Bitcoin’s rally is facing a major headwind near $38,000. Repeated failures to remove overhead obstacles trigger the corrective phase. During this, buyers regroup at lower levels and try to attack resistance levels again. On the other hand, bears are trying to pull the price below important support levels and begin a deeper downtrend. A fight between the two in the coming days is likely to increase volatility.

Investors are ignoring near-term uncertainty and focusing on two big events in 2024: the Bitcoin halving in April and the Securities and Exchange Commission’s Bitcoin exchange-traded fund spot decision in January. Cryptocurrency exchange-traded products saw record inflows of $346 million in the week ending November 24, according to CoinShares. data. Bitcoin ETP attracted the most investment at $312 million, bringing annual inflows to approximately $1.5 billion.

Analysts viewed the news of the $4.3 billion settlement between Binance, Changpeng “CZ” Zhao, and the U.S. Department of Justice (DOJ) as positive for the cryptocurrency industry. Several analysts believe the deal has removed a hurdle and paved the way for the approval of a spot Bitcoin ETF.

PlanB, creator of the Stock-to-Flow family of BTC price models, believes Bitcoin is unlikely to remain below the $40,000 level for long. Reply to post At

Some long-term investors are ignoring short-term price movements and not selling their holdings. William Clemente, co-founder of cryptocurrency research firm Reflexivity, uploaded Glassnode. chart This shows that 70% of all Bitcoin in circulation has not moved in at least a year.

Will Bitcoin and major altcoins find buying support at lower levels, or will the correction deepen? Let’s study the chart to find out.

BTC/USD market analysis

Bitcoin topped $38,000 on November 24, but bears were selling at higher levels, as seen by the long wicks of the day’s candlesticks. The price action over the past few days has formed a rising wedge pattern, which is considered negative if the price breaks out to the downside.

The first important support level for the downtrend is $34,750. If the price rebounds from this level, the BTC/USD pair may consolidate within the $34,750-$38,000 range for some time.

Conversely, if the price falls below $34,750, it means traders are rushing for the exits. This could initiate a deeper correction to the 50-day simple moving average (SMA) and then towards $32,400. Buyers are expected to aggressively defend the $32,400 to $31,050 zone.

On the positive side, $38,000 remains a key level to watch. If the price rises from the current level and breaks the overhead resistance, it will signal the resumption of the uptrend. The pair could first rise to $40,000 and then sprint towards the next major hurdle at $48,000.

ETH/USD market analysis

We said in our previous analysis that a drop below $2,030 would send Ether down to its 20-day SMA, and that is exactly what happened. It attracted strong buying from the bulls at lower levels, but the bulls were unable to overcome the $2,142 hurdle.

This means that the ETH/USD pair could remain in the $1,900-$2,142 range for some time. Rising moving averages suggest an advantage for buyers, but RSI near 55 suggests bullish momentum is slowing.

If the price remains below the 20-day SMA, the bears will strengthen their positions and try to take the pair below $1,900. If that happens, the pair could fall to its 50-day SMA and later $1,750.

Conversely, if the price rises and surpasses $2,142, it means the start of a new upward trend. The pair could rise to $2,516 and then reach $2,950.

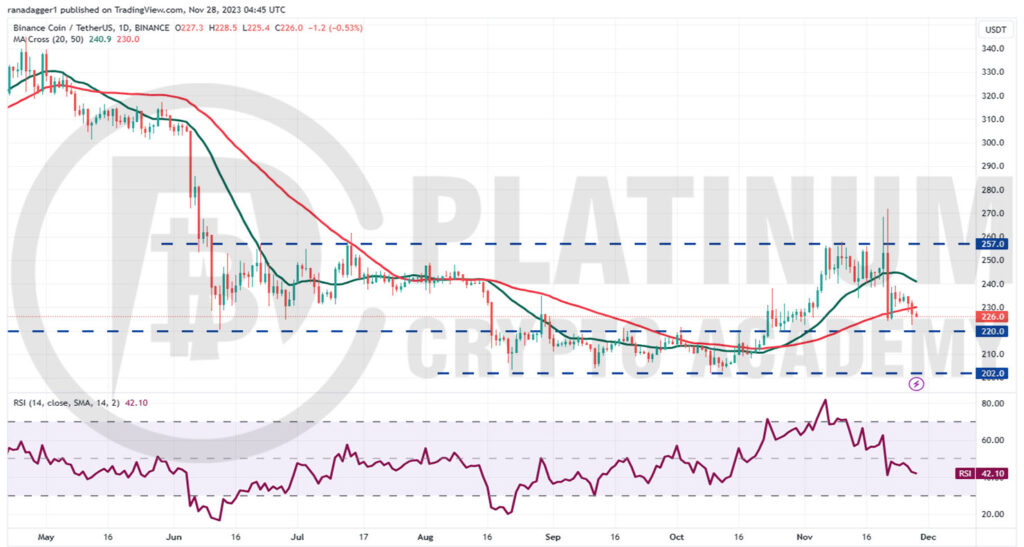

BNB/USD market analysis

Binance Coin has been all over the place over the past few days. Buyers pushed the price above the indirect resistance of $257 on November 20th and 21st, but were unable to sustain it higher, as seen by the long wick of the candlestick.

Failure to do so may result in short-term traders being tempted to book profits. This caused the price to fall below the 20-day SMA on November 21. The bulls attempted to begin a recovery on November 22nd, but it was short-lived. This suggests that the bears are trying to establish their hegemony.

The 20-day SMA has started to decline and the RSI is in negative territory, indicating that bears have the upper hand. If the price falls below $220, the decline could extend to $202. Aggressive buying by the bulls may occur at this level.

If bulls want to prevent a sharp decline, they will have to fiercely defend the $220 level. A strong bounce from this level increases the likelihood of action within the range between $220 and $257.

