- Despite the decline in daily active addresses, BNB’s daily trading volume has increased.

- BNB appears to be testing a key support level at the time of writing.

BNB Chain (BNB) It has been known for its activity for years. The good news is that the blockchain has proven this once again, outperforming all its competitors in key aspects. Will this finally help push up the price of BNB?

BNB’s recent performance

Coin98 Analytics recently shared: Twitter We are revealing the main developments. According to the same, BNB has been the number 1 blockchain in terms of unique addresses over the past 30 days, with the number exceeding 463 million.

Although the growth rate was only 1% compared to the previous month, BNB still ranked first. In addition to BNB Chain, Polygon (MATIC) and Ethereum (ETH) also ranked in the top three on the same list. MATIC had 452 million monthly unique addresses, while ETH had 277 million.

AMBCrypto has confirmed Artemis. data To better understand the network activity of the BNB chain, we found that the daily transactions on the blockchain have increased over the past month. However, surprisingly, the daily active addresses of BNB have decreased over the past 30 days, despite being at the top of the table.

Source: Artemis

After the rapid rise, the blockchain’s TVL also started to decline on the charts.

Nevertheless, things looked optimistic in terms of captured value, as fees and yields have been on the rise over the past few days.

The bears continue to dominate

Although the BNB chain has achieved a new milestone, its price action has been under the control of the bears, with a drop of over 8% and 5% over the past 7 and 24 hours respectively. At the time of writing, the coin transaction The stock price is $538.20 and the market cap is over $78.5 billion.

