Bitcoin’s recent rally attracted investors’ attention because the price inch was nearly $ 105,000. Major cryptocurrencies have gained momentum for strong institutional interest and market optimism over the past month.

But the conflicting market situation can prevent Bitcoin from reaching a new all -time high.

Bitcoin holder is greatly accumulated

Investor activities were overwhelmingly optimistic. Last week alone, more than 30,072 BTCs were purchased, worth more than $ 3.13 billion. The surge in purchasing activities led the exchange net position to the lowest level in four months.

This metric indicates that more coins are withdrawn from exchange than sediment.

The fear of losing profits is pushing Bitcoin holders to accumulate at high speeds. As Bitcoin floats near the record highs, long -term investors appear to be added to their positions and bet on a new brake out.

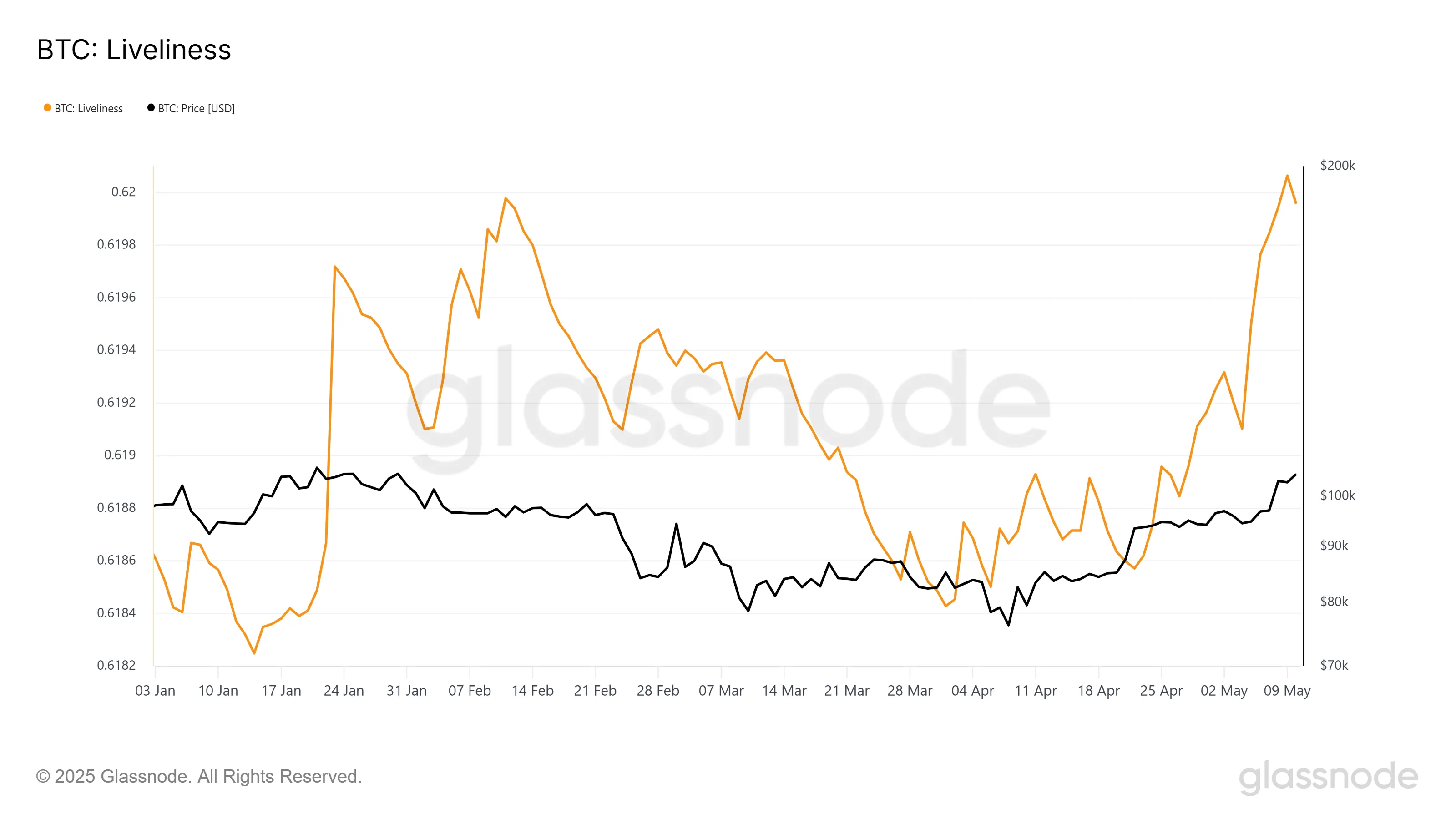

The accumulation is still strong, but the macro trend presents a mixed picture. Liveliness indicators, the main warmth metrics, have seen notable spikes since early May. It suggests that long -term holders (LTH) are starting to settle down at the highest point of multiple main.

