indeed maintain bullish momentum over the next 700 days, strengthening its position in the financial system.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts.