- Maker explained that it would reorganize DAI and MKR.

- DAI may not be able to compete with USDT despite plans to increase supply.

If MakerDAO (MKR) co-founder Rune Christensen’s plan goes through, the project could upgrade its governance token and decentralized stablecoin DAI. AMBCrypto reviewed a note Christensen wrote to the Maker community on March 12.

Most of it is centered around the endgame, which aims to expand the DAI supply to over 100 billion. For those unfamiliar, the current supply of DAI was 5.35 billion.

The upgraded version doesn’t seem to be the solution.

In May 2023, the Maker team introduced Endgame as a way to support DAI. One of its missions was to make it competitive with stablecoins like USDT. However, since then, developments have failed to impact stablecoins.

This time, Maker said it will get closer to its goal with upgraded MKR and DAI. If this happens and DAI receives a supply of 100 billion, the stablecoin’s market cap could jump from 27th place.

However, this prediction does not mean that other stablecoins such as USDT and USDC will remain stagnant. As of press time, MakerDAO’s Total Value at Lack (TVL) has increased by 20.32% over the past 30 days.

TVL evaluates the overall health of a specific protocol. Therefore, the above increase suggests that market participants believe that their deposits will earn better returns.

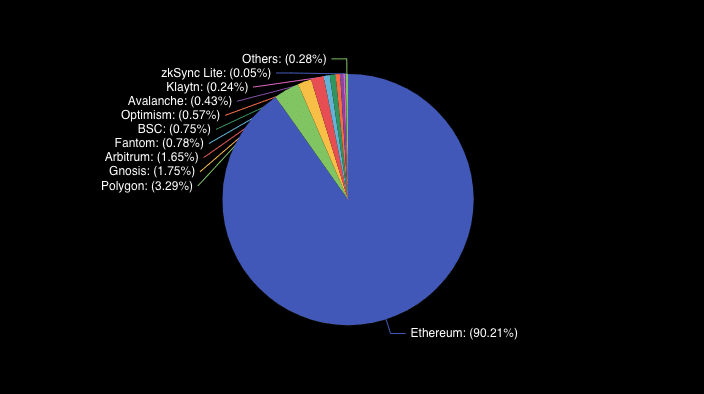

However, DAI lags behind in terms of stablecoin transaction volume. AMBCrypto used data from DeFiLlama to confirm that participants had linked stablecoins such as Ethereum (ETH), Arbitrum (ARB), and more.

However, changes over the past seven days are less impressive, indicating that participants’ attention is unstable. If DAI’s trading volume no longer increases, stablecoins may remain “king” only in the decentralized space and not in the broader market.

Decreased development, as well as traction.

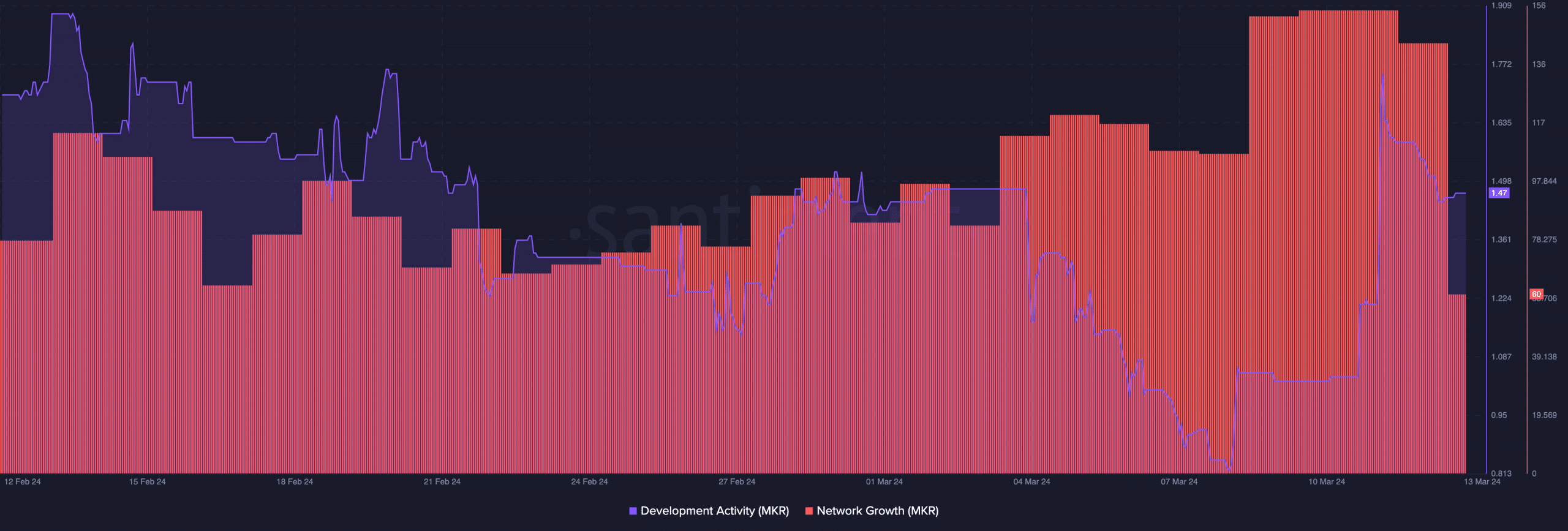

We also made sure that MakerDAO was putting in the effort in terms of development activities. Development activity surged on March 11, according to Santiment.

An increase in this indicator means that developers are releasing new features. However, at press time, development had declined, suggesting a slowdown in code commits as the network upgrades. This decline also suggested that this was not the time for MKR to be bullish.

Another metric that AMBCrypto examined was network growth. Network Growth shows user adoption by tracking the number of new addresses associated with initial transfers.

Source: Santiment

Realistic or not, the market cap of DAI in terms of MKR is:

An increase in the metric would have signaled a surge in interest in the Maker ecosystem. However, the decline here means that network traction has dropped.

Going forward, market participants can keep an eye on DAI and MKR to see how any proposals or potential approvals will impact the cryptocurrencies.