- MATIC saw the daily market structure reverse to bearish.

- April could see a further 8% decline.

Polygon (MATIC) saw the beginning of a downtrend on its sub-period chart in the second half of March.

Bitcoin (BTC)’s recent stagnation and inability to rise above $70,000 has created short-term fears, leading to selling in the altcoin market.

Technical analysis showed that further losses were likely, and the liquidation heatmap agreed. But higher term forecasts showed optimism could carry over into next months. Here’s how things could go:

The structure is turning bearish. Should traders consider selling MATIC?

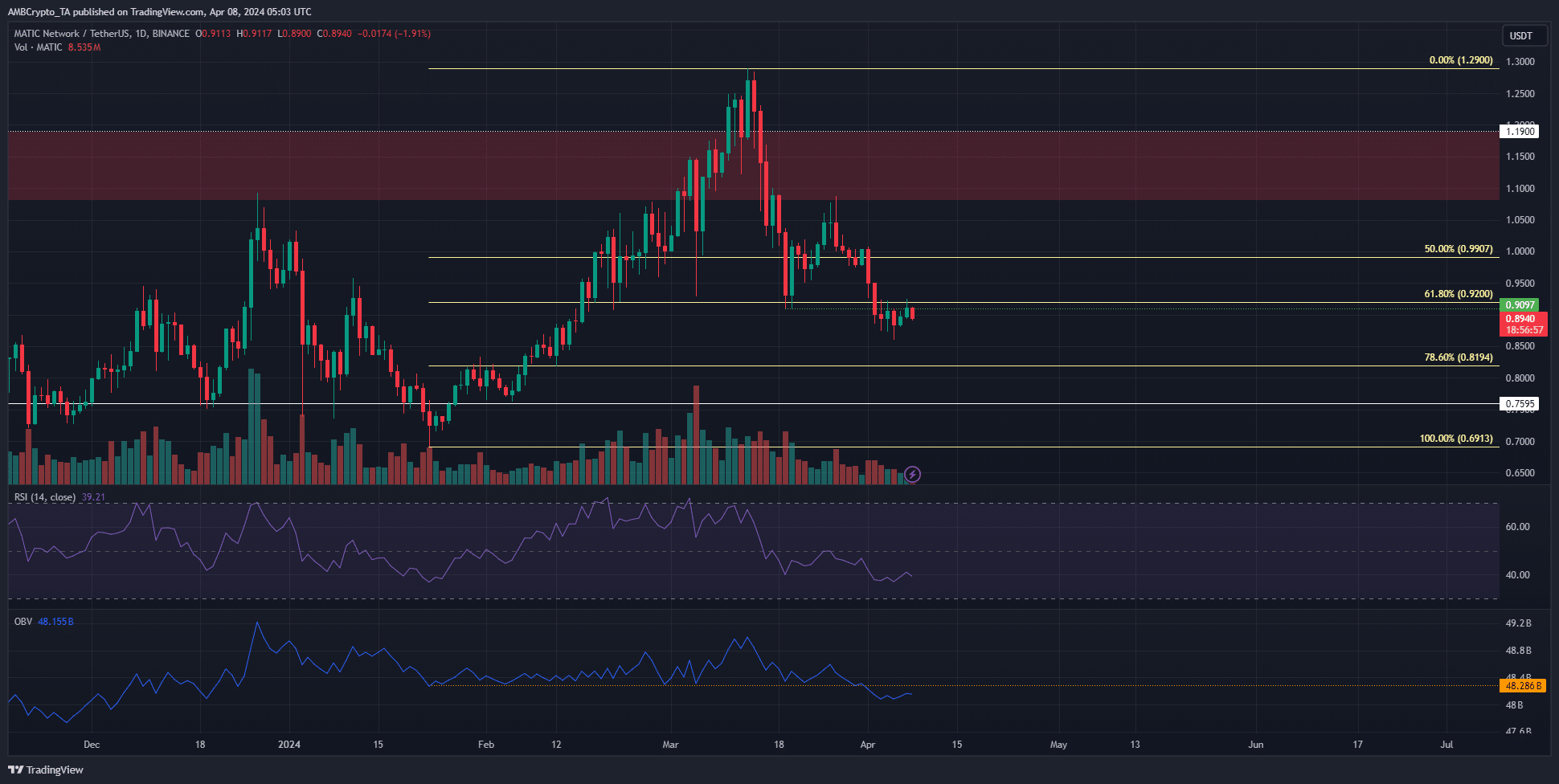

Source: MATIC/USDT on TradingView

The price of MATIC fell below $0.91 on April 2nd. At press time, after testing again with support, it faced rejection at the same level.

