The cryptocurrency market, especially Bitcoin, goes through a phase of change called ‘halving’ every four years where mining rewards are halved, which has a significant impact on the inflow of new BTC.

These anticipated events reduce supply and traditionally drive up the price of Bitcoin due to increased scarcity. As the 2024 halving progresses, industry leaders share important insights. They highlight the impact of this event on trading strategies and the wider investment environment.

Immediate effect after half-life

John Patrick Mullin, CEO of real-world asset (RWA) layer 1 blockchain MANTRA, spoke to BeInCrypto about the immediate impact of the Bitcoin halving. He predicted that a sharp decline in block rewards would lead to increased market volatility.

“After the halving, short-term traders should prepare for increased volatility. Reduced block rewards can lead to immediate market reactions and traders must carefully watch potential price movements to capitalize on quick profits or mitigate losses,” Mullin explained.

These periods of volatility present opportunities and risks, so investors must pay close attention to and respond to market signals.

Mullin points out that it is important to monitor the hash rate and miner activity after the halving. The hashrate decline following the halving could signal miners’ capitulation, which could trigger a short-term decline in the price of Bitcoin. This scenario can provide investors with a strategic entry point or serve as a warning signal to delay further investment.

While the halving sparks significant activity and speculation among short-term traders, Mullen advocates a different approach for long-term investors. He suggested that “you might consider holding on to or gradually accumulating more Bitcoin,” focusing on the continued potential for price appreciation as the newly limited supply of Bitcoin interacts with steady or growing demand.

Likewise, Nash Lee, co-founder of decentralized exchange (DEX) MerlinSwap, believes that long-term investors should expect significant price increases following halving events, beyond immediate fluctuations.

“A decrease in Bitcoin supply could lead to a rise in price, making you consider increasing your Bitcoin holdings in the long term. “Compared to other altcoins, Bitcoin has less price volatility, and there is some optimistic news this year, such as the Bitcoin Exchange Traded Fund (ETF) spot, so it is a good idea to consider increasing your BTC holdings compared to other assets,” Lee told BeInCrypto. said to

Looking back at historical data surrounding supply and price dynamics during previous Bitcoin halving events can provide valuable context.

During the first halving event on November 28, 2012, the price of Bitcoin skyrocketed from $12 to a high of $1,242, recording an incredible increase of 9,937%. Likewise, the second halving event on July 16, 2016 saw the price at $664 and eventually reached a high of $19,804, an increase of 2,903%. During the most recent halving, on May 11, 2020, the price was $8,571, and the subsequent high was $68,997, an increase of 705%.

Read more: What happened at the last Bitcoin halving? Forecast for 2024

According to Kristian Haralampiev, head of product at cryptocurrency platform Nexo, these historical trends show the potential for significant price increases following the halving.

“Bitcoin’s deflationary nature, highlighted by the decline in new supply issued during halvings, strengthens its appeal as a hedge against global inflation. These characteristics solidify their status as desirable assets, especially in times of economic uncertainty. As a result, the intensified interest in the halving event further strengthened Bitcoin’s reputation as a store of value,” Haralampiev said in an interview with BeInCrypto.

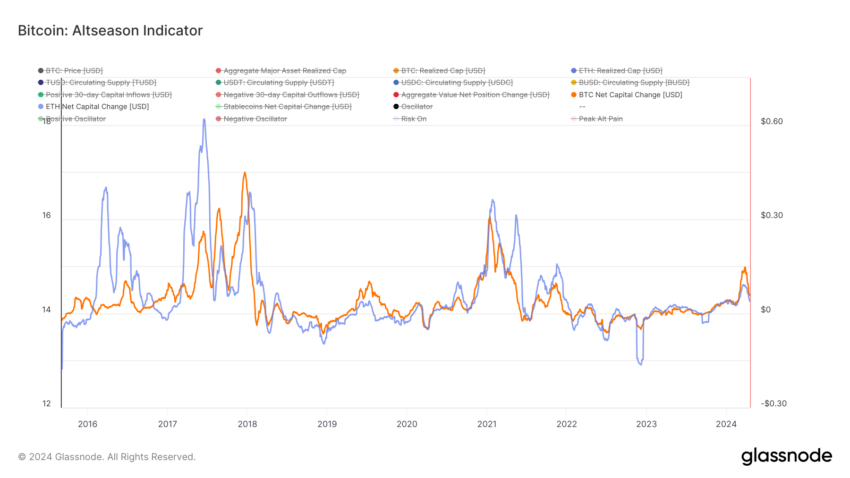

When the altcoin season begins

The discussion extends beyond Bitcoin. Mullin points out that after the halving, the cryptocurrency market often sees a shift in investor focus expanding to include altcoins.

“Increased interest and capital flows into the market could lead to a so-called ‘altcoin season’ where altcoin prices rise significantly following Bitcoin’s initial surge. Once the hype around the Bitcoin halving dies down, investors may look to diversify. This strategy should be approached, especially as investors look for the ‘next big thing’ following the Bitcoin bull market rally,” Mullin asserted.

This expanded perspective will be critical as markets adapt and rebalance following the halving. Historically, as the price of Bitcoin surged after the halving and then stabilized, altcoins began to gain attention.

In fact, the parabolic altcoin season typically unfolds when the price of Bitcoin surges after the halving and then stabilizes, leaving investors seeking higher returns. If Bitcoin’s price rises significantly and its market power increases, this dominance could be reversed, causing investors to profit and reallocate their funds to altcoins.

This pattern was observed after the 2020 halving, when Bitcoin dominance peaked at 73%. If a similar trend repeats in 2024, a shift from Bitcoin to altcoins can be expected.

Read more: What are the best altcoins to invest in in April 2024?

Investors considering such a move should meticulously evaluate altcoins based on their use cases, technology base, development team, community support, and market position. Additionally, it is important to monitor market sentiment and trends as altcoins tend to rally when the market is optimistic about a new technology or project.

However, due to its higher volatility and risk compared to Bitcoin, investors should carefully evaluate their risk tolerance and consider portfolio diversification to manage these risks effectively. Lee argues that conducting comprehensive research is essential to mitigate the risk of succumbing to the Fear of Missing Out (FOMO) and investing in little-known altcoins that can pose significant risks.

“After the Bitcoin halving, some people believe that altcoins offer more attractive investment opportunities. However, altcoins are known to be more volatile than Bitcoin, so careful evaluation is required. “It is important to thoroughly research the project and its background to understand the value of the investment and potential return,” Lee emphasized.

Going forward, the impact of the halving will extend to the broader financial ecosystem. Mullin, Haralampiev, and Lee’s insights suggest that halving strengthens Bitcoin’s position as the leading cryptocurrency. This also acts as a catalyst for increased market power and subsequent investment shift towards altcoins.

These dynamics highlight the importance of a balanced investment strategy that accommodates both the immediate impact of Bitcoin halving and its longer-term impact on market behavior and investor sentiment.

disclaimer

In accordance with Trust Project guidelines, these feature articles present the opinions and perspectives of industry experts or individuals. While BeInCrypto is committed to transparent reporting, the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should independently verify the information and consult with professionals before making any decisions based on this content. Our Terms of Use, Privacy Policy and Disclaimer have been updated.