- SOL’s network activity remained high over the past month.

- The token’s technical indicators suggested the price to fall to $127.

Solana (SUN) We have seen a significant influx of funds into the network, reflecting the growing adoption and use of blockchain. This development can be viewed as optimistic as it suggests investor confidence in Solana is growing.

But will this episode have a positive impact on the token price?

A new milestone for Solana

IntoTheBlock recently posted: tweet Highlights exciting developments in the Solana ecosystem. According to the tweet, over $100 million has been connected to Solana from all other chains in the past seven days. This included over $70 million in Ethereum.

Since this appeared to be a large influx of funds into the network, AMBCrypto was able to data Learn more about blockchain network activity.

Our analysis shows that Solana’s daily active addresses dropped briefly before starting to rise again. Daily transactions have also remained fairly stable over the past 30 days, once again reflecting high usage and adoption rates.

Aside from that, Solana’s status in the DeFu space looked optimistic as its TVL increased last month.

Source: Artemis

However, despite the influx of new funds, SOL’s performance on the captured value front has declined over the past few days or weeks. This can be seen by looking at the decline in fees. Due to this, blockchain profits also began to plummet.

Will my SOL be affected?

Since a lot has happened in the blockchain ecosystem, AMBCrypto planned to investigate the state of SOL to see if all factors are influencing the token’s price action.

We find that SOL bears dominate the market. Last week the token price fell by more than 7%. In fact, in the last 24 hours alone, the token price has fallen by 3%.

At the time of writing, Solana transaction Its market capitalization is $144.03, which is over $67 billion. The bad news is that while the price of SOL is falling, volume has increased by over 40%, suggesting a continued price decline.