This level was important because it marked the most recent low in an upward trend that began in November 2023.

The change in structure also brought OBV below a key support level that buyers have been championing since mid-January. RSI also showed strong bearish momentum at 39.

Taken together, the inference is that it is very likely that MATIC will fall much lower and begin a downtrend. However, there was a strong bullish bias on the weekly chart.

Additionally, the Fibonacci 78.6% retracement level at $0.819 could halt the downtrend.

Liquidity pockets could soon play a significant role.

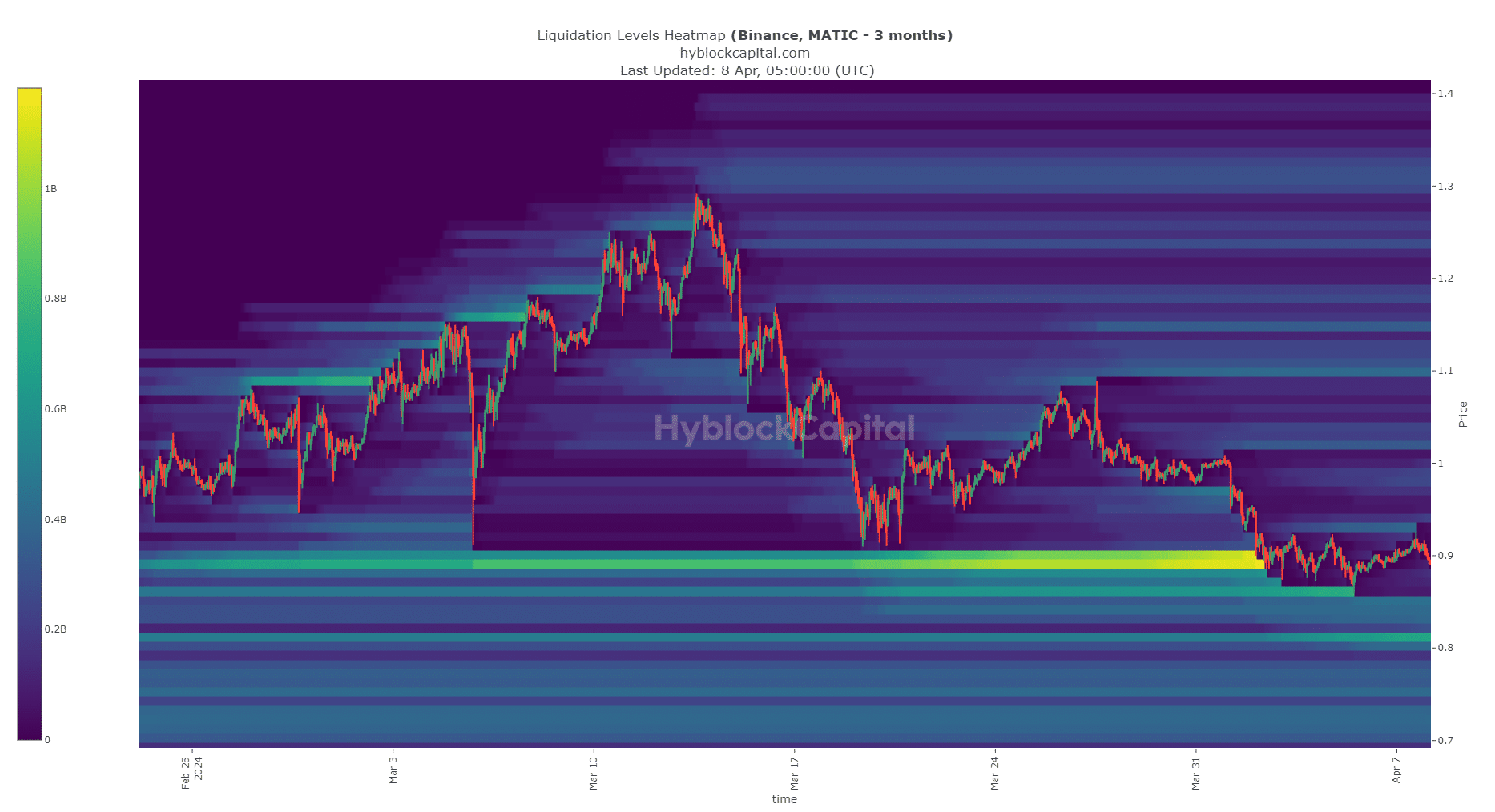