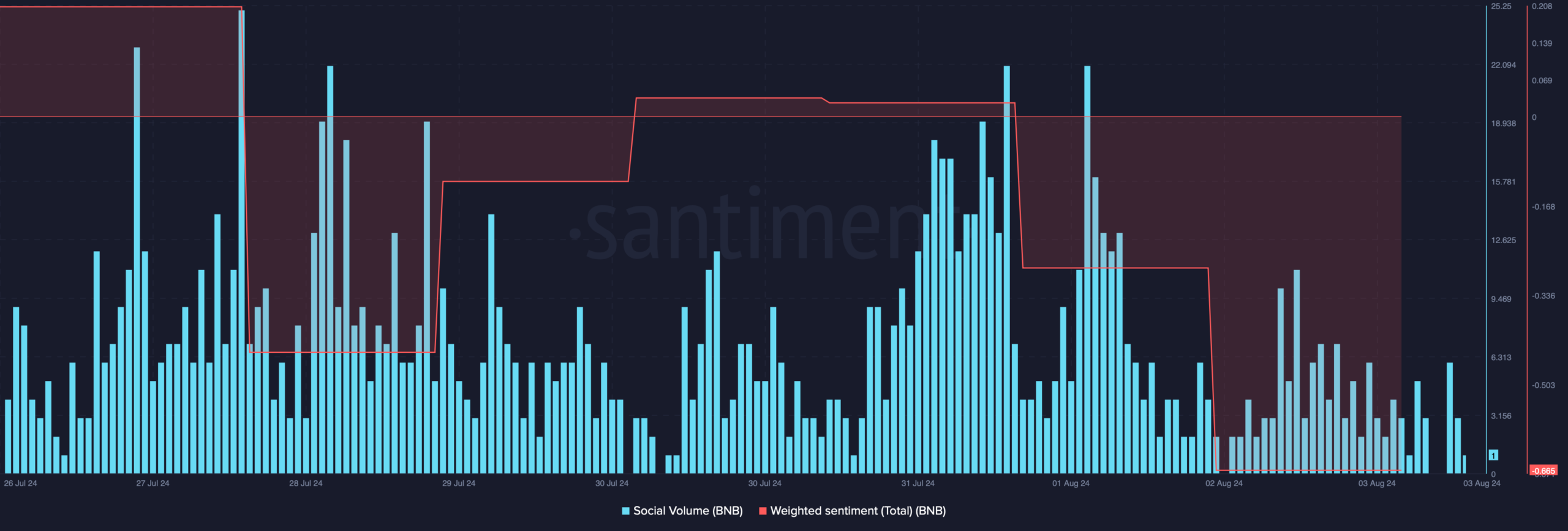

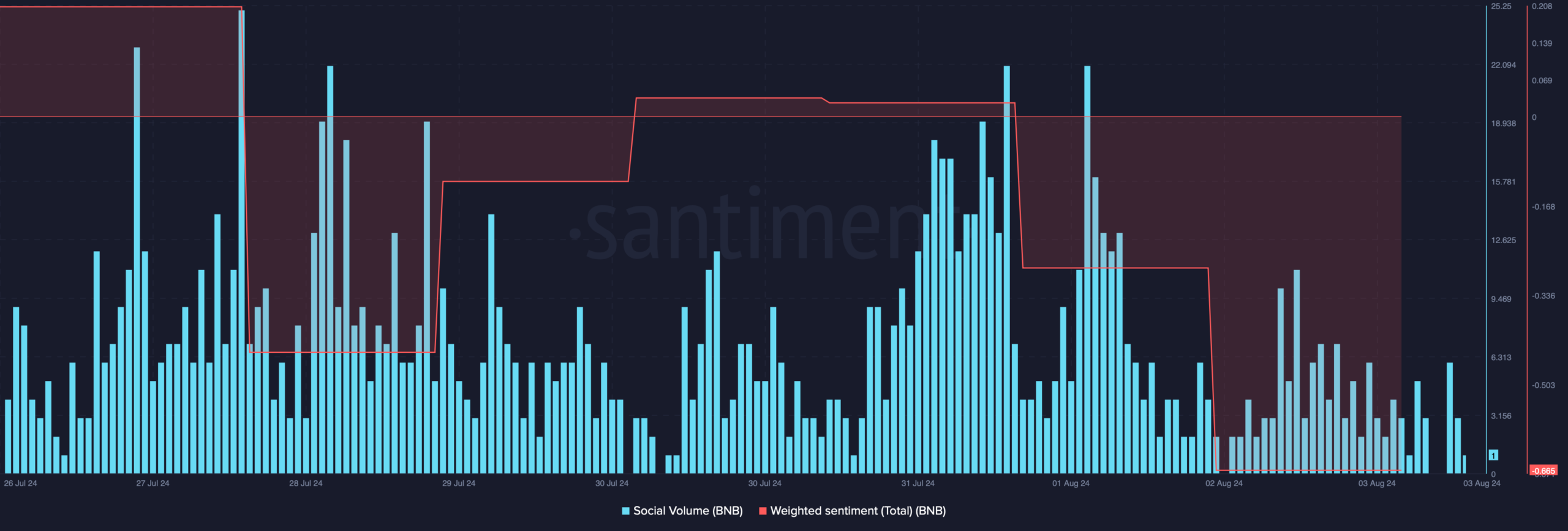

The decline of the altcoin had a negative impact on social metrics.

For example, the weighted sentiment has dropped, which means bearish sentiment is dominant. Conversely, the social volume has increased, which reflects the popularity of BNB in the crypto space.

Source: Santiment

AMBCrypto looked at data from Coinglass and found that the BNB long/short ratio has dropped sharply.

This means there are more short positions than long positions in the market, which is a bearish signal.

