- Solana is set to benefit from the pre-election mood as investors turn to lower-risk assets.

- Traders can easily push Solana to its next target of $185. Especially as top altcoin Ethereum is struggling.

Last week was an important one for Solana (SOL) as it finally broke the $160 resistance level after several attempts, marking the end of a two-month downward trend.

A sharp 6% intraday drop two days ago erased some gains, but SOL gains remained stable in the $175 range, preventing further declines.

With increased liquidity due to the election, Solana could be poised to reach $185 and potentially rebound towards $200 if it turns the $160 level into solid support.

Pre-election preparations are in full swing.

During the last presidential election, Bitcoin broke from a months-long consolidation and closed above $40,000 for the first time two months later.

This is consistent with a general psychological pattern in which low-risk assets typically attract a lot of attention, especially in markets where election results are unpredictable.

As a result, we expect a significant rally in the post-election cycle as investors adapt to newly introduced market trends and diversify their portfolios to find returns in high-denomination altcoins.

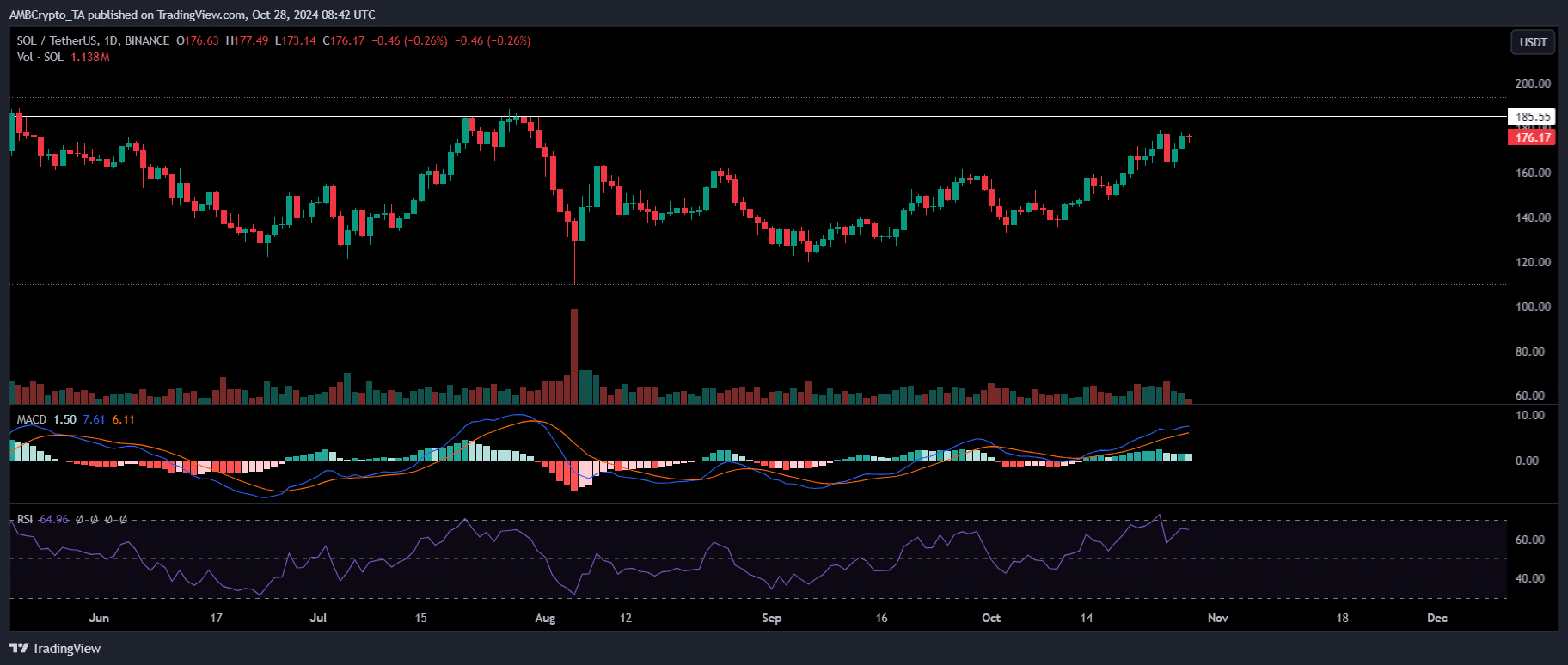

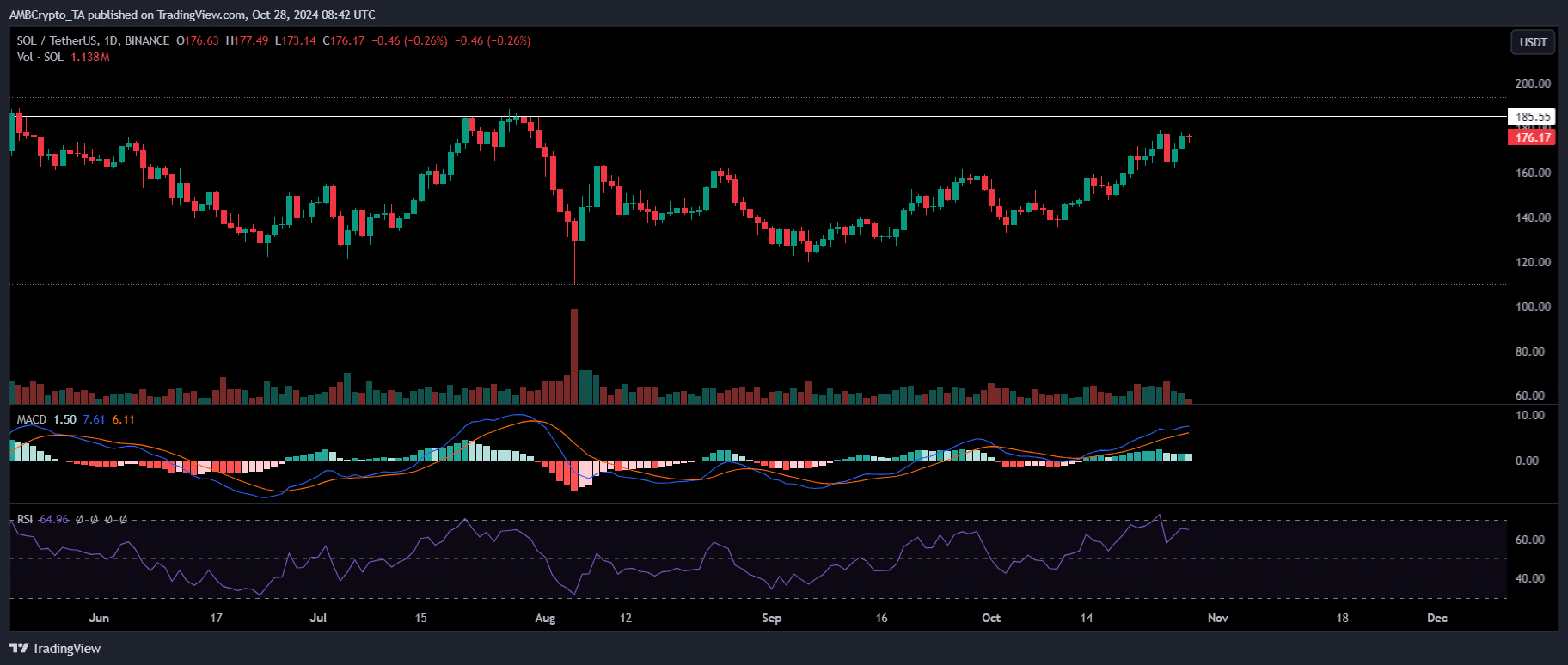

The market is currently in a pre-election mood, which suggests investors are trying to capitalize on the high returns of low-risk assets like Solana, as seen in the chart below.