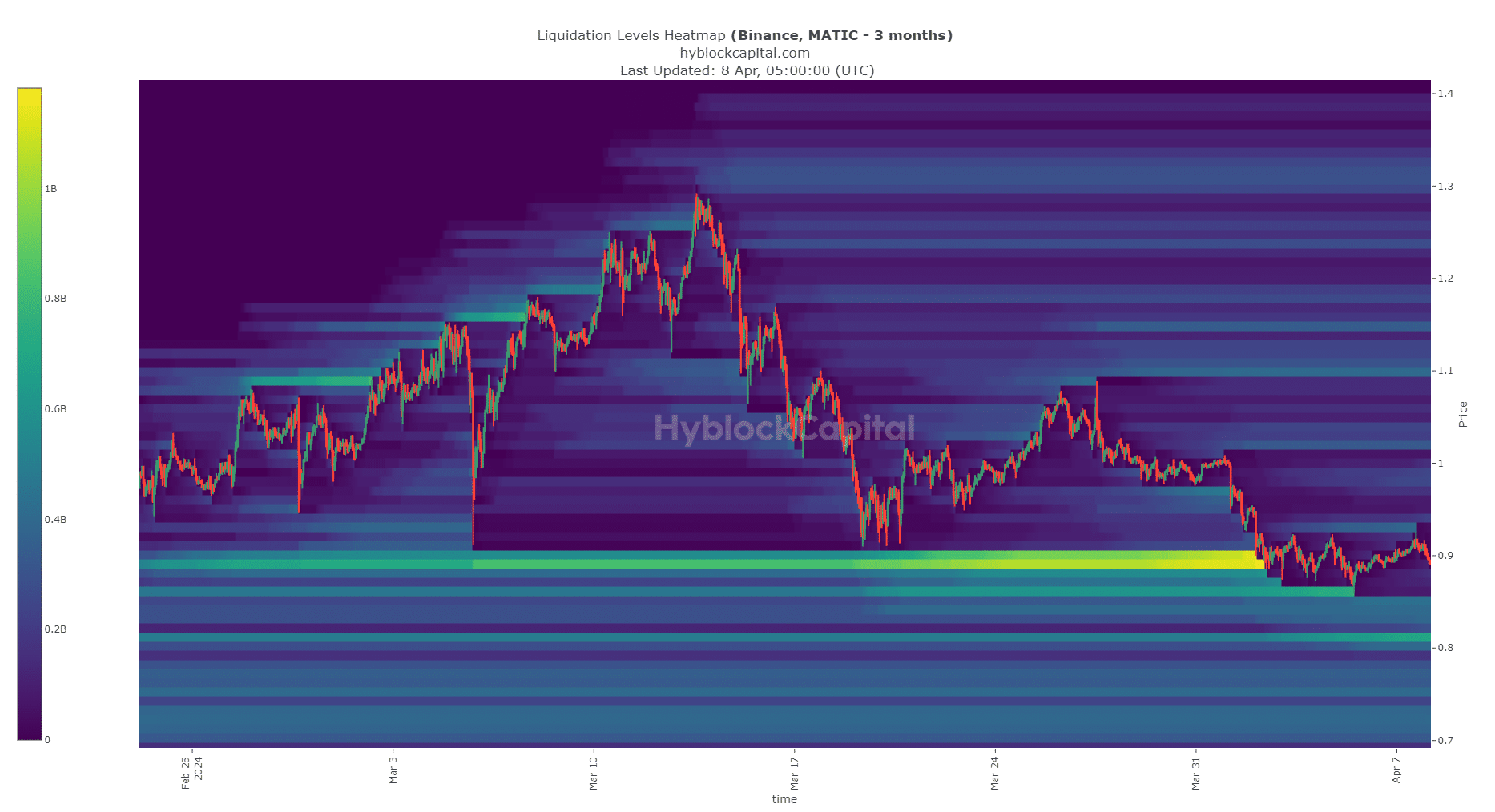

Source: Hiblock

Analysis of the liquidation heatmap shows that liquidation orders centered at $0.89 on April 2 were extinguished as MATIC plummeted to $0.86.

Since then it has bounced between $0.89 and $0.92.

Is your portfolio green? Check out the MATIC Profit Calculator

The closest liquidation amount was $0.81. Another area of interest was $0.84-$0.85. The $0.81 level was also coincident with the 78.6% retracement level of $0.819.

Therefore, MATIC bulls can sweep this pocket of liquidity and then reverse the bearish structure.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.