Source: Coinglass

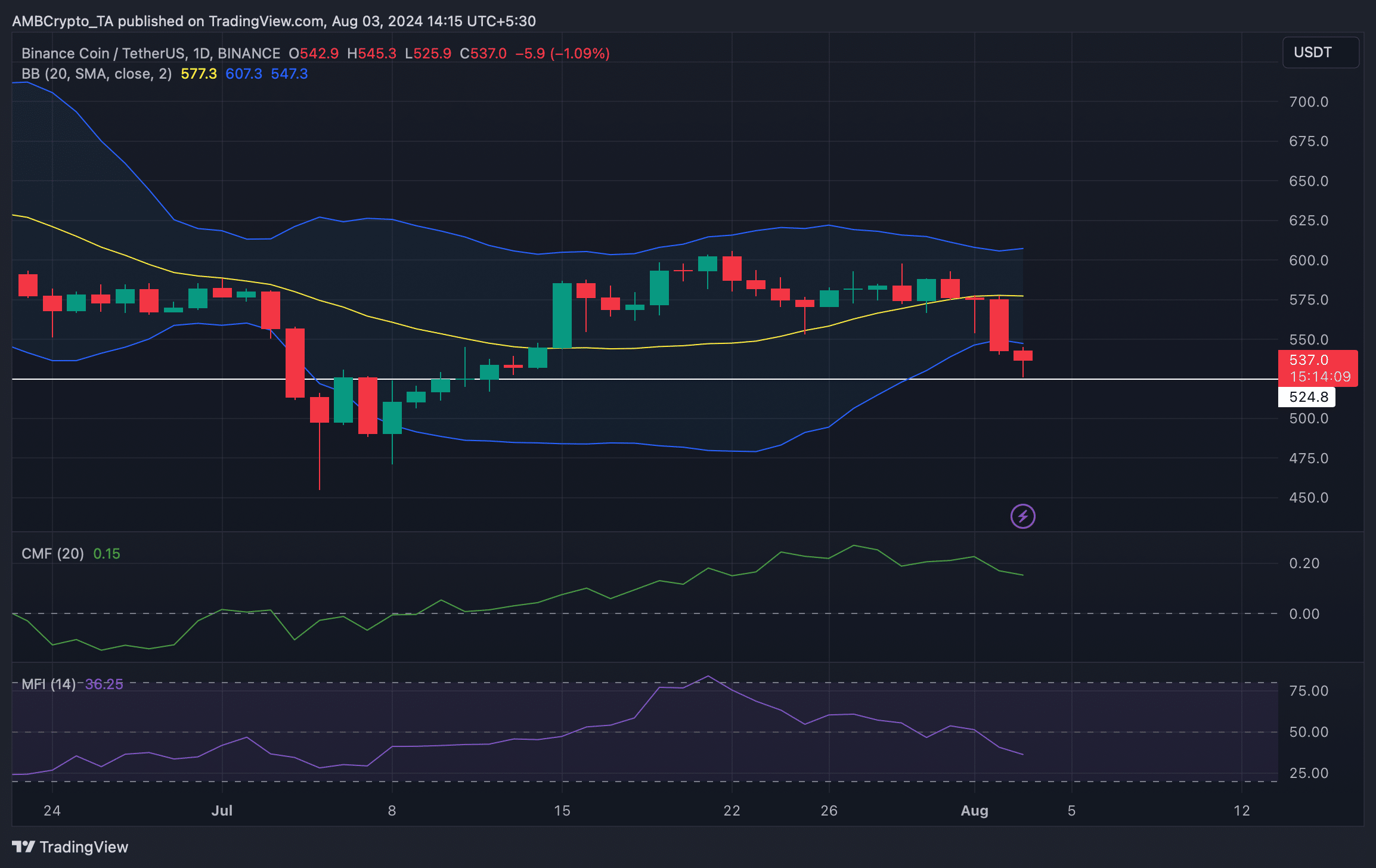

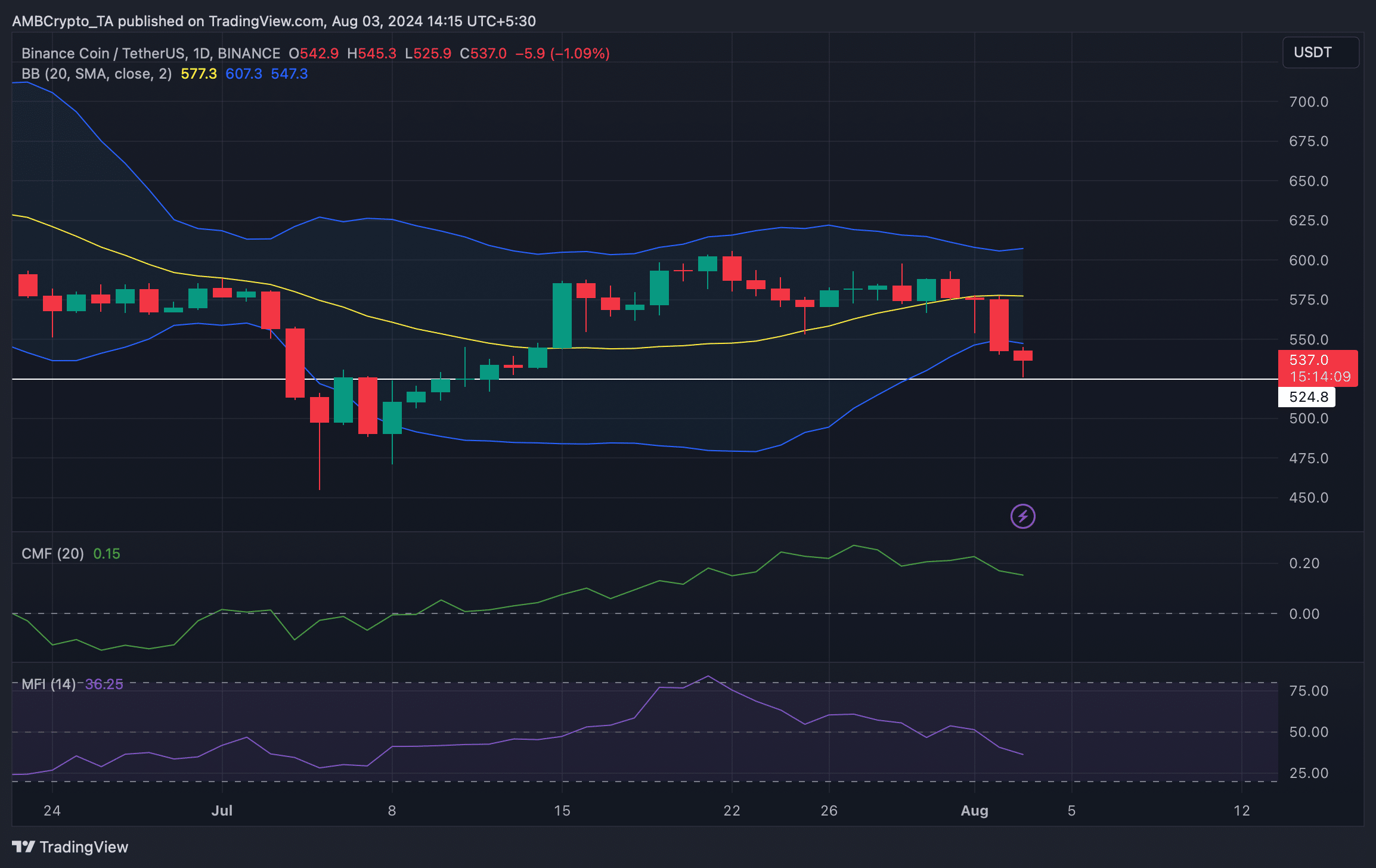

Finally, we checked the daily chart of the coin to see if there is a change in trend reversal in the short term. According to our analysis, the price of BNB has broken below the lower band of the Bollinger Band, which indicates further price declines.

Additionally, both the Money Flow Index (MF) and Chaikin Money Flow (CMF) recorded declines.

read Binance Coin (BNB) Price Prediction 2024-25

At the time of writing, BNB is testing a key support level, below which a drop could be disastrous. However, this is also an opportunity for the market bulls to defend their positions and start a rally.

Source: TradingView