- ADA is down 6.4% from its monthly high of $0.62.

- After modification the whale address has increased.

Cardano (ADA) has fallen significantly over the past two days of trading, effectively giving back all the gains it made earlier this week.

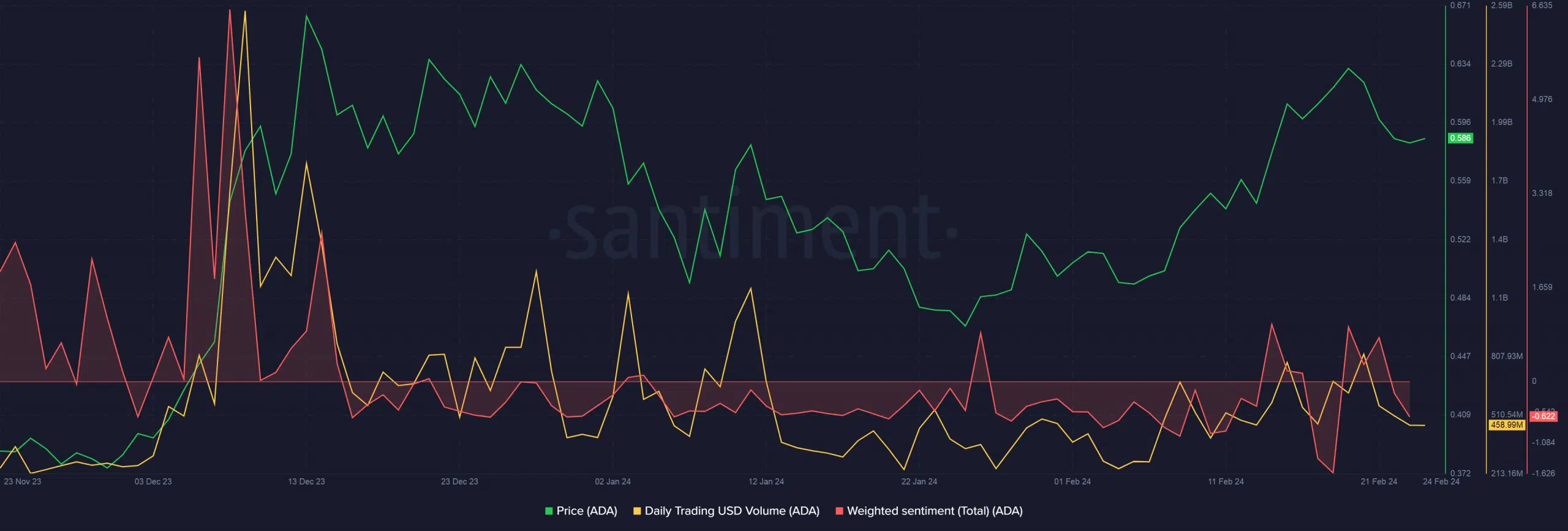

The eighth-largest asset is down 6.4% from its monthly high of $0.62 on February 20, according to CoinMarketCap. The coin has barely moved in the last 24 hours, leading to a decrease in trading volume.

AMBCrypto’s analysis of Santiment data shows negative market sentiment towards the coin at the time of writing, highlighting the fallout from the recent correction.

Source: Santiment

Is the ADA facing difficult days ahead?

The decline was amplified by renowned technical analyst Ali Martinez, who spotted a sell signal on ADA’s 3-day chart. “It is important to note that this indicator has sent bearish signals the last two times. ADA “We have experienced price adjustments,” Martinez marveled.

Expert forecasts are valuable in investing, but before you go any further, remember DYOR.

AMBCrypto investigated other additional technical indicators to confirm the validity of the aforementioned claims.

ADA faced a correction after the Relative Strength Index (RSI) reached an overbought level of 70. Since then, buying pressure has eased considerably. However, at the time of writing, RSI was still above neutral 50, so it is too early to draw a definitive bearish signal for ADA.

The Moving Average Convergence Divergence (MACD) line is about to cross the signal line bearishly, indicating that it may be time to sell.