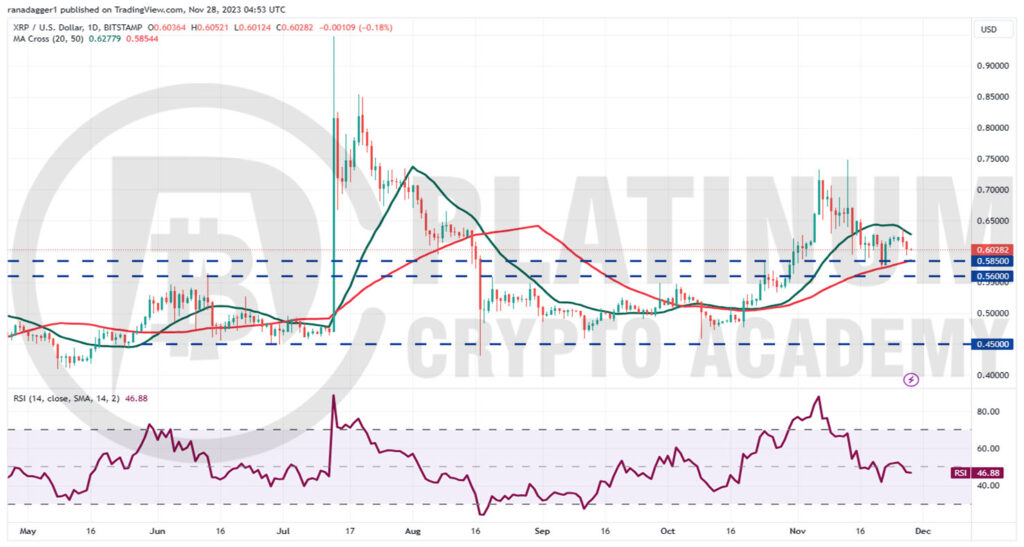

XRP/USD market analysis

We mentioned in our previous analysis that the price would fall to the 20-day SMA, and if that support is broken, XRP could plummet to the 50-day SMA, and this is the result.

The price bounced off the 50-day SMA on November 22, but the bulls are struggling to push the price above the 20-day SMA. This suggests that sentiment has turned negative and traders are selling the rally.

Bears will try to take the price below the $0.58-$0.56 area. Doing so will benefit the seller. The XRP/USD pair could then begin a steeper correction towards $0.45.

Conversely, if the price rises from current levels and rises above the 20-day EMA, this would indicate that the bulls are vigorously defending the support at $0.56. This could open the door to a possible rise to $0.75.

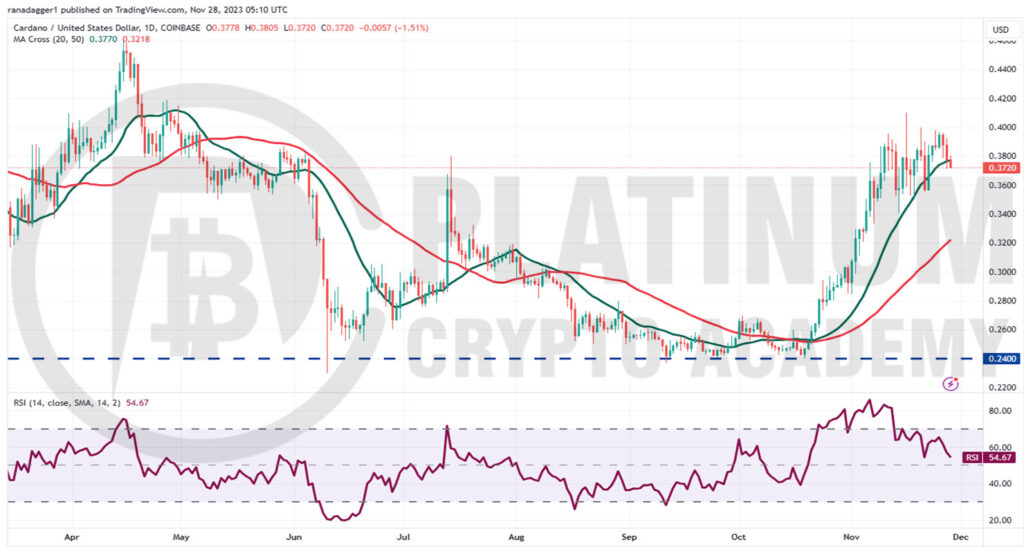

ADA/USD market analysis

Cardano has been stuck between its 20-day SMA and $0.40 for the past few days, but this tight trading is unlikely to continue for long. A repeated failure to overcome the $0.40 hurdle could tempt short-term bulls to book profits. This could push the price below the 20-day SMA and open the door for a decline to $0.34.

Bulls will need to actively defend the $0.34 level to maintain positive momentum. That could push the ADA/USDT pair up to $0.40. A break and close above this resistance will initiate the next leg up to $0.46.

Meanwhile, the bears likely have other plans. They will likely try to drive the price below $0.34 and initiate a correction to its 50-day SMA. A break below this level could cause the price to fall to $0.28, so it is an essential level for bulls to defend.

Hopefully, you enjoyed reading today’s article. Check out our cryptocurrencies. blog page. Thanks for reading! Have a fantastic day! It will be live on the Platinum Crypto Trading Floor.

Import Disclaimer: The information found in this article is provided for educational purposes only. We do not promise or guarantee any earnings or profits. You should do some homework, use your best judgment, and conduct due diligence before using any of the information in this document. Your success still depends on you. Nothing in this document is intended to provide professional, legal, financial and/or accounting advice. Always seek competent advice from a professional on these matters. If you violate city or other local laws, we will not be liable for any damages incurred by you.