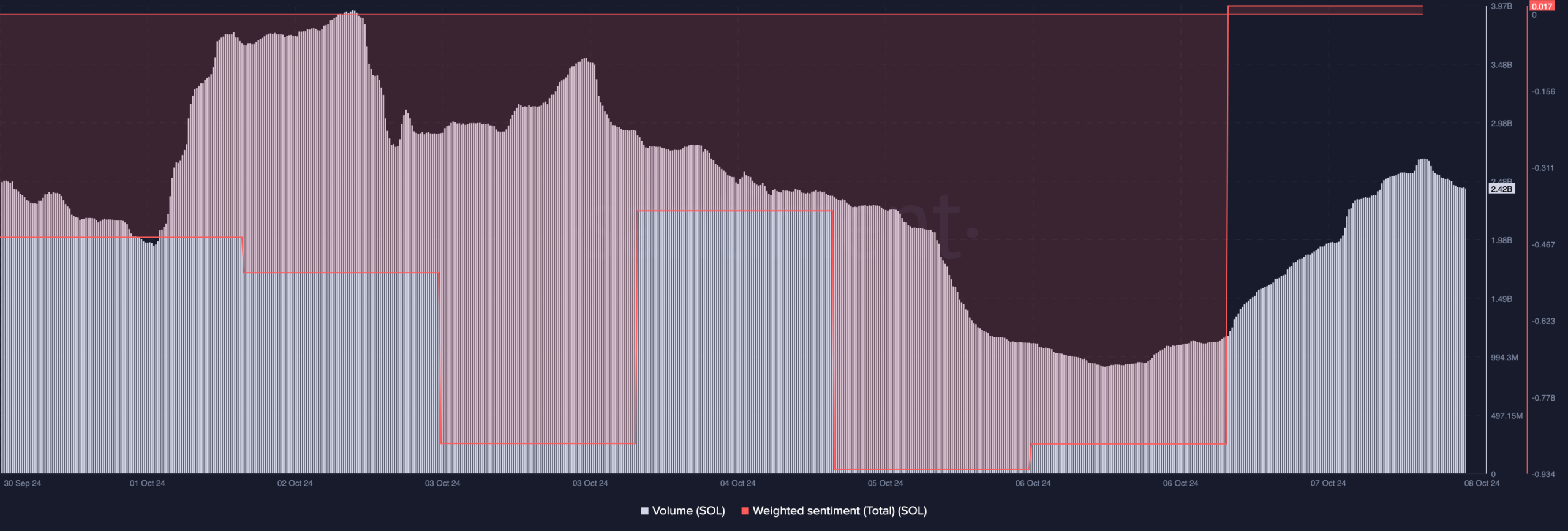

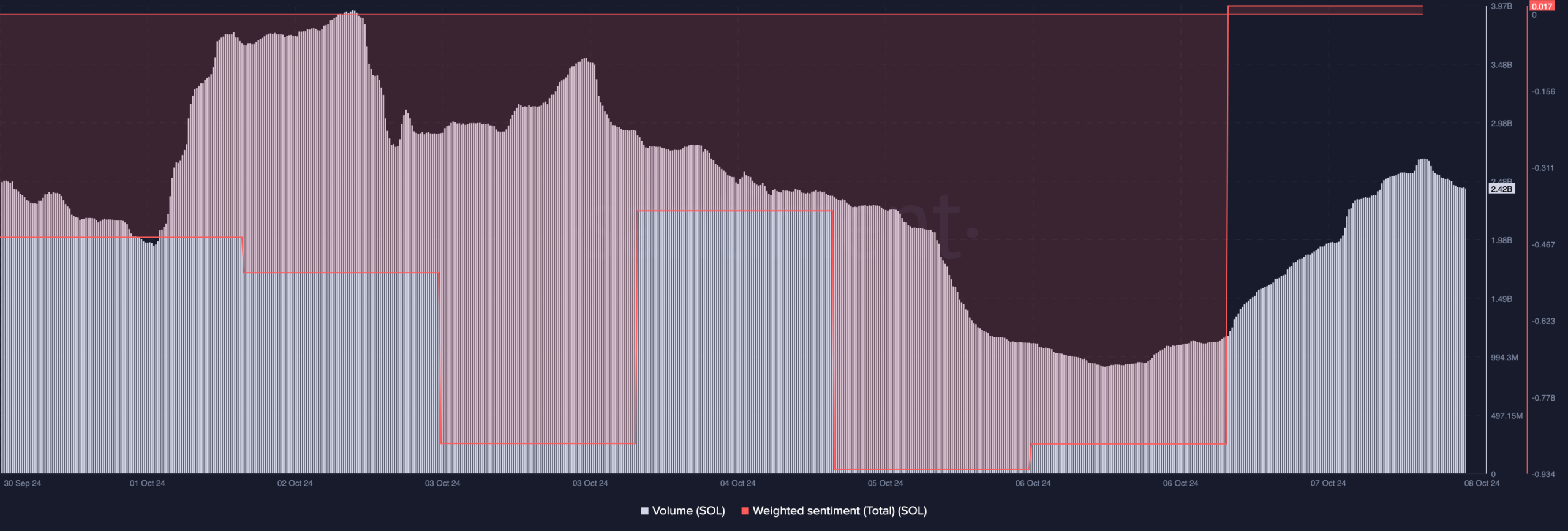

Nonetheless, investor confidence in the token has increased. This is when SOL’s weighted sentiment moves into positive territory, indicating rising bullish sentiment.