Source: Trading View

Whales never miss an opportunity

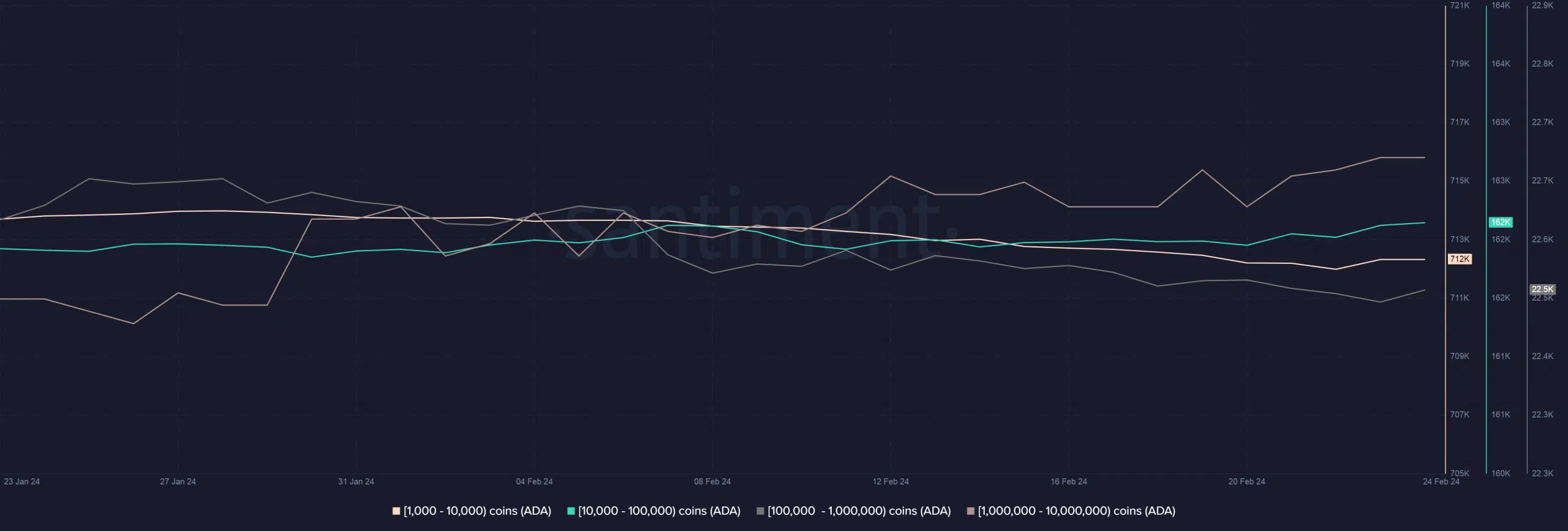

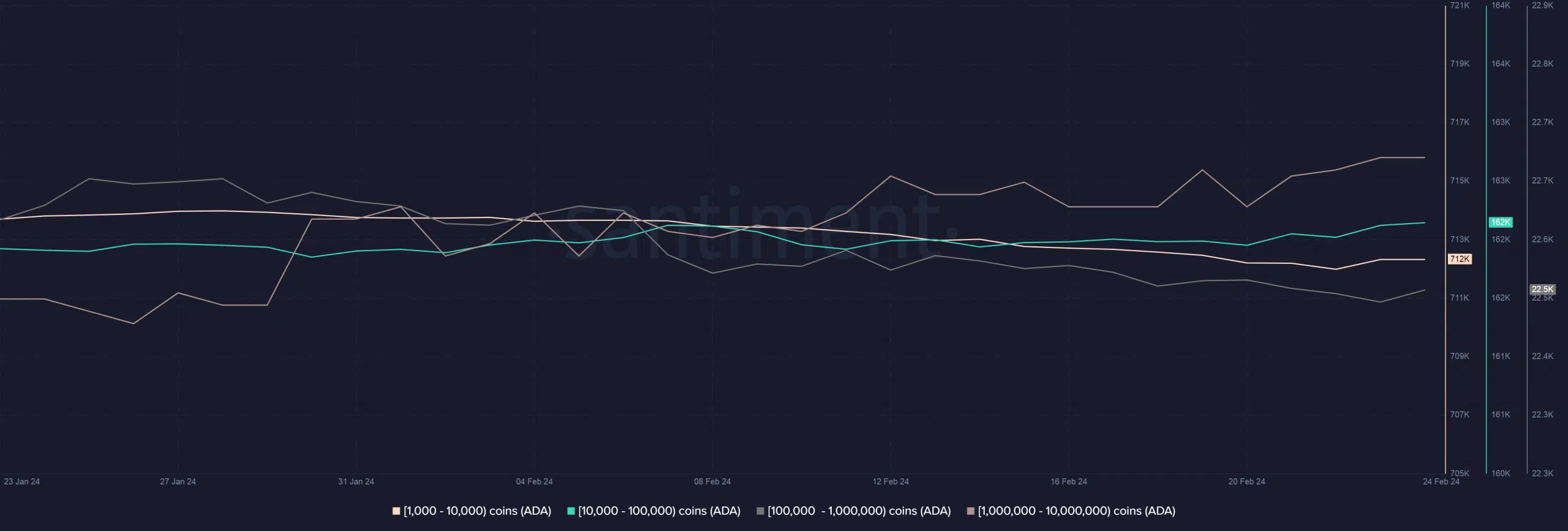

Interestingly, ADA whales seemed to take advantage of the retreat to fill their coffers. Data from Santiment shows an increase in addresses holding more than 1,000 coins since February 2nd.

Amid all the bearish indicators, this appears to be a strong statement in favor of ADA in the medium to long term.

Source: Santiment

Read ADA’s 2024-25 Price Forecast

ADA derivatives market is weak

Meanwhile, short position traders continued to dominate the ADA futures market. According to AMBCrypto’s analysis of Coinglass data, the Longs/Shorts Ratio remained below 1 throughout February, meaning expectations are higher for a decline rather than an advance for ADA.

Source: Coinglass