that much Bitcoin (BTC) price is approaching yearly highs, while cryptocurrency market cap (TOTALCAP) and Oasis Network (ROSE) have already reached first place.

In today’s news:

TOTALCAP breaks annual high

Cryptocurrency market capitalization has been increasing since October with rising support trend lines. This rise reached an annual high of $1.63 trillion on December 9.

Market traders use RSI as a momentum indicator to identify overbought or oversold conditions and decide whether to accumulate or sell assets. Readings above 50 and an upward trend indicate that bulls still have the advantage, while readings below 50 indicate the opposite.

Before the decline, there was a bearish divergence (green) in the daily RSI. A bearish divergence occurs when a decrease in momentum is accompanied by an increase in value. As in the case of TOTALCAP, it often leads to a downward trend reversal.

However, TOTALCAP bounced back again with a strong rally on December 18 (green icon). The resulting increase today hit a new annual high of $1.65 trillion.

If the upward trend continues, TOTALCAP could increase by another 18% to reach the next resistance at $1.9 trillion.

Despite these optimistic TOTALCAP forecasts, a break in the rising support trend line is likely to push the 0.382 Fib retracement support level down 15% to $1.38 trillion.

Read more: 7 cryptocurrencies you need in your portfolio before the next bull market

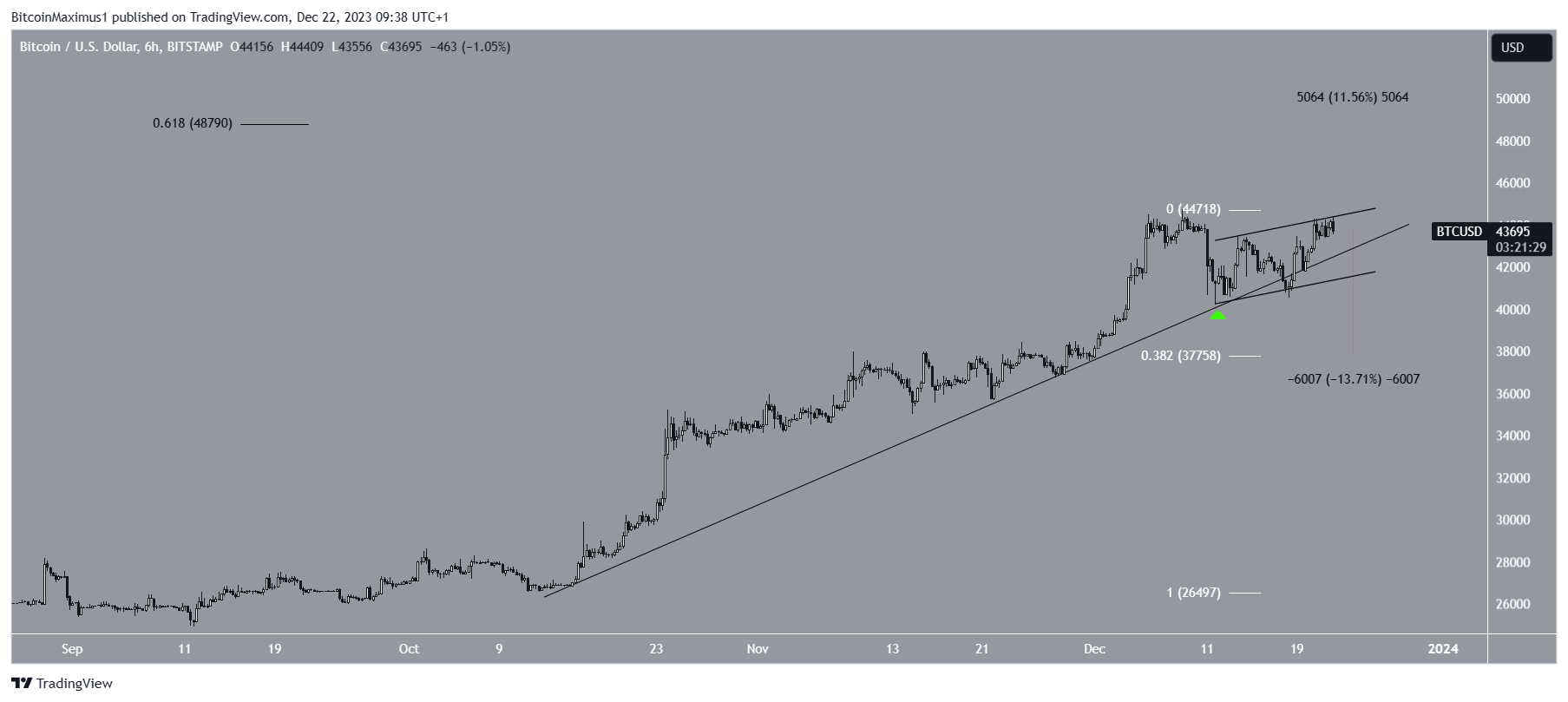

Bitcoin transactions within the channel

Like TOTALCAP, BTC price has been rising along an upward support trendline since October. The rise peaked at a yearly high of $44,729 on December 8.

After an initial decline, BTC price rebounded from the support trend line on December 11. It then rose within a rising parallel channel, which is considered a correction pattern.

Currently, BTC is trading at the resistance trendline of this channel. Whether something is challenged or rejected will likely determine future trends.

A BTC breakout could lead to a 12% increase to the next resistance at $48,800. On the other hand, a break could lead to a 14% decline to the 0.382 Fib retracement support level at $37,800.

Read more: 9 Best Cryptocurrency Demo Accounts for Trading

ROSE, long-term resistance resolved

ROSE prices have risen sharply since mid-October (green icon). We created 8 bullish weekly candles over 10 weeks.

ROSE hit a new yearly high of $0.12 today, clearing the $0.08 and $0.11 horizontal resistance areas during the uptrend.

If ROSE closes above the $0.11 area, it could see a 90% increase to the next resistance at $0.22. Weekly RSI supports this possibility as the indicator increases and exceeds 70.

Despite ROSE’s optimistic price forecast, a close below $0.11 would likely result in a 35% decline to the nearest support at $0.08.

In the case of BeInCrypto‘Click here for the latest cryptocurrency market analysis.

Read more: Best airdrops of 2023

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.