- As MakerDAO sells some of its tokens, the price of MKR decouples from ETH.

- On-chain and technical analysis suggests a rebound to $3,545 once the selling pressure stops.

Over the past two weeks, certain multi-signature wallets linked to MakerDAO have moved $14.4 million worth of MKR to other exchanges.

According to Spot On Chain, some of the platforms where the token landed were Binance (BNB), Coinbase, and Kraken.

A multi-signature wallet is shorthand for a multi-signature wallet that serves as a storage option for your organization. To unlock your assets in this type of wallet, you need to manage more than one private key.

Back to MakerDAO’s activities. One thing that AMBCrypto noticed was that the price of MKR fell each time a project was sold.

MKR cannot match ETH.

At press time, MKR was trading at $2,952, down 3.84% in the last 24 hours.

Interestingly, this token has shown a different behavior than Ethereum (ETH), and appears to have a strong correlation with it.

As of this writing, the price of ETH is $3,216, up 1.48% over the same period that MKR fell.

According to our findings, there are still 21,928 MKR tokens held in multi-sig wallets, meaning there could be more exchange deposits in the future.

If this happens, ETH could continue to split from MKR and the price of the latter could fall below $2,800. However, further declines could be a good thing for the token value.

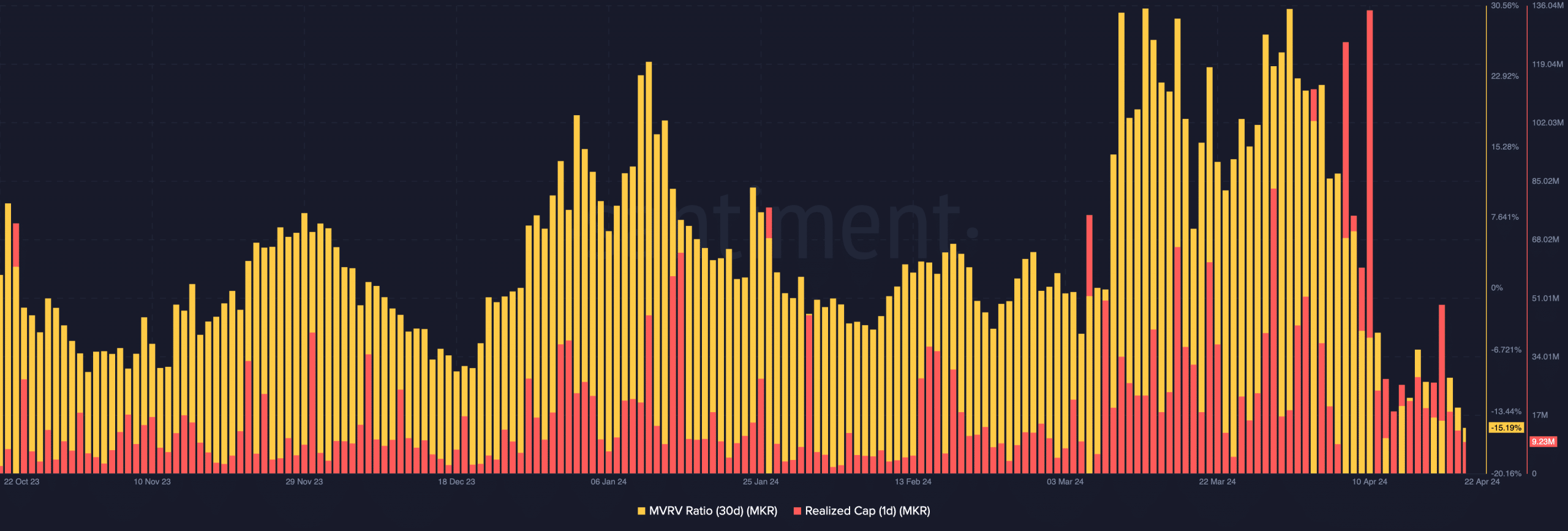

This was due to the signal shown by the Market Value to Realized Value Ratio (MVRV). This metric tracks the profitability and perceived value of the token.

According to data from Santiment, the 30-day MVRV rate was -15.19%. Historically, when metrics reach numbers like these, prices bounce back.

If this happens again, MKR price could rise to $3,545 in a few weeks. Moreover, on the 1st, Realize Cap also shared this sentiment.

Source: Santiment

Once the selling stops, prices will rebound.

At press time, Realized Cap was down to 9.23 million. This decline was evidence that older tokens were realizing profits.

However, this decline indicates that MKR is undervalued compared to its historical trading value.

Moreover, this represents a potential floor in prices. Therefore, MKR may not need to rely on ETH for direction in the near term.

