- ETH whale activity has increased over the past few months.

- Daily whale trading volume has increased since the SEC approved the ETH spot ETF.

Ethereum (ETH) has witnessed a surge in whale activity over the past few months, Santiment points out in a newly released report.

According to the on-chain data provider, the recent increase in whale activity was triggered by rumors and the U.S. Securities and Exchange Commission’s approval of a spot Ethereum exchange-traded fund (ETF).

On May 23, regulators Approved Form 19b-4 for ETF applications filed by BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

This approval came unexpectedly after a long period of refusal to communicate with the issuer.

ETH Whale is in charge

According to a report by Santiment, over the past 14 months, the cumulative holdings of whale wallets holding at least 10,000 ETH coins have increased by 27%.

This group of ETH holders purchased 21.39 million ETH during that period, worth $83 billion at current market prices.

According to Santiment,

“Ethereum has risen (%) from Bitcoin over the past month after the SEC announced rumors and final approval of the first Spot ETH ETF. So it is not surprising that the whale accumulation is far from over.”

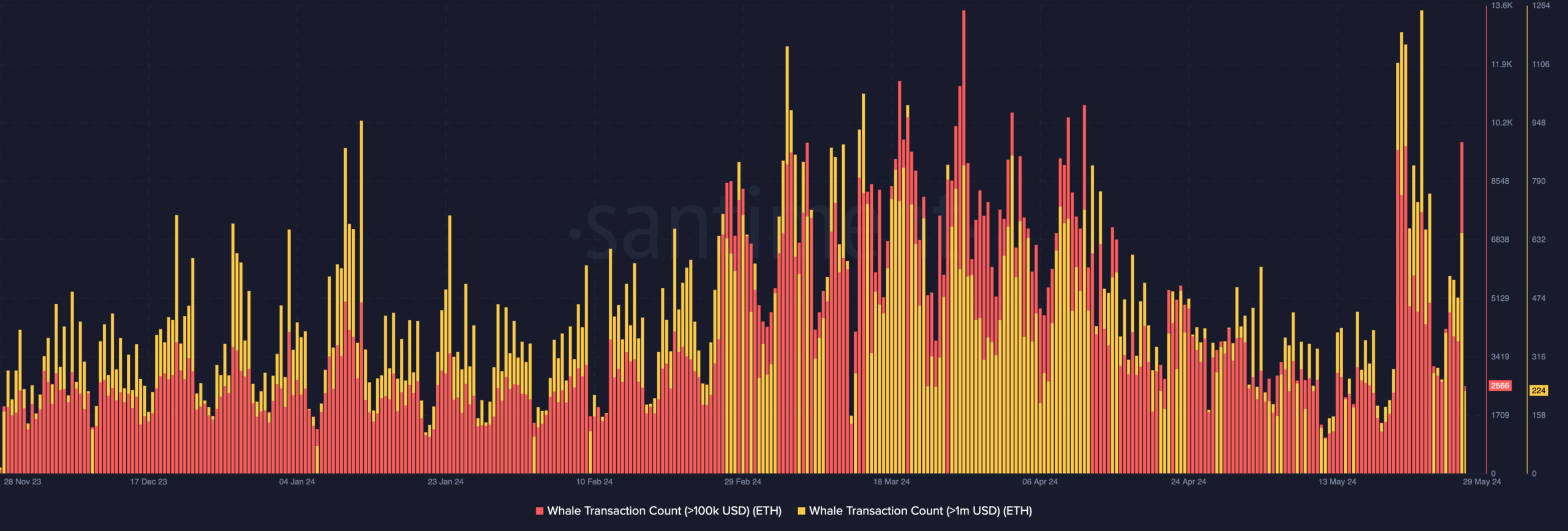

Regarding daily whale trading involving ETH, the on-chain data provider noted that the number of ETH whale trades exceeding $100,000 and $1 million has surged to YTD highs following the approval of the spot ETF last week.

On this day, the number of transactions exceeding $100,000 reached 7,649, and the number of transactions exceeding $1 million reached 1,252.

Source: Santiment

This surge is due to increased profit-taking activity among large holders of the coin. Santiment noted.

“This was clearly an opportunity the whales saw to profit. However, as long as 10,000+ ETH wallets continue to move north rather than south through this volatility, the price could continue to outperform Bitcoin.”

ETH holder ledger full

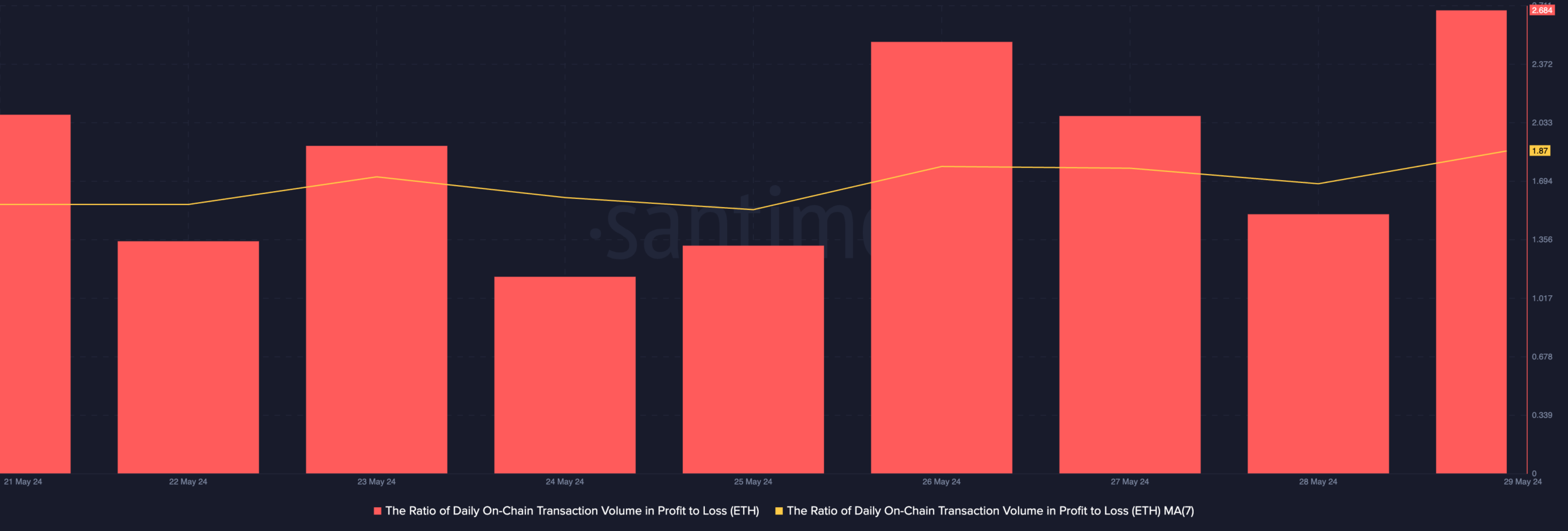

Day trading involving ETH has been profitable amid increased whale activity since last week’s approval.

AMBCrypto evaluated the daily P/L ratio of altcoin trading volume (using a 7-day moving average) and found it to be 1.87.

Source: Santiment

Is your portfolio green? Check out our ETH Profit Calculator

This means that for every ETH trade that ended in a loss last week, 1.87 trades returned a profit.

At the time of reporting, the altcoin was said to be trading at $3,865. CoinMarketCap’s data.