Source: Santiment

read Solana (SOL) Price Prediction 2024~2025

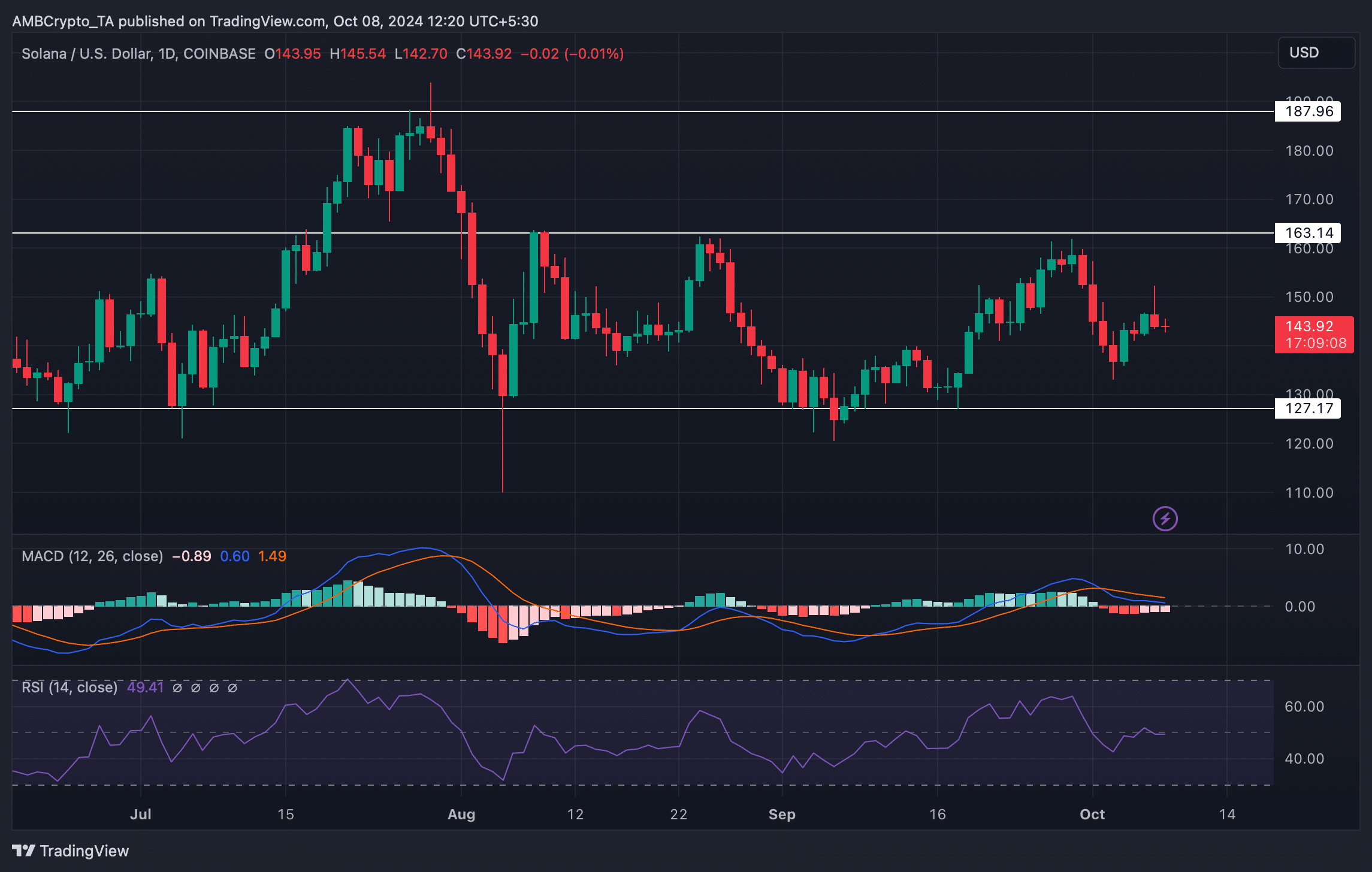

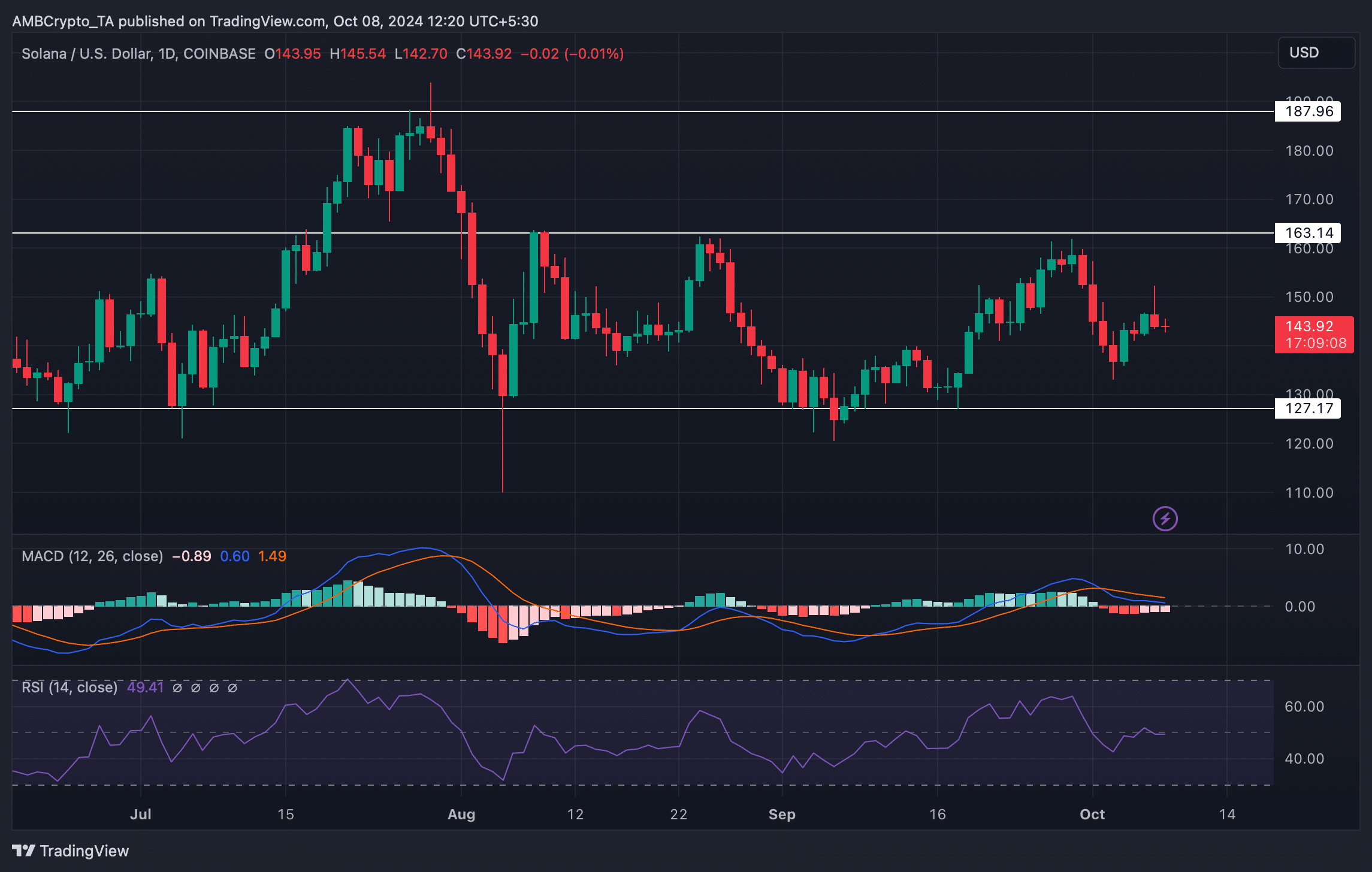

So, we checked out Solana’s daily chart to learn more about where the token is heading. Despite the rise in bullish sentiment, technical indicators showed a bearish edge in the market.

The token’s relative strength index (RSI) also recorded a downward trend. This indicator suggested that SOL could fall to $127 in the coming days.

Source: TradingView