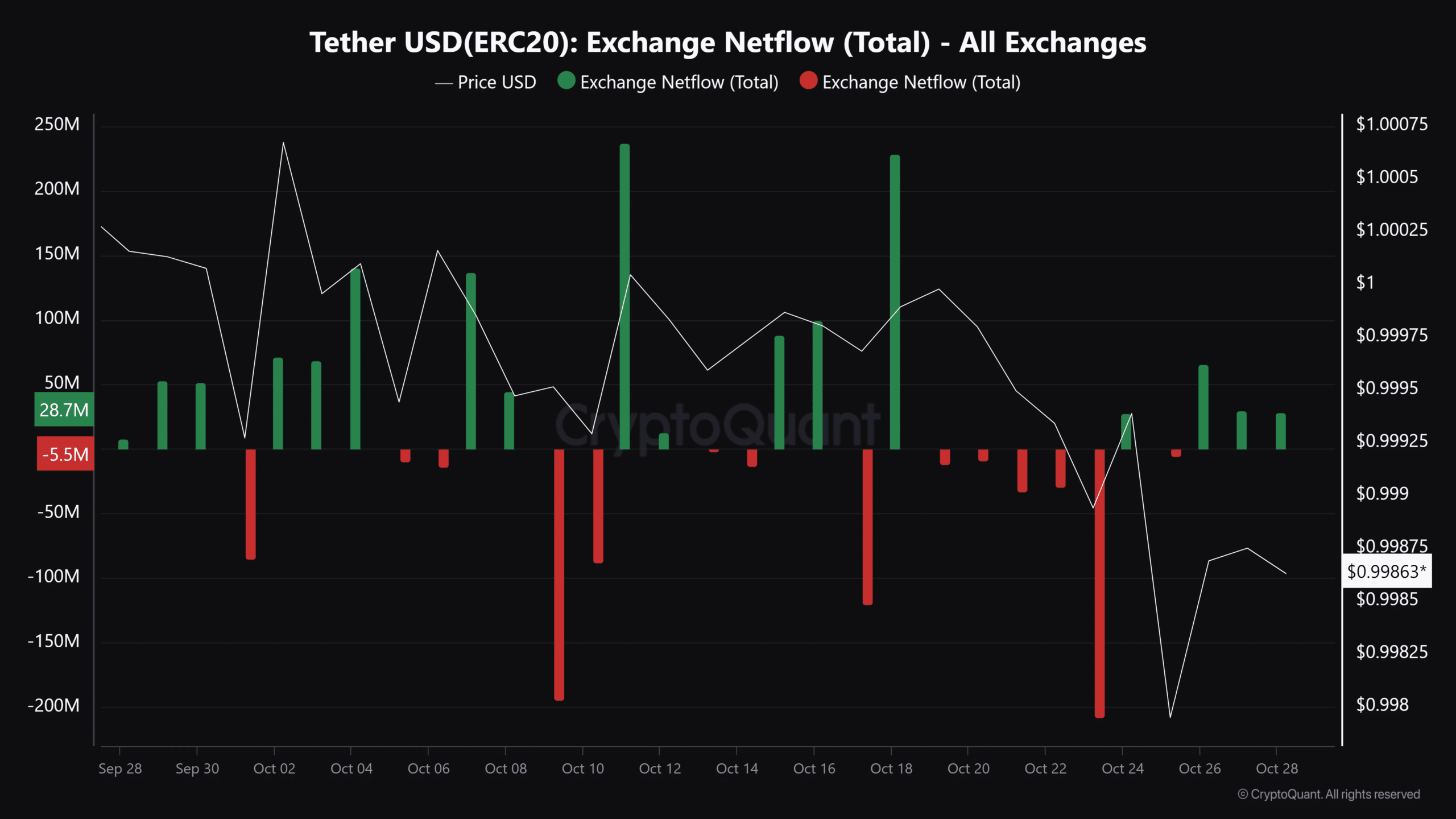

Source: CryptoQuant

Over the past three days, USDT inflows have recovered significantly, with over $28 million Tether deposited on exchanges. This surge follows the withdrawal of $200 million worth of USDT tokens just five days ago.

Historically, high USDT inflows are often a precursor to Bitcoin reaching daily highs. As a result, analysts expect Solana to benefit, especially since it has outperformed many top altcoins in previous cycles.

If the Solana bulls follow this pattern:

With weekly gains of over 5%, Solana broke a two-month slump by surpassing $170, a level last reached in July, while the rest of the altcoins are struggling in the red zone.

Currently trading at $176 and with a 22% increase in volume over the last 24 hours, this could indicate overbought conditions as the price is currently approaching a two-week high, suggesting a trend reversal is imminent.

Source: TradingView

However, if bulls see increased election liquidity as a catalyst for strength in November, Solana will likely absorb this pressure as the bulls enter the cycle.

Is your portfolio green? Check out our SOL Profit Calculator

If this pattern holds true, traders could easily push Solana to its next target of $185. This is an area where Solana excels, especially as top altcoin Ethereum struggles with its own network health.

Simply put, the market conditions are ripe for Solana to hit its short-term price target as pre-election sentiment increases volatility and SOL’s dominance in altcoin pools, with capital moving into high-denomination tokens.