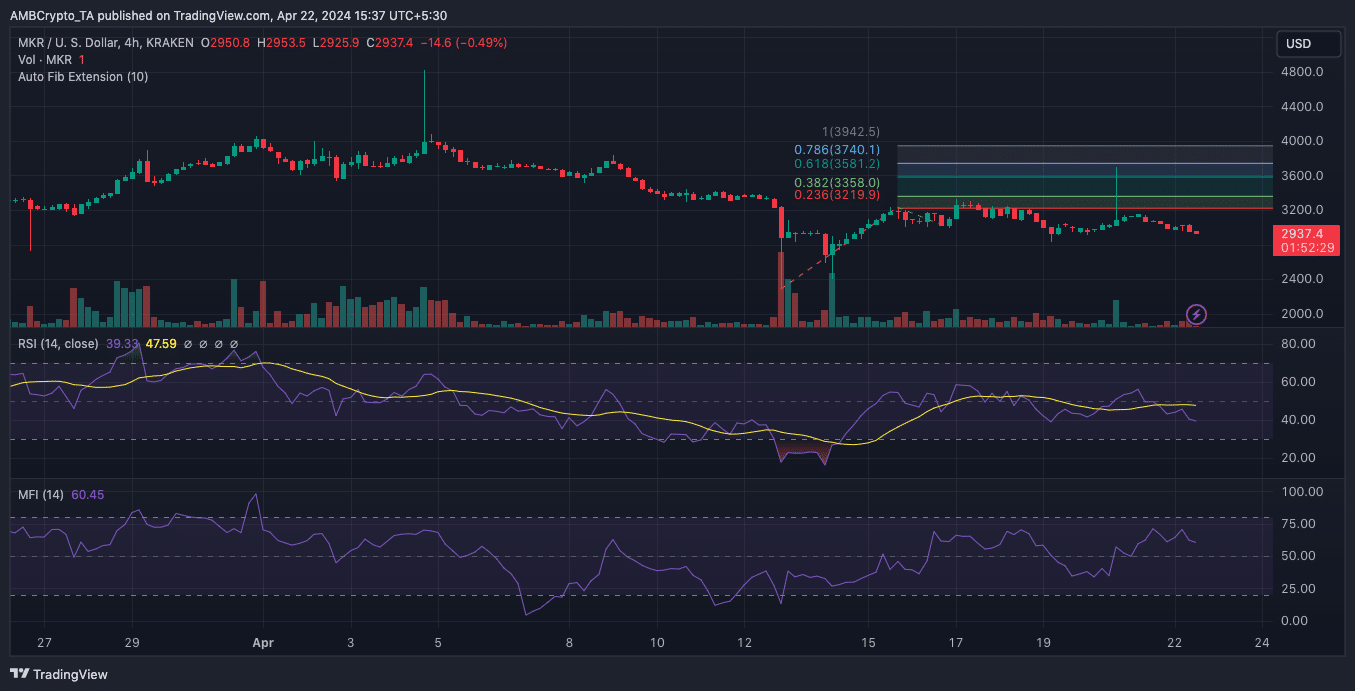

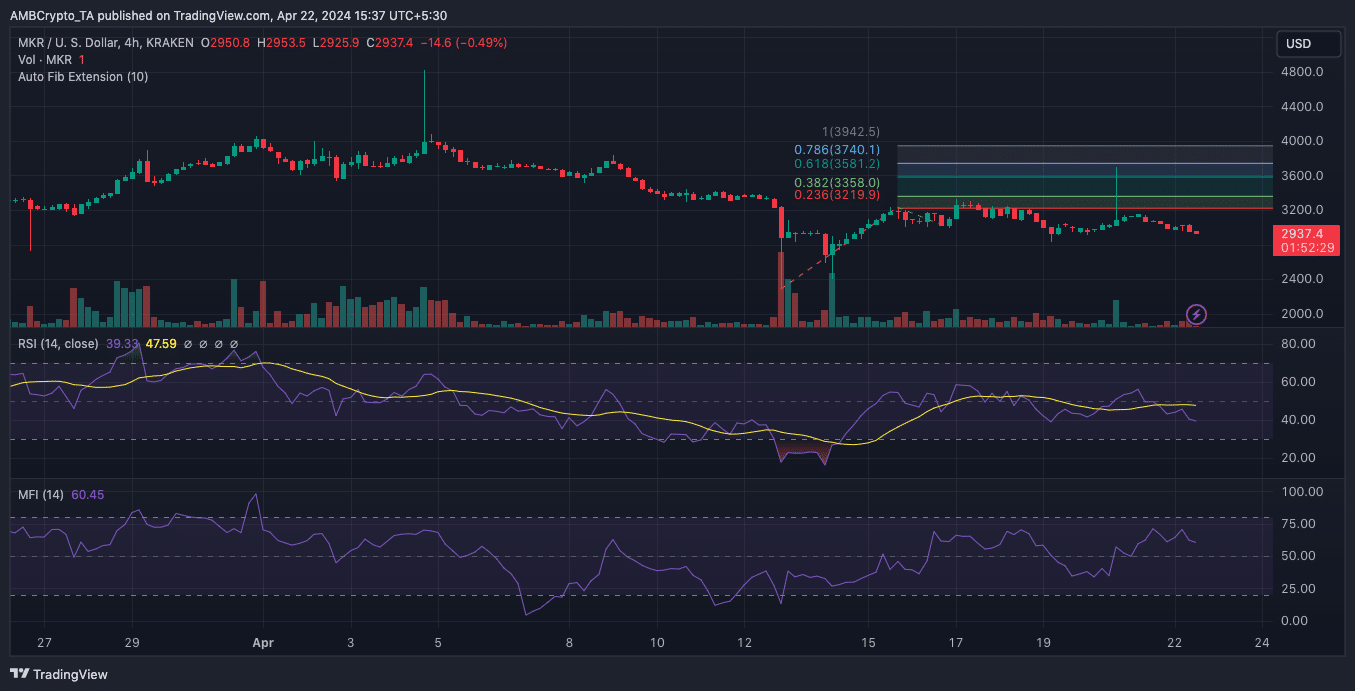

From a technical perspective, the Relative Strength Index (RSI) has fallen below the zero midpoint. This hinted at bearish momentum for the token. Therefore, further price declines can be expected.

Realistic or not, the market cap of MKR in ETH terms is:

However, if RSI reaches 30.00, MKR is considered oversold and the next bounce may occur. In this case, the 0.786 Fibonacci indicator showed that the price could rise to $3,740 in the short and medium term.

Source: TradingView

However, the value of MKR may fall before the expected increase as the Money Flow Index (MFI) reveals that capital is flowing out of cryptocurrencies.