The increase in vividness generally means that dormant coins are being activated again, and often the adapter is gaining profit. This behavior can introduce new sales pressure into the market.

If Bitcoin LTH continues to offer a stake, it can undermine the optimistic feelings that run with fresh accumulation.

The BTC price is aimed at a new ATH

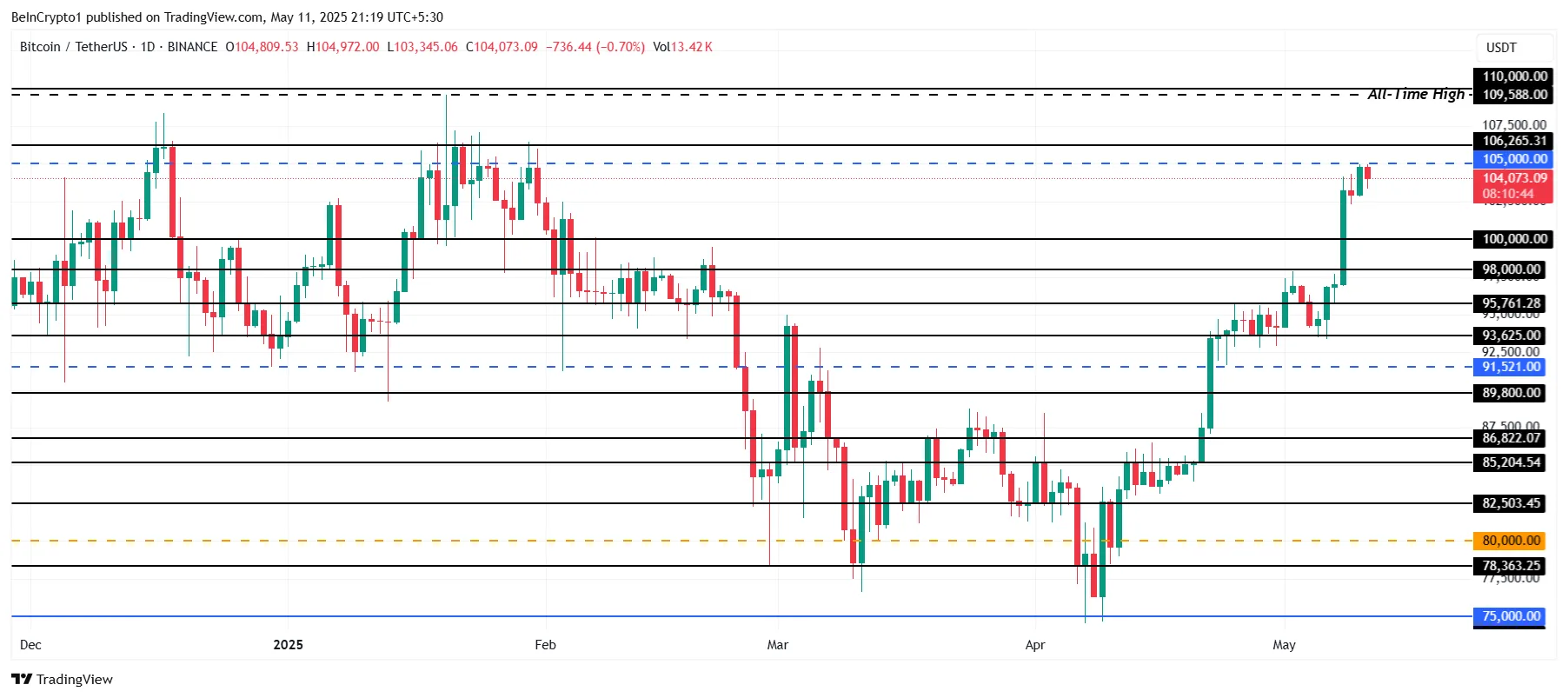

Bitcoin is currently $ 105,231, lower than the main psychological resistance of $ 105,000. However, according to technical data, the actual resistance is $ 106,265. This price level acts as an upper limit since December 2024, preventing Bitcoin from getting more traction.

Despite the record high of $ 109,588, $ 106,265 is an immediate obstacle to Bitcoin. Market epidemiology, including LTHS’s sales and conflicting investor sentiment, is particularly difficult to violate this level.

If Bitcoin does not overcome this resistance, the price modification to $ 100,000 is still a strong possibility.

On the contrary, if the BTC can break $ 106,265 with the bottom of the support, it can rebuild optimistic momentum. This move will open a way for Bitcoin to regain $ 109,588 and potentially form the best of new history.

This level will be able to invalidate the weak outlook and set the stage for $ 110,000.

disclaimer

According to The Trust Project Guidelines, this price analysis article is used only for information provision and should not be considered financial or investment advice. Beincrypto is committed to accurate and prejudice, but market conditions can be changed without notice. Always do your own research and consult with an expert before making financial decisions. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.