Wall Street may be sure that the Federal Reserve Bank (Fed) will try to cut interest rates, but many experts claim that difficult economic data is not.

On the other hand, Bitcoin (BTC) attempts to recover, shows weaknesses at the beginning of the week, and exceeds the threshold of more than $ 111,000.

Experts say that cutting speed can now be counterproductive.

boost

According to the CME Fedwatch Tool, the market is 99.6%, and the price of 99.6%is set at the probability of cutting interest rates at the September meeting.

Nearly two weeks after the next FOMC meeting, traders are almost definitely relaxed. They say that a softer policy stance will ignite another liquidity -centered asset rally.

But analysts warned that this agreement depends more on the emotional investigation than the actual economic basics.

Hard data to soft narrative

Justin D ‘ERCOLE, founder and CIO of ISO-MTS Capital Management, told Tradfi Media that the Fed should not reduce the Fed in Tradfi Media.

boost

He argued that policymakers were at risk of shaking due to the wrong story of the soft economy survey.

D ‘ERCOLE pointed out that these surveys reflect only at high prices with only consumer frustration, but they cannot capture the wider strength of the economy.

The Financial Times said, “The economy is potential, stock evaluation is extreme, inflation is 3%, and unemployment remains historically low.”

He has an increase in total labor income available at 4-5%, and credit card delinquency has fallen compared to the previous year. Even commercial real estate, even commercial real estate, which is often depicted as a temporary crisis, shows improving asset quality and lowering loans.

The market wants to cut, but the data is different to Echo in 2024.

boost

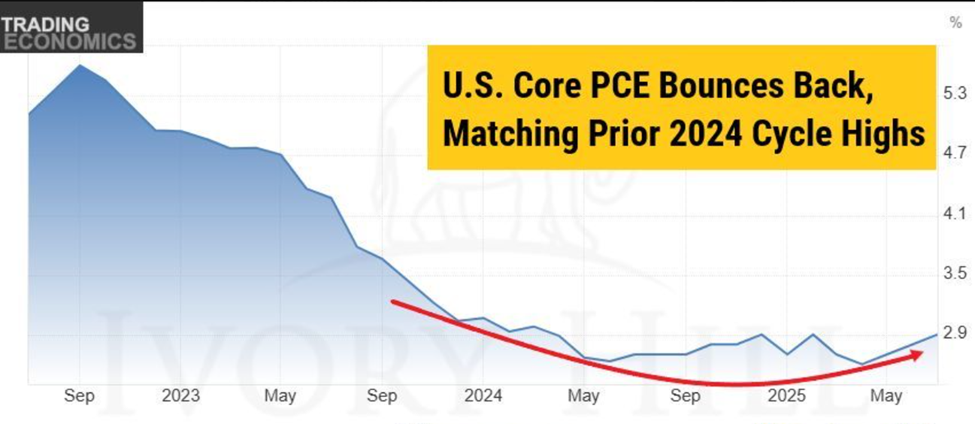

In other places, Kurt S. Altrichter, the founder of Ivory Hill, reflects emotions. In a recent post on X (Twitter), he mentioned PCE (personal consumption) inflation data.

“The core PCE has returned to 2.9%. Inflation has not died. GDP has just printed 3.3%. This is not a background for interest rate cuts.

Altrichter argued that the risk would be market pressure at the expense of long -term reliability in the inflation fight.

If the Fed repeats the playbook in 2024, other observers will warn about the financial market instability. Independent analyst TED compared the current setting in September 2024.

boost

Last year, the surprise interest rate cuts further enhanced the encryption market before it first caused a rapid reversal.

“In September 2024, the Fed Interior Rate and #Altcoin MCAP pumped 109%in just three months. After that, $ 30%dumped $ 30%, while ALTS fell 60%-80%to 60%. It looks like the pump during the time is repeated.

boost

A wider debate is summarized as a reliability vs. relief. The cut rate may be temporarily relieved of the debt households and businesses. But critics argue that there is a risk of causing inflation pressure, asset bubbles and long -term instability.

“Is saving more limit jobs in the US economy than all consumers’ inflation-fighting reliability and financial stability?” D ‘ERCOLE has been raised.

The market has already celebrated its cuts, and the Fed has decided whether to follow the data in one of the most difficult policy tests for decades.